http://klse.i3investor.com/files/my/ptres/res35018.pdf

rm2.03 收padini 保本外,dy =5% 与取得長期资本增值,

padini 两季(Q1+Q2)己赚6490万,EPS=9.87SEN,

我估算Q3和Q4只需赚2697万,EPS=4.1SEN,(和去年同季对比也呈上升的.)

那共计为5394万, EPS=8.2SEN

2016年财年共赚118M,EPS=18SEN,取PE=15,股价=RM2.70

当本财年净利創新高後,公司大有可能发送红股回報投资者,之前2004年,2007年,2010年

公司发送红股,2016年红股是否要来了。

马币回升对公司是利好.绝对讓你丰衣又足食!

rolling 4 quarters--

eps=16.67 sen

nta=0.669

dps=10 sen

pe=11.8

roe=24.9

dy=5.07

52w ;1.29--2.20

取自-资汇

http://www.malaysiastock.biz/Corporate-Infomation.aspx?type=A&value=P&securityCode=7052

http://www.padini.com/

http://klse.i3investor.com/servlets/stk/7052.jsp

1)

rm2.03 收padini 保本外,dy =5% 与取得長期资本增值,

padini 两季(Q1+Q2)己赚6490万,EPS=9.87SEN,

我估算Q3和Q4只需赚2697万,EPS=4.1SEN,(和去年同季对比也呈上升的.)

那共计为5394万, EPS=8.2SEN

2016年财年共赚118M,EPS=18SEN,取PE=15,股价=RM2.70

当本财年净利創新高後,公司大有可能发送红股回報投资者,之前2004年,2007年,2010年

公司发送红股,2016年红股是否要来了。

马币回升对公司是利好.绝对讓你丰衣又足食!

rolling 4 quarters--

eps=16.67 sen

nta=0.669

dps=10 sen

pe=11.8

roe=24.9

dy=5.07

52w ;1.29--2.20

取自-资汇

股价连升4个多月的巴迪尼控股(7052,PADINI)今日面对不小沽售压力,

股价急挫8.33%或18仙,跌穿2令吉关口,收市报1.98令吉,全日转手量达483万股。

《资汇》在去年11月23日的封面,曾以巴迪尼赢的秘密为大标题,

看好巴迪尼可在衣饰股中跑出。当时其股价是每股1.58令吉,过后一路升高,

并于今年3月2日做到2.20令吉的最高水平。

由于今日股价是在急增转手量中滑低,不排除是套利干扰所致。

http://www.malaysiastock.biz/Corporate-Infomation.aspx?type=A&value=P&securityCode=7052

http://www.padini.com/

http://klse.i3investor.com/servlets/stk/7052.jsp

1)

| 巴迪尼控股 股价已反映利好 财经 股市 行家论股 2016-02-12 11:22 1 of 2 目标价:2令吉 最新进展 巴迪尼控股(PADINI,7052,主板消费产品股)计划在2016财年,增设13家新分店。 自从在2015年7月份,巴迪尼控股开设了3家概念店与6家“Brands Outlet”后, 该公司计划在2016财年下半年,再开多4家分店,即在莎阿南永旺(2家)及哥打峇鲁永旺(2家)。 行家建议 据我们了解,概念点与“Brands Outlet”在2016财年第二季(截至2015年12月底)的按年销量, 继续强劲增长,归功于巴迪尼控股积极的促销,尤其是在概念店推出的捆绑式销售优惠。 比起2016财年首季,我们更看好第二季和第三季的销售,因为时值佳节,也是传统的销售旺季。 2016至2018财年每股净利按年增长率预测,分别为50%、10%、3%, 促使我们看好短期盈利展望。 不过,由于利好已经反映在股价里,因此维持“守住”评级,但把目标价, 从1.90令吉上修至2.00令吉。 分析:马银行投行 http://www.nanyang.com/node/747765?tid=462 |

3)

Dude, what is up with Padini?

Author: cephasyu | Publish date: Mon, 1 Feb 2016, 05:38 PM

Padini is a both a brand and a counter that needs little introduction. The overall thesis of this article is that Padini has in the last 2-3 years suffered both in share price and profitability due to aggressive opening of new stores and offloading old stock at deep discounts due to the imminent GST, but starting from Q1 2016 (Sept), Padini has reached a turning point and the Group’s strategy is starting to bear fruit. This is why the share price is rallying in the past 2 months, and this article argues that if the turning point is legitimate, Padini will continue to rise to RM3.00.

As a caveat, I must first confess that I am but a desktop armchair amateuranalyst guy. I do not have any professional qualifications in regards to investing (no CFA… for now?). I do have a CPA though (please don’t start stoning me saying that Accountants make bad investors), but am not a practicing accountant. I only hope to share and learn from everyone else.

