取全年eps=rm0.15 ,pe=10 (少少算),

股价都有rm1.50 ,估计Q2(8月),Q3(11月)会发各3 sen dividen ,dy=4.6% ,物有所值.

现RM1.24只是PE=8.2 倍在交易,明显被低估了,合理的PE=12,价位=RM1.80

Q1己有EPS=RM0,065

Q2+Q3+Q4 只要净利 EPS=RM0.085 ,每季净利850万(EPS=RM0.0283)

全年可有EPS=RM0.15

净利4500万,当然期待旦价回升,玉米价稳定,

公司一站式的经营模式很好.

供参考.

a)

联邦土地局合作社 减持潮成至4.84%

财经新闻 财经 2015-07-03 10:26

(吉隆坡2日讯)联邦土地局合作社(Koperasi Permodalan Felda)脱售潮成集团

(TEOSENG,7252,主板消费产品股)股权,减持至4.84%,不再是大股东。

根据文告,联邦土地局合作社是于上月29日,脱售该公司48万2300股,或相等于0.16%股权。

在4月时,该合作社也曾脱售100万股,将持股降至5%;经过这轮脱售后,持股减至1452万股,或

4.84%。

5年内专注永平业务 潮成拟2亿建5蛋鸡农场

B)2015-07-08 11:16

玉米价也会穩定下來,大老板的扩大产量计昼会使公司長远取得成長,此时rm1.24 是吸引人的价位.

http://bursadummy.blogspot.com/2015/07/teoseng-real-price-concern.html

股价都有rm1.50 ,估计Q2(8月),Q3(11月)会发各3 sen dividen ,dy=4.6% ,物有所值.

现RM1.24只是PE=8.2 倍在交易,明显被低估了,合理的PE=12,价位=RM1.80

Q1己有EPS=RM0,065

Q2+Q3+Q4 只要净利 EPS=RM0.085 ,每季净利850万(EPS=RM0.0283)

全年可有EPS=RM0.15

净利4500万,当然期待旦价回升,玉米价稳定,

公司一站式的经营模式很好.

供参考.

a)

联邦土地局合作社 减持潮成至4.84%

财经新闻 财经 2015-07-03 10:26

(吉隆坡2日讯)联邦土地局合作社(Koperasi Permodalan Felda)脱售潮成集团

(TEOSENG,7252,主板消费产品股)股权,减持至4.84%,不再是大股东。

根据文告,联邦土地局合作社是于上月29日,脱售该公司48万2300股,或相等于0.16%股权。

在4月时,该合作社也曾脱售100万股,将持股降至5%;经过这轮脱售后,持股减至1452万股,或

4.84%。

5年内专注永平业务 潮成拟2亿建5蛋鸡农场

B)2015-07-08 11:16

(麻坡7日讯)潮成集团(TEOSENG,7252,主板消费产品股)搁置在哥打丁宜双溪林桂的蛋鸡农场,并专注于发展峇都巴辖永平的5座新农场。

主席刘裕平日前出席股东大会后向媒体指出,据可行性研究显示,目前不是开发双溪林桂农场的良机。

“我们发现,若要增加鸡蛋的日产量,在永平设立新农场相对更符合成本效益,因与现有设施,如饲料厂和纸蛋托厂毗邻。”

他续说,未来4至5年,投资约2亿令吉兴建5个新蛋鸡农场。

鸡蛋产量上看500万

他指出,这有助公司成为国内最大的上市家禽公司。

“当永平新农场全面投运后,我们预测每日鸡蛋产量为350万粒,并在2018或2019年增加至500万粒。”

潮成集团目前在峇都巴辖有近20座农场和450万只鸡,新增5座农场后,将增至650万只鸡。

另一方面,董事经理蓝旭汕指出,凭借新农场,出口至新加坡的鸡蛋,将从目前30%至35%,提升至40%至45%。

他说,大马仍是主要的市场,加上近年来鸡蛋的价格在已稳定。

--个人浅见;Teoseng 近期下降其中一个原因,而旦价己下降许多,旦价在马來年后想信将回穩,玉米价也会穩定下來,大老板的扩大产量计昼会使公司長远取得成長,此时rm1.24 是吸引人的价位.

C)Teoseng: A Real Price Concern - Bursa Dummy

Author: Tan KW | Publish date: Thu, 2 Jul 2015, 10:25 PM

Thursday, 2 July 2015

There is little doubt that Teoseng is a successfully-run poultry company.

Its revenue and especially net profit, grew by leaps and bounds in the last 2 years.

Its FY14 ROE breaches 30.

It gives great dividends and bonus issue.

It has a 5-year plan to increase its chicken egg production capacity by 60% from 3.2 mil/day to 5.1 mil/day.

It plans to increase its export to Singapore from 30% to 40%.

Its first of five biogas plant to save cost is on track to be completed this year.

