估计月底第4季业积10m与股息,老板对公司前景好。进

只供参考,投资自負。

--冷眼前輩介紹的心水股摘要:

RGB國際(RGB,0037,主板貿服股)

-製造老虎機,過去幾年增長20%至30%,

-自由現金流出奇的高,3000萬令吉,雖然每年賺2分,但是其實賺5分錢,因為折舊很高。

-大股東說,在2018年回到60仙。

-符合冷眼5大選股標準:成长、资金回酬率、股息、本益比和现金流。

多谢下列的分享人,感恩---

1)

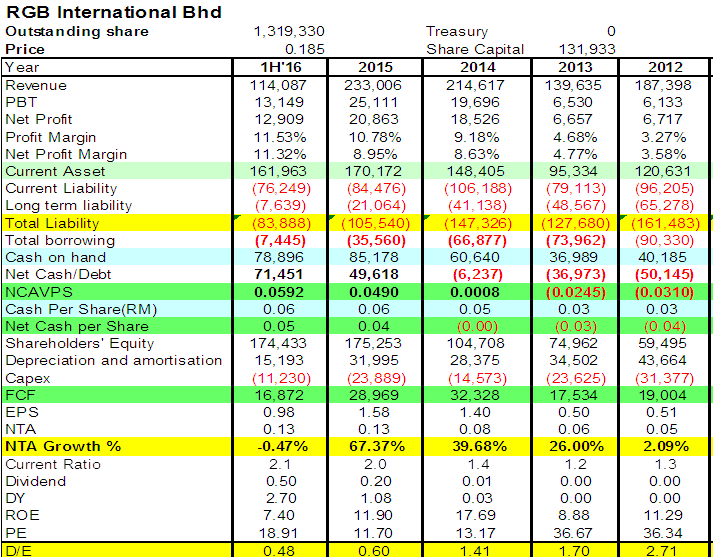

Counter Update ( 0037 RGB International Bhd )

RGB的资产负债表越来越强劲,基本面持续改善。

2)[The No.2 cheapest stock in Bursa] RGB International Berhad

Author: GoldenEggs | Publish date: Wed, 5 Oct 2016, 02:08 PM

RGB International Berhad 是一家制造,销售与维修 Gaming Machine 的公司,旗下有多家知名的赌博游戏机品牌(请看下图),业务主要位于东南亚,照片中是Datuk Chuah, 也就是 RGB 的 MD. 营业额的62%来自于销售而37%是维修服务那里取得。其他大家可以在年报里看到的资料我就不多说了。

主要还是专注于我的看法与分析。我注意到很多人分析,会去project 那个公司的 earnings, 我其实不明白为什么要 project,因为未来的东西是无法预测的,我们能照顾的只有风险,也就是在那些 2 块钱 卖 1 块的公司去买,然后如果公司赚更多钱,其他投资者就会发现公司的价值,慢慢发现这间公司值两块,再加上成长,那就更好了。而当盈利下跌的话,也能亏少一些,比如说 FAVCO 这家公司,上个季度公司的盈利跌了一半,照理来说股价肯定是崩盘的,可是股价是下滑了13.7%,而且在 Oil & Gas 的不景气之下,估计股价还是会被严重低估一阵子了。

现在是牛市的尾端,距离上次股灾已经是8年了,我提醒各位跟我一样的散户,记得买有价值的股票,不要去追那些 PE 很高的股,不然准备烧手。

RGB 在我看来,不是一块买两块的问题,目前的盈利和基本面可以说,接近三倍,也就是一块买三块,投资的话,风险极低 (注意:不是包赚,是亏的可能性低)。我知道很多血气方刚的人又要骂我分析烂啦什么的,那请你看完我的分析,比较一下你手上持有的股,心里就会有答案了。

以今天的股价计算,买完所有RGB 的股票是 224.32M, 而目前 RGB 的现金是 70.32M。自己除来看,我是不是吹水?31.3%的 CASH。。。债务是7.45M,所以是一家 NET CASH 公司,知道那些人又要骂了,冷静点,不要每次都要生气,自己看看你买的公司,比较一下再来发脾气。

公司近一年的Free Cash Flow 是51.57M , 就是公司在过去一年修理机器等等的开销后的现金,是你买下整间公司的22.9%,定存的四倍多。

那我们用 LOGIC 来想一下,买下整间公司以后,还完所有债务,再除以每年的现金流,3.13 年就回本了(盈利下跌,慢一点,上升,就缩短)。我知道很多人又要骂了,三年这样慢!,那我祝你好运,因为这已经是Bursa 第二便宜的股了,你要多的话,就是在做梦,准备烧手~

公司方面也是非常小心使用公司的现金,平均每放一块钱下去,就能每年赚回0.46仙左右~ 但是有一点是 RGB 的致命弱点,就是太多 CASH, 一定有人又要骂了, CASH 你都嫌多?

我要表达的是,公司有这么多钱,放着定存又无法为股东创造利益,倒不如把钱还给股东,留一部分应急就好。这么多的 CASH 又无法赚钱,其实董事局就是失职。这也是为什么,公司的股价可以那么的低,因为董事局无法为股东创造利益,放任股价随意漂泊。公司有两位董事领着一年 700千的薪水~(对这样一间比较小的上市公司,是蛮高的了)

我的看法是,公司要提高股价,第一要增加派息,毕竟钱多~ 第二,大量 share buy back, 因为公司股价已经是应有价值的 三份之一,公司 buy back 的话对公司的股东可以说是风险低,又能提高股价,以回馈股东。

这就是我没有买入这家公司的原因,风险很低,现金很多,但是在我看来,一家公司如果无法利用现金去赚更多的钱,又不把多余的钱派息,又不 buy back, 就是没有对股东的利益着想,也是算有些失职了。

我的分析主要在于我的看法,而不是从annual report 里 copy 一大堆 facts, 因为如果想知道这些 facts, 倒不如自己去看?

