非常有看头的政联股! 短期上下起伏为正常,但長期在穩定净利与成長的支撑下,

股价是向上的.公司于30~9~2015 cash 有7877万,loan 才区区761万,每季制造强劲的现金流.

于30~10~2015 的30大股己持有66.311%,包括许多国内外机构基金的喜好,前景一片光明.

Myeg 原來官方机构己有7家可网上服务了,未來还会增加,可说是生金旦的股呀!

--这里借了cc兄之分享,谢谢他的功课.

先看看MyEG有什么服务,这个最简单直接的就是去MyEG那里开个户口,在网上就可以了。这点我在我的讲座会那里已经讲解了,所以你去那边开个户口看看就知道它的潜力了(还有多少个政府工程还没电子化)。

然后,再看看目前这个最新的MyMotor,也谢谢你分享这个资讯来让我们可以知道它这个MyMotor大概可以贡献多少钱于MyEG。这个只是表面而已,当你知道它有什么服务后,你会发觉到它已经是一条龙服务了(也可以称之为一站式服务)。这种服务的好处是可以为消费者省上很多时间加金钱,也就是你可以只依赖MyEG就可以达到你要的东西了。

看到关键点了吗?依赖,当人变成依赖的时候就可以慢慢的加钱。排除这个,目前可以看得出MyEG在2手车的行业里的卖点在那里了,便宜+方便。我相信这个是很多二手车业者的问题和要买二手车的人的问题。

为何我说便宜+方便?便宜是因为要买二手车的消费者不用给多钱给中间人(也就是二手车行业的业者),试想想原本要给多至少几千的钱变相为只给几百块的钱给中间人(这个是MyEG),那么这是不是变成很便宜了?

至于方便,别忘了MyEG有和RHBBANK合作,甚至有MyEG的信用卡,所以这个也变成可以直接跟RHBBANK贷款了。除此之外,MyEG还有卖保险,所以更新保险也可以直接一起和卖出的二手车一起卖。这个不方便吗?据我所知,现在的人都是为了方便,尤其是车险方面。还有一点值得注意的是MyEG也是有更新路税(Renew Roadtax)这个服务的哦。而且还是直接可以送到你家门口那种,试问下这种服务够不够力?

要踏足这个领域的路,MyEG一早就已经打好根基了。所以,MyEG踏足这个领域基本上已经是万事俱备而且还是站尽优势那种。你说它很难在这短短的一个月里给接下来的季报贡献,我不认为咯。。。目前这个月是马来人的重要日子,马来人的生意是很容易赚那种,再加上我所讲的优势。。。这个季度的盈利多过上一季(三月的)盈利的确定性实在是太高了。

当然还有很多,不过我就不打算再讲了。。。费事给他人讲我有意去散播消息推高股价。。

---取自战略特工,谢谢他的功课.

盈利爆炸点

不仅如此,【MYEG 服务】也推出名为MyMotor的全新汽车平台,

以提供综合性网络转账及汽车所有权服务。

最后附上如何使用MYEG更新路税的分享。

副刊

理财 2009-06-22 14:57

随着市场波动不定,使到一些投资者开始收敛,而倾向于选择营收、盈利和业务稳定的公司,以便在市场面对激烈调整时,可以采取“进可攻、退可守”的策略。

根据笔者发现,MYEG服务(MYEG,0138,主板贸易服务股)其中一只拥有这样特质的股项,因为根据它2008财政年第三季至2009财政年第三季这5季度期间的记录显示,它的盈利都处在400万令吉以上的稳定水平。

它能够取得稳定的盈利表现,而不受经济起落波动的影响,这主要是与它的业务有着莫大的关系。

众所周知,MYEG服务是一家为大马政府以及人民与商业提供电子服务的公司,其服务包括电子考试登记、执照与传票服务以及公共帐单偿还等。

它是于2007年1月7日在自动报价市场上市,并在2008年12月8日完成以5送6比例派送红股之后,于2009年1月成功转至主板。它的缴足资本为6010万令吉,分别6亿100万股,每股面值10仙的普通股。

