谈股论票

Jaycorp 7152(高股息+美金出口家具股)

Jaycorp是一家橡木家具制造商(如Liihen),也从事沙发椅制造(如Homeriz)和家具包装。

目前股价:RM0.925

目标价:RM1.40

单季EPS:RM0.029

把单季净利年度化:RM0.116

本益比:8

派息率:50%以上

股息率:3.8%

【利好】

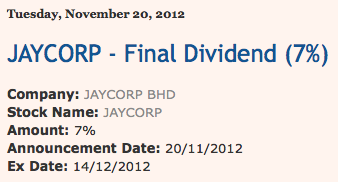

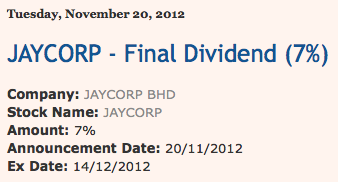

1)公司派息率这几年都超过50%

2)公司刚买的Instyle沙发厂会在下季开始入账

3)去年同期单季EPS为1.59,随美金高涨,今年单季EPS为2.9成长了81%!

4)目前原料产品大跌,公司制造成本降低!

5)去年同期美金阅马币RM3.30, 现在为RM3.80, 净利肯定上扬!

6)公司发股RM68,000,000, 储备为RM58,000,00, 有望发行红股。

7)随着盈利上升,未来股息有望达到RM0.05或5.4%股息率

8)老板和股价大涨的Liihen, Pohuat, Homeriz一样来自家具城麻坡。

【风险】

1)散户持股颇高,波动可能很大

2)美国如果升息,对公司比较不利

3)缺少了官有缘或冷眼的垂青

【后语】

派息慷慨曾经派发RM0.075的股息,且是一家赚钱的美金家具公司,目前已经很难找到。价格合理,在家具股里面是明显严重被低估了。加上当Sofa厂全面入账,公司维持目前派息率,那盈利和股息就可能提高,本益比进一步降低。因此给预中期目标价RM1.40。

Jaycorp 7152 : An undervalue furniture stock. Last quarter EPS 2.9, with yearly dividend of 3.5cents. It will surely benefit from strong USD! Issused share 68millons with reserve of 58milllons, potantial to annouce bonus.

Jaycorp manufactures rubberwood furniture, processes rubberwood and converts corrugated boards into carton boxes. Export, mainly to North America and Asia.

On April 30 2015, Jaycorp completed the acquisition of a 51% stake in Instyle Sofa Sdn Bhd, a manufacturer of sofa sets and non rubberwood furniture products, for RM4.2 million. The acquisition will enable Jaycorp to diversify into new export markets segments.

Compare to Pohuat's last quarter EPS of 4.2 and share price of RM2.70, Jaycorp TP can be as high as RM1.40. The owner of the company come from Muar, same with Homeriz, Pohuat and Liihen.

https://www.facebook.com/HollandStock

谢谢火旺兄的功课,(rm0.93已買入)

http://www.jaycorp.com.my/

杰业机构净利飙84%

2015-06-27 12:34

Jaycorp 7152(高股息+美金出口家具股)

Jaycorp是一家橡木家具制造商(如Liihen),也从事沙发椅制造(如Homeriz)和家具包装。

目前股价:RM0.925

目标价:RM1.40

单季EPS:RM0.029

把单季净利年度化:RM0.116

本益比:8

派息率:50%以上

股息率:3.8%

【利好】

1)公司派息率这几年都超过50%

2)公司刚买的Instyle沙发厂会在下季开始入账

3)去年同期单季EPS为1.59,随美金高涨,今年单季EPS为2.9成长了81%!

4)目前原料产品大跌,公司制造成本降低!

5)去年同期美金阅马币RM3.30, 现在为RM3.80, 净利肯定上扬!

6)公司发股RM68,000,000, 储备为RM58,000,00, 有望发行红股。

7)随着盈利上升,未来股息有望达到RM0.05或5.4%股息率

8)老板和股价大涨的Liihen, Pohuat, Homeriz一样来自家具城麻坡。

【风险】

1)散户持股颇高,波动可能很大

2)美国如果升息,对公司比较不利

3)缺少了官有缘或冷眼的垂青

【后语】

派息慷慨曾经派发RM0.075的股息,且是一家赚钱的美金家具公司,目前已经很难找到。价格合理,在家具股里面是明显严重被低估了。加上当Sofa厂全面入账,公司维持目前派息率,那盈利和股息就可能提高,本益比进一步降低。因此给预中期目标价RM1.40。

Jaycorp 7152 : An undervalue furniture stock. Last quarter EPS 2.9, with yearly dividend of 3.5cents. It will surely benefit from strong USD! Issused share 68millons with reserve of 58milllons, potantial to annouce bonus.

Jaycorp manufactures rubberwood furniture, processes rubberwood and converts corrugated boards into carton boxes. Export, mainly to North America and Asia.

On April 30 2015, Jaycorp completed the acquisition of a 51% stake in Instyle Sofa Sdn Bhd, a manufacturer of sofa sets and non rubberwood furniture products, for RM4.2 million. The acquisition will enable Jaycorp to diversify into new export markets segments.

