--視Q4业绩与某些企业消息而定,个人估计RM8.00,不是買賣建议.

自己考虑风险.扣除30大股东的票,市场流量只有约36000,000股.

1)

(星洲日報/財經)

(星洲日報/財經)

3)

重组上游‧提高效率 蚬壳拟2年裁1300人

2015-09-30 12:56

4)

2015-10-31 11:10

(图取自互联网)

(图取自互联网)

自己考虑风险.扣除30大股东的票,市场流量只有约36000,000股.

1)

揣測不斷‧PETRON一度漲46仙‧蜆殼沾光最高飆23%

Author: Tan KW | Publish date: Tue, 12 Jan 2016, 05:53 PM

2016-01-12 17:20

(吉隆坡12日訊)兩家由外資掌控的油氣相關公司——PETRON大馬(PETRONM,3042,主板工業產品組)和蜆殼石油(SHELL,4324,主板工業產品組)異軍突起;前者股價連日來狂漲不止,後者今日一度飆升23%,引起市場熱議。

業務不同

合作可能低

合作可能低

兩家公司的異動讓一些投資者不禁揣測是否是重大企業活動的前兆;然而,《星洲財經》嘗試向行內人士打聽,但沒有發現任何相關的傳言,行內人士也認為兩家公司業務不同,不太可能合作。

兩個月前股價只有3令吉10仙的PETRON大馬,是從去年11月杪迎來首波漲潮,推動股價上探4令吉50仙,儘管該股後來曾陷入鞏固,卻在12月杪再次爆發,且第二輪暴發威力遠勝首輪,讓股價從4令吉30仙,一路暴漲至昨日收市的6令吉85仙。

今日,PETRON大馬依然牛勁十足,盤中最高再漲46仙或6.71%至7令吉31仙,終場收市掛7令吉零1仙,漲16仙,成交量212萬7千900股。

或是受PETRON大馬暴漲刺激,股價向來平凡無奇的蜆殼石油也平地一聲雷,一度飆升1令吉18仙或23%至6令吉28仙,收市掛6令吉零3仙,漲93仙,成交量461萬5千200股。

經紀:蜆殼突漲

或是借題炒作

或是借題炒作

股票經紀受詢時,表示沒有聽到任何與PETRON大馬或蜆殼石油有關的傳言,但相信蜆殼石油突然大漲,或純粹是借題炒作。

“兩家公司都是由外資持有,且都是油氣相關公司;因此,在PETRON大馬上演暴漲後,投資者很自然會把焦點放在另一家尚未上漲的同類公司,並借題炒作。”

PETRON大馬和蜆殼石油實際上乃兩家業務性質不同的公司,前者主要涉足零售汽油和石油氣業務,後者則是涉足石油精煉業務,SHELL油站並非歸蜆殼石油所有。

在油站翻新和開銷減少的帶動下,PETRON大馬業績已連續第三個季放晴,成功在2015年首9個月轉虧為盈,報淨利2億零245萬6千令吉,相當於每股盈利75.69仙,顯示歷時4年的品牌重塑和效率強化活動終於開花結果。