该公司可为公众提供大马政府部门如陆路交通局(JPJ)、马来西亚皇家警察部队(PDRM)、马来西亚破产局(JIM)、国家能源(TENAGA,5347,主板贸服股)、马电讯(TM,4863,主板贸服股)和吉隆坡市议会(DBKL)的电子服务。

MYEG服务可分类成

a)政府对民众: 这包括不必赶在办公时间亲临政府部门,只需轻轻按键,就能安坐家中或办公室,在网上处理私人事务,如缴付交通罚单、更新路税、申请或报失或重新申请损毁的大马卡,查询个人或公司财务状况。

b)政府/企业方案:这包括软件方案和维修、驾驶执照笔试和数码影像等。

独特商业模式缔 双赢

MYEG服务的商业模式非常独特,它为各参与方面创造双赢的局面,以及符合政府的目标,即支付少许费用便可以方便获得服务便利,从而提升公共传递系统。

这个概念允许MYEG服务可以不断地向政府建议新的服务和产品。

政府也会喜欢这种方式,因为政府不必在这一方面花费大笔的金钱。

对于民从而言,他们只要支付少许的费用(大部份每个交易介于2令吉至3令吉之间,这同邮政局收费不相上下),便可以获得服务便利,而省下许多的时间、汽车和停车费。

现在MYEG服务已经在行业中占有领导地位,这使到它可以提出更多新的商业建议,而不会面对科技限制,或是必须与其他竞争者分享的问题。

开发新产品的成本非常低以及提供额外的服务,将使到它进一步提升营运效率和赚幅。

MYEG服务的业务拥有强劲增长前景、高赚幅以及几乎不必担心经济不景气。

数据显示,在我国拥有1600万辆车辆,这包括轿车,而其余的则是电单车及罗里,它们每年都需要更新路税和保费,这为MYEG服务的业务提供了强稳的基础。

MYEG服务也与国内银行合作,在全国各地置放了55架互动式多媒体资讯站(KIOSK),协助民众更新路税。

除了原有的服务之外,MYEG服务也计划推出更多的服务,包括在2010年推出更多与路陆交通局相关服务,例如电子车辆注册号码申请以及电子新车注册申请服务。

此外,到2010年,它也会推介与统计局和国际贸工部合作的网上服务。

股价估值 仍 廉宜

尽管拥有强劲的盈利增长趋势,但是MYEG服务的股价估值却仍然“廉宜”。

根据Insider Asia的资料显示,它2009和2010财政年的预测每股盈利分别为3.7仙(年对年增长37%)和5仙(年对年增长35%),因此它的股价处于42.5仙的水平,意味着它是在2009财政年11.5倍和2010财政年8.5倍本益比水平交易。

以其吸引人的增长前景、不受不景气影响以及高赚幅的优势看来,它这样的估计属于廉宜的水平。

此外,鉴于前景和盈利改善,Insider Asia也预测它在2009和2010财政年分别会派息1仙和1.5仙,这意味着这两个财政年的周息率分别显2.4%和3.5%。

该公司所面对的风险就是,政府撤回特许经营、计划的批准时限严重展延以及新竞争对手参与特许经营,这些都是会严重影响该公司经常收入的关键。●南洋商报

股价是向上的.公司于30~9~2015 cash 有7877万,loan 才区区761万,每季制造强劲的现金流.

于30~10~2015 的30大股己持有66.311%,包括许多国内外机构基金的喜好,前景一片光明.

Myeg 原來官方机构己有7家可网上服务了,未來还会增加,可说是生金旦的股呀!

--这里借了cc兄之分享,谢谢他的功课.