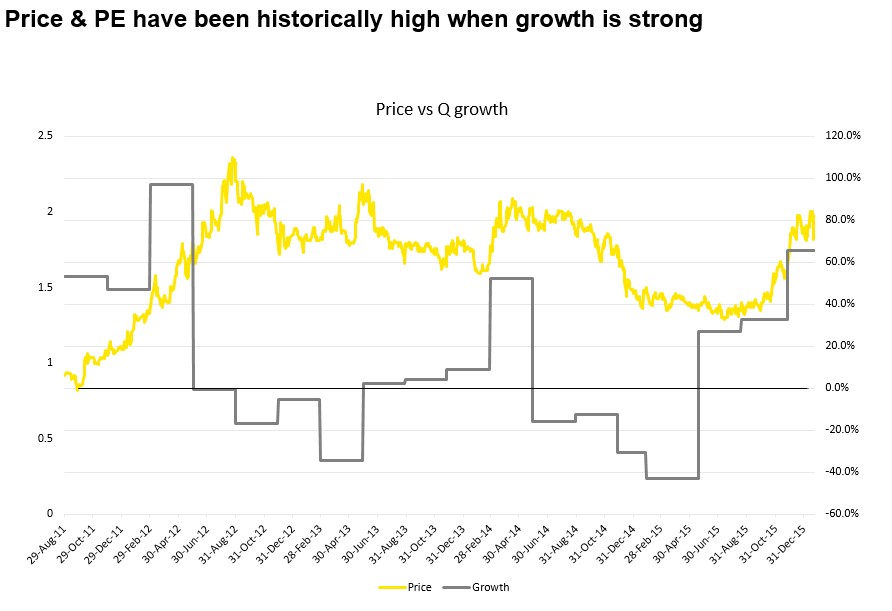

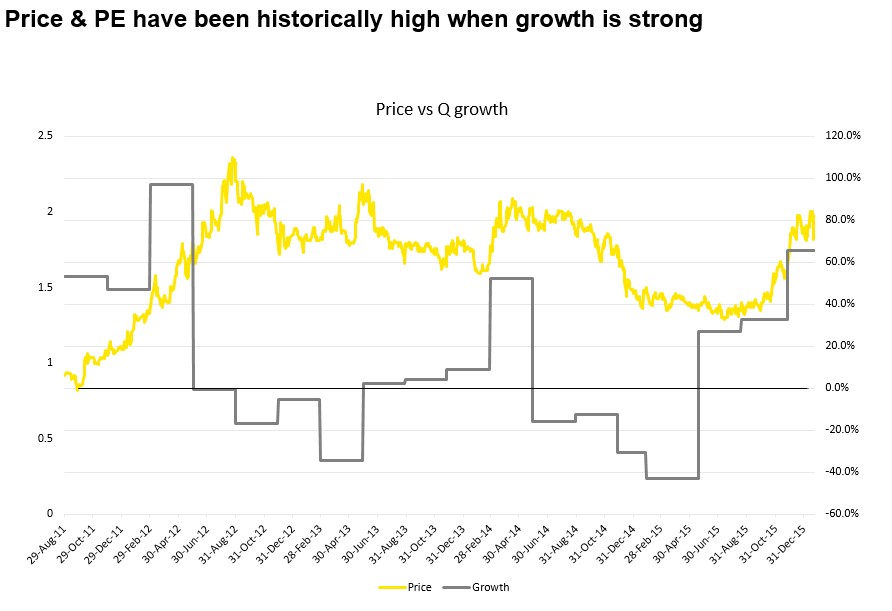

The above chart shows Padini’s 5 year share movement (dividend unadjusted). From 2011 – 2012, price rallied from roughly RM1 to RM2 in approximately 1 year. Subsequently, after a series of disappointing quarters, it was not able to surpass the RM2.40 level.

Padini holds a variety of reputable brands under their belt. Most of them are quite well known besides the fairly new Tizio brand. Padini segments their operations into five separate Sdn Bhd(s) as follows.