業績大好

或是PETRON大馬勁揚主因

或是PETRON大馬勁揚主因

觀察家認為,業績大好或是PETRON大馬股價過去兩個月勁揚的關鍵原因。

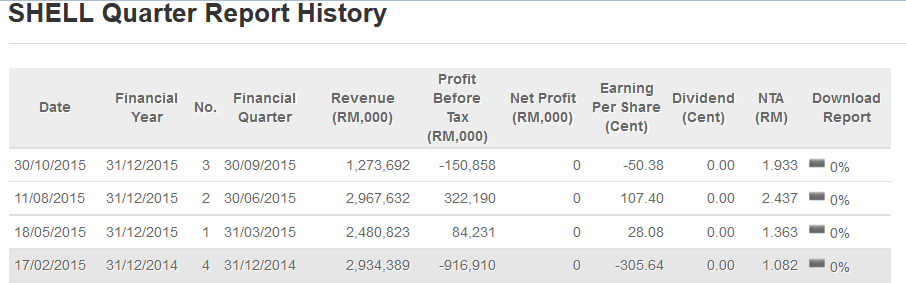

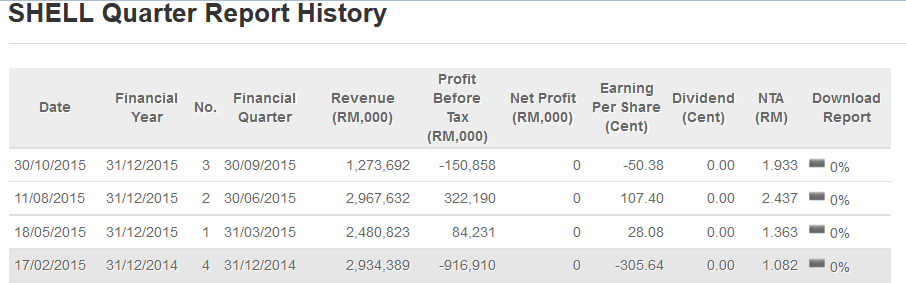

比較之下,蜆殼石油則在第三季業績淨虧1億5千113萬令吉,但總結9個月仍書寫2億5千529萬令吉淨利,相當於每股盈利85.10仙。

值得一提的是,持有蜆殼石油15.45%股權的雇員公積金局(EPF),過去1年來頻頻減持股票,但進度不明顯,原因或是該股流通量偏低的緣故。

(星洲日報/財經)

(星洲日報/財經)

2)

PETRONM vs. SHELL - you can't compare these two

Author: fayeTan | Publish date: Tue, 12 Jan 2016, 03:28 PM

1. Why I write this article? I am writing after seeing this news which says "Oil refineries gain on falling oil prices". Source of the news: http://www.theedgemarkets.com/my/article/oil-refineries-gain-falling-oil-prices you can also read the full news below.

2. PETRONM and SHELL cannot be compared AT ALL. PETRONM is a turnaround company. The past 3 quarters show positive earnings after loss. As for SHELL, the Company latest quarter EPS is still at loss. In summary, you can't compare between these two as their earnings outlook are different.

3. Summary: There's value in PETRONM but I reserved my opinion on SHELL. PETRONM has shown positive earnings for the past 3 quarters. SHELL earnings outlook is not that great as it has been volatile historically.

4. BUY and SELL at your own risk.

A. Historical record for SHELL

B. Historical record for PETRON

2. PETRONM and SHELL cannot be compared AT ALL. PETRONM is a turnaround company. The past 3 quarters show positive earnings after loss. As for SHELL, the Company latest quarter EPS is still at loss. In summary, you can't compare between these two as their earnings outlook are different.

3. Summary: There's value in PETRONM but I reserved my opinion on SHELL. PETRONM has shown positive earnings for the past 3 quarters. SHELL earnings outlook is not that great as it has been volatile historically.

4. BUY and SELL at your own risk.

A. Historical record for SHELL

B. Historical record for PETRON

C. News as per below

Oil refineries gain on falling oil prices

Translated by Google Translator:

KUALA LUMPUR (Jan 12): Oil refineries, namely Shell Refining (Federation of Malaya) Bhd and Petron Malaysia Refining and Marketing Bhd (PetronM) are bucking the trend of the falling crude oil prices to rise in the morning trade.

Shell rose RM1.00 or 19.60% to a high of RM6.10 this morning, but gave up the gains to trade at RM5.93 apiece, up 83 sen or 16.27% at 11.21am. The counter saw 1.1 million units changed hands.

PetronM also rose as much as 8 sen or 1.17% to RM6.93 with 1.44 million shares traded as at 11.00am. The stock has earlier gone up to RM7.31 before it pared down the gains.

Kenanga Research analyst Lim Sin Kiat said that the positive sentiment towards Shell and PetronM because the two companies had turned profitable from losses a year earlier.

In addition, he opined that the refineries are in for a better year in 2016 as the selling price of oil products were not going down as much as the crude oil price, and had reached to a point where it is profitable to the refinery.

“When the crude oil price was traded at US$100 per barrel, the pump prices did not go up very high, and with the crude oil prices coming down, the pump prices did not go down as much, now they are getting the good side of it,” he added.

He said, the sustainability of this situation will depend on the supply of the oil product, but he believed the government will not cut the pump price so fast and so severe.

He added that earlier the crude oil was traded at US$ 40-50, now it is between US$30-40, there is a saying that it would go down further to US$20 per barrel, so the refinery is in for a good year in 2016.

As at 11.19am, Brent Crude Oil was traded at US$31.19 per barrel, down 1.14%.

Crude oil prices continued a relentless dive early on Tuesday approaching a 20% drop since the beginning of the year as analysts scrambled to cut their 2016 oil price forecasts and traders bet on further price falls, Reuters reported.

Meanwhile, the other downstream oil and gas counter such as Petronas Chemicals Group Bhd(Petchem) and Petronas Dagangan Bhd (PetDag) ( Valuation: 1.10, Fundamental: 2.10) also rose in morning trade today.

Valuation: 1.10, Fundamental: 2.10) also rose in morning trade today.

Petchem increase as much as 21 sen or 2.92% to RM7.41, with some 2.2 million shares traded as at 11.10am.

Meanwhile, PetDag increased marginally by 2 sen to RM23.92,with 177,000 units done.

Lim said that PetChem could be rise in tandem with the positive sentiment against the downstream oil and gas counter.

