--再穷,鸡蛋总是不会少,

日常所需品不怕经济低迷,鸡蛋为人类主要食品,业务抗跌性强,永远不会有销售问题.持有也有信心。

目前3个季度eps达12.7 sen,估计Q4 EPS=4.3SEN,

则2015 eps=17 sen,pe=10,stock price=rm1.70

于30-09-2015公司现金有3676万,债务为9055万.业务扩展中.

于30-04-2015 的30大股东已持有76.96%(230891张),市场流通量只有69109张,总股数为300000張.

TEOSENG 绝对是投资者的首选股,公司的潜在价值好,成长佳,将会是一只黑马股。

看看其他同行----a)LAYHONG 9385 ,RM8.18 ,PE=22.3 的高pe成交下,

b)ql 7084 rm4.54 ,pe=28.5

c)cab 7174 rm1.69 ,pe=15.8,

d)ltkm 7085 rm1.50 ,pe=5 ,

e)huatlai 7141 rm4.97 pe=7.3

f)pwf 7134 rm1.28 pe=11.2

g))teoseng 7252 rm1.32 ,pe=7.23 (是不是值得进入,haha)

---还有年关到了,对鸡旦大须求呀,

A)layhong 每股5 元被曰本公司收购部分股权,eps=36.6sen ,pe=13 ,

因此teoseng eps=17sen,pe=13,stock price=rm2.21 ,

http://www.nanyang.com/node/745208?tid=462

B)cab 每股2.07 元被印尼公司認购部分股权,

eps=10.6sen ,pe=19.5 , 因此teoseng 的eps=17sen,pe=19.5

stock price=rm3.31

http://www.nanyang.com/node/744602?tid=462

,参考一下

1)

日常所需品不怕经济低迷,鸡蛋为人类主要食品,业务抗跌性强,永远不会有销售问题.持有也有信心。

目前3个季度eps达12.7 sen,估计Q4 EPS=4.3SEN,

则2015 eps=17 sen,pe=10,stock price=rm1.70

于30-09-2015公司现金有3676万,债务为9055万.业务扩展中.

于30-04-2015 的30大股东已持有76.96%(230891张),市场流通量只有69109张,总股数为300000張.

TEOSENG 绝对是投资者的首选股,公司的潜在价值好,成长佳,将会是一只黑马股。

看看其他同行----a)LAYHONG 9385 ,RM8.18 ,PE=22.3 的高pe成交下,

b)ql 7084 rm4.54 ,pe=28.5

c)cab 7174 rm1.69 ,pe=15.8,

d)ltkm 7085 rm1.50 ,pe=5 ,

e)huatlai 7141 rm4.97 pe=7.3

f)pwf 7134 rm1.28 pe=11.2

g))teoseng 7252 rm1.32 ,pe=7.23 (是不是值得进入,haha)

---还有年关到了,对鸡旦大须求呀,

A)layhong 每股5 元被曰本公司收购部分股权,eps=36.6sen ,pe=13 ,

因此teoseng eps=17sen,pe=13,stock price=rm2.21 ,

http://www.nanyang.com/node/745208?tid=462

B)cab 每股2.07 元被印尼公司認购部分股权,

eps=10.6sen ,pe=19.5 , 因此teoseng 的eps=17sen,pe=19.5

stock price=rm3.31

http://www.nanyang.com/node/744602?tid=462

,参考一下

1)

雞蛋跌價‧潮成賺益難有起色

Author: Tan KW | Publish date: Tue, 1 Dec 2015, 11:54 AM

2015-12-01 11:42

(吉隆坡30日訊)潮成資本(TEOSENG,7252,主板消費品組)第三季業績成長不如預期,分析員相信雞蛋價格走跌將抵銷能源成本減少利多,未來賺益料難有重大起色。

雞蛋價格下跌影響潮成資本9個月淨利表現低於預期,因此大馬研究調低其2015至2017年盈利預測19至24%,以反映產品賺益減少現況。

展望未來,大馬研究認為,2016年竣工的生物發電廠帶來的能源成本節省將被雞蛋價格走低抵銷,賺益不會有太大改善。

不過,大馬研究指出,該公司估值依然十分吸引,現10倍本益比較同儕平均的14倍低32%,因此維持其“買進”評級,但目標價下調至2令吉45仙。

股價:1令吉53仙

總股本:3億零1千225股

市值:4億零500萬1千654令吉

30天日均成交量:176萬股

最新季度營業額:1億零247萬2千令吉

最新季度盈虧:淨利1千197萬2千令吉

每股淨資產:67仙

本益比:-

週息率:3.23%

大股東:龍合控股(51.12%)(星洲日報/財經)

總股本:3億零1千225股

市值:4億零500萬1千654令吉

30天日均成交量:176萬股

最新季度營業額:1億零247萬2千令吉

最新季度盈虧:淨利1千197萬2千令吉

每股淨資產:67仙

本益比:-

週息率:3.23%

大股東:龍合控股(51.12%)(星洲日報/財經)

2)