Compare to Pohuat's last quarter EPS of 4.2 and share price of RM2.70, Jaycorp TP can be as high as RM1.40. The owner of the company come from Muar, same with Homeriz, Pohuat and Liihen.

https://www.facebook.com/HollandStock

谢谢火旺兄的功课,(rm0.93已買入)

http://www.jaycorp.com.my/

杰业机构净利飙84%

2015-06-27 12:34

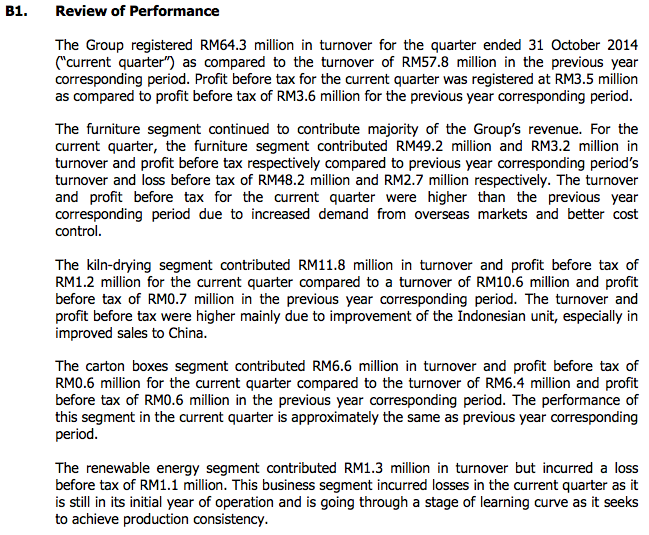

(吉隆坡26日讯)杰业机构(JAYCORP,7152,主板消费股)截至4月杪第3季,净利按年激增83.79%,至399万2000令吉或每股赚2.92仙。

第3季营业额按年微涨8.87%,至5960万6000令吉。

合计首9个月,营业额微增1.26%至1亿7861万2000令吉,净利则下跌10.81%至617万1000令吉,或每股盈利4.51仙。

由于海外市场的需求增长以及销售成本降低,家具业务贡献大部分的净利。

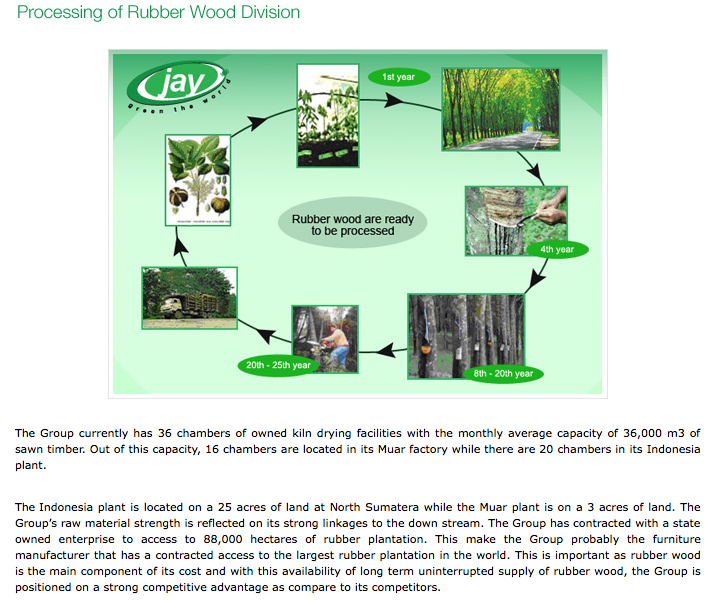

该公司指出,印尼子公司表现更好,高温窑干(kiln drying)业务也表现不俗。

然而,纸箱业务表现持平;再生能源业务则蒙受20万令吉的税前亏损。http://www.nanyang.com/node/709048?tid=462

个人估算,2015(7月财政年) , eps=rm0.075sen,

现RM0.925只是PE=12.3倍 在交易,明显被低估了,合理的PE=15,价位=RM1.12

供参考,进出自负.