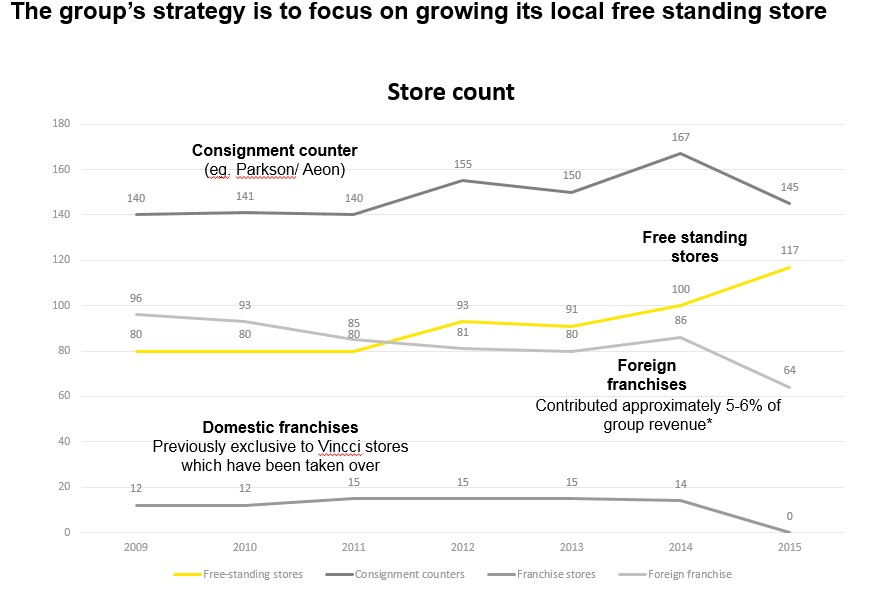

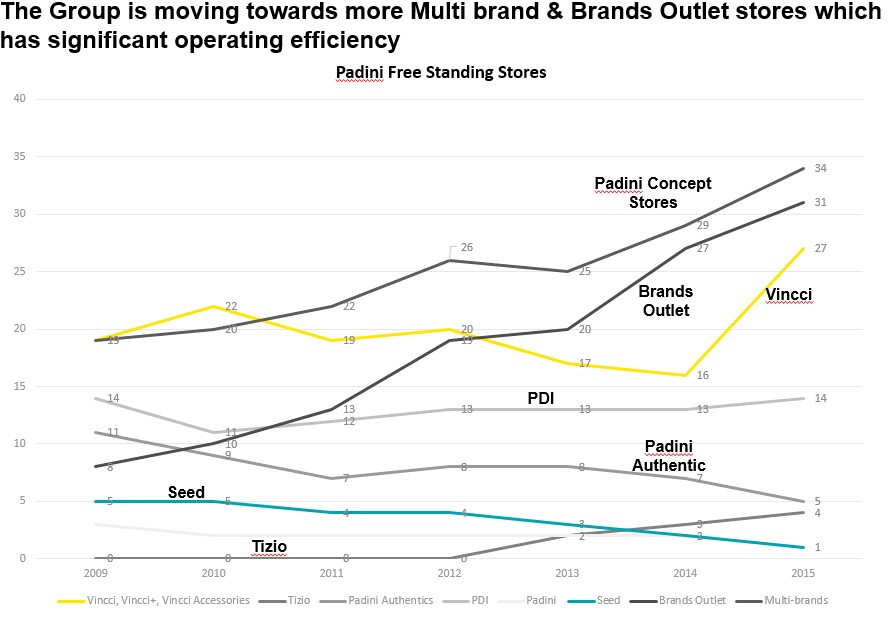

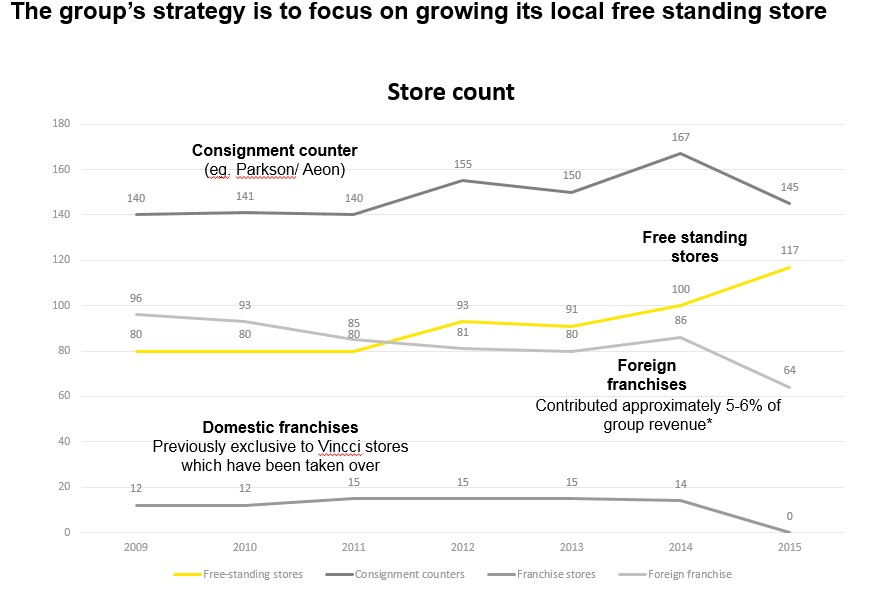

Vincci specializes in shoes and accessories and contributes 20% of total revenue and 12% of PBT to the Group. As at 30th June ’15, Vincci also has 64 foreign franchises. Total foreign franchise contribute approximately 5-6% of total Group revenue. No other brands have foreign exposure.

As you can see in the graph above, from 2010 – 2015, Vincci’s revenue has been flattish and PBT & PBT margin declining. However, looking at Q1 2016 (Sept Q), profit margins have rebounded strongly.

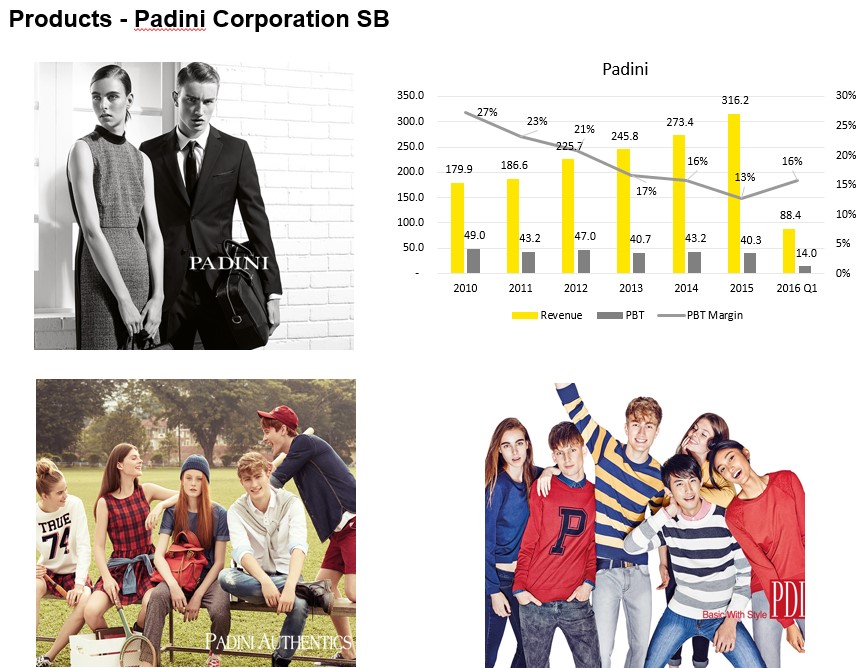

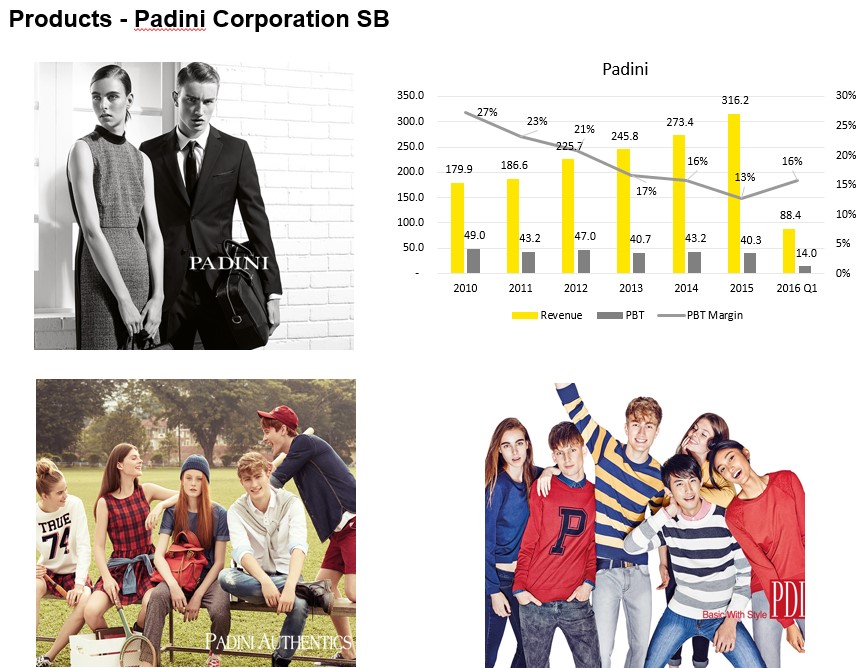

Padini Corp S/B holds the office, summer and casual wear. It contributes 32% of revenue and 39% of PBT for the Group.

However, unlike Vincci, revenue has been growing YOY. PBT however has been flattish with PBT margins declining. Similar to Vincci, PBT margins have reversed in Q1 of 2016.

Yee Fong Hung S/B (“YFH”) holds P&CO and the very popular Brands Outlet store. Unlike the other S/B in the group, YFH has shown tremendous revenue and PBT growth. PBT margin have also been at a steady mid to high teens. Revenue and profit contributions to the Group have grown from 11% and 7% in 2010 respectively to 32% and 43% in 2015.

Brands Outlet appeals to the mass market, delivering marginally less quality and design with significant discounts. This strategy has worked very well for them.