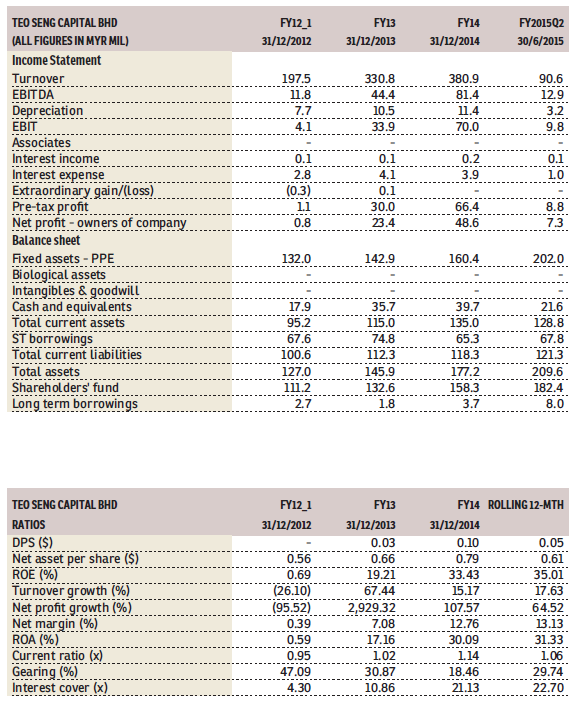

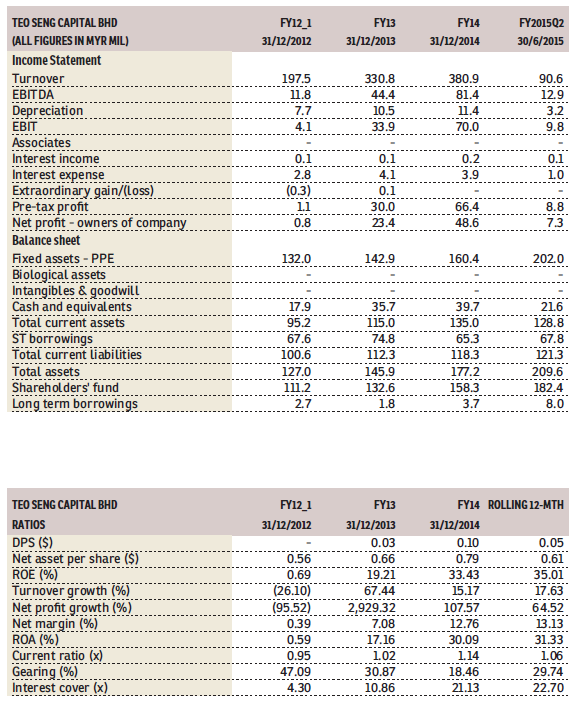

Teo Seng Capital - Key takeaways from corporate luncheon BUY

Author: kiasutrader | Publish date: Thu, 19 Nov 2015, 11:27 AM

- We reiterate BUY on Teo Seng Capital (TSC) with an unchanged fair value of RM2.45/share. We continue to peg our valuation to a fully-diluted FY16F PE of 13x.

- We hosted a corporate luncheon with key personnel from TSC and institutional funds yesterday, and came away assured of the group’s earnings prospects and position as a leading egg producer. We continue to like TSC for its undemanding valuations, robust earnings growth (3-year CAGR: +15%) and expanding dividend payout (historically 25%, policy: 20%-50%).

- Key takeaways from the luncheon:

- TSC’s present valuations are undemanding. The stock is currently trading at an attractive fully-diluted FY16F PE of only 8x. This is a 47% discount to the average PE of 15x for the consumer companies under our coverage.

Source: AmeSecurities Research - 19 Nov 2015

3)

- We hosted a corporate luncheon with key personnel from TSC and institutional funds yesterday, and came away assured of the group’s earnings prospects and position as a leading egg producer. We continue to like TSC for its undemanding valuations, robust earnings growth (3-year CAGR: +15%) and expanding dividend payout (historically 25%, policy: 20%-50%).

- Key takeaways from the luncheon:

(1) Management clarified that its flattish YoY PBT for 9MFY15 and corresponding 1.5ppt margin contraction was primarily due to low egg prices (particularly in 2Q and a weaker-than-expected rebound in 3Q). We understand that a 1 sen decline in egg prices results in a RM1mil/month decline in the group’s net profit. Looking ahead, management expects prices to rise in 4QFY15 in tandem with year-end festivities, and to average at 30 sen/egg for FY15F and 31 sen/egg for FY16F.

(2) The group’s expansion plans remain on track. Although it only added one new farm in FY15F (in Nov; target was 2), it still met its production capacity of 3.3mil eggs per day as it had added new ‘houses’ to its existing farms instead of building a new farm. We understand that land for its FY16F’s expansion (1 farm, capacity +13%) has been secured.

(3) Demand from Singapore, to which it exports 30% of its egg production, remains robust. While the group can still gain from the stronger SGD vs RM, we note that the price differential between the two markets has narrowed to 2 sen/egg from 5 sen/egg just two months ago.

(4) Feedstock prices are expected to remain low and stable moving forward. In 9MFY15, corn and soybean prices were lower by 20% and 17% YoY, respectively. However, after forex adjustments, they were only lower by 1.2% and 1.5%. The group has bought forward its raw materials up to 1QFY16.

(5) TSC’s superior margins are expected to remain stable. Any price weakness may be offset by energy cost savings from its biogas plant-ups, use of natural gas for egg tray production, and margin enhancements from external sales of paper egg trays (GP margin of 20+%). It foresees no impact from the minimum wage hike next year as most of its workers are paid above that level (at ~RM1,400).

- We leave our FY15F-FY17F earnings estimates unchanged for now in view of our recent downward revision (-19% to -24%) post the release of its 9MFY15 results.- TSC’s present valuations are undemanding. The stock is currently trading at an attractive fully-diluted FY16F PE of only 8x. This is a 47% discount to the average PE of 15x for the consumer companies under our coverage.

Source: AmeSecurities Research - 19 Nov 2015

3)

Teo Seng Capital - 9MFY15 weighed down by soft prices BUY

Author: kiasutrader | Publish date: Wed, 18 Nov 2015, 09:51 AM

- We reaffirm BUY on Teo Seng Capital (TSC) but with a lower fair value of RM2.45/share post its weaker-thanexpected 3QFY15 results. Our fair value is based on an unchanged fully-diluted PE of 13x over rolled-forward FY16F earnings.

- TSC’s 9MFY15 results came in below expectations. The group reported a 3QFY15 net profit of RM12mil (QoQ: +65%; YoY: +11%) to bring its 9MFY15 earnings to RM37mil (YoY: +20%). A single-tier interim dividend of 2.5 sen/share was declared.

- In light of this, we have revised downwards our FY15FFY17F earnings forecasts by 19%-24% to reflect its softer margins (-2ppts). Nonetheless, we note that its margins are still superior to that of its peers (EBITDA margin of 19% vs. peers’ average of 15%).

- The negative variance vis-à-vis our forecast can be primarily attributed to lower-than-expected average egg prices for the cumulative nine months (29.5 sen/egg vs our projected 32 sen/egg). Volumes were firm, with the quantity of eggs sold being 11% higher YoY thanks to the addition of its new farm (+400,000 eggs per day) in November last year.

- On a sequential basis, TSC’s earnings had improved as anticipated. Note that a better comparison for its QoQ performance would be its profit before tax (+37%) in view of its abnormally low tax rate (1%) in 3QFY15. We understand that this was due to the availability of a oneoff tax incentive (~RM3.5mil) from its increased exports to Singapore.

- The rebound in TSC’s earnings was in tandem with the recovery of egg prices over the quarter, i.e. from an average of 26 sen/egg in 2QFY15 to 29 sen/egg in 3QFY15 (peak was 34 sen/egg) as well as new capacity from the addition of new houses to its existing farms in July.

- Feed prices have also been on a downward trend. TSC’s corn and soybean input prices were still lower by 12% and 7% QoQ, respectively, after adjusting for the currency impact.

- Looking ahead, we do not expect TSC’s margins to contract further as any price weakness may be offset by energy cost savings from its usage of natural gas (vs. LPG previously) for its egg tray production and upcoming biogas plant-ups (early FY16).

- TSC’s valuations remain compelling. The stock is currently trading at an attractive fully-diluted forward PE of only 10x. This is a 32% discount to the average PE of 14x for the consumer companies under our coverage. Since the order-driven sell-down in August, TSC’s share price has been on an upward trend, rising 43%.