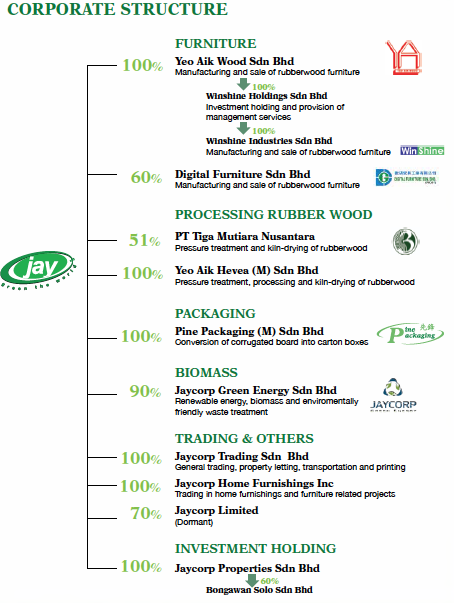

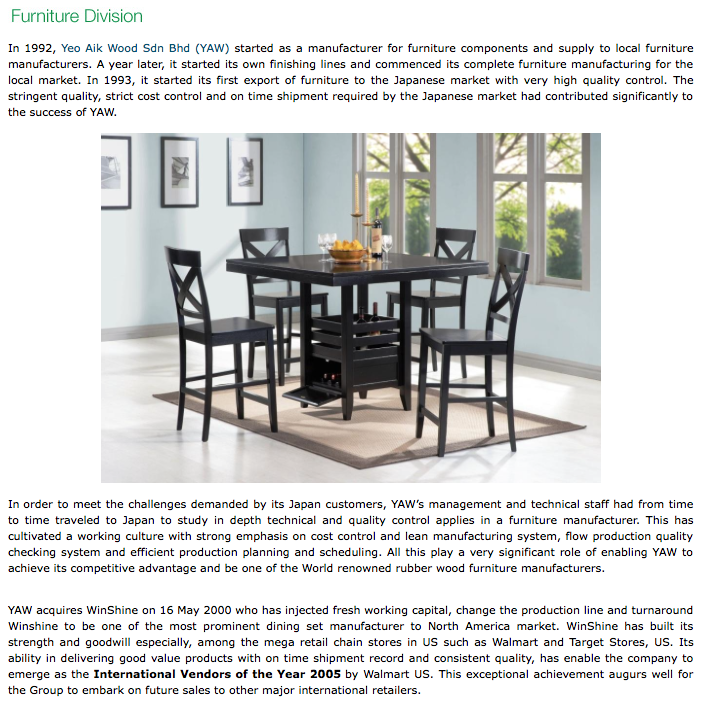

Jaycorp Berhad manufactures and sells rubber wood furniture.

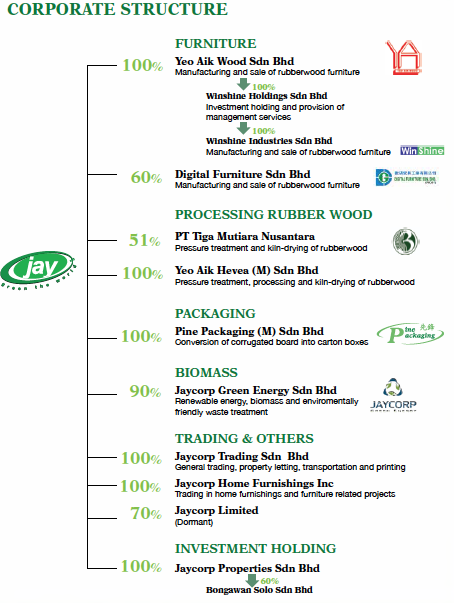

The company operates through four segments: Rubberwood Furniture, Packaging, Processing of Rubberwood, Renewable Energy, and Others.

It offers wooden dining sets, bedroom sets, and occasional side boards.

The company is also involved in the conversion of corrugated boards into carton boxes; processing and kiln–drying of rubber wood; etc.

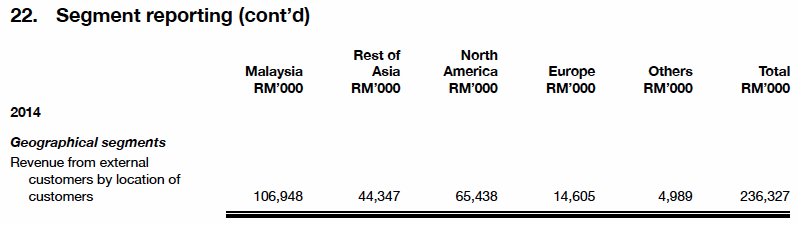

Jaycorp serves various customers primarily in Malaysia and the rest of Asia, as well as North America and Europe.

The company was formerly known as Yeo Aik Resources Berhad and changed its name to Jaycorp Berhad in 2006.

Jaycorp Berhad was founded in 1992 and is based in Kuala Lumpur, Malaysia.

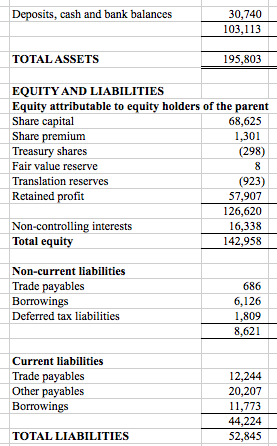

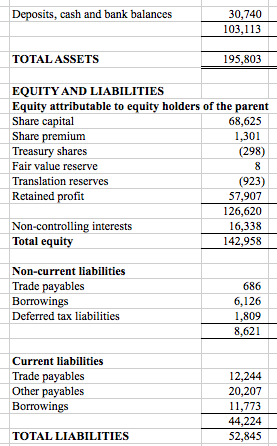

The group has healthy balance sheets with net cash of RM12 mil.

The company paid dividend of 3.5 sen in 2012, 2013 and 2014. Based on 73 sen, dividend yield is 4.8%.

The group has been consistently profitable throughout recent yars.

