CANONE: To sell 32.9% KianJoo stakes at RM 3.8 - RM 4.2? Final translation at 40% to 70% gain of share price?

PLEASE TAKE NOTE THAT THIS IS NOT A RECOMMEDATION TO BUY!!!!!

ALL FIGURES PENDING VERIFICATION!!! I'm not accountant and i do not know if my assumption is reliable or not.

Dear all, I'm doing below calculation hopeful for my own decent gain. Please raise your opinion too and correct me if i am wrong.

Back in Sept 2013, Aspire thinking to take over Kian Joo with RM 3.30 cash per share (RM 1.47 billion). However, due to legal issues, the case went on up to early this month and finally the court case has sort of settled pending EGM in March 2016 (5 more months to go).

I try to search back the Canone's company financial statement in 2012, The sum of "Investment in Associate - Kian Joo" being investment of Canone in Kian joo since Jan 2012 was RM 360,740,000. [The price paid was RM 1.65 per share and final sum paid was RM 241,864,000 + Share of post-acquisition reserves RM 118,876,000 ]

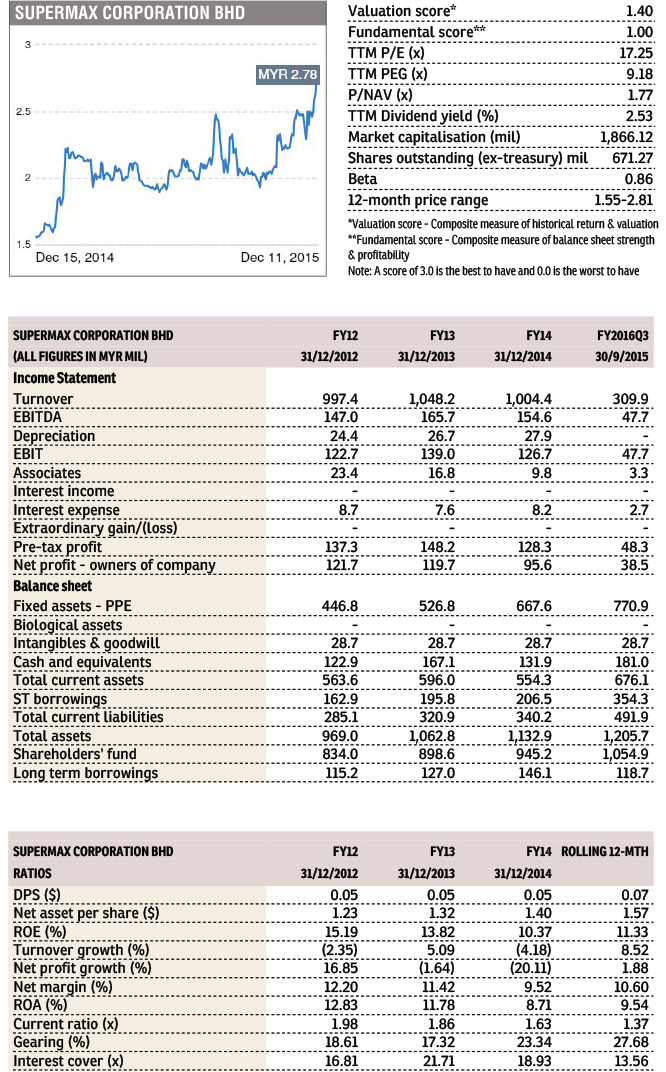

Below the important figures:

1) Investment in associate Kian Joo, 2012 - RM 360,740,000

2) 32.9% stake (146,131,272 shares) (@ RM 3.30 per share cash = RM 482,233,198

3) Kian joo's contribution to Canone bottom line is at RM 39 million profit

If i would to use RM 482,233,198 - RM 360,740,000. Canone will get a instant cash profit of RM 121,493,198 or about 3 times of RM 39 million contributed by Kian Joo to Canone annually, in advance, in merely 3 years plus period.

The cash can then be used to settle company loan which Canone took back in year 2012 for this acquisition [RM 231,011,000 diferential in Non-Current Secured Term Loan in FY 12 account].