Source: AmeSecurities Research - 17 Nov 2015

4)

· TEOSENG (Stopped Out @ RM1.58). We previously recommended a ‘Trading Buy’ call on TEOSENG when the share price appeared to set to ride on the recent hype on the rising egg prices to complete its ‘Rounding Bottom’ chart pattern. However, the share price failed to play out according to our expectations as it broke down from our stop-loss level of RM1.58 to form a ‘Cup and Handle’ chart pattern. On top of that, the price weakness could possibly be prolonged from here, underpinned by the neutralization process of both RSI and Stochastic from their respective overbought territory. Hence, we are stopping out on this counter but will re-look when the share price forms a more compelling technical picture.

5)

- TSC’s 9MFY15 results came in below expectations. The group reported a 3QFY15 net profit of RM12mil (QoQ: +65%; YoY: +11%) to bring its 9MFY15 earnings to RM37mil (YoY: +20%). A single-tier interim dividend of 2.5 sen/share was declared.

- In light of this, we have revised downwards our FY15FFY17F earnings forecasts by 19%-24% to reflect its softer margins (-2ppts). Nonetheless, we note that its margins are still superior to that of its peers (EBITDA margin of 19% vs. peers’ average of 15%).

- The negative variance vis-à-vis our forecast can be primarily attributed to lower-than-expected average egg prices for the cumulative nine months (29.5 sen/egg vs our projected 32 sen/egg). Volumes were firm, with the quantity of eggs sold being 11% higher YoY thanks to the addition of its new farm (+400,000 eggs per day) in November last year.

- On a sequential basis, TSC’s earnings had improved as anticipated. Note that a better comparison for its QoQ performance would be its profit before tax (+37%) in view of its abnormally low tax rate (1%) in 3QFY15. We understand that this was due to the availability of a oneoff tax incentive (~RM3.5mil) from its increased exports to Singapore.

- The rebound in TSC’s earnings was in tandem with the recovery of egg prices over the quarter, i.e. from an average of 26 sen/egg in 2QFY15 to 29 sen/egg in 3QFY15 (peak was 34 sen/egg) as well as new capacity from the addition of new houses to its existing farms in July.

- Feed prices have also been on a downward trend. TSC’s corn and soybean input prices were still lower by 12% and 7% QoQ, respectively, after adjusting for the currency impact.

- Looking ahead, we do not expect TSC’s margins to contract further as any price weakness may be offset by energy cost savings from its usage of natural gas (vs. LPG previously) for its egg tray production and upcoming biogas plant-ups (early FY16).

- TSC’s valuations remain compelling. The stock is currently trading at an attractive fully-diluted forward PE of only 10x. This is a 32% discount to the average PE of 14x for the consumer companies under our coverage. Since the order-driven sell-down in August, TSC’s share price has been on an upward trend, rising 43%.

Source: AmeSecurities Research - 17 Nov 2015

4)

· TEOSENG (Stopped Out @ RM1.58). We previously recommended a ‘Trading Buy’ call on TEOSENG when the share price appeared to set to ride on the recent hype on the rising egg prices to complete its ‘Rounding Bottom’ chart pattern. However, the share price failed to play out according to our expectations as it broke down from our stop-loss level of RM1.58 to form a ‘Cup and Handle’ chart pattern. On top of that, the price weakness could possibly be prolonged from here, underpinned by the neutralization process of both RSI and Stochastic from their respective overbought territory. Hence, we are stopping out on this counter but will re-look when the share price forms a more compelling technical picture.

5)

Teo Seng Capital - Egg prices stage a rebound BUY

Author: kiasutrader | Publish date: Wed, 30 Sep 2015, 10:03 AM

- We maintain BUY on Teo Seng Capital (TSC) with an unchanged fair value of RM2.70/share. This is based on an unchanged fully-diluted PE of 13x FY15F EPS.

- From our recent discussions with management, we learnt that egg prices have gradually rebounded from 28 sen/egg in 2QFY15 to 34 sen/egg over 3QFY15. Note that the latter was the average egg price in 4QFY14 and 1QFY15 and is the highest historically.

- The upward trend in egg prices is positive for TSC. Although we had earlier anticipated prices to tick up in tandem with increased domestic demand during the festive periods (eg. Hari Raya), we did not expect the quantum to be as large. The supply backlog has also eased, thanks to higher exports to Hong Kong.

- Egg prices had declined by 24% QoQ back in 2QFY15 due to seasonally low demand (i.e. absence of festivities and the fasting month in June/July) and to a smaller extent, the impact of GST on overall consumer sentiment.

- Interestingly, we also understand that the price of its egg exports to Singapore (~30% of total production) is presently as high as 38 sen/egg. This is unusual given that the price differential between the domestic and Singapore market is typically between 1-2 sen/egg. The wider spread is mainly attributable to the current weakness of the RM vis-à-vis the SGD (YTD: -31%).

- We make no changes to our FY15F-FY17F earnings estimates unchanged for now. The rebound in egg prices alongside the timely addition of two new farms in July and November (+25% capacity from 3.1mil eggs per day) bode well for TSC’s 2HFY15 earnings.

- Post its recent order-driven sell-down, TSC’s share price has been on an upward trend, rising 31% in the past month. The stock is currently trading at an attractive fully-diluted forward PE of only 7x. This is a steep 53% discount to the average PE of 15x for the consumer companies under our coverage.

Source: AmeSecurities Research - 30 Sep 2015

6)

Insider Asia’s Stock Of The Day: TEOSENG (28/09/2015)

7)

- From our recent discussions with management, we learnt that egg prices have gradually rebounded from 28 sen/egg in 2QFY15 to 34 sen/egg over 3QFY15. Note that the latter was the average egg price in 4QFY14 and 1QFY15 and is the highest historically.

- The upward trend in egg prices is positive for TSC. Although we had earlier anticipated prices to tick up in tandem with increased domestic demand during the festive periods (eg. Hari Raya), we did not expect the quantum to be as large. The supply backlog has also eased, thanks to higher exports to Hong Kong.

- Egg prices had declined by 24% QoQ back in 2QFY15 due to seasonally low demand (i.e. absence of festivities and the fasting month in June/July) and to a smaller extent, the impact of GST on overall consumer sentiment.

- Interestingly, we also understand that the price of its egg exports to Singapore (~30% of total production) is presently as high as 38 sen/egg. This is unusual given that the price differential between the domestic and Singapore market is typically between 1-2 sen/egg. The wider spread is mainly attributable to the current weakness of the RM vis-à-vis the SGD (YTD: -31%).

- We make no changes to our FY15F-FY17F earnings estimates unchanged for now. The rebound in egg prices alongside the timely addition of two new farms in July and November (+25% capacity from 3.1mil eggs per day) bode well for TSC’s 2HFY15 earnings.

- Post its recent order-driven sell-down, TSC’s share price has been on an upward trend, rising 31% in the past month. The stock is currently trading at an attractive fully-diluted forward PE of only 7x. This is a steep 53% discount to the average PE of 15x for the consumer companies under our coverage.