Annual Result:

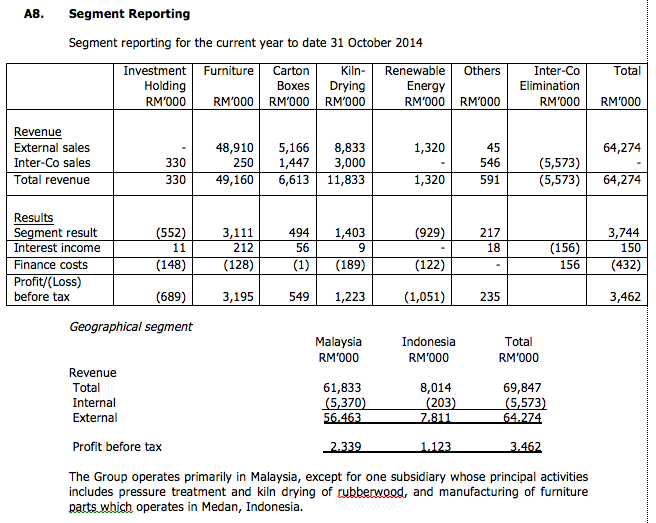

The group reported net profit of RM1.16 mil for the Q1 of FY2014 (the quarter ended 30 October 2014).

The company will be releasing its second quarter result by end of March 2015.

Quarter Result:

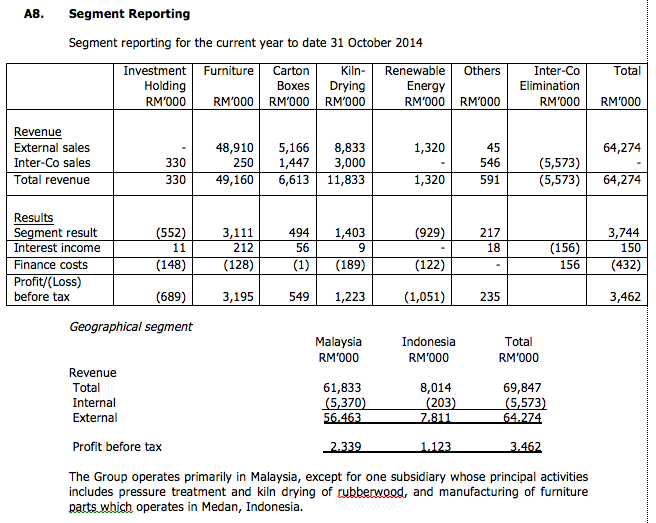

In the October 2014 quarter, furniture making accounted for the bulk of the profit (RM3.2 mil PBT). Processing of rubber wood was the second largest contributor (RM1.22 mil PBT). Losses at renewable energy division dragged down overall group performance (LBT of RM1 mil).

In FY2014, the group exports approximately 55% of its products.

Appendix - The Jaycorp Group

Introduction

After publishing the Jaycorp article on Friday, 20 March 2015, I carried out further study and noticed that there are certain information that could help readers to have better understanding of the group.

Instead of amending the original article, I decided to introduce the new information by writing Part 2.

Historical Profitability

Comments :-

(a) On average, the furniture division reported PBT of RM3.2 mil per quarter.

(b) On average, the packaging division reported PBT of RM0.5 mil per quarter.

(c) The rubber wood division's performance was erratic. Profitability fluctuated between loss of RM0.9 mil and PBT of RM2.1 mil in FY2014.

(d) The renewable energy division (acquired in 2012) dragged down the group' overall performance with total loss before tax of RM1.8 mil in FY2014 and LBT of RM1.1 mil in Q1 of FY2015.

(e) It is likely that high minority interest (for example July and October 2014 quarter MI of RM0.9 mil and RM1.0 mil respectively) was due to strong performance of the rubber wood processing division. Jaycorp only owns 51% of the Indonesia based rubber wood manufactruing subsidiary.

Growing Through Mergers & Acquisitions

The Jaycorp group has a tradition of inorganic growth by taking over industry peers.