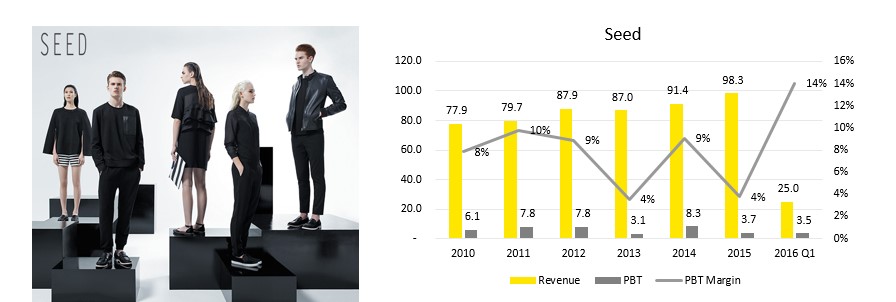

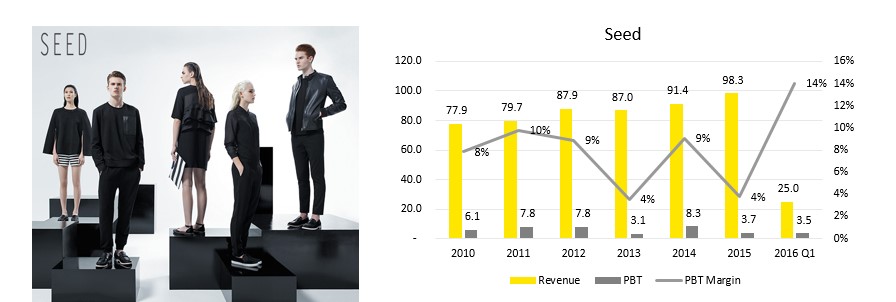

Seed contributes 10% revenue and 4% of PBT to the Group respectively. Margins have been at sub 10%, however in Q1 2016, this trend has reversed significantly.

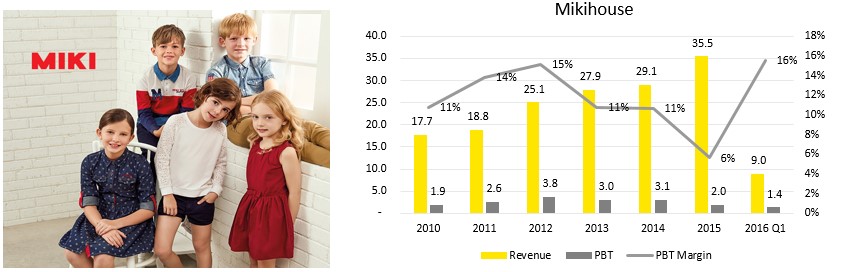

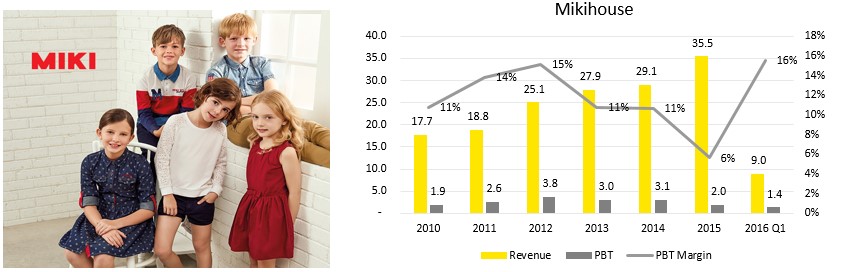

Miki Kids contributes 4% of revenue and 2% of PBT to the group. Revenue has been growing steadily, with PBT being stagnant. PBT margins have been decreasing, and similar to other S/B, PBT margins have been reversing in Q1 2016.

As you can quite easily see, across the board for all S/B, the downward PBT trend have been reversing. Let’s find out why.

