--本集团本季营业数为1490万令吉,相比去年涨幅大幅增长

288%(1160万令吉),相比去年季度为384万令吉,

本季度报告显示,制造商的机器销售额激增,

智能设备和汽车行业都满足其生产需求。

其他营业收入的增加归因于其他投资的公允价值调整

其他营运费用减少则由于外汇损失减少所致,

根据全球对LED产品的需求,董事会预计下來季度将会维持盈利.

--冷眼持有3000,000股为第9大股东.

--公司于31-3-2017的定存与現金有2021万,无借款,每股净现金达12.39仙

库存价值达1044万.

--公司主要负责LED和半导体工业自动化系统和机械的设计和制造,

LED的需求日益增加,例如智能手机、家电、汽车等.

--公司旗下有30%产品卖给汽车领域,另外30%卖给智能手机领域,其余则是卖给一般的照明业者

--该公司有60%的产品供出口,特别是欧美国家,其余份额则是迎合国内跨国企业的需求。

公司Roe 达31,87是隆市中少见,前景光明。

估计全年EPS=12SEN,PE=20,股价=RM2.40

--Mmsv: 0113 短期2元,長期3元,公司基本面佷好,业务处成長趋势,净利增長中,

配合公司本身企业目的,技术面也处向上走势,買入与守住为良策。

--LED在汽车照明中的应用日渐增多,从最初的汽车内部照明应用,跨越到了前照大灯及组合尾灯等更宽广应用。特别是由于尺寸小,LED能够配合丰富的形状和线条变化,有助提升车灯辨识度,被指定用于众多中高档车的前照灯系统,配合漂亮的外观造型设计。未来,随着技术与市场不断提升,LED在汽车照明领域应用将会得到更广泛全面。

--最省电的是LED大灯,又亮又省电是LED大灯最显著的特点。LED大灯的发明灵感来源于荧火虫,一只荧火虫在夜晚自己发光,不须通电也不须烧油,你说省电不?因此,LED技术被称为第三次照明革命,未来我们家庭用灯也会普及LED。

--台湾LED行业已有19家企业相继披露了2017年上半年业绩预告,

其中有13家企业预计净利润同比实现增长.LED车灯渗透率将持续上升.

Based on MMSV's daily chart above, MMSV broke the bullish flag pattern and formed a new high today. If you look at the chart above carefully, you might notice the flag pattern just keep repeating itself many times since 2017.

MMSV has been trending up nicely since this year and move in-tandem with PENTA, another multi-bagger which I first analyzed it here and updated subsequently. Since they are both test equipment makers and are benefiting from the strong boom of the semiconductor industry, the in sync movement is not unexpected.

Based on the flag projection, the immediate target price is 1.80. A trailing stop to ride the nice uptrend could be a good option.

I am bullish on MMSV as long as it is staying above 1.50.

g)Monday, 13 March 2017

Read more at http://www.thestar.com.my/business/business-news/2017/03/13/mmsv-eyes-doubledigit-growth/#pbZY7g2GOshEkKW0.99

The Edge Malaysia

March 29, 2017

AMID the rally in semiconductor stocks, MMS Ventures Bhd (MMSV) has largely gone unnoticed due to its listing on the ACE Market. Many large funds simply do not have the mandate to take positions in ACE Market stocks.

Even with a 27% rally in its share price over the past two weeks to 75 sen per share last Thursday, MMSV is valued at only 12.6 times earnings. In contrast, larger semiconductor stocks like Globetronics Technology Bhd and Inari Amertron Bhd are valued at 52.8 times earnings and 21.65 times earnings respectively.

But MMSV may soon shed its ACE Market discount.

“We hit the net profit requirement back in 2015. We only need three years cumulative net profit of RM20 million to qualify for a promotion to the Main Board. It is something that we are planning. If all goes well, we might be on the Main Board by the third or fourth quarter,” says chairman and managing director Sia Teik Keat, adding that the final decision lies with the Securities Commission Malaysia.

With a cumulative net profit of RM33.08 million over the past four years, MMSV should not have a hard time securing SC’s approval.

Furthermore, Sia expects MMSV’s 1H2017 net profit performance to further build a case for promotion to the Main Board.

“Barring any unforeseen circumstances, we anticipate that earnings will be at least 20% higher in the first half,” he says.