先看看MyEG有什么服务,这个最简单直接的就是去MyEG那里开个户口,在网上就可以了。这点我在我的讲座会那里已经讲解了,所以你去那边开个户口看看就知道它的潜力了(还有多少个政府工程还没电子化)。

然后,再看看目前这个最新的MyMotor,也谢谢你分享这个资讯来让我们可以知道它这个MyMotor大概可以贡献多少钱于MyEG。这个只是表面而已,当你知道它有什么服务后,你会发觉到它已经是一条龙服务了(也可以称之为一站式服务)。这种服务的好处是可以为消费者省上很多时间加金钱,也就是你可以只依赖MyEG就可以达到你要的东西了。

看到关键点了吗?依赖,当人变成依赖的时候就可以慢慢的加钱。排除这个,目前可以看得出MyEG在2手车的行业里的卖点在那里了,便宜+方便。我相信这个是很多二手车业者的问题和要买二手车的人的问题。

为何我说便宜+方便?便宜是因为要买二手车的消费者不用给多钱给中间人(也就是二手车行业的业者),试想想原本要给多至少几千的钱变相为只给几百块的钱给中间人(这个是MyEG),那么这是不是变成很便宜了?

至于方便,别忘了MyEG有和RHBBANK合作,甚至有MyEG的信用卡,所以这个也变成可以直接跟RHBBANK贷款了。除此之外,MyEG还有卖保险,所以更新保险也可以直接一起和卖出的二手车一起卖。这个不方便吗?据我所知,现在的人都是为了方便,尤其是车险方面。还有一点值得注意的是MyEG也是有更新路税(Renew Roadtax)这个服务的哦。而且还是直接可以送到你家门口那种,试问下这种服务够不够力?

要踏足这个领域的路,MyEG一早就已经打好根基了。所以,MyEG踏足这个领域基本上已经是万事俱备而且还是站尽优势那种。你说它很难在这短短的一个月里给接下来的季报贡献,我不认为咯。。。目前这个月是马来人的重要日子,马来人的生意是很容易赚那种,再加上我所讲的优势。。。这个季度的盈利多过上一季(三月的)盈利的确定性实在是太高了。

当然还有很多,不过我就不打算再讲了。。。费事给他人讲我有意去散播消息推高股价。。

---取自战略特工,谢谢他的功课.

MYEG 服务】- 快速了解崛起中的政府网络服务

不知道大家是否试过亲自去政府部门排队处理过东西,并且深深的觉得如果不需要

耗上那么长的时间等待,会有多么的美好。

耗上那么长的时间等待,会有多么的美好。

近年来,电子商务迅速的崛起,成为了新时代的变革者。

这股趋势势必将会延续,为马来西亚展开新的时代章节。

今天,战略特工将带领大家了解一家提供政府网路服务的上市公司 - 【MYEG 服务】。

【MYEG 服务】是一家提供电子政府服务的供应商,专为大马政府开发线上服务

的上市公司。

的上市公司。

主要两大策略业务:

1.政府—公民(G2C)服务:涵盖更新驾驶执照、缴付电子账单以及线上资讯

服务,如检查与缴付交通罚单summons、新路税、申请或报失或重新申请损毁

的大马卡、以及查询破产或清算状态。

服务,如检查与缴付交通罚单summons、新路税、申请或报失或重新申请损毁

的大马卡、以及查询破产或清算状态。

2.政府/企业解决方案(GES):非网上服务、如软件与企业解决方案、系统

开发与维修、驾驶执照笔试和数码影像等、以及提供电子服务中心

E-Services Centres)服务。【MYEG 服务】的商业模式非常独特,

它为各参与方面创造双赢的局面,以及符合政府的目标,即支付少许费用便可以

方便获得服务便利,从而提升公共传递系统。

开发与维修、驾驶执照笔试和数码影像等、以及提供电子服务中心

E-Services Centres)服务。【MYEG 服务】的商业模式非常独特,

它为各参与方面创造双赢的局面,以及符合政府的目标,即支付少许费用便可以

方便获得服务便利,从而提升公共传递系统。

这个概念允许【MYEG 服务】可以不断地向政府建议新的服务和产品。

并且政府也会喜欢这种方式,因为政府不必在这一方面花费大笔的金钱。

对于民众而言,他们只要支付少许的费用,便可以获得网上服务的便利,

从而省下许多的时间、车油和停车费。

从而省下许多的时间、车油和停车费。

现在【MYEG 服务】已经在行业中占有领导地位,这使到它可以提出更多新

的商业建议,而不会面对科技限制,或是必须与其他竞争者分享的问题。

的商业建议,而不会面对科技限制,或是必须与其他竞争者分享的问题。

开发新产品的成本非常低以及提供额外的服务,将使到它进一步提升营运效率

和赚幅。

和赚幅。

该公司拥有强劲增长前景、高赚幅以及几乎不必担心经济不景气。

数据显示,其2007年6月30日财年的净利从1477万8000令吉,攀高至2015财年

的6804万7000令吉。

的6804万7000令吉。

【MYEG 服务】的业绩自2007年上市以来,一直呈增长趋势,并于2009年,

从当时的自动报价股转至主版。

从当时的自动报价股转至主版。

2015年可谓是【MYEG 服务】的重点惊喜年,因为该公司获得政府的合约,

垄断外劳准证更新服务。该公司与移民局合作,负责收集和整合国内合法与

非法外劳的数据库。

垄断外劳准证更新服务。该公司与移民局合作,负责收集和整合国内合法与

非法外劳的数据库。

今年开始,所有雇主必须为外劳,使用【MYEG 服务】的外劳年度更新工作证

(FWPR)

(FWPR)

同时,政府极可能在2016年展开新一轮非法外劳漂白活动,分析员预期MYEG服务

有望从中赚取至少1亿令吉收入和4千万令吉净利。

有望从中赚取至少1亿令吉收入和4千万令吉净利。

以提供综合性网络转账及汽车所有权服务。

根据文告,该平台將为用户搜罗最好的交易,確保平台所销售车辆已获汽车

专家认证,以成为安全可靠的一站式交易平台。

专家认证,以成为安全可靠的一站式交易平台。

电子商务与服务的兴起,预料可谓公司带来持续的盈利与新业务!

不仅如此,2016财政年首季,该公司净利大涨136.7%至2850万令吉,

相较于上财年同期的1204万令吉,归功于网上更新外劳准证和保险交易增加,

以及来自新收购子公司 Cardbiz Holding私人有限公司的贡献。

以下是摘自东方日报在2015年12月18日的报道:

推2新服务 MYEG明年收入加强

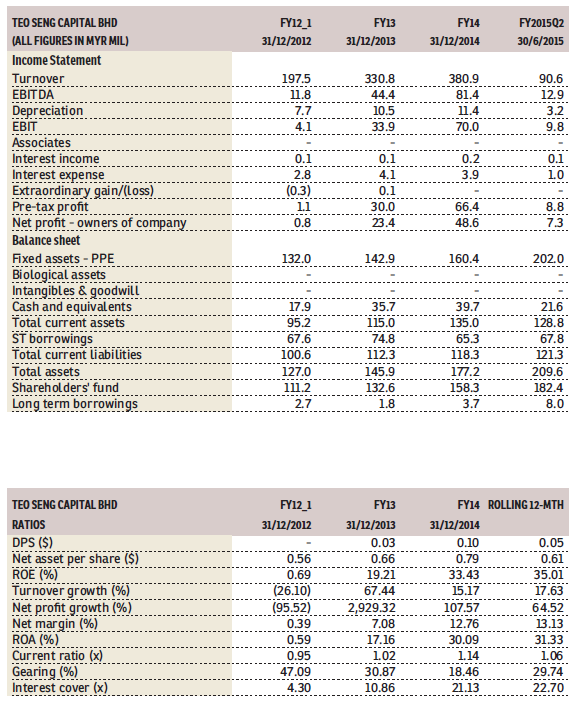

以下是该公司近5年财务重点表现:

相较于上财年同期的1204万令吉,归功于网上更新外劳准证和保险交易增加,

以及来自新收购子公司 Cardbiz Holding私人有限公司的贡献。

以下是摘自东方日报在2015年12月18日的报道:

推2新服务 MYEG明年收入加强

(吉隆坡18日讯)隨著MYEG服务(MYEG,0138,主板贸服股)

將于2016年落实两项新服务,预计可进一步加强该公司的收入。

將于2016年落实两项新服务,预计可进一步加强该公司的收入。

上述两项服务,分別为6P非法外劳漂白计划中的外劳准证更新服务,

以及关税服务税监控系统(CSTM),各將于明年1月和下半年推出,

相信可为该公司营业额带来正面贡献。

以及关税服务税监控系统(CSTM),各將于明年1月和下半年推出,

相信可为该公司营业额带来正面贡献。

根据一名今天出席MYEG服务股东常年大会和特別大会的小股东向媒体表示,

管理层透露服务將陆续启用。

管理层透露服务將陆续启用。

每位外劳准证更新费用为100令吉。现时非法外劳人数介于300万至500万人,

因此,预期MYEG服务明年营业额表现料趋好。

因此,预期MYEG服务明年营业额表现料趋好。

该名股东引述MYEG服务董事经理黄天顺在大会上向股东指出,

该公司早前获得大马移民局所颁发的非法外劳登记服务合约,预计在明年1月实行。

该公司早前获得大马移民局所颁发的非法外劳登记服务合约,预计在明年1月实行。

股东也补充,涵盖视频和饮料业务的首阶段CSTM预计在明年下半年推行。

「MYEG服务將可向皇家关税局收取每店家1000令吉固定收入。」

该公司首阶段CSTM原定于2015年第3季落实,惟被延展。若一切顺利,

MYEG服务將会推出第2阶段CSTM,目標为大型零售领域。

该公司首阶段CSTM原定于2015年第3季落实,惟被延展。若一切顺利,

MYEG服务將会推出第2阶段CSTM,目標为大型零售领域。

股东也称,该公司管理层透露亦会在明年落实道路安全侦查器(

Road Safety Diagnostic Kit)。但,基于政府並未强制性地要求所有罗里及

巴士业者安装有关侦查器,所以无法预测该项目对公司带来的潜在盈利贡献。

Road Safety Diagnostic Kit)。但,基于政府並未强制性地要求所有罗里及

巴士业者安装有关侦查器,所以无法预测该项目对公司带来的潜在盈利贡献。

另一方面,MYEG服务在今日的特大获得股东通过派送红股的议案。

该公司將以1送1比例,派送12亿零210万股红股(包括433万库存股)予股东,

惟除权日待定。

该公司將以1送1比例,派送12亿零210万股红股(包括433万库存股)予股东,

惟除权日待定。

该项计划將把缴足资本从12亿零210万股或1亿2021万令吉,提高至

24亿零420万股或2亿4042万令吉。

24亿零420万股或2亿4042万令吉。

MYEG服务股价年初至今「跑贏大市」,涨幅为85.3%,

优于富时综指年初至今的6.66%跌幅。该股今天闭市报3.91令吉,全天起5仙或1.3%

优于富时综指年初至今的6.66%跌幅。该股今天闭市报3.91令吉,全天起5仙或1.3%

--------------------------------------------------------------------------------------------------------------------------

--取自南洋.

