1)Daily Technical Highlights – SUPERMX

Author: kiasutrader | Publish date: Thu, 7 Jan 2016, 09:44 AM

SUPERMX (Trading Buy, TP: RM4.17). As per our strategy to focus more

on export-oriented counters and beneficiaries of the stronger greenback,

we are highlighting SUPERMX, which is one of the hot stocks among

the rubber sector yesterday where it surged 26.0 sen (8.2%) to close

at RM3.45 on the back of strong trading volume. During the second

half of yesterday’s trading session, the share price garnered strong

investors interest as it staged a technical breakout from its ‘Flag’ chart

pattern. RSI indicator has shown a strong uptick to suggest that buying

momentum has piled up, while MACD is staging a bullish convergence

to reinforce the bullish picture. Thus, we are placing a trading buy call

on the stock with targets set 3.0 sen below our ‘Flagpole’ measurement

objective level of RM4.20 (R2) at RM4.17. Meanwhile, we are placing a

strict stop-loss at the RM3.07 (3.0 sen below the recent low level of RM3.10).

2)

Author: kiasutrader | Publish date: Thu, 7 Jan 2016, 09:44 AM

SUPERMX (Trading Buy, TP: RM4.17). As per our strategy to focus more

on export-oriented counters and beneficiaries of the stronger greenback,

we are highlighting SUPERMX, which is one of the hot stocks among

the rubber sector yesterday where it surged 26.0 sen (8.2%) to close

at RM3.45 on the back of strong trading volume. During the second

half of yesterday’s trading session, the share price garnered strong

investors interest as it staged a technical breakout from its ‘Flag’ chart

pattern. RSI indicator has shown a strong uptick to suggest that buying

momentum has piled up, while MACD is staging a bullish convergence

to reinforce the bullish picture. Thus, we are placing a trading buy call

on the stock with targets set 3.0 sen below our ‘Flagpole’ measurement

objective level of RM4.20 (R2) at RM4.17. Meanwhile, we are placing a

strict stop-loss at the RM3.07 (3.0 sen below the recent low level of RM3.10).

2)

Rubber Gloves - Stretching To The Top

Author: kiasutrader | Publish date: Wed, 6 Jan 2016, 09:48 AM

We maintain our OVERWEIGHT rating on the rubber gloves sector. The sustained weakness in Ringgit against the USD coupled with longer delivery lead days (implying robust demand) are expected to drive sequential earnings growth and provide the impetus for further upside in share price performance moving into 1Q16. Our investment case is based on: (i) earnings growth underpinned by new capacity expansions matched and fueled by pent-up demand for rubber gloves, especially nitrile gloves, (ii) longer delivery lead days, (iii) favourable USD/MYR exchange rate, and (iv) sustained low raw material prices, especially latex. Our TOP PICK is TOP GLOVE. The PER valuation of Top Glove (19x FY17E PER) has lagged behind its peers such as Kossan (22x FY17E PER) and Hartalega (27x CY17 PER), which we believe is unwarranted. Top Glove at 17.8x FY16E earnings is trading at an average 20% discount to Kossan and Hartalega’s FY17 PERs. The valuation gap should narrow considering that Top Glove has similar/higher total capacity and net profit level compared to Kossan and Hartalega. Hence, our Top Pick is Top Glove (TP: RM15.60). We also have OUTPERFORM calls for HARTALEGA (TP: RM6.40) and SUPERMX (TP: RM3.80). KOSSAN is at MARKET PERFORM (TP: RM9.11).

Solid results for gloves makers in the recently concluded 3QCY15. Glove makers reported a solid 3QCY15. Results of the gloves makers from the recently concluded 3QCY15 results season were mainly within expectations except for Supermax, which came in above. The good set of results for Kossan, Hartalega, Top Glove and Supermax were underpinned by both volume growth from new capacity expansion and favourable USD/MYR exchange rate. Sales volume grew strongly for Kossan (+33% YoY, +10% QoQ), Hartalega (+35% YoY, +15% QoQ) and Top Glove (+15% YoY, +1% QoQ). Supermax’s results came in above expectations driven by volume growth from new plants and favourable USD/MYR exchange rate.