Balance cash = RM 251,222,198 or about RM 1.30 cash per share (based on Canone's current outstanding shares), can also be used to settle any otherl outstanding loan with bank, and save finance cost of about RM 20 million per year and contribute to total earning, or use part of the money to pay out a special dividend.

At that time, toyota was offering RM 3.74 cash per share, so, 146,131,272 shares x RM 3.74 = RM 546,530,957. To minus the RM 360,740,000 = RM 185,790,957 or about 4.8 times of RM 39 million contributed by Kian joo to Canone annually.

Now, come to October 2015,

I once again search back the financial statement of Canone and try to find out the contribution of kian joo to Canone.

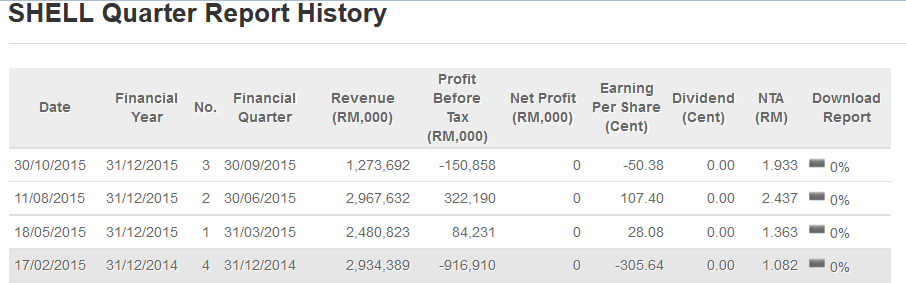

1) Investment in associate - kian joo - RM 434,097,000

2) Contribution of Kian Joo to Canone bottomline = RM 41 million

3) if i would to use back the 3 times of profit, that will be equal to RM 123,000,000 (RM 41 million x 3 times).

4) then, i add up RM 123,000,000 + RM 434,097,000, i got the figure at RM 557,097,000

5) i divide it back with 32.9% stake, that end up to be RM 1.69 billion or RM 3.81 per share (This will be the new cash offer price by Aspire?)

Let assume,

1) the final price is RM 3.81, which mean, Canone will be getting RM 314,896,146 instant cash profit (RM 1.64 per share)

2) But, because of selling off the Kian Joo, Canone will also loss RM 41 million annual contribution from Kian Joo. The RM 41 million is equal to EPS 21.2 sen for Canone.

3) if I would to try to picture the post kian joo era, current TTM EPS at 40.93 sen - eps 21.2 sen (ex- kian joo) + eps 10 sen (saving from finance cost), that ended up become 29.73 sen net.

4) we see a "missing" of 11.2 sen post kian joo era. I think minority shareholder sure will against the deal.

A higher offer price?

In order to balance the "missing" of 11.2 sen eps x 192,153,000 outstanding shares in Canone = RM 21,521,136, this sum should be added to the final sale price. So, RM 21,521,136 + RM 41 million = RM 61,521,136. times 3 = RM 184,563,408

Let add up the RM 184,563,408 + RM 434,097,000 (investment in associate), then we get RM 618,660,408.

divide again with 32.9%, we will get roughly RM 1.88 billion or RM 4.23 cash per share in the end by Aspire? or Toyota to offer this price?

Are We entitled to below?

If after all and all, the deal get through, are we anticipating:

1) Special dividend (RM 1.30 - RM 1.80 per share??).

2) Let assume it all happened NOW, at current share price of RM 2.60 per share, the ex-price will be at RM 1.30 - RM 0.80

3) at TTM EPS of 29.73 sen, the ex-price is traded at 6.1 times - 4.4 simple PE.

4) Compare with peers such as Johotin, let use 10 times simple PE, the share may worth RM 2.9.

I personally not expecting the above, if such event is true, i treat it as real bonus.

I am paying more attention of post-kian joo era, where current TTM EPS at 40.93 sen - eps 21.2 sen (ex- kian joo) + eps 10 sen (saving from finance cost), that ended up become 29.73 sen net.

SPECULATION????

The whole take over saga may have tamper the investor's sentiment, at the end, if the deal to go fairly, we could get a net net of 70% pure gain from calculation. EXCLUDING - the "rally", when the whole dark cloud finally clear?