MMSV booked a 13.7% year-on-year increase in revenue to RM35.6 million for the financial year ended Dec 31, 2016. Meanwhile, net profits rose by 17.8% y-o-y in the same period to RM9.52 million.

A 20% increase in net profits for FY2017 would translate into an earnings per share of 7.1 sen. In turn, that values the company at only 10.5 times forward earnings.

Sia is able to speak confidently about earnings prospects because the project-based nature of the group’s core operations offers earnings visibility.

MMSV produces testing and inspection equipment for LEDs, specifically, for smart devices, the automotive industry and general lighting as well. The inspection equipment has to be ordered by LED manufacturers ahead of a new product cycle.

New features are expected in this year’s line-up of smartphones — expecially Apple’s 10th anniversary iPhone 8 — that will act as a catalyst for semiconductor companies such as MMSV.

This year, Sia says orders from new customers as well as MMSV’s diversification into wafer inspection equipment will drive earnings growth.

“We managed to secure some new clients for our visual inspection equipment this year. On top of that, our wafer inspection is still on a low base. We have only received orders for the first few units; we expect this segment to grow,” he explains.

Sia says MMSV diversified last year into inspection machines for the LEDs semiconductor wafers — thin slices of crystalline semiconductor material.

“The degree of difficulty for wafer inspection is much higher. It is a high value machine that commands higher margins. It also has less competition.”

The group’s venture into wafer inspection is a direct result of research and development investment over the years, he adds. For now, MMSV has secured two customers for the wafer inspection machines, but expects the business to grow because the platform for the machines is relatively universal.

The main driver of MMSV’s earnings however, will continue to be the visual and inspection equipment for LEDs.

“One of our key products are visual inspection machines to inspect lenses for the flash in smart devices. Our clients include the top four LED makers in the world,” says Sia.

Currently, the smart devices segment makes up about 40% of profits. Automotive makes up about 25% while 10% comes from general lighting.

Going ahead, however, Sia anticipates more sales in MMSV’s smart devices segment that will increase its contribution to profits to 55%.

“Our automotive segment has a lower volume, but much higher margins. This is because automakers have longer product cycles and tight tolerances for quality. Smart devices have much higher volume, because phone makers are constantly launching new products. However, it is also more competitive, so margins are a little lower,” he notes.

Sia claims MMSV’s technology is on a par with its Taiwanese peers. However, MMSV boasts a cost advantage, with a substantial portion denominated in ringgit. Meanwhile, the bulk of MMSV’s earnings are in US dollars.

“We have been doing this for about 20 years and have a strong pool of technical expertise. Japan, for example, is ahead of us. But they are more expensive as well,” he says.

Between higher profits and the possibility of a Main Board listing, MMSV will certainly be an interesting stock to watch this year. However, it is also interesting to note that beyond the improved profile, the company does not have much need to move to the Main Board.

Specifically, MMSV does not need a transfer to the Main Board to raise funds. The group is currently sitting on cash of RM17.8 million and has zero borrowings. That translates into a net cash per share of 11.1 sen.

“MMSV has about 1.9 million treasury shares as we do buy backs from time to time when the share price is low. We will be able to place these shares out to funds interested to take a position in the company. However, we have no intention for now to place out new shares to raise funds. We have enough cash,” Sia says.

Another option would be for the company’s major shareholders to place out their shares. Sia himself has a 22.6% stake in the company.

For now, MMSV does not have any immediate plans to reinvest the large cash pile to scale up the business. Sia is content to place the funds into investments like unit trusts and the equity market for the time being, while seeking acquisition opportunities that can create synergy with MMSV.

There are no immediate plans to boost dividend payments either, says Sia, who is content to maintain the existing payout ratio in excess of 30%.

288%(1160万令吉),相比去年季度为384万令吉,

本季度报告显示,制造商的机器销售额激增,

智能设备和汽车行业都满足其生产需求。

其他营业收入的增加归因于其他投资的公允价值调整

其他营运费用减少则由于外汇损失减少所致,

根据全球对LED产品的需求,董事会预计下來季度将会维持盈利.

--冷眼持有3000,000股为第9大股东.

--公司于31-3-2017的定存与現金有2021万,无借款,每股净现金达12.39仙

库存价值达1044万.

--公司主要负责LED和半导体工业自动化系统和机械的设计和制造,

LED的需求日益增加,例如智能手机、家电、汽车等.