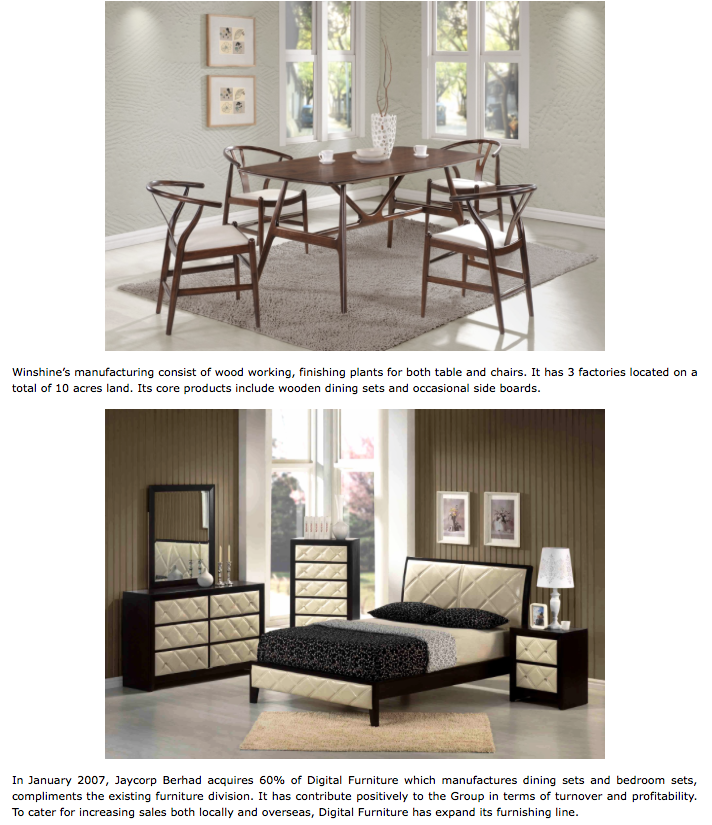

In 2000, the group acquired Winshine Industries Sdn Bhd, a rubber wood furniture manufacturer. They successfully turned Winshine around to become an exporter of dining sets to North America. Winshine was given an award by Walmart in 2005 for its good performance.

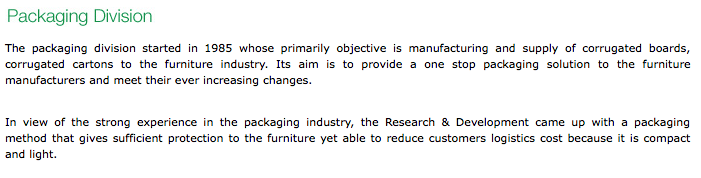

In 2007, Jaycorp acquired 60% equity interest in Digital Furniture Sdn Bhd which manufactures dining sets and bedroom sets. Post acquisition, Digital Furniture has contributed to group turnover and profitability.

现RM0.925只是PE=12.3倍 在交易,明显被低估了,合理的PE=15,价位=RM1.12

供参考,进出自负.

(Icon8888) Jaycorp (Part 1) - Rubber Wood Furniture Maker. Dividend Yield of 4.8%

Author: Icon8888 | Publish date: Fri, 20 Mar 2015, 03:25 PM

Jaycorp Bhd (JAYC) Snapshot

Open

0.71

|

Previous Close

0.71

| |

Day High

0.71

|

Day Low

0.71

| |

52 Week High

04/23/14 - 0.86

|

52 Week Low

12/17/14 - 0.62

| |

Market Cap

96.4M

|

Average Volume 10 Days

35.9K

| |

EPS TTM

0.06

|

Shares Outstanding

136.8M

| |

EX-Date

12/16/14

|

P/E TM

12.7x

| |

Dividend

0.04

|

Dividend Yield

4.96%

|

Jaycorp Berhad manufactures and sells rubber wood furniture.

The company operates through four segments: Rubberwood Furniture, Packaging, Processing of Rubberwood, Renewable Energy, and Others.

It offers wooden dining sets, bedroom sets, and occasional side boards.

The company is also involved in the conversion of corrugated boards into carton boxes; processing and kiln–drying of rubber wood; etc.

Jaycorp serves various customers primarily in Malaysia and the rest of Asia, as well as North America and Europe.

The company was formerly known as Yeo Aik Resources Berhad and changed its name to Jaycorp Berhad in 2006.

Jaycorp Berhad was founded in 1992 and is based in Kuala Lumpur, Malaysia.

The group has healthy balance sheets with net cash of RM12 mil.

The company paid dividend of 3.5 sen in 2012, 2013 and 2014. Based on 73 sen, dividend yield is 4.8%.

The group has been consistently profitable throughout recent yars.

Annual Result:

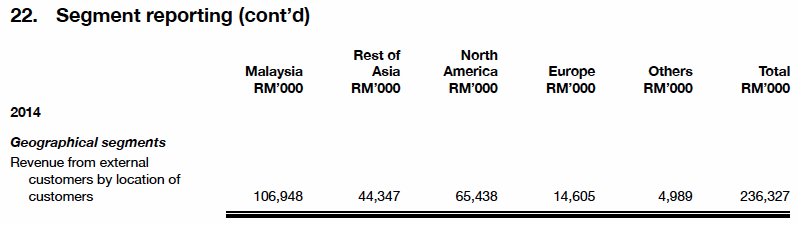

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) | PE | DPS (Cent) | DY | NAPS | ROE (%) |

|---|---|---|---|---|---|---|---|---|

| TTM | 242,849 | 7,515 | 5.54 | 13.00 | 3.50 | 4.86 | 0.9300 | 5.96 |

| 2014-07-31 | 236,327 | 8,625 | 6.31 | 12.37 | 3.50 | 4.49 | 0.9200 | 6.86 |

| 2013-07-31 | 209,281 | 5,086 | 3.72 | 13.58 | 3.50 | 6.93 | 0.8900 | 4.18 |

| 2012-07-31 | 236,612 | 10,261 | 7.50 | 6.27 | 3.50 | 7.45 | 0.8900 | 8.43 |

| 2011-07-31 | 192,059 | 2,548 | 1.86 | 30.11 | 2.00 | 3.57 | 0.8300 | 2.24 |

| 2010-07-31 | 227,414 | 13,924 | 10.41 | 7.40 | 7.50 | 9.74 | 0.8700 | 11.97 |

| 2009-07-31 | 252,657 | 12,297 | 9.48 | 5.28 | 9.00 | 18.00 | 0.8300 | 11.42 |

The group reported net profit of RM1.16 mil for the Q1 of FY2014 (the quarter ended 30 October 2014).