Canone, at the end, will become a net cash company. Bonus issues is one the way? We all know that bonus issue will not change the company's value, but, we are in Bursa now. ;-).

YiStock

Canone - To Sell 32.9% Kian Joo Stake at RM 5.40 per share? - YiStock

Author: yistock |

Publish date: Sun, 10 Jan 2016, 05:49 PM

Hi Value Investors,

If you have bought Canone

back in October and holding to it till now, you must be getting a handsome paper profit of

at least 80% till last friday.

Like you, i have been holding Canone since Oct 2015 at the cost of RM 2.60. I have also wrote an article on 13 Oct 2015 about my interpretation on possible upside gain of share price. Here is the link :

http://klse.i3investor.com/blogs/canone/84307.jsp

Till now, 3 months has passed. And the share price has reached my initial target.

AND I WILL GOING TO HOLD IT AS THINGS ARE GETTING REALLY INTERESTING NOW!!!

I have several reason to back my decision:

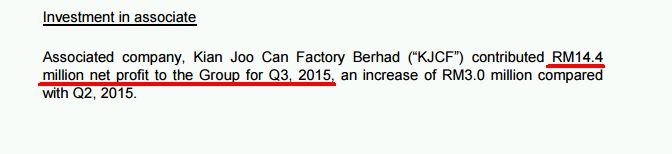

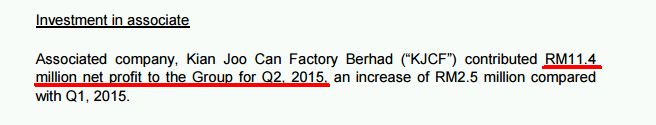

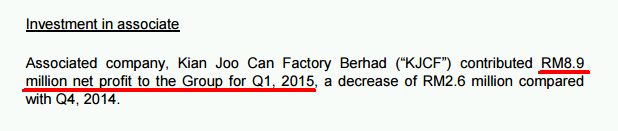

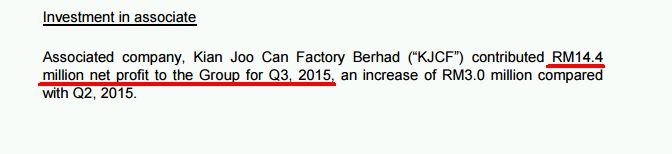

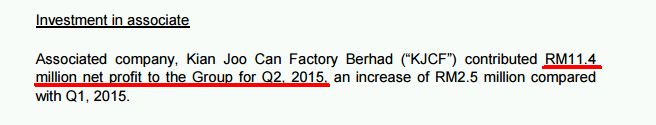

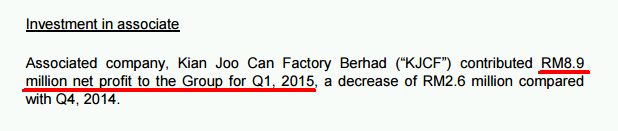

1st: CONTRIBUTION FROM KIAN JOO to CANONE

See Below: KianJoo has continue to contribute REMARKABLE SUM of profit to CANONE bottom line. For the past 3 quarters, it contribute RM 8.9 million (Q1), RM 11.4 million (

+28% from Q1) & RM 14.4 million

(+26% from Q2).

If i would to project using

27%, KianJoon

MAY contribute RM 18.3 in Q4 2015 to Canone and added up the whole year contribution to

RM 52.9 million full year. This is a remarkable achievement compared to FY 2013 @ RM 39 million and FY 2014@ 35.9 million.

2nd: EXCHANGE RATE

If you are one of the share holders, you must also know that the whole take over saga has aWHITE KNIGHT, TOYOTA TSUSHO. who offered RM 3.74 per share to take over Kianjoo.

2nd: EXCHANGE RATE

If you are one of the share holders, you must also know that the whole take over saga has aWHITE KNIGHT, TOYOTA TSUSHO. who offered RM 3.74 per share to take over Kianjoo.

AT that time, around Oct 2013, we have RINGGIT VS USD at around USD 1 : RM 3.05

If you use RM 3.74 x 146,131,272 shares (32.9% stake) = RM 546,530,957.20/ 3.05 = USD 179,190,477.7

The same amount of USD budget, is now worth:

USD 179,190,477.70 x 4.4 =

RM 788,438,101.8 @ RM 5.395 per share!!!