Rubber glove stocks should trade at previous peak valuations. Based on historical valuation at peak earnings, rubber glove stocks namely Top Glove, Hartalega, Supermax and Kossan trades at +2SD above historical mean. We believe rubber glove stocks are poised for further re-rating and should trade at their previous peak PER valuations given the following factors; (i) automation of plants and production processes leading to better efficiency and productivity and potentially translating to better margins, (ii) rubber gloves makers’ resilience and ability to transform and increasing product mix from purely latex-based gloves into the higher margin nitrile gloves, and (iii) expectations of solid and another record-peak quarterly earnings ahead.

Our TOP PICK is TOP GLOVE with an OUTPERFORM and TP of RM15.60. Top Glove’s historical valuation at peak earnings averaged at between 23-27x PER. The PER valuation of Top Glove (19x FY17E PER) has lagged behind its peers and is trading at an average 20% discount to Kossan (22x FY17E PER) and Hartalega (27x CY17E PER). We consider the under-performance as unwarranted. The valuation gap should narrow when we consider that Top Glove has similar/higher total capacity and net profit level compared to Kossan and Hartalega. We like Top Glove for its : (i) ability to evolve from purely a dominant latex-based rubber gloves producer into a higher margin nitrile-based products producer, and (ii) undemanding PER valuation at discount to peers.

Maintain OUTPERFORM on HARTALEGA with TP of RM6.40 based on 28.5x CY17 EPS (at +2.0 SD above its historical forward average). We believe Hartalega’s new gloves production lines in NGC could potentially lead to higher margins due largely to its focus on only two products, thus reducing idle downtime from frequent machinery setting adjustments to accommodate diverse specifications. We like Hartalega for its: (i) highly automated production processes model, (ii) solid improvement in its production capacity and reduction in costs leading to better margins compared to its peers, (iii) innovation in producing superior quality nitrile gloves, and (iv) positioning in a booming nitrile segment with a dominant market position.

Maintain OUTPERFORM on SUPERMAX, TP is RM3.80 based on unchanged 17x FY16E EPS (at +2.0 SD above its historical forward average). We like Supermax for: (i) potential re-rating catalyst upon commercial production of its new plant, which dispelled market skepticism of persistent delays in the new plant, (ii) steep 30% discount to the sector average, and (iii) being a beneficiary of the strengthening USD against MYR. Growth going forward is expected to be driven by two new plants and we understand that the building structures for Plant #10 and Plant #11, i.e Lot 6059 and 6058 in Meru, Klang are up and the first batch of lines have been commissioned. Lot 6059 and 6058 will have 24 and 16 production lines producing 3.2b and 2.2b pieces of nitrile gloves p.a., respectively, bringing the total nitrile production capacity from 6.9b (including the 1.4bn in Lot 6070) to 12.3b pieces p.a. or 52% of the total installed capacity.

Maintain MARKET PERFORM on KOSSAN with TP of RM9.11 based on 22x FY16 EPS (at +2.0 SD above its historical forward average). We like KOSSAN because: (i) of its superior net profit growth of 43% and 15% in FY15E and FY16E, respectively, (ii) KOSSAN’s unprecedented earnings growth is underpinned by rapid capacity expansion over the next two years, (iii) it is gradually raising its dividend payout ratio, and (iv) the fact that KOSSAN is not just a glove play but a bet on its technical rubber product (TRP) division, which is growing rapidly.

Source: Kenanga Research - 6 Jan 2016

3)

Solid results for gloves makers in the recently concluded 3QCY15. Glove makers reported a solid 3QCY15. Results of the gloves makers from the recently concluded 3QCY15 results season were mainly within expectations except for Supermax, which came in above. The good set of results for Kossan, Hartalega, Top Glove and Supermax were underpinned by both volume growth from new capacity expansion and favourable USD/MYR exchange rate. Sales volume grew strongly for Kossan (+33% YoY, +10% QoQ), Hartalega (+35% YoY, +15% QoQ) and Top Glove (+15% YoY, +1% QoQ). Supermax’s results came in above expectations driven by volume growth from new plants and favourable USD/MYR exchange rate.

