由于2015年Q1业绩只赚52万,股价由两个交易前的RM0.625下跌至RM0.305闭市,如Q2业绩有回升机会,股价将会回稳,公司有不错的基本面,淨現金公司,約3千300萬令吉淨現金,相等於每股7.71仙,無任何貸款。有資格成為馬股創業板中的頂尖公司之一,有很大的希望晉升主板。

2014年業績,企文營業額達1億8千609萬7千令吉,按年揚8.66%,淨利則飆升近12倍至創紀錄的1千185萬5千令吉淨利,现价位RM0.305是机会吗?通常恐惧出售后都有回弹的出现,见仁见智了.

先前刊登了報上,可以参考,进出自负.

渡過外圍風暴‧企文營收淨利衝新高

Author: Tan KW | Publish date: Sun, 5 Apr 2015, 09:14 PM

2015-04-05 19:29

上週,馬股在消費稅落實首日表現低迷,幾乎所有指標指數均以下跌收場;然而,就在紅海吞沒馬股之際,科技指數卻逆市揚升1.17%,這讓《股海撈月》更加堅信,科技股會是馬股今年的亮點之一。

然而,馬股目前有約89隻科技股,投資者該如何從這堆素質參差不齊的公司中,找出理想的投資對象呢?

《股海撈月》的建議很簡單:一,需有基本面。二,不宜完全寄託於未來展望。三,不宜追逐不合理的高估值。

順著這樣的選股條件,這一期的《股海撈月》,相中了企文科技(K1,0111,創業板科技組)。

蒙虧2年

迅速止血

迅速止血

創辦於2001年的企文科技,是家成長中的全方位科技方案公司,於2006年1月在第二交易板上市,核心業務是替客戶提供產品設計、發展、計劃管理、製造至測試階段的各種服務。

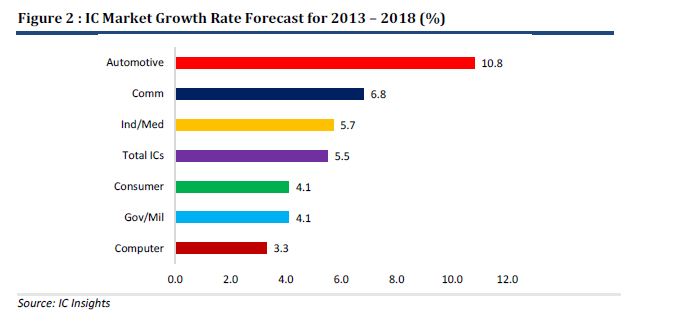

目前,企文所專精的領域,包括電子消費品、通訊產品、電腦週邊設備、汽車塑料配件和電子設備,另外也已開始多元化業務至醫療保健設施領域,和進軍電子教學市場。

科技業乃當代、甚至往後數十年的全球性大趨勢;投資角度來說,科技業就像是一個藏有無數危險和寶藏的探險天地,讓許多流著冒險家血液的投資者為之著迷、瘋狂。

然而,這不意味凡踏入科技界就必定能有所收穫,因為科技領域除了商機處處之外,亦是個極考驗趨勢嗅覺、科技能力和管理效率的行業,要真正將其中的商機盈利化,並保持競爭力,不是容易的事。

在這樣的環境中,企文仍成功生存下來,並且逐日壯大。

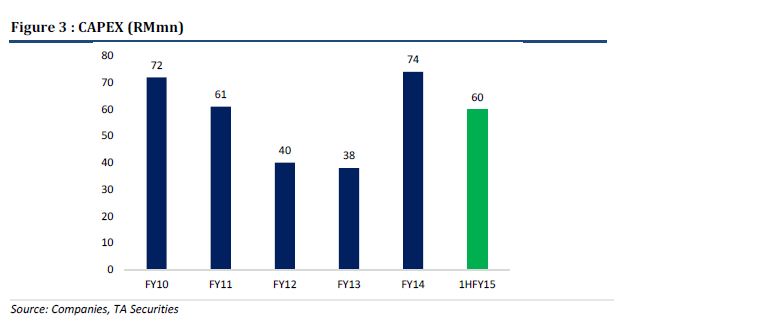

過去10年間,企文營業額每年均取得成長,這讓該公司營業額從2005年的3千221萬令吉,猛漲至2014年的1億8千609萬7千令吉,年均複合成長率達19.17%。

淨利飆升12倍

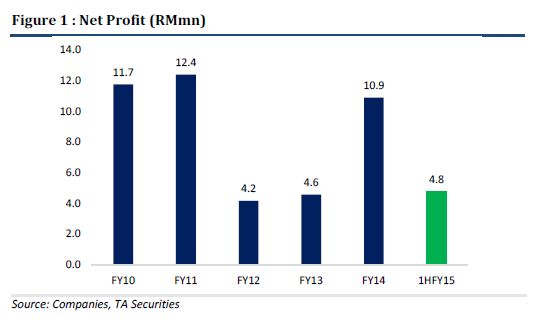

除了營業額增長外,該公司淨利紀錄也算不錯,但曾因歐債風暴、美國經濟低迷和日本海嘯等利空,在2011和2012年寫下虧損,慶幸頹勢在管理層的積極應變態度下很快終止,2013年即轉虧為盈,更於2014年將營業額和淨利推上歷史新高。