3rd: EPF consortium May offer up to RM 4.00 per share?

I suspect the offer may go as high as RM 4.23 in my previous article.

FOCUS MALAYSIA in their DEC 2015 issue has indicated that EPF may need to offer up to RM 4.00 per share due to getting valuable Kian Joo's stake based on company performance, cash pile and NTA in 2015 compared to 2013.

IF seriously EPF is to buy over Kian Joo which is more valueable now, he seriously has to fight with TOYOTA group which has now up to RM 5.395 per share waiting to offer to CANONE's shareholders.

3rd: EPF consortium May offer up to RM 4.00 per share?

I suspect the offer may go as high as RM 4.23 in my previous article.

FOCUS MALAYSIA in their DEC 2015 issue has indicated that EPF may need to offer up to RM 4.00 per share due to getting valuable Kian Joo's stake based on company performance, cash pile and NTA in 2015 compared to 2013.

IF seriously EPF is to buy over Kian Joo which is more valueable now, he seriously has to fight with TOYOTA group which has now up to RM 5.395 per share waiting to offer to CANONE's shareholders.

4th: HOW IMPORTANT IS KIANJOO's STAKE TO TOYOTA TSUSHO?

4th: HOW IMPORTANT IS KIANJOO's STAKE TO TOYOTA TSUSHO?

We all know that JAPAN ABENOMIC is on going and the enterprises there are now full of cash to expand their biz. And i believe TOYOTA is now MORE KEEN to fight for this deal, not only because ringgit is weaker, but also they really need to quickly achieve the inflation of 2%. Seriously a lot need to be done to achieve this target. Just look at how many time QE is USA.

Conclusion:

IF YOU ARE HOLDING CANONE, JUST HOLD AND SEE, I WILL AGAIN REVIEW THIS STOCK WHEN IT TOUCHES RM 6.00 per share

Cheers

YiStock.

Additional Note:

All my articles are for reading pleasure only and should not be treated as buy/ sell call on any particular company mentioned in the articles.

I can never be 100% sure on the data i sourced and correctly predict the performance of the company I mentioned in the articles.

My investment strategy is very simple, If the business fundamental is improving, i will buy in whatever amount i can. On the other hand, once i start noticing sign of deterioration, i will immediately cut the profit / losses. I only take care of downside, the upside will take care of itself

If i missed any investment opportunity, i will acknowledge i missed it. If i make a mistake on judging the source of info or material i read on certain company i invest in, i will only blame myself and vow to do better in future.

My strategy is FA come first, and forever FA.

I only have 2 sifu, one is KCChong, One is OTB. Take courses from these 2 sifu, and do my own practice. I believe in: the master leads you to the door, the rest is up to you.

I have 2 idol, Mr ColdEye and Bursa Dummy.

I have several investors that i pay high regards to: SooJinHou, Noby, ICON8888, RicheHo, Justabouttheprofit, EzraInvestor, Pakcik Saham, letitgoletitgo

I have an enemy: FEAR

Daily Technical Highlights – CANONEAuthor: kiasutrader | Publish date: Thu, 7 Jan 2016CANONE (Not Rated). For the day, CANONE’s share price surged 29.0 sen (6.3%) to close at a fresh all-time-high of RM4.88. The share price had earlier broke out of a “Bullish Pennant” chart pattern (23 Dec 2015) to signal a continuation of itsprior uptrend. However, it wasn’t until yesterday that the November high of RM4.70 was penetrated in a decisive manner. Taken in tandem with the buy signal from the MACD-Signal line, we expect follow-through buying to continuein the coming weeks. Traders may consider buying now with an upside target of RM5.94 (3 bids below the measurement objective). At the same time, losses should be contained with a stop-loss at RM4.17 (3 bids below Pennant support).Immediate resistance levels to look out for are RM5.34 (R1) and RM6.00 (R2) while support levels are RM4.50 (S1) and RM4.20 (S2).

(星洲日報/財經)

(星洲日報/財經)

(图取自互联网)

(图取自互联网)