Rubber glove stocks should trade at previous peak valuations. Based on historical valuation at peak earnings, rubber glove stocks namely Top Glove, Hartalega, Supermax and Kossan trades at +2SD above historical mean. We believe rubber glove stocks are poised for further re-rating and should trade at their previous peak PER valuations given the following factors; (i) automation of plants and production processes leading to better efficiency and productivity and potentially translating to better margins, (ii) rubber gloves makers’ resilience and ability to transform and increasing product mix from purely latex-based gloves into the higher margin nitrile gloves, and (iii) expectations of solid and another record-peak quarterly earnings ahead.

Our TOP PICK is TOP GLOVE with an OUTPERFORM and TP of RM15.60. Top Glove’s historical valuation at peak earnings averaged at between 23-27x PER. The PER valuation of Top Glove (19x FY17E PER) has lagged behind its peers and is trading at an average 20% discount to Kossan (22x FY17E PER) and Hartalega (27x CY17E PER). We consider the under-performance as unwarranted. The valuation gap should narrow when we consider that Top Glove has similar/higher total capacity and net profit level compared to Kossan and Hartalega. We like Top Glove for its : (i) ability to evolve from purely a dominant latex-based rubber gloves producer into a higher margin nitrile-based products producer, and (ii) undemanding PER valuation at discount to peers.

Maintain OUTPERFORM on HARTALEGA with TP of RM6.40 based on 28.5x CY17 EPS (at +2.0 SD above its historical forward average). We believe Hartalega’s new gloves production lines in NGC could potentially lead to higher margins due largely to its focus on only two products, thus reducing idle downtime from frequent machinery setting adjustments to accommodate diverse specifications. We like Hartalega for its: (i) highly automated production processes model, (ii) solid improvement in its production capacity and reduction in costs leading to better margins compared to its peers, (iii) innovation in producing superior quality nitrile gloves, and (iv) positioning in a booming nitrile segment with a dominant market position.

Maintain OUTPERFORM on SUPERMAX, TP is RM3.80 based on unchanged 17x FY16E EPS (at +2.0 SD above its historical forward average). We like Supermax for: (i) potential re-rating catalyst upon commercial production of its new plant, which dispelled market skepticism of persistent delays in the new plant, (ii) steep 30% discount to the sector average, and (iii) being a beneficiary of the strengthening USD against MYR. Growth going forward is expected to be driven by two new plants and we understand that the building structures for Plant #10 and Plant #11, i.e Lot 6059 and 6058 in Meru, Klang are up and the first batch of lines have been commissioned. Lot 6059 and 6058 will have 24 and 16 production lines producing 3.2b and 2.2b pieces of nitrile gloves p.a., respectively, bringing the total nitrile production capacity from 6.9b (including the 1.4bn in Lot 6070) to 12.3b pieces p.a. or 52% of the total installed capacity.

Maintain MARKET PERFORM on KOSSAN with TP of RM9.11 based on 22x FY16 EPS (at +2.0 SD above its historical forward average). We like KOSSAN because: (i) of its superior net profit growth of 43% and 15% in FY15E and FY16E, respectively, (ii) KOSSAN’s unprecedented earnings growth is underpinned by rapid capacity expansion over the next two years, (iii) it is gradually raising its dividend payout ratio, and (iv) the fact that KOSSAN is not just a glove play but a bet on its technical rubber product (TRP) division, which is growing rapidly.