2014年業績顯示,企文營業額達1億8千609萬7千令吉,按年揚8.66%,淨利則飆升近12倍至創紀錄的1千185萬5千令吉淨利,打下漂亮的翻身戰。

估值有上揚空間

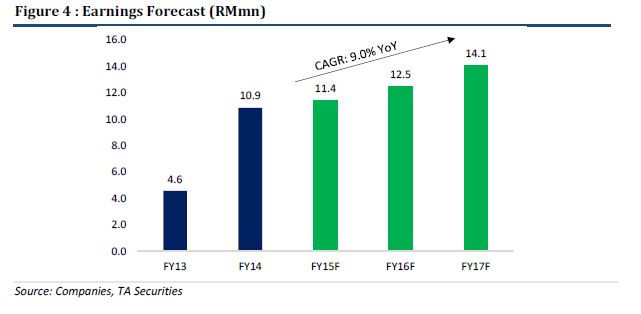

肯納格研究在今年1月發佈的報告中預測,企文將於2015年錄得淨利2千160萬令吉,較2014年成長82%,高淨利成長將成為企文的主要投資魅力。

肯納格表示,企文旗下流動電話週邊產品業務,將受惠於智能手機和平板電腦的強勁上升趨勢,該公司去年第四季從某知名國際公司手中拿下一紙價值2千萬令吉的高級通訊產品製造合約,應證這點。

“此外,我們瞭解到上述合約可能為企文打開機會之門,讓該公司有機會從另一位全球客戶手中贏得另一項規模達4至5倍大的訂單,管理層亦相信來自醫療保健領域的新客戶將開始為業績作出貢獻。”

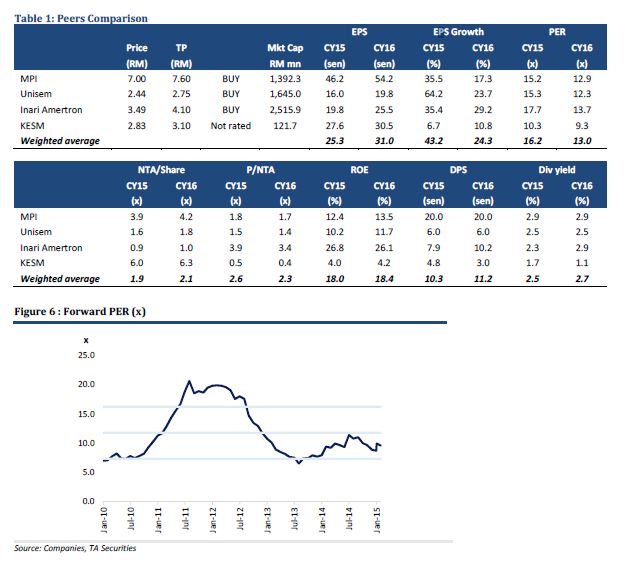

目前,肯納格給予企文的合理價是63仙,相等於2015年預估淨利的10倍本益比。

《股海撈月》認為,若企文今年業績符合肯納格的預期,那10倍本益比估值其實相對保守,因成功轉板、涉足併購、攫獲更大型訂單等潛在催化劑,都可能讓財測和估值上升。

而且,市場一般願意給予具備成良好展望的科技股較高估值;拿馬股情況來說,許多證券行給予科技股的本益比估值,其實是用2016年預估淨利所算出,並非2015年,且目標本益比更高達15至25倍。

按這標準來看,企文估值或仍有改善空間。

具備轉主板條件

無論從哪個角度來看,企文的現有條件都足有資格成為馬股創業板中的頂尖公司之一,而且有很大的希望晉升主板。

根據證監會的轉板指南,創業板公司必須在過去3至5年內累積2千萬令吉淨利,且最新一年的淨利不得低於600萬令吉,才有資格轉往主板上市。

企文單在去年就錄得了1千185萬令吉淨利,若這樣的業績能夠持續,這意味企文大有機會在今年內輕易跨越證監會規定的轉板業績門檻。

實際上,過往資料顯示企文確實有轉到主板上市的意願,因該公司曾在2009年提出轉板申請,惟後來不幸被證監會以不符合股票指南第1.06(a)條文為由駁回。

根據《股海撈月》觀察,企文是以2005至2008年業績申請轉主板上市,但次貸風暴的後遺症讓2009和2010年淨利劇減,或許是證監會駁回轉板申請的考量之一,因證監會駁回申請的時間是在2011年8月。