Source: AmeSecurities Research - 30 Sep 2015

6)

Insider Asia’s Stock Of The Day: TEOSENG (28/09/2015)

Author: Tan KW | Publish date: Mon, 28 Sep 2015, 10:02 AM

This article first appeared in The Edge Financial Daily, on September 23, 2015.

TEO Seng (Fundamental: 1.5/3, Valuation: 1.9/3) is predominantly involved in layer farming — rearing chickens to produce eggs. With current production of 3 million eggs per day, it is one of the largest egg producer in the country. The company has its own in-house feed mill and also manufactures animal health products.

We like Teo Seng as a well-managed company, with higher than industry average profit margin (trailing 12-month net margin of 13.1%) and lower than average gearing of 29.7%. It is also fairly inexpensive, trading at trailing 12-month P/E and EV/EBITDA of 7.96 and 5.48 times, respectively.

Whilst demand for eggs is fairly resilient — and should grow steadily — earnings are affected by fluctuating egg prices and costs for feed stock, mainly corn and soybean meal, which are denominated in US dollar.

Teo Seng’s share price rallied in 1Q2015, buoyed by higher egg prices and lower feed costs. But its shares then slumped to the current RM1.42, down 35.75% from a peak of RM2.21. This follows weak 2Q2015 earnings results where a sharp fall in egg prices — Grade “A” dropped from 37 cents to 29 cents — saw earnings drop 58.44% q-q to RM7.3 million.

Positively, egg prices are on the rebound and we expect better performance in 2H2015. This could be the catalyst for a fresh rally. Teo Seng has hedged about one year’s supply of animal feed in 2Q2015; thus, impact from recent weakening of ringgit will be minimal. It also exports about 27.75% of the revenue to Singapore and should benefit from the stronger Singapore dollar.

The company is expanding capacity, which should underpin longer-term growth. Dividends, however, may be cut back this year, in view of the higher capex. Teo Seng has a dividend policy to pay out 20-50% of annual net profits. We estimate dividends at roughly 5 sen per share — after taking into account the 1-for-2 bonus issue in January. That will earn shareholders a fairly decent yield of 3.52%.

http://www.theedgemarkets.com/my/article/insider-asia%E2%80%99s-stock-day-teo-seng-capital-bhd

Insider Asia’s Stock Of The Day: TEOSENG (28/09/2015)

7)

雞蛋產量將揚25%‧潮成前景看俏

Author: Tan KW | Publish date: Fri, 24 Jul 2015, 05:43 PM

2015-07-24 17:28

(吉隆坡22日訊)潮成資本(TEOSENG,7252,主板消費品組)2座新農場下半年投運後,雞蛋產量料增25%,加上能源成本降低的利好,分析員看好該公司前景。

今年增2新農場

大馬研究近日會晤該公司管理層後表示,該公司將在7月及11月增設2座新農場,屆時雞蛋產量可提高25%。目前,每年的產量為310萬粒。

管理層也表示,生產蛋托(egg tray)的能源已在5月份從石油天然氣(LPG)轉換成天然氣,預期每年可節省150萬令吉的能源成本。

此外,管理層指出,目前建造中5座生物氣體工廠進展滿意,首座工廠可在今年完工,預期每年可節省200萬令吉的電費。

管理層透露,基於季節性及消費稅的影響,導致雞蛋價格從每粒34仙高峰下滑24%,目前蛋價仍高於24仙的平均收支平衡價格。

分析員預期第二季淨利將放緩,但有信心在下半年在節慶日子需求及兩座新農場啟用的帶動下,該公司淨利將回彈。

分析員說,該公司早前趁大豆及玉米價格放緩時,已經將遠期購買合約從3個月延長至6個月(至2015年12月),因此即使保守假設美元匯率為3令吉70仙,其飼料成本仍比目前現貨價低11%至21%。

分析員預期該公司營運盈利(EBITDA)賺幅可維持在21%。

大馬研究表示,該公司產品需求每年取得3%至5%穩定的成長、具良好管理層、本益比低及3年23%的複合成長率(CAGR),加上提高派息率,維持該公司“買進”評級及2令吉70仙的目標價不變。(星洲日報/財經‧報導:謝汪潮)

8)

每股5元场外购13.8% NH Foods 增持丽鸿至22.88%

Published by 南洋网 at 2016-01-23 12:32:00

(吉隆坡22日讯)丽鸿(LAYHONG,9385,主板消费产品股)今日证实,大股东日本NHFoods周四在场外,以每股5令吉收购800万股或13.8%股权。

该售价相等于丽鸿周四闭市价8令吉的折价37.5%。

在收购该批股权之后,NH Foods如今的持股率将从原本的9.08%,提高至22.88%。

由此,NH Foods不但可在公司拥有高度影响力,还能根据持股比例,把投资所得纳入账目上。

早前《星报》引述消息透露,尽管NHFoods刚在近期崛起为大股东,但丽鸿依然很受国际业者青睐,持续收到缔结合作的献议。

国际业者锁定小家禽商

这些国际食品业者正锁定小型,但发展良好的家禽公司,来展开合作,从而能够更快速地扩展业务。

“从科技来看,丽鸿和潮成集团(TEOSENG,7252,主板消费产品股)是国外企业看好的目标,其中,丽鸿不仅拥有强劲的NutriPlus品牌,还能出口鸡蛋到新加坡,并具备鸡蛋相关专才。”

消息称,NutriPlus是我国顶尖的品牌之一,因此,NH Foods或其他潜在伙伴可借助该品牌,出口到我国和新加坡市场。

此外,另一家家禽公司CAB机构(CAB,7174,主板消费产品股),共有878万股或5.83%股权,于周二(19日)在场外易手,售价为每股1.68令吉。

消息相信,这批股权的买家,就是印尼三林集团(Salim Group)旗下KMP投资公司。

9)

10)

Teoseng: A Real Price Concern

There is little doubt that Teoseng is a successfully-run poultry company.

Its revenue and especially net profit, grew by leaps and bounds in the last 2 years.

Its FY14 ROE breaches 30.

It gives great dividends and bonus issue.

It has a 5-year plan to increase its chicken egg production capacity by 60% from 3.2 mil/day to 5.1 mil/day.

It plans to increase its export to Singapore from 30% to 40%.

Its first of five biogas plant to save cost is on track to be completed this year.

It aims to be the largest egg producer in Malaysia in the future.

Despite all these positive notes, Teoseng's share price has been trending down since reaching a height at RM2.20 in end of Mac15 after bonus issue.

Currently it is trading at slightly above RM1.50 level, and failed to follow the spectacular rebound in KLCI in the past 3 days.

If we annualize FY15Q1's PATAMI of RM17.5mil, its shares are traded at projected PE of only 6.4x, and this company is still in expansion mode.