The company will be releasing its second quarter result by end of March 2015.

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | DPS (Cent) | NAPS |

|---|---|---|---|---|---|---|---|

| 2015-07-31 | 2014-10-31 | 64,274 | 3,462 | 1,156 | 0.85 | - | 0.9300 |

| 2014-07-31 | 2014-07-31 | 59,946 | 3,383 | 1,706 | 1.25 | 3.50 | 0.9200 |

| 2014-07-31 | 2014-04-30 | 54,751 | 2,984 | 2,172 | 1.59 | - | 0.9100 |

| 2014-07-31 | 2014-01-31 | 63,878 | 3,615 | 2,481 | 1.85 | - | 0.8900 |

| 2014-07-31 | 2013-10-31 | 57,752 | 3,612 | 2,210 | 1.62 | - | 0.9000 |

| 2013-07-31 | 2013-07-31 | 54,581 | -97 | -1,554 | -1.14 | 3.50 | - |

| 2013-07-31 | 2013-04-30 | 46,464 | 5,265 | 3,621 | 2.65 | - | 0.9000 |

| 2013-07-31 | 2013-01-31 | 54,319 | 3,289 | 2,212 | 1.62 | - | 0.8700 |

| 2013-07-31 | 2012-10-31 | 53,917 | 1,584 | 871 | 0.64 | - | 0.8900 |

| 2012-07-31 | 2012-07-31 | 63,516 | 2,749 | 2,275 | 1.66 | 3.50 | - |

| 2012-07-31 | 2012-04-30 | 62,107 | 6,411 | 3,589 | 2.62 | - | 0.8700 |

| 2012-07-31 | 2012-01-31 | 59,547 | 3,947 | 2,904 | 2.12 | - | 0.8500 |

In the October 2014 quarter, furniture making accounted for the bulk of the profit (RM3.2 mil PBT). Processing of rubber wood was the second largest contributor (RM1.22 mil PBT). Losses at renewable energy division dragged down overall group performance (LBT of RM1 mil).

In FY2014, the group exports approximately 55% of its products.

Appendix - The Jaycorp Group

(Icon8888) Jaycorp (Part2) - Additional Information

Author: Icon8888 | Publish date: Sat, 21 Mar 2015, 02:17 PMIntroduction

After publishing the Jaycorp article on Friday, 20 March 2015, I carried out further study and noticed that there are certain information that could help readers to have better understanding of the group.

Instead of amending the original article, I decided to introduce the new information by writing Part 2.

Historical Profitability

| (RM mil) | Oct13 | Jan14 | Apr14 | Jul14 | FY2014 | Oct14 |

| Revenue | 57.8 | 63.8 | 54.8 | 59.9 | 178.5 | 64.3 |

| Investment hldg | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Furniture | 46.4 | 49.1 | 42.8 | 47.9 | 186.2 | 48.9 |

| Packaging | 5.0 | 5.0 | 4.7 | 5.1 | 19.8 | 5.2 |

| Rubber wood | 6.3 | 9.8 | 6.9 | 6.0 | 29.0 | 8.8 |

| Renewable | 0.0 | 0.0 | 0.3 | 0.9 | 1.2 | 1.3 |

| others | 0.0 | 0.0 | 0.1 | 0.1 | 0.2 | 0.0 |

| PBT | 3.6 | 3.6 | 3.0 | 3.4 | 13.6 | 3.5 |

| Investment hldg | 0.4 | 6.6 | 0.6 | 0.3 | 7.9 | (0.7) |

| Furniture (a) | 2.7 | 4.9 | 3.3 | 2.0 | 12.9 | 3.2 |

| Packaging (b) | 0.6 | 0.6 | 0.4 | 0.4 | 2.0 | 0.5 |

| Rubber wood (c) | 0.7 | (0.9) | (0.1) | 2.1 | 1.8 | 1.2 |

| Renewable (d) | 0.2 | (0.8) | (0.4) | (0.8) | (1.8) | (1.1) |

| others | 0.3 | 0.2 | 0.3 | 0.2 | 1.0 | 0.2 |

| Inter co elimination | 0.0 | (8.3) | (1.3) | (0.6) | (10.2) | 0.0 |

| Taxation | (0.9) | (0.9) | (0.5) | (0.8) | (3.1) | (1.4) |

| PAT | 2.7 | 2.7 | 2.5 | 2.6 | 10.5 | 2.2 |

| MI (e) | (0.6) | (0.2) | (0.3) | (0.9) | (1.9) | (1.0) |

| Net profit | 2.2 | 2.5 | 2.2 | 1.7 | 8.6 | 1.2 |

Comments :-

(a) On average, the furniture division reported PBT of RM3.2 mil per quarter.