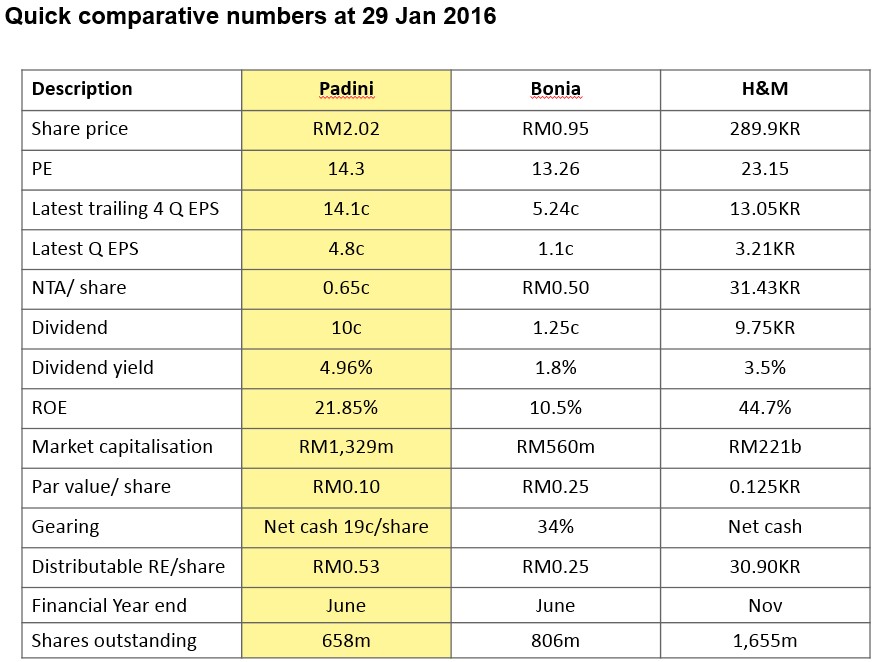

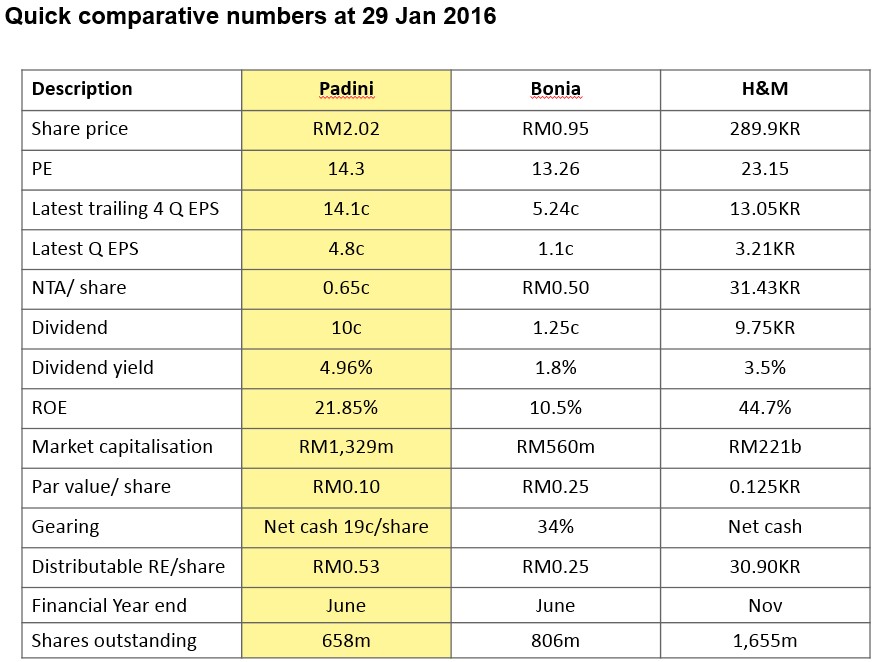

The above table compares Padini with Bonia and H&M. Most of the ratios should be quite familiar. At today’s price of RM2.02, the share is trading at a PE of 14.3 based on the rolling 4Q. Remember, this only accounts for one Q of Padini’s strong profits. Padini historically trades between 7 and 17 (refer to appendix), therefore a PE of 14 is not the highest Padini has seen.

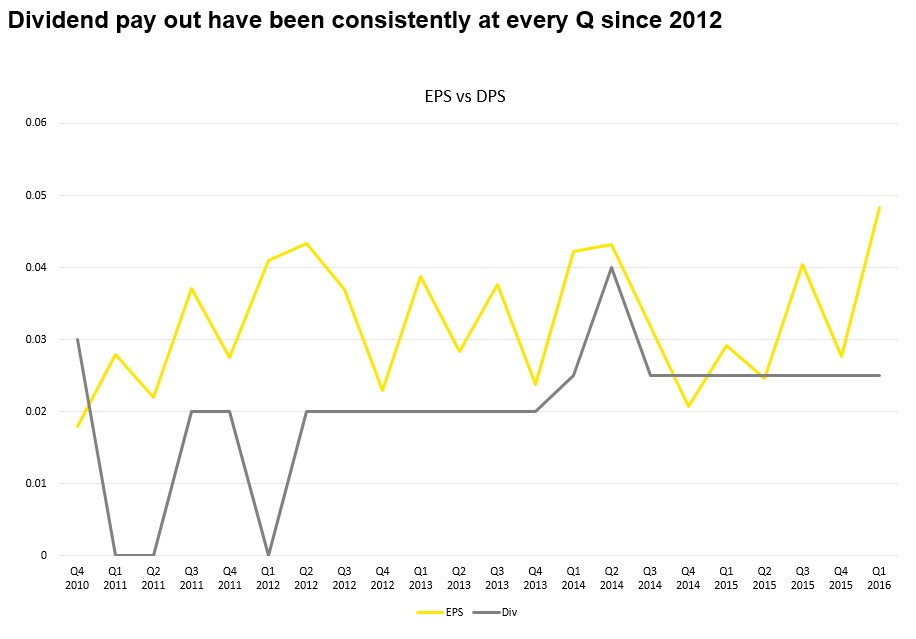

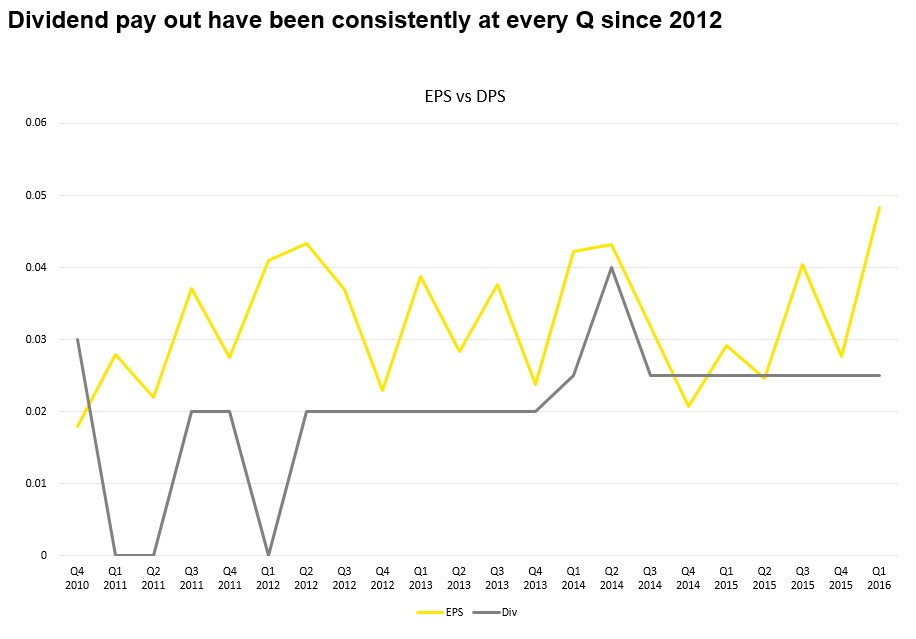

Dividend is at a decent 4.96%. Historically, dividend has ranged from as low as 2.5% to as high as 8.3% (ref to appendix). Usually, dividend is highest when the stock is being battered. Dividend has been consistently paid for the last 2 years (refer to appendix)

ROE is decent at 21.85%. However this figures is misguided as Padini has RM98mil of unit trust and RM174mil of cash. Stripping both and adding total debt, return on working capital yields a whopping 47%!!