Why?

Is poultry theme play over?

Teoseng share price in 2015

How did Teoseng achieve such an impressive financial result lately? Its net profit jumps 180% in just 2 years.

Though Teoseng has several businesses such as poultry farming (layer), trading of animal health products, manufacturing of paper egg trays & poultry feeds, its poultry farming contributes 90% of its bottom line in FY14.

So, the vast improvement in its earning should be related to its poultry farming segment.

I'm not sure how much has Teoseng expanded its layer farms between 2012-2014. Increased egg production capacity will certainly contribute directly to its revenue and profit.

I feel that there should be some expansion but perhaps not that much.

So, the improvement in financial performance in the last 2 years should be largely due to lower material cost and higher egg selling price.

Feeds (corn/soybean) make up about 70% of layer farming's cost. From 2012 to 2014, corn price fell by more than 50%. Surely low feeds price has raised Teoseng bottomline significantly.

Though corn & soybean price rebound in June15, they are expected to stay low due to increased harvest in North & South America.

Has recent sharp rebound in corn & soybean price affected investors' sentiment in Teoseng? I don't know.

Another potential culprit might be chicken egg price.

Teoseng currently produces about 3.2 million eggs per day. If egg price increases by 1sen, its revenue will potentially increase by RM32,000 a day, or RM2.88mil in a quarter.

If other cost & parameters remain the same, this extra RM2.88mil a quarter will go towards its PBT.

In other words, if egg price increases by 1sen, Teoseng can potentially earn RM2.88mil more in its pre-tax profit.

But if egg price drops 1sen, then Teoseng may potentially earn RM2.88mil less.

If egg price drop by 10sen, does it mean that Teoseng's profit will potentially drop RM28.8mil in a quarter which will throw it into loss???

Of course things are not that straight forward. Egg price fluctuates every few days and there are many other reasons that can affect its profit.

To check our country's egg price, I found a website that records Malaysia's historical chicken egg price, by Department of Veterinary Services.

If you study the price trend, there seems to be a rather significant drop in egg price since Mac15.

Malaysia Chicken Egg Price in 2015

The line chart below shows monthly Grade A chicken egg price since year 2013. Since there are a few data in each month, I will pick the price closest to middle of the month to represent that month.

Grade A Egg Price Chart 2013-2015

Grade A chicken egg price hit new high at 39sen in Nov14 and then 41sen in Dec14 and Jan15 before returning to 38-39sen in Feb/Mac15.

This coincides with significant jump in revenue and profit for Teoseng in FY14Q4 and FY15Q1.

However, in second quarter of 2015, grade A chicken egg price falls to 32-35 level. In average it is about 5sen lower than first quarter of 2015.

How do you think it will affect Teoseng's FY15Q2 earning?

Egg price is like CPO price, which will have direct impact on a company's top & bottom lines compared to other commodities used as raw materials.

It's a norm that egg price will fluctuate. Nevertheless, due to inflation, it is expected that egg price will trend upwards with time.

Many years ago, grade A eggs may be sold at 10-20sen, now it's 30-40sen, in the near future it might be 40-50sen.

I believe that current selling pressure on Teoseng's shares is mainly because of declining egg price, and to a certain extent, fear of bottoming out of feed price.

As Q2 is already over, I suspect that Teoseng's FY15Q2 result will not be as good as its latest 2 quarters.

If egg price continue to stay at Q2 2015 level for the rest of the year, then all layer farming operators should see poorer FY15 compared to FY14.

Is this part of the reason Teoseng put its Sungai Linggui expansion plan on hold?

As I have mentioned earlier, I think Teoseng is still a well-managed company who has no control over commodity price.

With its ambitious expansion plan, shareholders should get the reward in long term.

Who knows grade A egg price will suddenly go above 40sen in second half of 2015?

Posted by Bursa Dummy 17 comments:

Email This

BlogThis!

Share to Twitter

Share to Facebook

Share to Pinterest

Labels: Teoseng

Saturday, 10 January 2015

Poultry Farming & Listed Companies In Malaysia

After struggling in year 2012, many poultry farming companies finally caught investors' eyes by producing much better earnings since the start of year 2014.

As a result, most of their share prices have gone up about 50% and some more than 100% in just one year time, outperforming the unfortunate KLCI by several streets.

Is it too late to join the poultry party now? Are those poultry farming companies still undervalued after the jump in share price?

I have found 9 listed companies involved in poultry farming and related business. I'll just do a simple comparison among them.

Not every company runs exactly the same business. Some rear chicken only for its meat (broiler), some only for its eggs (layer), some slaughter the chicken, some process the meat to nuggets etc (food).

Some companies also venture into related businesses such as marine food, chicken feeds, making fertilizer from chicken manure, manufacturing egg trays and trading animal health products.

Below are main business for the 9 listed companies

Company Business

QL Broiler, Layer, Feeds, Marine, Palm Oil

Huat Lai Broiler, Layer, Feeds, Fertilizer, Trays

CAB Broiler, Food, Marine, Retail

Lay Hong Broiler, Layer, Food, Supermarket

Farmbes Broiler, Layer, Food, Property

PW Broiler, Layer, Feeds, Cattle, Food

Teo Seng Layer, Feeds, Trays, Animal food & health products

LTKM Layer, Sand mining, Property

TPC Layer

Looking into their historical financial results, almost all except QL and may be Teoseng, have rather "choppy" performance in which net profit swing up & down despite consistently higher revenue every year.

Due to company expansion and inflation, we would expect revenue to go up consistently. So the fluctuating net profit must be due to fluctuating cost.

For pure broiler and/or layer farming, chicken feeds make up 70-75% of its cost of sales. So market price of corn and soybean which are used as chicken feeds will have a big impact on the company's performance.

Other than increase in poultry & eggs selling price, significant reduction in corn and soybean price since 2013 has largely improved the earnings of poultry farming operators.

Charts below show 10-year historical corn & soybean price.

As we can see from the charts above, corn & soybean price have dropped about 50% from their peak in 2012, mainly due to overproduction in the US.

From 2010, corn price rose steeply for almost 100% in less than a year, while soybean price also rose about 50% in the same period. Both stayed at high level throughout 2011-2012.

This may explain why most poultry farming companies suffered loss (except QL, Teo Seng & PW) or lower profit (Teoseng & PW) in calendar year 2012.

Now the corn & soybean price have suddenly dropped to about 8-year low. Do you think it will continue to drop to its 10-year low, or rebound, or move sideways in 2015?

From history, it can rise as fast as it falls.

Nevertheless, I think no one can be sure but surely it will have a great impact on poultry farmers' earning.

Among those 9 poultry-related companies, which one is the best to invest in?

I will use annualized figures to calculate the EPS to better reflect each company's latest performance, as I predict most of them will release even better results in the final quarter of CY2014 due to even lower feed price in the 2nd half of 2014.