股海宝藏: 不受经济起落波动影响 MYEG盈利表现稳定

副刊

理财 2009-06-22 14:57

随着市场波动不定,使到一些投资者开始收敛,而倾向于选择营收、盈利和业务稳定的公司,以便在市场面对激烈调整时,可以采取“进可攻、退可守”的策略。

根据笔者发现,MYEG服务(MYEG,0138,主板贸易服务股)其中一只拥有这样特质的股项,因为根据它2008财政年第三季至2009财政年第三季这5季度期间的记录显示,它的盈利都处在400万令吉以上的稳定水平。

它能够取得稳定的盈利表现,而不受经济起落波动的影响,这主要是与它的业务有着莫大的关系。

众所周知,MYEG服务是一家为大马政府以及人民与商业提供电子服务的公司,其服务包括电子考试登记、执照与传票服务以及公共帐单偿还等。

它是于2007年1月7日在自动报价市场上市,并在2008年12月8日完成以5送6比例派送红股之后,于2009年1月成功转至主板。它的缴足资本为6010万令吉,分别6亿100万股,每股面值10仙的普通股。

该公司可为公众提供大马政府部门如陆路交通局(JPJ)、马来西亚皇家警察部队(PDRM)、马来西亚破产局(JIM)、国家能源(TENAGA,5347,主板贸服股)、马电讯(TM,4863,主板贸服股)和吉隆坡市议会(DBKL)的电子服务。

MYEG服务可分类成

a)政府对民众: 这包括不必赶在办公时间亲临政府部门,只需轻轻按键,就能安坐家中或办公室,在网上处理私人事务,如缴付交通罚单、更新路税、申请或报失或重新申请损毁的大马卡,查询个人或公司财务状况。

b)政府/企业方案:这包括软件方案和维修、驾驶执照笔试和数码影像等。

独特商业模式缔 双赢

MYEG服务的商业模式非常独特,它为各参与方面创造双赢的局面,以及符合政府的目标,即支付少许费用便可以方便获得服务便利,从而提升公共传递系统。

这个概念允许MYEG服务可以不断地向政府建议新的服务和产品。

政府也会喜欢这种方式,因为政府不必在这一方面花费大笔的金钱。

对于民从而言,他们只要支付少许的费用(大部份每个交易介于2令吉至3令吉之间,这同邮政局收费不相上下),便可以获得服务便利,而省下许多的时间、汽车和停车费。

现在MYEG服务已经在行业中占有领导地位,这使到它可以提出更多新的商业建议,而不会面对科技限制,或是必须与其他竞争者分享的问题。

开发新产品的成本非常低以及提供额外的服务,将使到它进一步提升营运效率和赚幅。

MYEG服务的业务拥有强劲增长前景、高赚幅以及几乎不必担心经济不景气。

数据显示,在我国拥有1600万辆车辆,这包括轿车,而其余的则是电单车及罗里,它们每年都需要更新路税和保费,这为MYEG服务的业务提供了强稳的基础。

MYEG服务也与国内银行合作,在全国各地置放了55架互动式多媒体资讯站(KIOSK),协助民众更新路税。

除了原有的服务之外,MYEG服务也计划推出更多的服务,包括在2010年推出更多与路陆交通局相关服务,例如电子车辆注册号码申请以及电子新车注册申请服务。

此外,到2010年,它也会推介与统计局和国际贸工部合作的网上服务。

股价估值 仍 廉宜

尽管拥有强劲的盈利增长趋势,但是MYEG服务的股价估值却仍然“廉宜”。

根据Insider Asia的资料显示,它2009和2010财政年的预测每股盈利分别为3.7仙(年对年增长37%)和5仙(年对年增长35%),因此它的股价处于42.5仙的水平,意味着它是在2009财政年11.5倍和2010财政年8.5倍本益比水平交易。

以其吸引人的增长前景、不受不景气影响以及高赚幅的优势看来,它这样的估计属于廉宜的水平。

此外,鉴于前景和盈利改善,Insider Asia也预测它在2009和2010财政年分别会派息1仙和1.5仙,这意味着这两个财政年的周息率分别显2.4%和3.5%。

该公司所面对的风险就是,政府撤回特许经营、计划的批准时限严重展延以及新竞争对手参与特许经营,这些都是会严重影响该公司经常收入的关键。●南洋商报