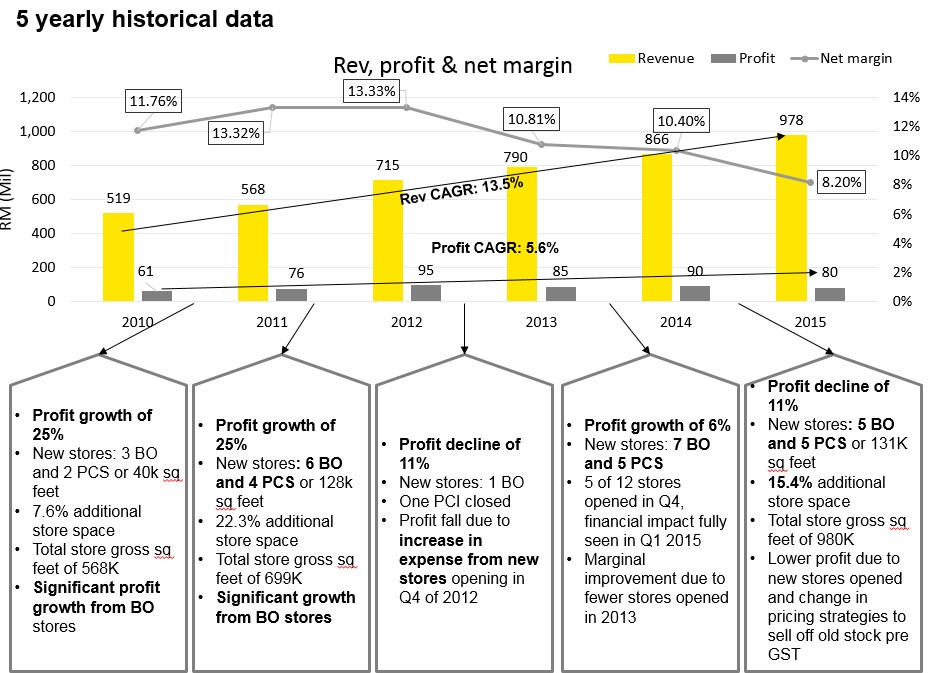

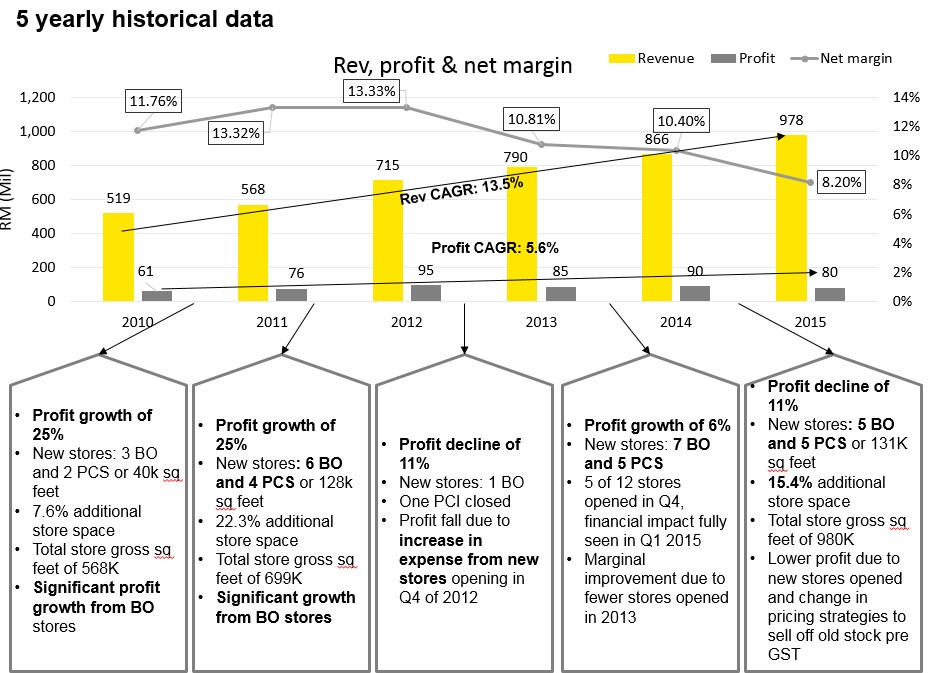

(Note: BO: Brands outlet; PCS: Padini Concept Store)

Revenue CAGR has been at a respectable 13.5% over the last 5 years. However, profit CAGR has not fared as well, at only 5.6%.

Profit decline in recent years were caused by declining profit from the opening of new stores. You must understand that every time Padini opens a new store, there will be two forms of cash outflow (thank you, CPA!). The money used to buy furniture and renovation are capitalized as assets. However there are pre-opening expenses such as cleaning, staff hired before the store is open, legal contracts, marketing expense (big), etc which are expensed immediately in the Q which the store opens. Therefore, whenever Padini opens new stores, especially in late 2011 and 2014, a PBT will suffer significantly in the first few Q after opening. Subsequently, the revenues will flow to cover the normal operating expense and profitability and margins will rise.

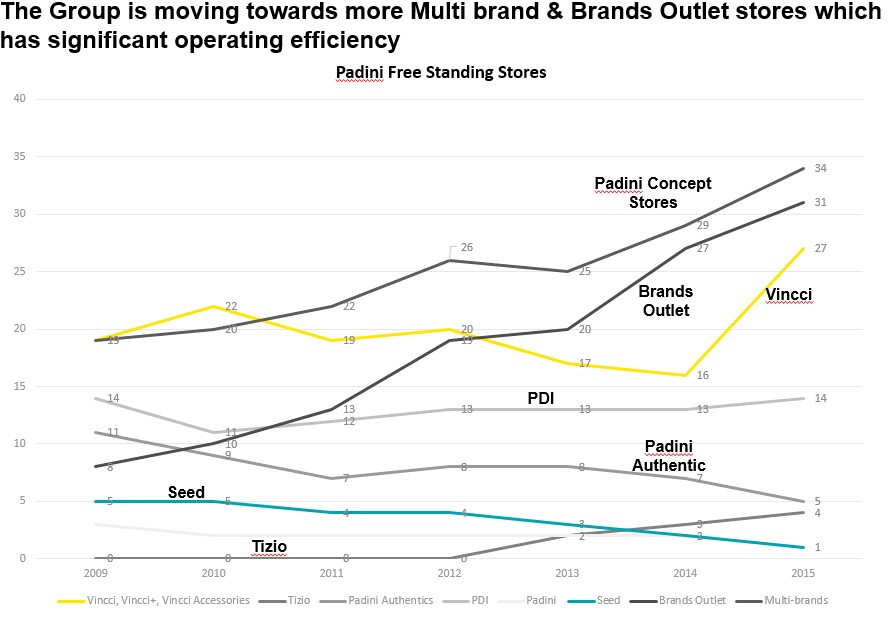

I must pause here for a little to highlight the group’s strategy of moving towards Padini Concept Store (“PCS”) and Brands Outlet (“BO”). PCS is a brilliant concept introduced at about 2003. While it may seem like a long time ago, Padini has actually existed since the 1970s. PCS combines all of Padini’s product offering under one roof. This is an excellent strategy as it gives Padini economies of scale leading to savings. Think lower rental PSF, contractor fees, shared support back end staff, etc. Also, it allows cross selling. Imagine, customers are looking to buy a pair of Vincci shoes and then “ooohh look at that cute top/ accessory/ sweater” (no, this isn’t me).