(b) On average, the packaging division reported PBT of RM0.5 mil per quarter.

(c) The rubber wood division's performance was erratic. Profitability fluctuated between loss of RM0.9 mil and PBT of RM2.1 mil in FY2014.

(d) The renewable energy division (acquired in 2012) dragged down the group' overall performance with total loss before tax of RM1.8 mil in FY2014 and LBT of RM1.1 mil in Q1 of FY2015.

(e) It is likely that high minority interest (for example July and October 2014 quarter MI of RM0.9 mil and RM1.0 mil respectively) was due to strong performance of the rubber wood processing division. Jaycorp only owns 51% of the Indonesia based rubber wood manufactruing subsidiary.

Growing Through Mergers & Acquisitions

The Jaycorp group has a tradition of inorganic growth by taking over industry peers.

In 2000, the group acquired Winshine Industries Sdn Bhd, a rubber wood furniture manufacturer. They successfully turned Winshine around to become an exporter of dining sets to North America. Winshine was given an award by Walmart in 2005 for its good performance.

In 2007, Jaycorp acquired 60% equity interest in Digital Furniture Sdn Bhd which manufactures dining sets and bedroom sets. Post acquisition, Digital Furniture has contributed to group turnover and profitability.

On 12 February 2015, Jaycorp announced that it had entered into a Subscription Agreement to subscribe for 51% equity interest in Instyle Sofa Sdn Bhd (“ISSB”) for RM4.2 mil. Subsequent to the Subscription, ISSB becomes a 51%-owned subsidiary of Jaycorp.

ISSB is principally engaged in manufacturing of sofa sets, bed sets, chairs and upholstery works.

Rationale given by the company is as follows :-

"The Subscription will be strategic and beneficial to Jaycorp Group's furniture division as it provides an opportunity for Jaycorp Group to tap onto ISSB’s expertise and diversify into new export market segments such as sofa and non rubberwood furniture products.

The company believes that the prospect of the furniture industry is bright and still growing. The Malaysia furniture export for the nine months from January 2014 to September 2014 was RM5,904.8 million, a 11.9% growth compared to the same period last year. Increased demand from major export destinations such as the US, Japan and Australia for Malaysian-made furniture contributed to higher output.

Therefore, the investment in ISSB provides an opportunity for Jaycorp Group to seek out new markets in the furniture industry to maintain financial growth. "