Source: Kenanga Research - 6 Jan 2016

3)

Rubber Gloves - Minimal Impact from Gas Tariff Hike

Author: kiasutrader | Publish date: Wed, 23 Dec 2015, 09:48 AM

Gas Malaysia in an announcement to Bursa Malaysia informed that the Government has approved a natural gas tariff revision for non-power sectors in Peninsular Malaysia with effect from 1 Jan 2016 (4th increase since Apr 2014) by an average of 17%. Ceteris paribus, assuming “no-cost pass through”, an average 17% increase in natural gas tariff is expected to only marginally impact rubber gloves players’ earnings by 3-5%. However, we are not overly concerned since rubber gloves players have generally been able to pass on the cost increase, judging from past experiences, such as in May 2014, Nov 2014 and July 2015. Hence, we are maintaining our OVERWEIGHT rating for the rubber gloves sector. Our Top Pick is Top Glove with a TP of RM15.60. Top Glove’s historical valuation at peak earnings averaged at between 23-27x PER. The PER valuation of Top Glove (19.5x FY17E PER) has lagged its peers and it is trading at an average 25% discount to Kossan (23x FY17E PER) and Hartalega (27x CY17E PER). We consider the under-performance as unwarranted. The valuation gap should narrow when we consider that Top Glove has similar/higher total capacity and net profit level compared to Kossan and Hartalega. We like Top Glove for: (i) its ability to evolve from purely a dominant latex-based rubber gloves producer into a higher margin nitrile-based products producer, (ii) undemanding discounted PER valuation to peers, and (iii) its solid management. We also have OUTPERFORM calls for HARTALEGA (TP: RM6.40) and SUPERMX (TP: RM3.80).

Average 17% tariff hike for natural gas for non-power sectors. Gas Malaysia Berhad in an announcement to Bursa Malaysia informed that the Government has approved a natural gas tariff revision for non-power sectors in the Peninsular Malaysia taking effect from 1 Jan 2016 (4th increase since Apr 2014) by an average of 17%. Ceteris paribus, assuming “nocost pass through”, an average 17% increase in natural gas tariff is expected to marginally impact rubber gloves players’ earnings by 3-5%. However, we are not overly concerned since rubber gloves players have generally been able to pass on the cost increase judging from past experiences, such as in May 2014, Nov 2014 and July 2015. Fuel accounts for an average of 10% of production cost, of which natural gas accounts for an average of 7% of the production cost. Based on our back-of-envelope calculations, players need to raise their average selling prices by 1-1.3%. Generally, its takes approximately between one to three months to pass through the cost increase. However, the weakening of the Ringgit (RM) against the US Dollar (USD) makes its relatively easier for glove makers to pass cost through.

Rubber glove stocks can trade at previous peak valuations. Based on historical valuation at peak earnings, rubber glove stocks namely Top Glove, Hartalega, Supermax and Kossan trades at +2SD above historical mean. We believe rubber glove stocks are poised for a further re-rating and should trade at their previous peak PER valuations given the following factors: (1) Automation of plants and production processes leading to better efficiency and productivity potentially translating to better margins, (2) Standing testimony to rubber gloves makers’ resilience and hence ability to transform and increasing its product mix from purely a latex-based gloves producer into the higher margin nitrile gloves, and (3) Expectations of solid and record peak quarterly earnings ahead.

Maintain OVERWEIGHT. Our TOP PICK is Top Glove with an OUTPERFORM and TP raised to RM15.60. We upgrade our target price from RM14.20 to RM15.60 based on 22x FY17E EPS (previously 20x). We believe the PER expansion is justifiable considering that Top Glove has shown the best quarterly earnings growth and the biggest quarterly profits amongst its peers. Top Glove’s historical valuation at peak earnings averaged at between 23-27x PER. The PER valuation of Top Glove (19.5x FY17E PER) has lagged its peers and is trading at an average 25% discount to Kossan (23x FY17E PER) and Hartalega (27x CY17E PER). We consider the under-performance as unwarranted. The valuation gap should narrow when we consider that Top Glove has similar/higher total capacity and net profit level compared to Kossan and Hartalega. We like Top Glove for: (i) its ability to evolve from purely a dominant latex-based rubber gloves producer into a higher margin nitrile-based products producer, (ii) undemanding PER valuation at discount to peers.