--公司旗下有30%产品卖给汽车领域,另外30%卖给智能手机领域,其余则是卖给一般的照明业者

--该公司有60%的产品供出口,特别是欧美国家,其余份额则是迎合国内跨国企业的需求。

未来,公司将以半导体和LED配件机械一站式解决方案供应商的身分,继续搭乘该领域的增长势头。

--2017首季EPS=2.55SEN,净利410万,营业数为1490万,赚副达27.5%,为历史高位,公司Roe 达31,87是隆市中少见,前景光明。

估计全年EPS=12SEN,PE=20,股价=RM2.40

--Mmsv: 0113 短期2元,長期3元,公司基本面佷好,业务处成長趋势,净利增長中,

配合公司本身企业目的,技术面也处向上走势,買入与守住为良策。

--LED在汽车照明中的应用日渐增多,从最初的汽车内部照明应用,跨越到了前照大灯及组合尾灯等更宽广应用。特别是由于尺寸小,LED能够配合丰富的形状和线条变化,有助提升车灯辨识度,被指定用于众多中高档车的前照灯系统,配合漂亮的外观造型设计。未来,随着技术与市场不断提升,LED在汽车照明领域应用将会得到更广泛全面。

--最省电的是LED大灯,又亮又省电是LED大灯最显著的特点。LED大灯的发明灵感来源于荧火虫,一只荧火虫在夜晚自己发光,不须通电也不须烧油,你说省电不?因此,LED技术被称为第三次照明革命,未来我们家庭用灯也会普及LED。

--台湾LED行业已有19家企业相继披露了2017年上半年业绩预告,

其中有13家企业预计净利润同比实现增长.LED车灯渗透率将持续上升.

--因而更加確定这行业的增长潜力.公司LED测试机械会增长.

--MMSV 0113 个人看作是类似 VITROX 0097 的走势翻板.

--Jhm,vitrox,elsoft 都分红股了,虽还会上但相对动力小,看好mmsv 0113配合转主板,

业积持续增長下,其股价动力十足,rm2 己是肯定的了。

--

--MMSV 0113 个人看作是类似 VITROX 0097 的走势翻板.

--Jhm,vitrox,elsoft 都分红股了,虽还会上但相对动力小,看好mmsv 0113配合转主板,

业积持续增長下,其股价动力十足,rm2 己是肯定的了。

--

X

http://www.cnbc.com/2017/07/21/valeo-earnings-q2-2017.html

Mmsv :生产,硏发,测试Led(发光二极管)与半导体自动化器材,公司出口市塲包括美国,,亞洲,大马,

。

http://www.cnbc.com/2017/07/21/valeo-earnings-q2-2017.html

Mmsv :生产,硏发,测试Led(发光二极管)与半导体自动化器材,公司出口市塲包括美国,,亞洲,大马,

澳洲,欧洲,因此可受惠其中。

。

个人观点与功课,買賣自负.

http://www.evolusystech.com/

相关资料:

http://www.malaysiastock.biz/Corporate-Infomation.aspx?securityCode=0113

http://klse.i3investor.com/servlets/stk/0113.jsp

相关资料:

http://www.malaysiastock.biz/Corporate-Infomation.aspx?securityCode=0113

http://klse.i3investor.com/servlets/stk/0113.jsp

a)科技股长期潜能可期

全球科技股今年成绩骄人。年初迄今美国科技股大涨20%,在标普500指数表现前20佳股票中囊括10席,亚洲科技股涨幅更高达37%,跑赢MSCI亚洲(日本除外)指数达14个百分点。

然而,随着股价节节上升,投资者不禁开始担心互联网泡沫会不会卷土重来。

今年6月科技股出现一波明显震荡,导致市场对於科技股可能崩盘的隐忧进一步加剧。虽然科技股沽压似乎是投资者套利并转战走势落後的补涨股所引起,而不是基本面发生变化,但投资者对科技板块长期前景的担心并未消退。

毕竟,股价已经涨至纪录高位,股价有涨必有跌──至少理论上来说是如此。

科技业不只是软件硬件

然而,我们认为,驱动科技股的因素将不同於其他板块。其中一个主要原因在於科技行业不再只是软件与硬件,而是深入我们的日常生活,像是亚马逊(Amazon)丶苹果(Apple)以及其他消费性科技企业等在便利店丶汽车丶电子钱包丶旅店等领域无所不在。社交媒体与电子商务平台的用户动辄以亿计。