“All the downstream oil and gas counter will fare better than the upstream oil and gas counters this year,” Lim added.

Shell rose RM1.00 or 19.60% to a high of RM6.10 this morning, but gave up the gains to trade at RM5.93 apiece, up 83 sen or 16.27% at 11.21am. The counter saw 1.1 million units changed hands.

PetronM also rose as much as 8 sen or 1.17% to RM6.93 with 1.44 million shares traded as at 11.00am. The stock has earlier gone up to RM7.31 before it pared down the gains.

Kenanga Research analyst Lim Sin Kiat said that the positive sentiment towards Shell and PetronM because the two companies had turned profitable from losses a year earlier.

In addition, he opined that the refineries are in for a better year in 2016 as the selling price of oil products were not going down as much as the crude oil price, and had reached to a point where it is profitable to the refinery.

“When the crude oil price was traded at US$100 per barrel, the pump prices did not go up very high, and with the crude oil prices coming down, the pump prices did not go down as much, now they are getting the good side of it,” he added.

He said, the sustainability of this situation will depend on the supply of the oil product, but he believed the government will not cut the pump price so fast and so severe.

He added that earlier the crude oil was traded at US$ 40-50, now it is between US$30-40, there is a saying that it would go down further to US$20 per barrel, so the refinery is in for a good year in 2016.

As at 11.19am, Brent Crude Oil was traded at US$31.19 per barrel, down 1.14%.

Crude oil prices continued a relentless dive early on Tuesday approaching a 20% drop since the beginning of the year as analysts scrambled to cut their 2016 oil price forecasts and traders bet on further price falls, Reuters reported.

Meanwhile, the other downstream oil and gas counter such as Petronas Chemicals Group Bhd(Petchem) and Petronas Dagangan Bhd (PetDag) (

Petchem increase as much as 21 sen or 2.92% to RM7.41, with some 2.2 million shares traded as at 11.10am.

Meanwhile, PetDag increased marginally by 2 sen to RM23.92,with 177,000 units done.

Lim said that PetChem could be rise in tandem with the positive sentiment against the downstream oil and gas counter.

“All the downstream oil and gas counter will fare better than the upstream oil and gas counters this year,” Lim added.

重组上游‧提高效率 蚬壳拟2年裁1300人

2015-09-30 12:56

蚬壳重组上游业务, 提高生产力及效率, 并维持产品和服务的安全和可靠。

蚬壳重组上游业务, 提高生产力及效率, 并维持产品和服务的安全和可靠。

(吉隆坡29日讯)蚬壳(SHELL,4324,主板工业产品股)着手重组上游业务,计划在2年内于我国裁退1300名员工,借此提高效率及竞争力。

蚬壳今日公布了上游业务的重组计划,旨在改善业务效率及简化繁杂程序,让公司成为更优秀的国际企业。

蚬壳主席罗元在文告中指出,为了强化本身的组织架构,公司将着手重组上游业务,来提高生产力及效率,并维持产品和服务的安全和可靠。

应对油价低企

“在油价低企的环境中,蚬壳放眼通过重组,可巩固和扩展上下游业务发展,成为更具竞争力的油气业者。”

目前,上游部门共有6500名员工左右,公司未来2年会逐步削减1300名员工,来达到相关目标。

罗元表示,为了能够迈向永续发展,公司必须采取艰难、但也是必要的行动。

“这是个艰难的决定,对上游业务的架构做出调整后,大幅提升了业务运作效率。但很遗憾的是,这也对员工造成无可避免的影响。”

对本地业务仍有信心

罗元重申,公司会遵照相关人事守则,尽力尊重和照顾受影响员工的福利,也努力协助他们度过这段艰难时期。

展望未来,蚬壳对本地业务前景,抱有绝对的信心,并期待与国家石油(Petronas)继续携手合作,建立长期伙伴关系。

罗元称,蚬壳集团只在极少数的国家,从事全面的业务发展,而大马正是这极少数之一。

“蚬壳在大马涉足的领域,涵盖上游、下游及其他商业服务业务。我们深信,公司可为大马的资源开发领域,继续做出贡献。

4)

2015-10-31 11:10

(吉隆坡30日訊)生產減少致使蜆殼石油(SHELL,4324,主板工業產品組)截至2015年9月30日第三季虧損收窄至1億5千113萬令吉,前期虧損為1億9千976萬5千令吉。

首9個月淨利則報2億5千529萬令吉,前期虧損2億7千185萬7千令吉。

石油減產

第三季營業額大挫至62.94%至12億7千369萬2千令吉,9個月營業額走低40.69%至67億2千214萬7千令吉。

根據文告,管理層表示,受惠賺幅走高、石油產量減少至470萬桶及持股公司虧損減少,以致虧損降低。

展望未來,石油提煉賺益依舊不明朗,主要是賺幅將受到國際石油產品供序,甚至是季節性和週期性因素影響。

此外,公司今年1月9日公佈的長期結構評估選項仍在進行中。(星洲日報/財經)