Supermax, Maintain Outperform, TP Raised to RM3.80. We upgrade our TP from RM2.83 to RM3.80 based on 17x FY17E EPS (+2.0SD above historical average). We raised the PER valuation from 13x to 17x inline with the industry strong prospects and valuations of players moving towards +2.0 SD above historical mean. Growth going forward is expected to be driven by two new plants and we understand that the building structures for Plant #10 and Plant #11 i.e. Lot 6059 and 6058 in Meru, Klang are up and the first batch of lines has been commissioned. Lot 6059 and 6058 will have 24 and 16 production lines producing 3.2b and 2.2b pieces of nitrile gloves p.a., respectively, bringing the total nitrile production capacity from 6.9b (including the 1.4bn in Lot 6070) to 12.3b pieces p.a. or 52% of the total installed capacity.

Hartalega, Maintain Outperform, TP raised to RM6.40. We upgrade our TP from RM6.00 to RM6.40 based on 28.5x CY17E EPS (at +2.0 SD above its historical forward average). We like Hartalega for its: (i) highly automated production processes model, (ii) solid improvement in its production capacity and reduction in costs leading to better margins compared to its peers, (iii) innovation in producing superior quality nitrile gloves, and (iv) positioning in a booming nitrile segment with a dominant market position. We believe Hartalega should trade at premium valuations for its superior profit margins which are head and shoulders above industry peers as well as its defensive and captive earnings stream.

Source: Kenanga Research - 23 Dec 2015

4)

Average 17% tariff hike for natural gas for non-power sectors. Gas Malaysia Berhad in an announcement to Bursa Malaysia informed that the Government has approved a natural gas tariff revision for non-power sectors in the Peninsular Malaysia taking effect from 1 Jan 2016 (4th increase since Apr 2014) by an average of 17%. Ceteris paribus, assuming “nocost pass through”, an average 17% increase in natural gas tariff is expected to marginally impact rubber gloves players’ earnings by 3-5%. However, we are not overly concerned since rubber gloves players have generally been able to pass on the cost increase judging from past experiences, such as in May 2014, Nov 2014 and July 2015. Fuel accounts for an average of 10% of production cost, of which natural gas accounts for an average of 7% of the production cost. Based on our back-of-envelope calculations, players need to raise their average selling prices by 1-1.3%. Generally, its takes approximately between one to three months to pass through the cost increase. However, the weakening of the Ringgit (RM) against the US Dollar (USD) makes its relatively easier for glove makers to pass cost through.

Rubber glove stocks can trade at previous peak valuations. Based on historical valuation at peak earnings, rubber glove stocks namely Top Glove, Hartalega, Supermax and Kossan trades at +2SD above historical mean. We believe rubber glove stocks are poised for a further re-rating and should trade at their previous peak PER valuations given the following factors: (1) Automation of plants and production processes leading to better efficiency and productivity potentially translating to better margins, (2) Standing testimony to rubber gloves makers’ resilience and hence ability to transform and increasing its product mix from purely a latex-based gloves producer into the higher margin nitrile gloves, and (3) Expectations of solid and record peak quarterly earnings ahead.

Maintain OVERWEIGHT. Our TOP PICK is Top Glove with an OUTPERFORM and TP raised to RM15.60. We upgrade our target price from RM14.20 to RM15.60 based on 22x FY17E EPS (previously 20x). We believe the PER expansion is justifiable considering that Top Glove has shown the best quarterly earnings growth and the biggest quarterly profits amongst its peers. Top Glove’s historical valuation at peak earnings averaged at between 23-27x PER. The PER valuation of Top Glove (19.5x FY17E PER) has lagged its peers and is trading at an average 25% discount to Kossan (23x FY17E PER) and Hartalega (27x CY17E PER). We consider the under-performance as unwarranted. The valuation gap should narrow when we consider that Top Glove has similar/higher total capacity and net profit level compared to Kossan and Hartalega. We like Top Glove for: (i) its ability to evolve from purely a dominant latex-based rubber gloves producer into a higher margin nitrile-based products producer, (ii) undemanding PER valuation at discount to peers.