So, this analysis which uses annualized earnings (except CAB), will not be very accurate.

Stock FY End Revenue PATAMI PATAMI % ROE CR D/E

QL Mac 2620 176.4 6.7 13.6 1.76 0.44

Huat Lai Dec 1222 44.6 3.6 20.5 0.58 2.44

CAB Sep 672 11.2 1.7 6.5 0.73 0.61

Lay Hong Mac 646 15.7 2.4 12.3 0.83 1.38

Farmbes Dec 432 2.7 0.6 2.8 1.15 2.74

Teo Seng Dec 363 40.9 11.3 27.2 1.12 0.26

PW Dec 287 14.1 4.9 6.5 0.88 0.40

LTKM Mac 187 29.7 15.9 16.9 2.40 NC

TPC Dec 79 3.8 4.8 20.1 0.41 2.25

NC = net cash

CR = current ratio

QL is the largest among all in term of market cap, revenue and net profit, with its diversification in businesses and also geographical location.

QL has been holding a significant stake in Lay Hong since 2010. It currently owns 38.3% of Lay Hong and recently failed in a rather hostile takeover bid to acquire Lay Hong.

Teo Seng is a subsidiary of Leong Hup which was recently taken private and delisted in 2012. Leong Hup is the country's largest integrated poultry operator.

TPC which is currently a PN17 company, is a 52.91% subsidiary of Huat Lai since 2012.

Meanwhile, Farmbes recently appears as a subject of a RM380mil reverse takeover by Chinese-owned SHH (M) Holding Sdn Bhd.

US-owned Cargill Malaysia is reported to be keen on a controlling stake in CAB as well.

It seems like merger & acquisition activities are robust within the poultry industry.

Other than CAB, PW & Farmbes, all other companies' ROE are good at above 10%, especially Teo Seng, Huat Lai & TPC which are above 20%, thanks to recent lower feeds price.

It's noteworthy that Teo Seng and LTKM's net profit margin stand out from the rest at more than 10%.

In term of balance sheet, it looks like poultry farming is a capital intensive business as many companies are heavily debt-ridden.

Huat Lai, Farmbes & TPC all have net debt to equity ratio of above 2x while Lay Hong is at 1.38. Only LTKM manage to keep a net cash position with impressive current ratio.

From the table above, generally the more "investable" ones to me are QL, Teo Seng & LTKM. CAB & PW are not that attractive due to thin margin and low ROE, besides higher borrowings.

Stock Price #EPS PE NAS PB DIV DY%

QL 3.26 14.1 23.1 1.04 3.1 3.5 1.1

Huat Lai 2.85 51.6 5.5 2.52 1.1 4 1.4

CAB 1.01 8.5 11.9 1.16 0.9 0 0

Lay Hong 3.42 31.0 11.0 2.55 1.3 5 1.5

Farmbes 0.60 4.4 13.6 1.55 0.4 0 0

Teo Seng 1.85 20.4 9.1 0.75 2.5 *10 5.4

PW 1.52 23.1 6.6 3.71 0.4 5 3.3

LTKM 4.09 68.4 6.0 4.05 1.0 18 4.4

TPC 0.385 4.8 8.0 0.24 1.6 0 0* may have more dividends

# base on annualized earnings

QL is no doubt a great company but its PE ratio and PB ratio are too high now.

Though Huat Lai has lowest PE, relatively low PB ratio and high ROE of 20.5, it also has scary amount of debts and very low current ratio.

Apart from Huat Lai, LTKM & PW have the lowest PE at 6.0x & 6.6x respectively, while both Farmbes & PW have the lowest PB at 0.4x.

Teo Seng's dividend is the most attractive, followed by LTKM and PW. It is a little surprise to me that Huat Lai still pay dividend.

So it is not difficult to come to a conclusion that Teo Seng & LTKM are the two companies that suit my investment style.

Coincidentally, both are only in layer farming without broiler farming. Both export their eggs to Singapore as well.

Though Teo Seng is valued higher compared to LTKM now, LTKM seems too conservative in expanding its poultry business compared to Teo Seng.

LTKM who already built 26 units of terrace houses in Banting since 2011 even plans to go bigger into property development with its 20-acre land in Jenjarom!

Anyway, I think both are still not bad to invest in, depending on your taste & timing.

For me, I don't know much about their future expansion plan but it seems like organic growth will be slow.

Besides Teo Seng & LTKM, PW is also worth a second look.

It just made its first venture into table eggs production since 2013 with its new layer farm at Pendang, Kedah.

From its FY13 annual report, PW mentioned that it was developing the 2nd phase of its layer farm which was expected to be completed by early 2015. This will double its daily capacity from 420,000 to 850,000 eggs.

Thus, even with lowish ROE at 6.5%, PW can be a dark horse with very low projected PE & PB ratio, along with satisfactory dividend yield.

Anyway, its tight balance sheet & cash flow remain a risk.

We can assume confidently that chicken & eggs price will only rise in the future. However, cost of energy, raw material and man power will rise as well.

I think corn and soybean price are particularly important to poultry industry, as it can fluctuate so much as shown earlier.

If corn & soybean price are to rebound furiously just like it happened in 2010, those companies' financial results will not be that pretty I guess.

Furthermore, if the raw materials for chicken feeds are imported in USD, recent weakening of RM against USD might add more pressure if corn & soybean price also go up later.

Anyway, I think investors can still anticipate good financial results from poultry operators for year 2015 at least.

As usual, investors need to study those companies in more detail. Invest at own risk.

8)

每股5元场外购13.8% NH Foods 增持丽鸿至22.88%

Published by 南洋网 at 2016-01-23 12:32:00

(吉隆坡22日讯)丽鸿(LAYHONG,9385,主板消费产品股)今日证实,大股东日本NHFoods周四在场外,以每股5令吉收购800万股或13.8%股权。

该售价相等于丽鸿周四闭市价8令吉的折价37.5%。

在收购该批股权之后,NH Foods如今的持股率将从原本的9.08%,提高至22.88%。

由此,NH Foods不但可在公司拥有高度影响力,还能根据持股比例,把投资所得纳入账目上。

早前《星报》引述消息透露,尽管NHFoods刚在近期崛起为大股东,但丽鸿依然很受国际业者青睐,持续收到缔结合作的献议。

国际业者锁定小家禽商

这些国际食品业者正锁定小型,但发展良好的家禽公司,来展开合作,从而能够更快速地扩展业务。

“从科技来看,丽鸿和潮成集团(TEOSENG,7252,主板消费产品股)是国外企业看好的目标,其中,丽鸿不仅拥有强劲的NutriPlus品牌,还能出口鸡蛋到新加坡,并具备鸡蛋相关专才。”

消息称,NutriPlus是我国顶尖的品牌之一,因此,NH Foods或其他潜在伙伴可借助该品牌,出口到我国和新加坡市场。

此外,另一家家禽公司CAB机构(CAB,7174,主板消费产品股),共有878万股或5.83%股权,于周二(19日)在场外易手,售价为每股1.68令吉。

消息相信,这批股权的买家,就是印尼三林集团(Salim Group)旗下KMP投资公司。

9)

10)

Teoseng: A Real Price Concern

There is little doubt that Teoseng is a successfully-run poultry company.