5)

蜆壳留守大马 精简结构裁员1300

(图取自互联网)

(图取自互联网)

(吉隆坡29日讯)蜆壳(SHELL,4324,主板工业股)宣布精简企业结构及转型的措施,包括两年內裁掉上游业务的1300名员工,以提升营运效率。

蜆壳主席罗元发文告,作出上述宣布。他表示,该公司將著重生產力和营运效率,力求在大马成为更灵活、具韧性和竞爭力的油气公司。

该公司进军大马的歷史久远,明年將是第125年纪念,惟將在未来2年內,从目前约6500名员工中,裁掉约1300个职位。

提升营运效率

罗元补充,裁员是一个「非常艰难的决定」,惟却是提升营运效率无可避免的措施。

他强调,蜆壳將继续在大马营运,包括继续和国油公司(Petronas)维持良好伙伴关係。

过去6年,蜆壳在大马的油田探勘工作方面,平均每年投资1亿美元(约4.4亿令吉),並在过去2年,发现了11个新採油区域。

隨著週二的宣布,意味著蜆壳不会退出大马市场。

今年6月30日,罗元在蜆壳的股东大会后,向媒体宣布一项令人震惊的消息,即由于净利赚幅受到油价下跌的负面衝击,导致接连面对亏损,该公司正考虑出售大马的炼油业务,退出大马炼油市场,或重新调整公司的业务方针,將大马炼油业务终站转型成为进出口和储存终站。

当时,该消息引发民间热议,促使蜆壳在7月2日发文告澄清,该公司对大马市场仍有信心,而其炼油业务与其它业务是分开且独立营运,所以炼油业务可能生变,不会影响其它业务。

5)

5)

Shell-Explosive Share Price= Explosive Earning? (MUST READ)

Author: GemDigger | Publish date: Tue, 12 Jan 2016, 07:40 PM

Shell exploded for 18% of gain today with high volume. SMA crosses 200 days confidently.

How about the earnings? Lets look at the past:

Earnings?

The trends of earnings move with oil price. The lower the oil price, the higher the earning. Particularly in 2004 and 2009 when the oil price dipped, the earning explodes and vice versa on 2008, 2011-2013.

2014 the losses were due to:

The declining oil price led to a stockholding loss of RM625.1 million in 2014. The loss refers to the difference between the current cost of inventoriesat the date of sale and the amount charged as the cost of goods sold in computing the historical cost profit.

In 2015 the EPS for first 2 quarters alone is 130 cents. Third quarter shell dipped into red due to SHUTDOWN FOR MAINTENANCE FOR 44 DAYS.

Final Quarter report is due in February and coincidently, oil price dipped further to 45-36 dollar per barrel in last Q of 2015.

How will be the earnings?

The chart above speaks thousand words.

Short term TP RM8.00

If oil price maintains at 30 dollar per barrel, the EPS will be 223.45 as suggested in 2004.

Long term TP RM10.00

Trade at your own risk.

http://src.shell.com/about-src.htmlHow about the earnings? Lets look at the past:

Earnings?

| Year | Average Oil Price (Dollar) | Shell EPS (cent) |

| 2004 | 34 | 223.45 |

| 2005 | 44 | 7.3 |

| 2006 | 70 | 2.6 |

| 2007 | 60 | 21.72 |

| 2008 | 110 | -93.1 |

| 2009 | 50 | 96.65 |

| 2010 | 78 | 35.46 |

| 2011 | 100 | -41.91 |

| 2012 | 110 | -31.94 |

| 2013 | 100 | -51.99 |

| 2014 | 60 | -396.51 |

| 2015 | 50 | ? |

The trends of earnings move with oil price. The lower the oil price, the higher the earning. Particularly in 2004 and 2009 when the oil price dipped, the earning explodes and vice versa on 2008, 2011-2013.

2014 the losses were due to:

The declining oil price led to a stockholding loss of RM625.1 million in 2014. The loss refers to the difference between the current cost of inventoriesat the date of sale and the amount charged as the cost of goods sold in computing the historical cost profit.

In 2015 the EPS for first 2 quarters alone is 130 cents. Third quarter shell dipped into red due to SHUTDOWN FOR MAINTENANCE FOR 44 DAYS.

Final Quarter report is due in February and coincidently, oil price dipped further to 45-36 dollar per barrel in last Q of 2015.

How will be the earnings?

The chart above speaks thousand words.

Short term TP RM8.00

If oil price maintains at 30 dollar per barrel, the EPS will be 223.45 as suggested in 2004.

Long term TP RM10.00

Trade at your own risk.

没有评论:

发表评论