目前,馬股創業板擁有58家科技公司;若以2014年業績作準,企文的營業額和淨利規模雙雙在創業板科技公司中名列第3。

淨現金3300萬

等於每股7.71仙

等於每股7.71仙

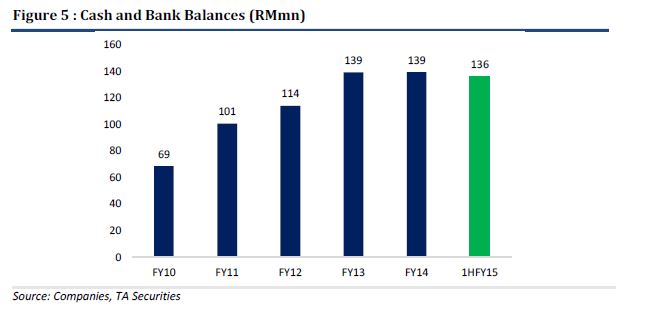

截至去年12月杪,企文已順利晉級成淨現金公司,掌握約3千300萬令吉淨現金,相等於每股7.71仙,無任何貸款。

企文科技WB

折價水平交易

折價水平交易

除母股外,企文科技WB(K1-WB,0111WB,憑單)則是高風險投資者的另一選擇,因這項將於今年12月11日到期的憑單,目前正以折價水平在馬股交易。

交易所資料顯示,企文科技WB轉換價為22仙,加上憑單截至上週五的31仙閉市價,總投資成本為53仙,較同日母股的54.5仙閉市價折價1.5仙。

值得一提的是,企文科技WB的折價,吸引了合計掌握45.72%憑單的3大股東――林明福、林順成及布萊登陸續在過去幾個月將本身持有的憑單全數轉換成母股。

上述3大股東曾於去年11月,以每股37仙在場外脫售約4千500萬股股票給機構投資者/基金,各位不妨留意企文即將於未來兩個月內公佈的2014年年報,看看這批佔總股本約10%的股權,究竟由誰買走。

此外,根據《交易所情報網》提供的5種阿爾法衡量(AlphaFactor)指標,企文在股價動力、過往成長率、資本效率和盈利素質方面,都獲得象徵最高評價的“1”,估值評價也取得不錯的“2”。

阿爾法衡量指標共分5個層次,“1”代表最佳,“5”則代表最弱,有關指標雖不可盡信,卻可作為輔助資料。

企文科技最新檔案:

上週五股價:54.5仙

每股淨資產:15.52仙

總資產:1億1千165萬令吉

現金:3千313萬令吉

總負債:4千681萬令吉

貸款:無任何貸款

股本:4億2千798萬6千股(每股面值10仙)

大股東:林明福(15.57%)、林順成(13.3%)、布萊登(10.83%)

上週五股價:54.5仙

每股淨資產:15.52仙

總資產:1億1千165萬令吉

現金:3千313萬令吉

總負債:4千681萬令吉

貸款:無任何貸款

股本:4億2千798萬6千股(每股面值10仙)

大股東:林明福(15.57%)、林順成(13.3%)、布萊登(10.83%)

聲明:股海撈月提供的資料只供參考,志在讓投資者更瞭解一些不獲證券行重視的小型股,至於是否投資,還請先徵詢股票經紀意見。(星洲日報/投資致富‧股海撈月‧文:李三宇)

點看全文: http://biz.sinchew.com.my/node/113103?tid=8#ixzz3WRMEltte

| K1 (0111) - K-One plunges 33% after posting losses in its first financial quarter KUALA LUMPUR (May 29): The shares of electronics end-product producer K-One Technology Bhd (K-One) continued to its plunge in the morning session today after AllianceDBS Research observed in a note yesterday that the stock was under heavy selling pressure after announcing losses in its first financial quarter ended March 31, 2015. At 12.30pm, 78 million shares were traded 30 sen or 33.33% or 15 sen lower from 45, the lowest since the start of this year, making it the most active counter in equities market this morning. Yesterday, AllianceDBS Research noted that K-One was under selling pressure after gaping down to reach a low of 43.5 sen on May 28. It added that K-One (valuation: 1.1; fundamental: 2.1) had fallen below the 20-day and 50-day moving average (MA) lines on May 28 after spending 13 days above the same two MA lines. The research house had warned that the stock was expected to move lower again with immediate support at 43.5 sen following a weak down close on May 28. “A fall below 43.5 sen should see further price decline to the subsequent support at 39 sen. The hurdle is at 48 sen. A rise above 48 sen would lift the stock to the next resistance at 54 sen,” AllianceDBS said. The tremendous plunge in share prices comes two days after K-One posted an 83% drop in net losses at RM520,000 compared to RM3.2 million, and with lower earnings per share of 0.12 units compared to 0.87 units the corresponding quarter last year. Revenue had also dropped by 28.9% to RM32.6 million in the current quarter in review from RM45.8 million last year as result of reduced demand of network cameras. (Note: The Edge Research's fundamental score reflects a company’s profitability and balance sheet strength, calculated based on historical numbers. The valuation score determines if a stock is attractively valued or not, also based on historical numbers. A score of 3 suggests strong fundamentals and attractive valuations.) http://www.theedgemarkets.com |

2201201421502890331757263402.jpg)