Its revenue and especially net profit, grew by leaps and bounds in the last 2 years.

Its FY14 ROE breaches 30.

It gives great dividends and bonus issue.

It has a 5-year plan to increase its chicken egg production capacity by 60% from 3.2 mil/day to 5.1 mil/day.

It plans to increase its export to Singapore from 30% to 40%.

Its first of five biogas plant to save cost is on track to be completed this year.

It aims to be the largest egg producer in Malaysia in the future.

Despite all these positive notes, Teoseng's share price has been trending down since reaching a height at RM2.20 in end of Mac15 after bonus issue.

Currently it is trading at slightly above RM1.50 level, and failed to follow the spectacular rebound in KLCI in the past 3 days.

If we annualize FY15Q1's PATAMI of RM17.5mil, its shares are traded at projected PE of only 6.4x, and this company is still in expansion mode.

Why?

Is poultry theme play over?

Teoseng share price in 2015

How did Teoseng achieve such an impressive financial result lately? Its net profit jumps 180% in just 2 years.

Though Teoseng has several businesses such as poultry farming (layer), trading of animal health products, manufacturing of paper egg trays & poultry feeds, its poultry farming contributes 90% of its bottom line in FY14.

So, the vast improvement in its earning should be related to its poultry farming segment.

I'm not sure how much has Teoseng expanded its layer farms between 2012-2014. Increased egg production capacity will certainly contribute directly to its revenue and profit.

I feel that there should be some expansion but perhaps not that much.

So, the improvement in financial performance in the last 2 years should be largely due to lower material cost and higher egg selling price.

Feeds (corn/soybean) make up about 70% of layer farming's cost. From 2012 to 2014, corn price fell by more than 50%. Surely low feeds price has raised Teoseng bottomline significantly.

Though corn & soybean price rebound in June15, they are expected to stay low due to increased harvest in North & South America.

Has recent sharp rebound in corn & soybean price affected investors' sentiment in Teoseng? I don't know.

Another potential culprit might be chicken egg price.

Teoseng currently produces about 3.2 million eggs per day. If egg price increases by 1sen, its revenue will potentially increase by RM32,000 a day, or RM2.88mil in a quarter.

If other cost & parameters remain the same, this extra RM2.88mil a quarter will go towards its PBT.

In other words, if egg price increases by 1sen, Teoseng can potentially earn RM2.88mil more in its pre-tax profit.

But if egg price drops 1sen, then Teoseng may potentially earn RM2.88mil less.

If egg price drop by 10sen, does it mean that Teoseng's profit will potentially drop RM28.8mil in a quarter which will throw it into loss???

Of course things are not that straight forward. Egg price fluctuates every few days and there are many other reasons that can affect its profit.

To check our country's egg price, I found a website that records Malaysia's historical chicken egg price, by Department of Veterinary Services.

If you study the price trend, there seems to be a rather significant drop in egg price since Mac15.

Malaysia Chicken Egg Price in 2015

The line chart below shows monthly Grade A chicken egg price since year 2013. Since there are a few data in each month, I will pick the price closest to middle of the month to represent that month.

Grade A Egg Price Chart 2013-2015

Grade A chicken egg price hit new high at 39sen in Nov14 and then 41sen in Dec14 and Jan15 before returning to 38-39sen in Feb/Mac15.

This coincides with significant jump in revenue and profit for Teoseng in FY14Q4 and FY15Q1.

However, in second quarter of 2015, grade A chicken egg price falls to 32-35 level. In average it is about 5sen lower than first quarter of 2015.

How do you think it will affect Teoseng's FY15Q2 earning?

Egg price is like CPO price, which will have direct impact on a company's top & bottom lines compared to other commodities used as raw materials.

It's a norm that egg price will fluctuate. Nevertheless, due to inflation, it is expected that egg price will trend upwards with time.

Many years ago, grade A eggs may be sold at 10-20sen, now it's 30-40sen, in the near future it might be 40-50sen.

I believe that current selling pressure on Teoseng's shares is mainly because of declining egg price, and to a certain extent, fear of bottoming out of feed price.

As Q2 is already over, I suspect that Teoseng's FY15Q2 result will not be as good as its latest 2 quarters.

If egg price continue to stay at Q2 2015 level for the rest of the year, then all layer farming operators should see poorer FY15 compared to FY14.

Is this part of the reason Teoseng put its Sungai Linggui expansion plan on hold?

As I have mentioned earlier, I think Teoseng is still a well-managed company who has no control over commodity price.

With its ambitious expansion plan, shareholders should get the reward in long term.

Who knows grade A egg price will suddenly go above 40sen in second half of 2015?

Posted by Bursa Dummy 17 comments:

Email This

BlogThis!

Share to Twitter

Share to Facebook

Share to Pinterest

Labels: Teoseng

Saturday, 10 January 2015

Poultry Farming & Listed Companies In Malaysia

After struggling in year 2012, many poultry farming companies finally caught investors' eyes by producing much better earnings since the start of year 2014.

As a result, most of their share prices have gone up about 50% and some more than 100% in just one year time, outperforming the unfortunate KLCI by several streets.

Is it too late to join the poultry party now? Are those poultry farming companies still undervalued after the jump in share price?

I have found 9 listed companies involved in poultry farming and related business. I'll just do a simple comparison among them.

Not every company runs exactly the same business. Some rear chicken only for its meat (broiler), some only for its eggs (layer), some slaughter the chicken, some process the meat to nuggets etc (food).

Some companies also venture into related businesses such as marine food, chicken feeds, making fertilizer from chicken manure, manufacturing egg trays and trading animal health products.

Below are main business for the 9 listed companies

Company Business

QL Broiler, Layer, Feeds, Marine, Palm Oil

Huat Lai Broiler, Layer, Feeds, Fertilizer, Trays

CAB Broiler, Food, Marine, Retail

Lay Hong Broiler, Layer, Food, Supermarket

Farmbes Broiler, Layer, Food, Property

PW Broiler, Layer, Feeds, Cattle, Food

Teo Seng Layer, Feeds, Trays, Animal food & health products

LTKM Layer, Sand mining, Property

TPC Layer

Looking into their historical financial results, almost all except QL and may be Teoseng, have rather "choppy" performance in which net profit swing up & down despite consistently higher revenue every year.

Due to company expansion and inflation, we would expect revenue to go up consistently. So the fluctuating net profit must be due to fluctuating cost.