The group’s venture into BO is also a brilliant one which begun as recent as 2007 when it had its first BO store during the global financial crisis. As the middle class Malaysian gets squeezed from a weaker RM, higher cost of living and stagnant wages, being normal humans who still need to be clothed, BO provides the avenue for Malaysians to buy decent clothes (better than Aeon/ pasar malam [no offense]) at affordable prices. Therefore, the more you hear “weak consumer sentiment” or “weaker ringgit”, please think Brands Outlet.

The other reason margins and profit has been decreasing is due to the Group’s strategy to sell old inventory at deep discounts prior to the implementation of GST. This allows them to “throw” it away at low prices before 1 Apr 2015. The group’s strategy has been to remain affordable despite the GST. Market share first, profitability second.

Let’s zoom into 9 quarters and future projections. The reasons for the drop in net margins are explained above.

The main catalyst for Padini, which follows my thesis is that Sept Q 2015 is the start of margin recovery which will be sustained now that the effects of GST is normalized and the revenue from all the new stores are kicking in. As a side note, Padini has been very impressive, chalking up its strongest Q ever while consumer sentiment was at its weakest.

Looking at red dotted line box, I am projecting that adjusting for seasonal fluctuations, Padini will chalk up a record profit of RM135mil vs RM80mil for 2015 (68 %!!) or an EPS of 20.5c. At a forward PE of 15, this allows for a TP of RM3.07. If you want a DCF valuation, look up KCChong or LCChong (are they brothers??)

Is a PE of 15 fair? Today the PE is 14.3 which is not far from that target. If Padini is on a growth trajectory, then a PE of 15 under normal market conditions would not be a stretch.

Can we simply project that sales will continue to be strong? To be honest, I can’t tell for sure. What I do know is that the reason I started studying Padini was because I wanted to buy some clothes (for the first time in my life) and I went to Padini because my friend told me it had quality products at an affordable price. When I went to the store, it was PACKED. I am borrowing some pictures from a fellow blogger (I can’t reference him because my friend passed me his pictures through whatsapp. Sorry bro)

This was during the Christmas season. With lines as long as the Great Wall of China, I think sales will continue to be strong, at least for Dec Q 2015, which will be out in Feb ’16.

As a loose follower of OTB, the technical indicators of the stock has to be right as well. The stock began up trending as early as 26th Oct 2015, when volume and price picked up (possibly due to insiders buying before results). When the Group released its Sept Q results on 26 Nov, it displayed an up-gap the very next day opening at RM1.67.

Subsequently, the stock has been trending between RM1.80 and RM2.00 until 27 Jan ’16 when (pardon my French) shit was hitting the fan across markets, it broke the RM2.00 resistance line. Personally, I thought this was a strong sign because Padini continued to trend upwards while every other counter was dying. Technically, it is unlikely to close below this level of RM2.00 and is on an uptrend (remember, technical charting is a probability not a certainty).

Conclusion

With a 10c dividend yield, buying at about RM2 will give you a yield of about 5%. Think of this as a safety net.

The big question is if you believe that their strategy is finally bearing fruit and strong margins/ profitability is returning to them. Of course, nothing is certain (unless you have insider intel), so place your bets. If their strategy is really bearing fruit, you will be rewarded for betting long. If you want certainty, wait for the Q results. Of course by that time, you may be too late to pick it up (unless another big market slump comes along).

My bet is that they are finally getting the profits that they deserve, and Sept Q ’15 is the first of many strong Q. Could I be wrong? Of course. As OTB puts it, “I am not God.” However, if I am right for the next 3Q, RM3 is really not such a fantasy.

Happy investing/ trading ya’ll.

Cephas

Appendix:

SWOT analysis

Strategy

Opportunity

Threat

Strength

As a caveat, I must first confess that I am but a desktop armchair amateur

The above chart shows Padini’s 5 year share movement (dividend unadjusted). From 2011 – 2012, price rallied from roughly RM1 to RM2 in approximately 1 year. Subsequently, after a series of disappointing quarters, it was not able to surpass the RM2.40 level.

Padini holds a variety of reputable brands under their belt. Most of them are quite well known besides the fairly new Tizio brand. Padini segments their operations into five separate Sdn Bhd(s) as follows.

Vincci specializes in shoes and accessories and contributes 20% of total revenue and 12% of PBT to the Group. As at 30th June ’15, Vincci also has 64 foreign franchises. Total foreign franchise contribute approximately 5-6% of total Group revenue. No other brands have foreign exposure.

As you can see in the graph above, from 2010 – 2015, Vincci’s revenue has been flattish and PBT & PBT margin declining. However, looking at Q1 2016 (Sept Q), profit margins have rebounded strongly.

Padini Corp S/B holds the office, summer and casual wear. It contributes 32% of revenue and 39% of PBT for the Group.

However, unlike Vincci, revenue has been growing YOY. PBT however has been flattish with PBT margins declining. Similar to Vincci, PBT margins have reversed in Q1 of 2016.

Yee Fong Hung S/B (“YFH”) holds P&CO and the very popular Brands Outlet store. Unlike the other S/B in the group, YFH has shown tremendous revenue and PBT growth. PBT margin have also been at a steady mid to high teens. Revenue and profit contributions to the Group have grown from 11% and 7% in 2010 respectively to 32% and 43% in 2015.

Brands Outlet appeals to the mass market, delivering marginally less quality and design with significant discounts. This strategy has worked very well for them.

Seed contributes 10% revenue and 4% of PBT to the Group respectively. Margins have been at sub 10%, however in Q1 2016, this trend has reversed significantly.

Miki Kids contributes 4% of revenue and 2% of PBT to the group. Revenue has been growing steadily, with PBT being stagnant. PBT margins have been decreasing, and similar to other S/B, PBT margins have been reversing in Q1 2016.

As you can quite easily see, across the board for all S/B, the downward PBT trend have been reversing. Let’s find out why.

The above table compares Padini with Bonia and H&M. Most of the ratios should be quite familiar. At today’s price of RM2.02, the share is trading at a PE of 14.3 based on the rolling 4Q. Remember, this only accounts for one Q of Padini’s strong profits. Padini historically trades between 7 and 17 (refer to appendix), therefore a PE of 14 is not the highest Padini has seen.