科技已经演变至跨行业发展,而由传统营运商手中抢占市场份额的争夺战才刚刚开始。评估科技行业快速崛起以及预测其未来走向的时候,分析其短期与长期潜力就显得极为重要。

科技行业盈利增长突出

近期科技股下跌可能仅是短暂现象。需求面与企业基本面依然稳健,这从近期大型软件公司公布的财报都十分强劲可得到证明。

虽然过去几年科技股的估值持续走高,但还没有到15至20年前那样的极端水平。以市场平均预估盈利计,当前全球科技股的市盈率在18.5倍,与2000年时的峰值55.1倍不可同日而语。目前美国科技股相对於标普500指数的溢价仅为5%,远低於20年均值25%。此外,FAAMG(Facebook丶亚马逊丶苹果丶微软以及谷歌)合计市盈率仅为22倍,距离互联网泡沫时期的58倍还差得很远。

大型科技股的增长速度明显超过平均水平,而且提供优厚的现金分红。更重要的是,大多数周期性因素以及长期盈利驱动因素都还在健康发展。为取得云端架构先机,企业纷纷增加支出。

互联网广告继续从传统媒体平台争得市场份额。虽然智能手机终端市场似乎已经饱和,但是大多数相关股票的估值相对整体科技板块处於折让。总而言之,全球科技行业盈利增速将超越大型股份,今明两年将以两位数的增幅傲视群雄。

考虑到目前股市处於经济增长全面复苏的周期,短期内板块轮动仍可能有利於价值股和补涨股,然而,在稳固的产品周期以及企业IT支出增长的推动下,科技行业基本面持续走强,未来股价前景依然可期。

b)网友bpng分享:

b)So many ppl are saying good news on this stock.

HITnRUN bro said coming QR is the highest ever in the mmsv history in terms of revenue, profit, eps.....very good bussiness outlook for Q3 & Q4...

Then, Chelsea bro said Coming EPS is around 5.5 to 5.76. It easily hit RM2.

And Berkshire bro said Director of MMSV, Mr Tan has acquired another 130k of MMSV share at 10 Jul, with price range 1.47 -1.51 on that day. Still doubt on the coming results?

Ok lo, since so many ppl are optimistic on this stock, I think we should do some simple calculations to see if that is true. Afterall, the KLCI is on downtrend leh. Referring to the below article from the Star: http://www.thestar.com.my/business/business-news/2017/06/05/chip-test-equipment-makers-remain-bullish/

50 units equipment were delivered to client as of June 5, 2017 and 20 units to go before end of June, meaning 70 units in the 1H2017. Each unit can sell between 100k to 220k USD. So, for simplicity, I take the average which is 160k USD. 1H2017 revenue should be 70 unit * USD 160k/unit * RM 4.25/USD = RM 47.6mils. Q1 reported revenue is 14.9mils, so Q2 revenue should be 32.7mils. The average past 4 quarters profit margin for MMSV is 26.625%. Hence, 32.7mils * 0.26625 = 8.7mils. WOW, that is fantastic man. It is equivalent to 5.34 EPS. Seems like HITnRUN bro and Chelsea bro are right.

Ok, next, 30 to 40 units to be delivered in the 2H2017 as of June 5, 2017. That is assuming no more additional order coming till the end of 2017, which I think should be quite conservative. So, total 110 units in 2017. If you repeat the steps above, you will get RM 74.8mils revenue and 19.92mils net profit for whole year 2017! The best result ever.

Finally, let us see what should be the fair price. 19.92mils is 12.22 EPS. If we use PER of 15, MMSV worths RM 1.83, slightly less than Chelsea bro TP of RM 2. Nevermind, if let says MMSV can transfer to Mainboard due to all these excellent results, they should demand higher PER. Considering PER of 20, the share price should be 12.22 * 20 = RM 2.44!! Awesome.