Supermax, Maintain Outperform, TP Raised to RM3.80. We upgrade our TP from RM2.83 to RM3.80 based on 17x FY17E EPS (+2.0SD above historical average). We raised the PER valuation from 13x to 17x inline with the industry strong prospects and valuations of players moving towards +2.0 SD above historical mean. Growth going forward is expected to be driven by two new plants and we understand that the building structures for Plant #10 and Plant #11 i.e. Lot 6059 and 6058 in Meru, Klang are up and the first batch of lines has been commissioned. Lot 6059 and 6058 will have 24 and 16 production lines producing 3.2b and 2.2b pieces of nitrile gloves p.a., respectively, bringing the total nitrile production capacity from 6.9b (including the 1.4bn in Lot 6070) to 12.3b pieces p.a. or 52% of the total installed capacity.

Hartalega, Maintain Outperform, TP raised to RM6.40. We upgrade our TP from RM6.00 to RM6.40 based on 28.5x CY17E EPS (at +2.0 SD above its historical forward average). We like Hartalega for its: (i) highly automated production processes model, (ii) solid improvement in its production capacity and reduction in costs leading to better margins compared to its peers, (iii) innovation in producing superior quality nitrile gloves, and (iv) positioning in a booming nitrile segment with a dominant market position. We believe Hartalega should trade at premium valuations for its superior profit margins which are head and shoulders above industry peers as well as its defensive and captive earnings stream.

Source: Kenanga Research - 23 Dec 2015

4)