Dividend is at a decent 4.96%. Historically, dividend has ranged from as low as 2.5% to as high as 8.3% (ref to appendix). Usually, dividend is highest when the stock is being battered. Dividend has been consistently paid for the last 2 years (refer to appendix)

ROE is decent at 21.85%. However this figures is misguided as Padini has RM98mil of unit trust and RM174mil of cash. Stripping both and adding total debt, return on working capital yields a whopping 47%!!

(Note: BO: Brands outlet; PCS: Padini Concept Store)

Revenue CAGR has been at a respectable 13.5% over the last 5 years. However, profit CAGR has not fared as well, at only 5.6%.

Profit decline in recent years were caused by declining profit from the opening of new stores. You must understand that every time Padini opens a new store, there will be two forms of cash outflow (thank you, CPA!). The money used to buy furniture and renovation are capitalized as assets. However there are pre-opening expenses such as cleaning, staff hired before the store is open, legal contracts, marketing expense (big), etc which are expensed immediately in the Q which the store opens. Therefore, whenever Padini opens new stores, especially in late 2011 and 2014, a PBT will suffer significantly in the first few Q after opening. Subsequently, the revenues will flow to cover the normal operating expense and profitability and margins will rise.

I must pause here for a little to highlight the group’s strategy of moving towards Padini Concept Store (“PCS”) and Brands Outlet (“BO”). PCS is a brilliant concept introduced at about 2003. While it may seem like a long time ago, Padini has actually existed since the 1970s. PCS combines all of Padini’s product offering under one roof. This is an excellent strategy as it gives Padini economies of scale leading to savings. Think lower rental PSF, contractor fees, shared support back end staff, etc. Also, it allows cross selling. Imagine, customers are looking to buy a pair of Vincci shoes and then “ooohh look at that cute top/ accessory/ sweater” (no, this isn’t me).

The group’s venture into BO is also a brilliant one which begun as recent as 2007 when it had its first BO store during the global financial crisis. As the middle class Malaysian gets squeezed from a weaker RM, higher cost of living and stagnant wages, being normal humans who still need to be clothed, BO provides the avenue for Malaysians to buy decent clothes (better than Aeon/ pasar malam [no offense]) at affordable prices. Therefore, the more you hear “weak consumer sentiment” or “weaker ringgit”, please think Brands Outlet.

The other reason margins and profit has been decreasing is due to the Group’s strategy to sell old inventory at deep discounts prior to the implementation of GST. This allows them to “throw” it away at low prices before 1 Apr 2015. The group’s strategy has been to remain affordable despite the GST. Market share first, profitability second.

Let’s zoom into 9 quarters and future projections. The reasons for the drop in net margins are explained above.

The main catalyst for Padini, which follows my thesis is that Sept Q 2015 is the start of margin recovery which will be sustained now that the effects of GST is normalized and the revenue from all the new stores are kicking in. As a side note, Padini has been very impressive, chalking up its strongest Q ever while consumer sentiment was at its weakest.

Looking at red dotted line box, I am projecting that adjusting for seasonal fluctuations, Padini will chalk up a record profit of RM135mil vs RM80mil for 2015 (68 %!!) or an EPS of 20.5c. At a forward PE of 15, this allows for a TP of RM3.07. If you want a DCF valuation, look up KCChong or LCChong (are they brothers??)

Is a PE of 15 fair? Today the PE is 14.3 which is not far from that target. If Padini is on a growth trajectory, then a PE of 15 under normal market conditions would not be a stretch.

Can we simply project that sales will continue to be strong? To be honest, I can’t tell for sure. What I do know is that the reason I started studying Padini was because I wanted to buy some clothes (for the first time in my life) and I went to Padini because my friend told me it had quality products at an affordable price. When I went to the store, it was PACKED. I am borrowing some pictures from a fellow blogger (I can’t reference him because my friend passed me his pictures through whatsapp. Sorry bro)

This was during the Christmas season. With lines as long as the Great Wall of China, I think sales will continue to be strong, at least for Dec Q 2015, which will be out in Feb ’16.

As a loose follower of OTB, the technical indicators of the stock has to be right as well. The stock began up trending as early as 26th Oct 2015, when volume and price picked up (possibly due to insiders buying before results). When the Group released its Sept Q results on 26 Nov, it displayed an up-gap the very next day opening at RM1.67.

Subsequently, the stock has been trending between RM1.80 and RM2.00 until 27 Jan ’16 when (pardon my French) shit was hitting the fan across markets, it broke the RM2.00 resistance line. Personally, I thought this was a strong sign because Padini continued to trend upwards while every other counter was dying. Technically, it is unlikely to close below this level of RM2.00 and is on an uptrend (remember, technical charting is a probability not a certainty).

Conclusion

With a 10c dividend yield, buying at about RM2 will give you a yield of about 5%. Think of this as a safety net.

The big question is if you believe that their strategy is finally bearing fruit and strong margins/ profitability is returning to them. Of course, nothing is certain (unless you have insider intel), so place your bets. If their strategy is really bearing fruit, you will be rewarded for betting long. If you want certainty, wait for the Q results. Of course by that time, you may be too late to pick it up (unless another big market slump comes along).

My bet is that they are finally getting the profits that they deserve, and Sept Q ’15 is the first of many strong Q. Could I be wrong? Of course. As OTB puts it, “I am not God.” However, if I am right for the next 3Q, RM3 is really not such a fantasy.

Happy investing/ trading ya’ll.

Cephas

Appendix:

SWOT analysis

Strategy

- Value for money quality clothing at affordable prices through Brands Outlet

- Grow multi-brand stores (Padini Concept Stores), which have significant operating efficiency of distributing multiple group products

- Single outlet with all brands under one roof

- Lower price/sq feet due to larger rental space

- Lower overheard cost/ revenue

- Quality products to price sensitive Malaysian consumers

Opportunity

- Increasing number of shopping malls in Malaysia

- Growing middle class which is being squeezed

- Price Control and Anti-Profiteering: 18 months from 01 January 2015 till 30 June 2016, traders and retailers are not allowed to increase their net profit – subsequent, may increase prices

Threat

- Online retailers (Lazada etc)

- Foreign multinational brands

- Local brands

Strength

- Strong branding presence – Padini, Brands Outlet

- High efficiency of working capital use

Weakness

- Purchase unit trust

- Depressed margins

没有评论:

发表评论