In the end, we don't know what is the actual result until the company publishes it. What do you think?

c)mmsv可受惠其中。

LEDinside: 車用LED市場需求帶動2017-2021 全球LED市場產值

2017-03-13

2017年的LED產業受惠於LED市場價格止穩,加上車用照明領域的快速成長,LEDinside預估2017年的車用LED產值達到28.17 億美金 (+14.8% YoY)。相對而言2015年至2021年,整體LED產業的年複合成長率僅3%的成長幅度。LED產業的幾項主流應用包括手機應用,中大尺寸面板背光等應用,將因OLED的崛起而逐年下滑。至於LED照明雖然已經是LED產業的最大宗應用,但由於滲透率飽和以及競爭者眾,使得整體產值出現成長趨緩的狀態。但由於各家LED廠商紛紛投入汽車照明,以及小間距顯示屏領域,因此整體的市場仍呈現增長態勢。

LEDinside 分析車用市場主要成長動能:

一、中國車市持續成長

整體車市受到國際政治板塊不確定性影響,以及對於未來經濟走勢悲觀的心理預期,2016年整體新車銷售量僅微幅增加。然而從個別區域來看,北美乘用車銷售出現下滑情形,石油减産的效益並未能刺激新車銷售量;歐洲地區也因為英國脫離產生的不確定性,讓市場買氣縮手;亞洲市場表現亮眼,中國一線城市雖然持續推出限購令,但受到中國國內産業升級的影響,成長幅度已不如過去

二、頭燈與霧燈導入滲透率提升

頭燈與霧燈市場依然是最主要高功率LED成長動力來源,再加上亮度與門檻都較高,滲透率基期也較低,預估頭燈與霧燈滲透率分別為12%與16%,2015~2020年的產值年複合成長率將達到18%與15%,在各種車外應用上,排名在前兩名,未來後勢看好

三、產品設計提升車用LED市場需求

因應導光板在尾燈的導入比例拉高,因此提高LED在尾燈總成的使用顆數。隨著車輛智慧化與多媒體的功能逐漸增加,包括車內智能後視鏡等功能的導入,可减少死角的問題並提升駕駛安全性,未來兩年將有機會列入車輛標準配備,增加車用鏡頭與面板的使用量,可預期的未來五年內,車用面板依舊是車內成長最爲快速的應用,預估2021年產值將迅猛增長達到1.73億美金 (2016~2021 CAGR:26%)

四、保險市場改善提升售後市場品質

隨著美國保險市場對於供應多元化的要求增加,使得過去以CAPA獨大的局面逐漸被打破,NSF也逐漸拓展美國市場滲透率,使得後裝市場更加熱絡,對於成本控管的要求也逐漸反映在供應鏈。

d)

上週五(6/9)晚上,相較於英國的大選結果出爐,我想更重要的事,就是打開看盤軟體或網頁,結果道瓊工業指數上漲,象徵科技類股的「那斯達克竟然是大跌的」,S&P500也是漲的,直到午盤後才翻黑。

一般來說美股這三大指數相關性很高,漲跌類似,方向偶有不同但不會差異太大。

但上週五確實發生那斯達克幾家大公司少見的長黑,影響了整體科技類股的連帶殺盤。

臉書(股票代號:FB):跌幅3.3%

蘋果(股票代號:AAPL):跌幅3.88%

Google(股票代號:GOOG):跌幅3.41%

微軟(股票代號:MSFT):跌幅2.27%

亞馬遜(股票代號:AMZN):跌幅3.16%

蘋果(股票代號:AAPL):跌幅3.88%

Google(股票代號:GOOG):跌幅3.41%

微軟(股票代號:MSFT):跌幅2.27%

亞馬遜(股票代號:AMZN):跌幅3.16%

請注意!這是收盤的跌幅,收了長長的下引線,也就是說,盤中的賣單力道極為龐大,若不是拉尾盤的關係,跌幅會更驚人。下圖為科技類股五大龍頭與SPY當日走勢比較圖:

什麼原因導致這次的科技股殺盤?被放空機構盯上?