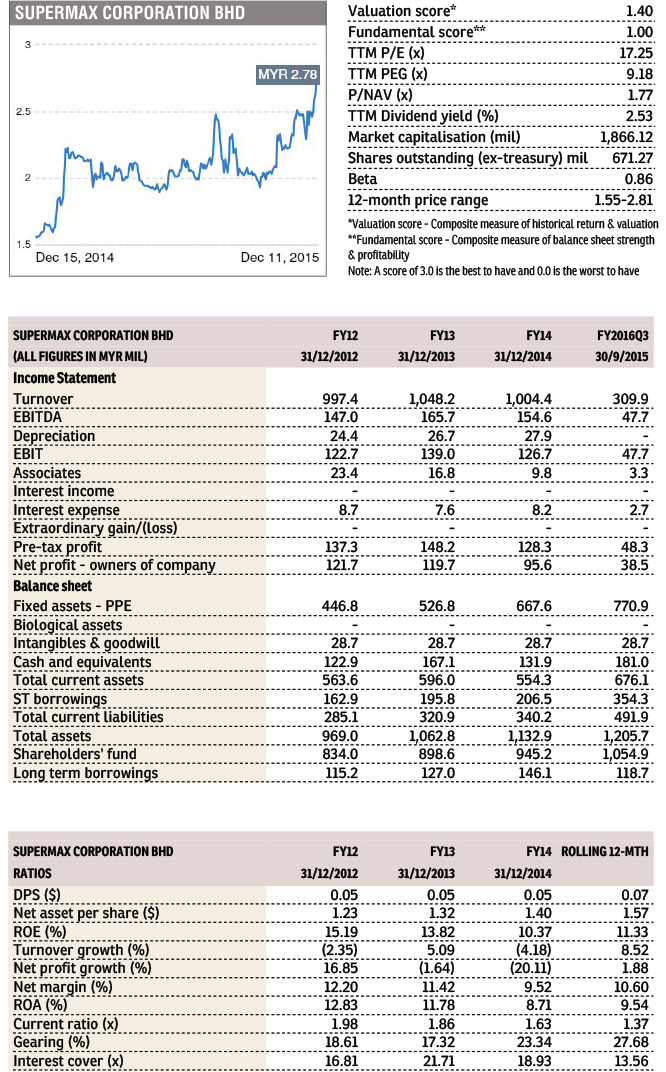

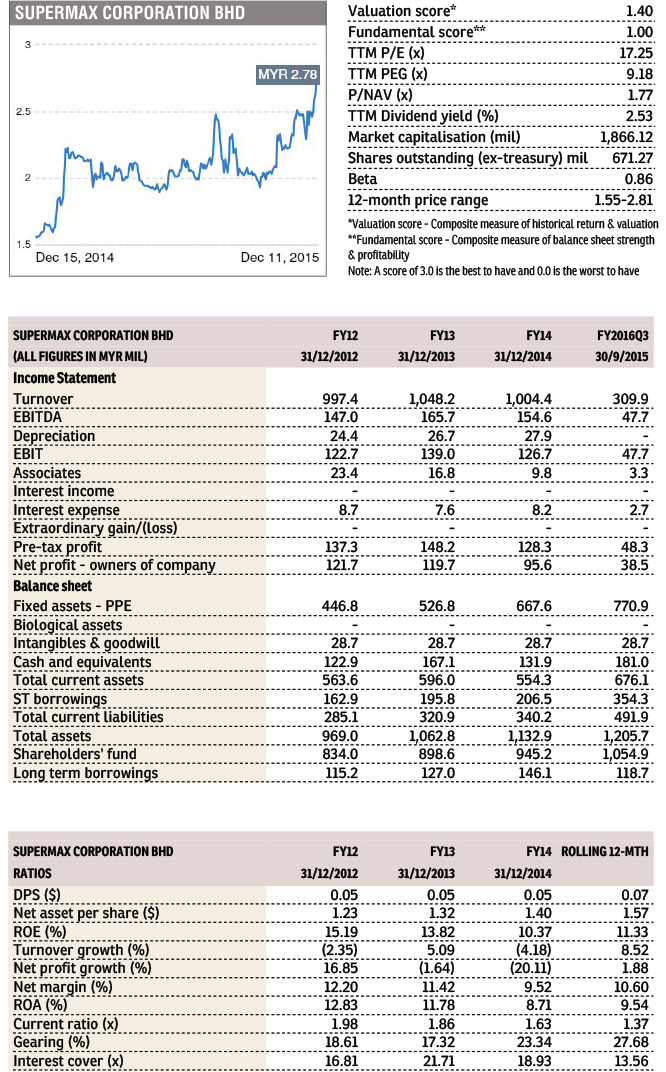

Insider Asia’s Stock Of The Day: SUPERMX (15/12/2015)

Author: Tan KW | Publish date: Tue, 15 Dec 2015, 02:57 PM

This article first appeared in The Edge Financial Daily, on December 15, 2015.

Supermax Corporation Bhd

WE continue to favour Supermax (Fundamental: 1.0/3, Valuation: 1.4/3) for its comparatively undemanding valuations and strong growth potential. Its peers Hartalega, TopGlove and Kossan are trading at trailing 12-month P/E of 25.2-40.8 times and 4.3-6.5 times book. In comparison, Supermax is trading at 30-50% discount with trailing P/E of only 17.2 times and 1.8 times book.

The stock has been a laggard for the past one year (+47.5% year-to-date) compared to the other Big Four glovemakers (+62.2-146.9%). This was partly due to repeated delays in commissioning its new plants, which affected its financial performance. However, we believe Supermax has largely overcome the issue, judging from its latest quarter results.

For the quarter ended September 2015 (change in FYE to June from December, starting FYJune2016), revenue grew 11.3% y-y to RM309.9 million, thanks to higher output from the new production lines and efficiency gains. Net profit surged 38.3% to RM38.5 million, boosted by increased sales of higher-margin nitrile glove and the stronger USD.

Going forward, we expect Supermax to continue its strong double-digit growth momentum, underpinned by the two new plants in Meru, Klang, which has started production in batches since early 2015. The plants will have a total of 40 production lines with installed capacity of 600 million pieces of nitrile gloves per month.

When fully commissioned at end-2015, total production capacity will increase by 40% to 25 billion gloves per year. Higher-value nitrile gloves will then account for 53% of its total installed capacity.