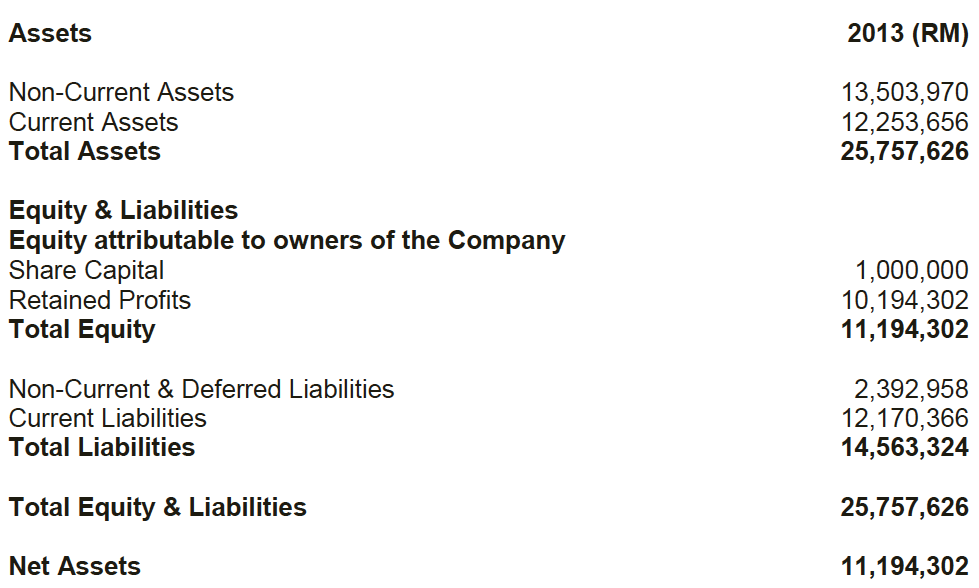

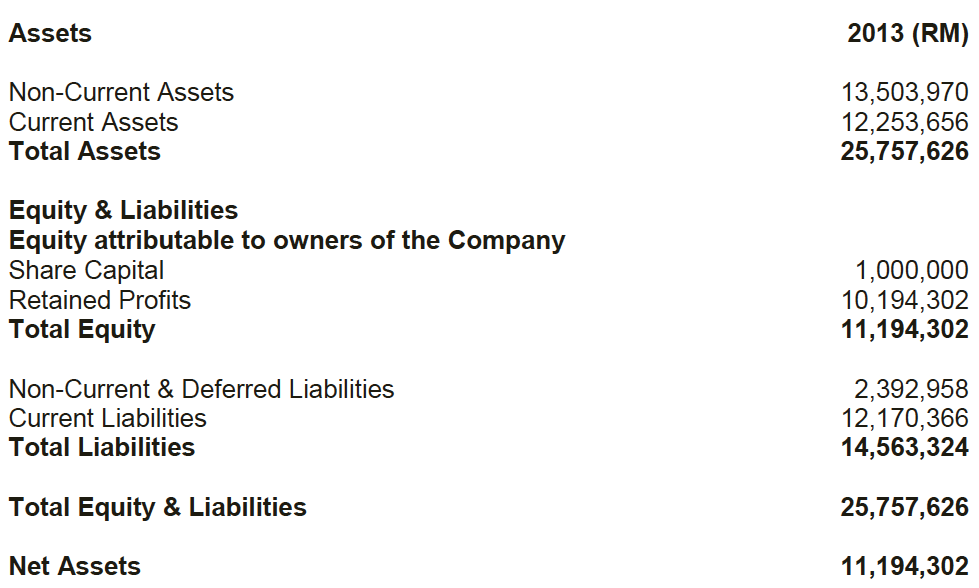

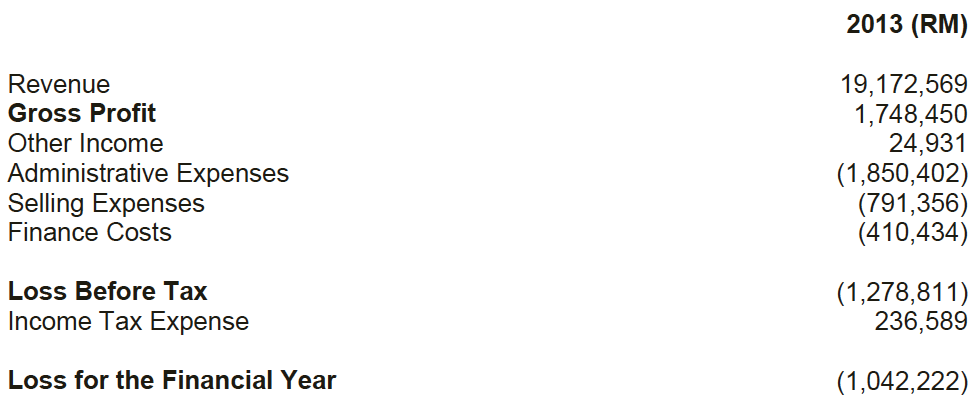

ISSB has a respectable size of operation with total assets of RM25.8 mil.

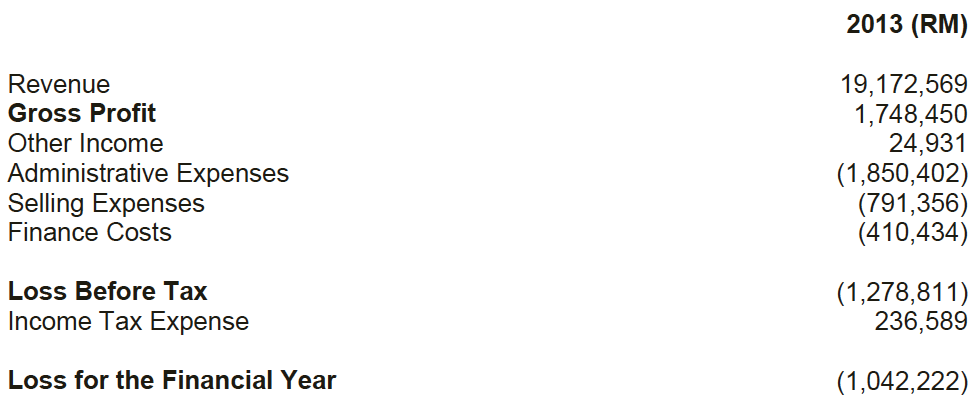

In 2013, ISSB reported revenue of RM19.2 mil and loss of RM1.0 mil.

In my opinion, we should not be unduly worried about Jaycorp buying into a loss making entity. The merger should create a lot of synergy for both parties. ISSB could tap into Jaycorp group's resources, financial strength, marketing network, etc to enhance its performance. I anticipate ISSB to turn around quickly after being incorporated into the Jaycorp group.

Concluding Remarks

(1) Anybody who buys into Jaycorp probably likes its high dividend yield of 4.8% (3 years in a row). PE wise, the stock doesn't look undervalued (approximately 12 times).

(2) However, upon closer inspection, the group's profitability has been dragged down by the renewable energy division. Improvement of this division's performance will quickly increase the group's overall profit.

(3) The company has just acquired 51% equity interest in a sofa manufacturing company (ISSB) through subscription of new shares.

I am positive about the transaction. ISSB's size of operation is quite respectable. Instead of starting from scratch, the acquisition will allow Jaycorp to scale up its operation quickly to take advantage of business opportunities presented by the existing favorable operating environment.

By leveraging on its resources, expertise and marketing network, Jaycorp should be able to turn ISBB around pretty quickly. This new asset could be a material source of growth for the coming few quarters.

(4) Last but not least, the Ringgit is now at 3.73 vs the US dollars. The coming quarter results (to be released over next two weeks) should reflect the positive impact of the strong US dollars.

没有评论:

发表评论