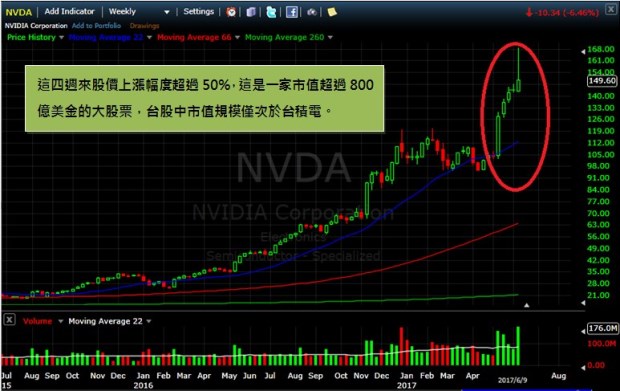

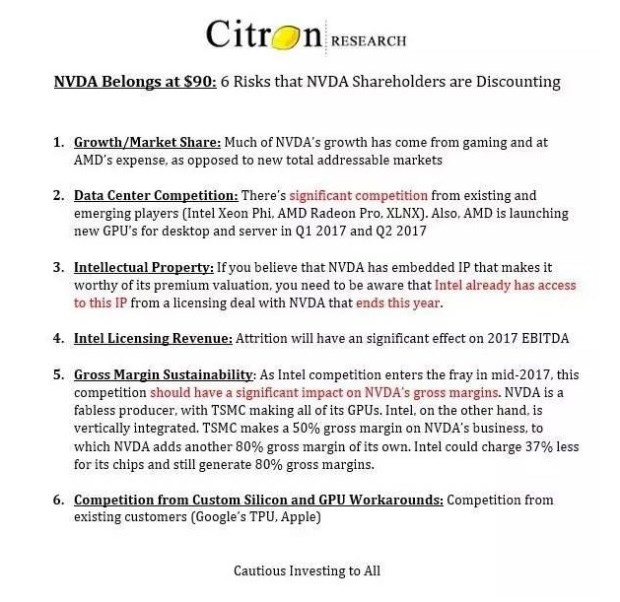

有一說是NVIDIA輝達(股票代號:NVDA)被某家放空機構發布了狙擊的評等......

做空機構Citron Research說:NVIDIA股價將跌回130美元。

他們預計,NVIDIA股價將跌回130美元。該機構聲稱,近期NVIDIA的上漲是「瘋狂的賭場行為」。這是一家偉大的公司,但是漲幅實在太不合理了!市場上的交易員們都喪失了自制力,才造成了這個誇張的價格!

光一個星期,NVIDIA大漲14%,過去一個月來,股價大漲59%,下圖為NVIDIA(股票代號:NVDA)週線圖:

當然這是他們單一的說法,畢德歐夫找到該機構在去年底就看空NVIDIA(股票代號:NVDA)如下圖:

而去年底的時候NVIDIA(股票代號:NVDA)股價為106.7左右,他們認為90才是合理價格......

2017年的現在,結果相當明顯,相信他們的客戶,都被軋爆了......因為NVIDIA(股票代號:NVDA)股價最高上漲到168,週五收在149.6......

所以週五的殺盤若是因為這家研究機構發布的報告導致,那這段跌幅在幾週內極可能很快收復。

蘋果新機出問題了,所以連帶台積電ADR也大跌!

另一說是蘋果(股票代號:AAPL),美國媒體Business Insider報導說:今年下半年將推出的iPhone手機上網的技術會慢於對手很多倍!

報告提到最新一代的無線網絡速度最快可以達到1千兆(Gigabit),比當前的速度要快了約100倍。

蘋果在最新款的iPhone手機上和英特爾(股票代號:INTC)合作,配置了該公司生產的無線網絡技術晶片技術,但英特爾並不能實現最新的無線上網速度。

而競爭對手高通(股票代號:QCOM)則可以提供更快網速的晶片技術,蘋果的最大競爭對手三星在今年推出的Galaxy S8,早就配備了高通生產的這個關鍵晶片技術。

正在和高通處於法律糾紛的蘋果,很明顯想要分散單一供應商(不想只看高通的臉色),這意味著有些蘋果手機將能夠達到最快網速,有些則不能。

為確保所有的出貨手機都是公平而一致,所以即便是配備了高通的晶片,蘋果也會關掉這個強大的上網功能。

消息一發布後,蘋果股票最低一度大跌5.78%,終場跌3.88%,收在148.98美元,市值瞬間蒸發400億美元。(中華電信目前市值約280億美元。)是的,相當於1.4家的中華電信就這樣消失了。

而英特爾(股票代號:INTC)股價收-2.11%,高通(股票代號:QCOM)股價收-1.84%。值得一提的是台積電(股票代號:TSM)也重挫將近3%。下圖為台積電ADR上週五走勢圖:

市場派如何解讀這根長黑?

