Mass Rapid Transit Corporation Sdn Bhd (MRT Corp) Strategic Communications and Stakeholder Relations director Datuk Najmuddin Abdullah said construction works on the Sungai Buloh-Serdang-Putrajaya (SSP) Line will begin aggressively following the ground-breaking ceremony. Sam Tham/The Star

KUALA LUMPUR: The ground breaking of the RM32bil mass rapid transit (MRT) Sungai Buloh-Serdang-Putrajaya (SSP) line today marks another milestone for Greater Kuala Lumpur to achieve 40% of public transport model share within the next 15 years.

As at the end of last year, the city’s public transport model share stood at 25%.

The SSP line is the second of three MRT lines planned to promote the use of greener public transport systems for the capital.

The first MRT line, the Sungai Buloh-Kajang (SBK), which is being built at a cost of RM23bil, is now 89% completed.

“SSP line will have greater daily ridership of 530,000 people, while SBK line will see daily ridership of 440,000 people,” MRT Corp director of strategic communications and stakeholder relations Datuk Najmuddin Abdullah told a briefing.

Najmuddin said the tender process of the SSP line was still ongoing, with 23 work packages already awarded to date.

The total length of the SSP line will be 52.2km, with 13.5km underground portion. The line will have a total of 24 stations, of which 11 stations will be underground.

“The development of this SSP line is very crucial to the sustainable growth of Kuala Lumpur. All three MRT lines will be the main arteries or backbones of the city’s public transport system, which also includes light rail transit, monorail and KTM Komuter.

“The SSP line will provide accessibility and ridership primarily to job catchment areas, commercial, residential, education and recreational,” he said.

Updating reporters on the development of the SBK line, Najmuddin said the metro is on track to start its first phase of operation in December.

“The entire line will be ready for the public by July next year. So far, we have kept the development cost within the budgeted estimation.”

Both the SBK and SSP lines will be supported by 58 train sets for each line.

On the circle line, Najmuddin said the development timeline would be more definite once the engineering feasibility study is completed. “Based on our experience, the circle line is expected to be mostly underground,” he said.

Prime Minister Datuk Seri Najib Tun Razak will be officiating at the ground breaking ceremony of the SSP line today, which will mark the commencement of the construction of the second MRT line in the country.

Masteel Factories:

Wisma Masteel, Lot 29C, Off Jln Tandang, Section 51, 46050 Petaling Jaya, Selangor Darul Ehsan Office, factory and warehouse 33 years Leasehold for 99 years expiring on 15.04.2067 130,897 sq. ft. (63,187 sq. ft.) Land – 8,764 Building – 1,482 30.09.2005

Lot 29B, Off Jln Tandang, Section 51, 46050 Petaling Jaya, Selangor Darul Ehsan Factory 7 years Leasehold for 99 years expiring on 15.04.2067 110,425 sq. ft. (69,960 sq. ft.) Land – 7,907 Building – 2,972 22.12.2009

Lot PT 20299, Jln Waja, Bukit Raja Industrial Estate, 41050 Klang, Selangor Darul Ehsan Office, factory and warehouse 15 years Leasehold for 99 years expiring on 03.12.2111 1,562,266 sq. ft. (187,220 sq. ft.) Land – 50,380 Building – 25,582 30.09.2005

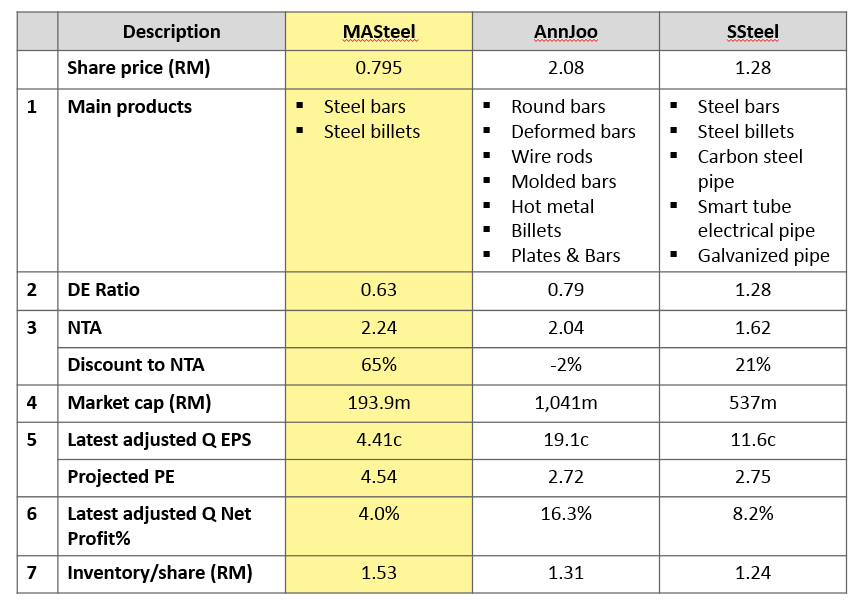

Company Profile

Malaysia Steel Works (KL) Bhd factories are located strategically at Petaling Jaya and Bukit Raja, Klang in the state of Selangor.

The Bukit Raja factory produces steel bars, steel billets which are the feed stock for the rolling mill in Petaling Jaya. Both the manufacturing plants are equipped with modern equipment and are fully computerised to produce precision quality products from both the mills.

The principal activities of Masteel is in the manufacturing and marketing of high tensile steel bars, mild steel bars and prime steel billets. Masteel has a wide network of customers domestically as well as internationally.

The finished products manufactured by Masteel conforms to those required by SIRIM (MS 146:2000) as well as the ISO 9001 standards.

Malaysia Steel Works (KL) Bhd factories are located strategically at Petaling Jaya and Bukit Raja, Klang in the state of Selangor.

Malaysia Steel Works (KL) Bhd factories are located strategically at Petaling Jaya and Bukit Raja, Klang in the state of Selangor.