For pure broiler and/or layer farming, chicken feeds make up 70-75% of its cost of sales. So market price of corn and soybean which are used as chicken feeds will have a big impact on the company's performance.

Other than increase in poultry & eggs selling price, significant reduction in corn and soybean price since 2013 has largely improved the earnings of poultry farming operators.

Charts below show 10-year historical corn & soybean price.

As we can see from the charts above, corn & soybean price have dropped about 50% from their peak in 2012, mainly due to overproduction in the US.

From 2010, corn price rose steeply for almost 100% in less than a year, while soybean price also rose about 50% in the same period. Both stayed at high level throughout 2011-2012.

This may explain why most poultry farming companies suffered loss (except QL, Teo Seng & PW) or lower profit (Teoseng & PW) in calendar year 2012.

Now the corn & soybean price have suddenly dropped to about 8-year low. Do you think it will continue to drop to its 10-year low, or rebound, or move sideways in 2015?

From history, it can rise as fast as it falls.

Nevertheless, I think no one can be sure but surely it will have a great impact on poultry farmers' earning.

Among those 9 poultry-related companies, which one is the best to invest in?

I will use annualized figures to calculate the EPS to better reflect each company's latest performance, as I predict most of them will release even better results in the final quarter of CY2014 due to even lower feed price in the 2nd half of 2014.

So, this analysis which uses annualized earnings (except CAB), will not be very accurate.

Stock FY End Revenue PATAMI PATAMI % ROE CR D/E

QL Mac 2620 176.4 6.7 13.6 1.76 0.44

Huat Lai Dec 1222 44.6 3.6 20.5 0.58 2.44

CAB Sep 672 11.2 1.7 6.5 0.73 0.61

Lay Hong Mac 646 15.7 2.4 12.3 0.83 1.38

Farmbes Dec 432 2.7 0.6 2.8 1.15 2.74

Teo Seng Dec 363 40.9 11.3 27.2 1.12 0.26

PW Dec 287 14.1 4.9 6.5 0.88 0.40

LTKM Mac 187 29.7 15.9 16.9 2.40 NC

TPC Dec 79 3.8 4.8 20.1 0.41 2.25

NC = net cash

CR = current ratio

QL is the largest among all in term of market cap, revenue and net profit, with its diversification in businesses and also geographical location.

QL has been holding a significant stake in Lay Hong since 2010. It currently owns 38.3% of Lay Hong and recently failed in a rather hostile takeover bid to acquire Lay Hong.

Teo Seng is a subsidiary of Leong Hup which was recently taken private and delisted in 2012. Leong Hup is the country's largest integrated poultry operator.

TPC which is currently a PN17 company, is a 52.91% subsidiary of Huat Lai since 2012.

Meanwhile, Farmbes recently appears as a subject of a RM380mil reverse takeover by Chinese-owned SHH (M) Holding Sdn Bhd.

US-owned Cargill Malaysia is reported to be keen on a controlling stake in CAB as well.

It seems like merger & acquisition activities are robust within the poultry industry.

Other than CAB, PW & Farmbes, all other companies' ROE are good at above 10%, especially Teo Seng, Huat Lai & TPC which are above 20%, thanks to recent lower feeds price.

It's noteworthy that Teo Seng and LTKM's net profit margin stand out from the rest at more than 10%.

In term of balance sheet, it looks like poultry farming is a capital intensive business as many companies are heavily debt-ridden.

Huat Lai, Farmbes & TPC all have net debt to equity ratio of above 2x while Lay Hong is at 1.38. Only LTKM manage to keep a net cash position with impressive current ratio.

From the table above, generally the more "investable" ones to me are QL, Teo Seng & LTKM. CAB & PW are not that attractive due to thin margin and low ROE, besides higher borrowings.

Stock Price #EPS PE NAS PB DIV DY%

QL 3.26 14.1 23.1 1.04 3.1 3.5 1.1

Huat Lai 2.85 51.6 5.5 2.52 1.1 4 1.4

CAB 1.01 8.5 11.9 1.16 0.9 0 0

Lay Hong 3.42 31.0 11.0 2.55 1.3 5 1.5

Farmbes 0.60 4.4 13.6 1.55 0.4 0 0

Teo Seng 1.85 20.4 9.1 0.75 2.5 *10 5.4

PW 1.52 23.1 6.6 3.71 0.4 5 3.3

LTKM 4.09 68.4 6.0 4.05 1.0 18 4.4

TPC 0.385 4.8 8.0 0.24 1.6 0 0* may have more dividends

# base on annualized earnings

QL is no doubt a great company but its PE ratio and PB ratio are too high now.

Though Huat Lai has lowest PE, relatively low PB ratio and high ROE of 20.5, it also has scary amount of debts and very low current ratio.

Apart from Huat Lai, LTKM & PW have the lowest PE at 6.0x & 6.6x respectively, while both Farmbes & PW have the lowest PB at 0.4x.

Teo Seng's dividend is the most attractive, followed by LTKM and PW. It is a little surprise to me that Huat Lai still pay dividend.

So it is not difficult to come to a conclusion that Teo Seng & LTKM are the two companies that suit my investment style.

Coincidentally, both are only in layer farming without broiler farming. Both export their eggs to Singapore as well.

Though Teo Seng is valued higher compared to LTKM now, LTKM seems too conservative in expanding its poultry business compared to Teo Seng.

LTKM who already built 26 units of terrace houses in Banting since 2011 even plans to go bigger into property development with its 20-acre land in Jenjarom!

Anyway, I think both are still not bad to invest in, depending on your taste & timing.

For me, I don't know much about their future expansion plan but it seems like organic growth will be slow.

Besides Teo Seng & LTKM, PW is also worth a second look.

It just made its first venture into table eggs production since 2013 with its new layer farm at Pendang, Kedah.

From its FY13 annual report, PW mentioned that it was developing the 2nd phase of its layer farm which was expected to be completed by early 2015. This will double its daily capacity from 420,000 to 850,000 eggs.

Thus, even with lowish ROE at 6.5%, PW can be a dark horse with very low projected PE & PB ratio, along with satisfactory dividend yield.

Anyway, its tight balance sheet & cash flow remain a risk.

We can assume confidently that chicken & eggs price will only rise in the future. However, cost of energy, raw material and man power will rise as well.

I think corn and soybean price are particularly important to poultry industry, as it can fluctuate so much as shown earlier.

If corn & soybean price are to rebound furiously just like it happened in 2010, those companies' financial results will not be that pretty I guess.

Furthermore, if the raw materials for chicken feeds are imported in USD, recent weakening of RM against USD might add more pressure if corn & soybean price also go up later.

Anyway, I think investors can still anticipate good financial results from poultry operators for year 2015 at least.

As usual, investors need to study those companies in more detail. Invest at own risk.

没有评论:

发表评论