或許是因為多頭走太久了,也很久沒看到像樣的跌勢,市場的波動率破了新低,這在兩週前的專欄已經提醒了讀者,當波動率低到這麼離譜的地步,搭配第二季即將結束,很可能發生大波動,並且讓短線投資人重創。科技股與標普500指數再過歷史新高,VIX卻創下一年新低,我們該如何解讀?

在大多頭走勢中,緩漲急跌是常見的現象,也因此以下兩種投資人會賺最多錢:

第一、奉行拉回就是買點的膽大新手

第二、持股一路創新高,並且持續加碼的老手

第二、持股一路創新高,並且持續加碼的老手

當然有沒有人買了股票,忘了看盤,一放就好幾年,之後發現大賺的?當然也是有,不過這是少數,我們就先不討論了。

高盛在上週五開盤前有發布了一份報告,大意差不多就是:「簡稱FAAMG的五大科技股——Facebook、亞馬遜、蘋果、微軟和谷歌對美股影響太大,又波動率偏低,導致投資者低估司五家科技公面臨的風險,一旦形勢有變,風險就會加劇。」

有人把上週五的大跌都怪在高盛(股票代號:GS)盤前發布的這份報告,或許是有點牽強,因為高盛(股票代號:GS)從金融海嘯之後,其實影響力也衰退不少。

況且現在投資銀行跟2008年之前,完全不能比較了,當初真的可以喊水會結凍......

那既然這樣,上週五科技股到底跌些什麼?

跟人在紐約的基金經理人Wade交換了點意見,其實我們都認為這個下跌還算合理,況且之前科技類股也漲得十分誇張,亞馬遜(股票代號:AMZN)本益比目前183,相較於金融、基礎建設、生技,資金輪動到其他類股,還算正常。

手上持有這幾家科技類股的讀者,先盯緊季線,跌破先走一半,可保住到手的七八成獲利。至於之後,第三季的到來,你還要問些什麼呢?休息一下吧!

希望本週文章對你們有幫助,也請分享給更多朋友了解全球財經資訊,謝謝。

[快速結論]

這次的長黑不是用跳空呈現,對於多頭來說,視為緩漲急跌的拉回格局,未來如果不破季線,都不能算轉空。而蘋果的新機資訊,無人能一窺究竟,與其猜測無法掌握的,不如順從趨勢。

e)

近期S&P500財報 大型科技股表現相對亮眼

今年科技股成長的大局勢未變

f)

MMSV This Pattern Has Keep Showing Up For More Than Half A Dozen Since 2017 And It Is Here Again

Author: Ming Jong Tey | Publish date:

MMSV (0113): Bullish

Pattern: Bullish Flag Breakout

Based on MMSV's daily chart above, MMSV broke the bullish flag pattern and formed a new high today. If you look at the chart above carefully, you might notice the flag pattern just keep repeating itself many times since 2017.

MMSV has been trending up nicely since this year and move in-tandem with PENTA, another multi-bagger which I first analyzed it here and updated subsequently. Since they are both test equipment makers and are benefiting from the strong boom of the semiconductor industry, the in sync movement is not unexpected.

Based on the flag projection, the immediate target price is 1.80. A trailing stop to ride the nice uptrend could be a good option.

I am bullish on MMSV as long as it is staying above 1.50.

g)Monday, 13 March 2017

Read more at http://www.thestar.com.my/business/business-news/2017/03/13/mmsv-eyes-doubledigit-growth/#pbZY7g2GOshEkKW0.99

h)MMS Ventures eyes Main Board transfer in 2H:

Ben Shane LimThe Edge Malaysia

March 29, 2017

AMID the rally in semiconductor stocks, MMS Ventures Bhd (MMSV) has largely gone unnoticed due to its listing on the ACE Market. Many large funds simply do not have the mandate to take positions in ACE Market stocks.

Even with a 27% rally in its share price over the past two weeks to 75 sen per share last Thursday, MMSV is valued at only 12.6 times earnings. In contrast, larger semiconductor stocks like Globetronics Technology Bhd and Inari Amertron Bhd are valued at 52.8 times earnings and 21.65 times earnings respectively.

But MMSV may soon shed its ACE Market discount.