Supermax was recently awarded one of the licenses to supply medical gloves to the UK’s National Health Service (NHS) for the next four years. The NHS, which covers all hospitals in the UK, consumes approximately GBP50 million (about RM327.6 million) of medical gloves per year. Assuming a conservative 25% market share, this contract alone would contribute an additional 8% to its topline, starting FY2017.

5)手套业冲击微

InterPacific研究主管冯廷秀接受《南洋商报》访问时预测,各种消费品的价格,也将随着能源价格上涨而调高。

无论如何,他指出,手套业者料不会受到太大的冲击,因为大部分手套业者,现在都在本身的手套厂附近设立了生物燃料发电厂。

他说:“手套业者无疑将受到天然气价格上涨的冲击,但相比以前,现在没有这么依赖天然气。”

他举例,大马天然气的客户之一贺特佳(HARTA,5168,主板工业产品股),本身就有生物燃料发电厂,减少了对天然气发电的依赖。

他补充,政府有奖掖发展生物燃料发电厂,所以,其他手套业者包括顶级手套(TOPGLOV,7113,主板工业产品股)和速柏玛(SUPERMX,7106,主板工业产品股),也都设立了生物燃料发电厂,减低对天然气的依赖。

Supermax Corporation Bhd

WE continue to favour Supermax (Fundamental: 1.0/3, Valuation: 1.4/3) for its comparatively undemanding valuations and strong growth potential. Its peers Hartalega, TopGlove and Kossan are trading at trailing 12-month P/E of 25.2-40.8 times and 4.3-6.5 times book. In comparison, Supermax is trading at 30-50% discount with trailing P/E of only 17.2 times and 1.8 times book.

The stock has been a laggard for the past one year (+47.5% year-to-date) compared to the other Big Four glovemakers (+62.2-146.9%). This was partly due to repeated delays in commissioning its new plants, which affected its financial performance. However, we believe Supermax has largely overcome the issue, judging from its latest quarter results.

For the quarter ended September 2015 (change in FYE to June from December, starting FYJune2016), revenue grew 11.3% y-y to RM309.9 million, thanks to higher output from the new production lines and efficiency gains. Net profit surged 38.3% to RM38.5 million, boosted by increased sales of higher-margin nitrile glove and the stronger USD.

Going forward, we expect Supermax to continue its strong double-digit growth momentum, underpinned by the two new plants in Meru, Klang, which has started production in batches since early 2015. The plants will have a total of 40 production lines with installed capacity of 600 million pieces of nitrile gloves per month.

When fully commissioned at end-2015, total production capacity will increase by 40% to 25 billion gloves per year. Higher-value nitrile gloves will then account for 53% of its total installed capacity.

Supermax was recently awarded one of the licenses to supply medical gloves to the UK’s National Health Service (NHS) for the next four years. The NHS, which covers all hospitals in the UK, consumes approximately GBP50 million (about RM327.6 million) of medical gloves per year. Assuming a conservative 25% market share, this contract alone would contribute an additional 8% to its topline, starting FY2017.

5)手套业冲击微

InterPacific研究主管冯廷秀接受《南洋商报》访问时预测,各种消费品的价格,也将随着能源价格上涨而调高。

无论如何,他指出,手套业者料不会受到太大的冲击,因为大部分手套业者,现在都在本身的手套厂附近设立了生物燃料发电厂。

他说:“手套业者无疑将受到天然气价格上涨的冲击,但相比以前,现在没有这么依赖天然气。”

他举例,大马天然气的客户之一贺特佳(HARTA,5168,主板工业产品股),本身就有生物燃料发电厂,减少了对天然气发电的依赖。

他补充,政府有奖掖发展生物燃料发电厂,所以,其他手套业者包括顶级手套(TOPGLOV,7113,主板工业产品股)和速柏玛(SUPERMX,7106,主板工业产品股),也都设立了生物燃料发电厂,减低对天然气的依赖。

没有评论:

发表评论