Its first of five biogas plant to save cost is on track to be completed this year.

It aims to be the largest egg producer in Malaysia in the future.

Despite all these positive notes, Teoseng's share price has been trending down since reaching a height at RM2.20 in end of Mac15 after bonus issue.

Currently it is trading at slightly above RM1.50 level, and failed to follow the spectacular rebound in KLCI in the past 3 days.

If we annualize FY15Q1's PATAMI of RM17.5mil, its shares are traded at projected PE of only 6.4x, and this company is still in expansion mode.

Why?

Is poultry theme play over?

How did Teoseng achieve such an impressive financial result lately? Its net profit jumps 180% in just 2 years.

Though Teoseng has several businesses such as poultry farming (layer), trading of animal health products, manufacturing of paper egg trays & poultry feeds, its poultry farming contributes 90% of its bottom line in FY14.

So, the vast improvement in its earning should be related to its poultry farming segment.

I'm not sure how much has Teoseng expanded its layer farms between 2012-2014. Increased egg production capacity will certainly contribute directly to its revenue and profit.

I feel that there should be some expansion but perhaps not that much.

So, the improvement in financial performance in the last 2 years should be largely due to lower material cost and higher egg selling price.

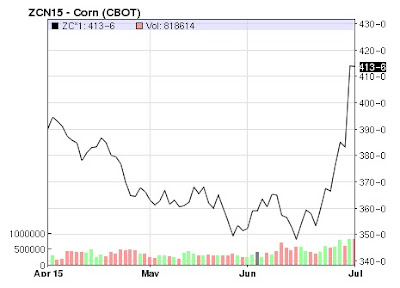

Feeds (corn/soybean) make up about 70% of layer farming's cost. From 2012 to 2014, corn price fell by more than 50%. Surely low feeds price has raised Teoseng bottomline significantly.

Though corn & soybean price rebound in June15, they are expected to stay low due to increased harvest in North & South America.

Has recent sharp rebound in corn & soybean price affected investors' sentiment in Teoseng? I don't know.

Another potential culprit might be chicken egg price.

Teoseng currently produces about 3.2 million eggs per day. If egg price increases by 1sen, its revenue will potentially increase by RM32,000 a day, or RM2.88mil in a quarter.

If other cost & parameters remain the same, this extra RM2.88mil a quarter will go towards its PBT.

In other words, if egg price increases by 1sen, Teoseng can potentially earn RM2.88mil more in its pre-tax profit.

But if egg price drops 1sen, then Teoseng may potentially earn RM2.88mil less.

If egg price drop by 10sen, does it mean that Teoseng's profit will potentially drop RM28.8mil in a quarter which will throw it into loss???

Of course things are not that straight forward. Egg price fluctuates every few days and there are many other reasons that can affect its profit.

To check our country's egg price, I found a website that records Malaysia's historical chicken egg price, by Department of Veterinary Services.

If you study the price trend, there seems to be a rather significant drop in egg price since Mac15.

Malaysia Chicken Egg Price in 2015

Malaysia Chicken Egg Price in 2015

The line chart below shows monthly Grade A chicken egg price since year 2013. Since there are a few data in each month, I will pick the price closest to middle of the month to represent that month.

Grade A chicken egg price hit new high at 39sen in Nov14 and then 41sen in Dec14 and Jan15 before returning to 38-39sen in Feb/Mac15.

This coincides with significant jump in revenue and profit for Teoseng in FY14Q4 and FY15Q1.

However, in second quarter of 2015, grade A chicken egg price falls to 32-35 level. In average it is about 5sen lower than first quarter of 2015.

How do you think it will affect Teoseng's FY15Q2 earning?

Egg price is like CPO price, which will have direct impact on a company's top & bottom lines compared to other commodities used as raw materials.

It's a norm that egg price will fluctuate. Nevertheless, due to inflation, it is expected that egg price will trend upwards with time.

Many years ago, grade A eggs may be sold at 10-20sen, now it's 30-40sen, in the near future it might be 40-50sen.

I believe that current selling pressure on Teoseng's shares is mainly because of declining egg price, and to a certain extent, fear of bottoming out of feed price.

As Q2 is already over, I suspect that Teoseng's FY15Q2 result will not be as good as its latest 2 quarters.

If egg price continue to stay at Q2 2015 level for the rest of the year, then all layer farming operators should see poorer FY15 compared to FY14.

Is this part of the reason Teoseng put its Sungai Linggui expansion plan on hold?

Is this part of the reason Teoseng put its Sungai Linggui expansion plan on hold?

As I have mentioned earlier, I think Teoseng is still a well-managed company who has no control over commodity price.

With its ambitious expansion plan, shareholders should get the reward in long term.

Who knows grade A egg price will suddenly go above 40sen in second half of 2015?

没有评论:

发表评论