“We hit the net profit requirement back in 2015. We only need three years cumulative net profit of RM20 million to qualify for a promotion to the Main Board. It is something that we are planning. If all goes well, we might be on the Main Board by the third or fourth quarter,” says chairman and managing director Sia Teik Keat, adding that the final decision lies with the Securities Commission Malaysia.

With a cumulative net profit of RM33.08 million over the past four years, MMSV should not have a hard time securing SC’s approval.

Furthermore, Sia expects MMSV’s 1H2017 net profit performance to further build a case for promotion to the Main Board.

“Barring any unforeseen circumstances, we anticipate that earnings will be at least 20% higher in the first half,” he says.

MMSV booked a 13.7% year-on-year increase in revenue to RM35.6 million for the financial year ended Dec 31, 2016. Meanwhile, net profits rose by 17.8% y-o-y in the same period to RM9.52 million.

A 20% increase in net profits for FY2017 would translate into an earnings per share of 7.1 sen. In turn, that values the company at only 10.5 times forward earnings.

Sia is able to speak confidently about earnings prospects because the project-based nature of the group’s core operations offers earnings visibility.

MMSV produces testing and inspection equipment for LEDs, specifically, for smart devices, the automotive industry and general lighting as well. The inspection equipment has to be ordered by LED manufacturers ahead of a new product cycle.

New features are expected in this year’s line-up of smartphones — expecially Apple’s 10th anniversary iPhone 8 — that will act as a catalyst for semiconductor companies such as MMSV.

This year, Sia says orders from new customers as well as MMSV’s diversification into wafer inspection equipment will drive earnings growth.

“We managed to secure some new clients for our visual inspection equipment this year. On top of that, our wafer inspection is still on a low base. We have only received orders for the first few units; we expect this segment to grow,” he explains.

Sia says MMSV diversified last year into inspection machines for the LEDs semiconductor wafers — thin slices of crystalline semiconductor material.

“The degree of difficulty for wafer inspection is much higher. It is a high value machine that commands higher margins. It also has less competition.”

The group’s venture into wafer inspection is a direct result of research and development investment over the years, he adds. For now, MMSV has secured two customers for the wafer inspection machines, but expects the business to grow because the platform for the machines is relatively universal.

The main driver of MMSV’s earnings however, will continue to be the visual and inspection equipment for LEDs.

“One of our key products are visual inspection machines to inspect lenses for the flash in smart devices. Our clients include the top four LED makers in the world,” says Sia.

Currently, the smart devices segment makes up about 40% of profits. Automotive makes up about 25% while 10% comes from general lighting.

Going ahead, however, Sia anticipates more sales in MMSV’s smart devices segment that will increase its contribution to profits to 55%.

“Our automotive segment has a lower volume, but much higher margins. This is because automakers have longer product cycles and tight tolerances for quality. Smart devices have much higher volume, because phone makers are constantly launching new products. However, it is also more competitive, so margins are a little lower,” he notes.

Sia claims MMSV’s technology is on a par with its Taiwanese peers. However, MMSV boasts a cost advantage, with a substantial portion denominated in ringgit. Meanwhile, the bulk of MMSV’s earnings are in US dollars.

“We have been doing this for about 20 years and have a strong pool of technical expertise. Japan, for example, is ahead of us. But they are more expensive as well,” he says.

Between higher profits and the possibility of a Main Board listing, MMSV will certainly be an interesting stock to watch this year. However, it is also interesting to note that beyond the improved profile, the company does not have much need to move to the Main Board.

Specifically, MMSV does not need a transfer to the Main Board to raise funds. The group is currently sitting on cash of RM17.8 million and has zero borrowings. That translates into a net cash per share of 11.1 sen.

“MMSV has about 1.9 million treasury shares as we do buy backs from time to time when the share price is low. We will be able to place these shares out to funds interested to take a position in the company. However, we have no intention for now to place out new shares to raise funds. We have enough cash,” Sia says.

Another option would be for the company’s major shareholders to place out their shares. Sia himself has a 22.6% stake in the company.

For now, MMSV does not have any immediate plans to reinvest the large cash pile to scale up the business. Sia is content to place the funds into investments like unit trusts and the equity market for the time being, while seeking acquisition opportunities that can create synergy with MMSV.

There are no immediate plans to boost dividend payments either, says Sia, who is content to maintain the existing payout ratio in excess of 30%.

I)Monday, 5 June 2017