3)

RGB - The figures speak for itself

Author: Stockify | Publish date: Mon, 26 Dec 2016, 08:10 PM

In previous post, we conducted a business analysis on RGB. In this post, we look into the financial figures of RGB for the past 5 financial years + latest trailing twelve month (TTM). For the sake of simplicity, we will only extract the figures and illustrations that are relevant to our findings. When come across some financial terms that are new to the readers, we suggest the readers to find out the definitions from respectable sources like http://www.investopedia.com/ to fully understand the article. We are obligated to remind our readers that at the time of writing, RGB was last traded at RM 0.27, which is the figure being applied in some valuations and assumptions in later part of this article.

Income Statement

Illustration 1

Table 1

As indicated in Illustration 1, RGB shows a clear sign of uptrend in its revenue, gross profit and net profit. Table 1 shows that RGB recorded impressive 5 year CAGR in revenue (18.3%), gross profit (26.4%), EBIT (22.1%) and net profit (44.7%). When we look into the figures of each year, it's not hard to notice the growth in RGB revenue has not been very stable over the financial years under coverage. Thus, we will look close into RGB's revenue segments in the later part of this article to conduct further analysis.

Back to Table 1, the higher CAGR in gross profit, EBIT and net profit (compared to revenue) suggested there have been better cost control for RGB over the years, so we move on to see what Illustration 3 tells us about the profit margin of RGB.

Illustration 2

In Illustration 2, there is no clear sign of margin expansion in gross profit margin and EBIT margin, but a clear one in net profit margin. This was attributable to lower financial costs resulted from reducing borrowings. We would like to point out that such net profit margin expansion was achieved at the back of higher tax expense, which we suppose it was resulted from diminishing tax loss carry forward from loss making years. Going forward, RGB may not able to continue to expand its net profit margin through financial costs reduction as there will not be much room to do so.

4)

RGB aiming South America - Argentina

Author: excelyou | Publish date: Sun, 30 Oct 2016, 12:21 AM

RGB aiming South America - Argentina

RGB mentioned they are eyeing South America as below.

The Star, Monday, 1 August 2016

So how big is South America market?

Source: Worldcasinodirectory

South America Casinos and Ga

Saturday Oct 29th, 2016

This section of World Casino Directory deals specificially with South American casinos and gambling. The continent of South America has 9 countries with casinos in them and 4 countries with pari-mutuel facilities in them, including horse racing and dog racing or the newer racinos which have slots or video poker terminals within reach of the gamblers. Click the following articles for a run-down on specific gambling in this continent. South American Poker for the poker guide, or South American Lottery for South American lottery results and lottery information and last but not least visit this page for the current gambling news in South America.

Is RGB really penetrated South America market as at 30 June 2016?

Based on their Corporate Presentation for 1H2015 below, RGB partner for casino equipment & parts is GPI. SHFL, Cartamundi, Suzo and many.

CORPORATE PRESENTATION - 1H2015

If we look at RGB latest Corporate Presentation for 1H2016 below, we will notice "IGT", the new partner appear in RGB latest corporate presentation as one of the product distributor.

Who is IGT?

CORPORATE PRESENTATION - 1H2016

Further investigate revealed that IGT have been promoting their products in Argentinasince 2014 at the only gaming show in Argentina, SAGSE Argentina.

From, SAGSE website, we can see IGT have been participating SAGSE since 2014.

SAGSE website:

http://monografie.com/sagselatam/eng/?page_id=35854#listado-2014

http://monografie.com/sagselatam/eng/?page_id=35854#listado-2015

http://monografie.com/sagselatam/eng/?page_id=35854#listado-2016

CONCLUSION:

Will RGB able to derive significant revenue for South America?

Time will tell.

CORPORATE PRESENTATION - 1H2015

5)

Nepal seem likely will be RGB next crown of jewel.

SOURCE:

Will Nepal be the next "The Philippines" market for RGB?

RGB mentioned they are eyeing South America as below.

The Star, Monday, 1 August 2016

RGB eyes new markets in Europe, S. America

GEORGE TOWN: Electronic gaming machine and equipment maker RGB International Bhd is eyeing new businesses in Europe and South America, as the company seeks to expand its market reach.

RGB derives 95% of its sales from the Asia-Pacific region.

“We want to move away from our traditional markets to broaden the revenue base for the group,” said group managing director Datuk Chuah Kim Seah (pic).

The company, he said had secured orders for 700 units of gaming machines valued at RM80mil for the first half 2016.

So how big is South America market?

Source: Worldcasinodirectory

South America Casinos and Ga

Saturday Oct 29th, 2016

This section of World Casino Directory deals specificially with South American casinos and gambling. The continent of South America has 9 countries with casinos in them and 4 countries with pari-mutuel facilities in them, including horse racing and dog racing or the newer racinos which have slots or video poker terminals within reach of the gamblers. Click the following articles for a run-down on specific gambling in this continent. South American Poker for the poker guide, or South American Lottery for South American lottery results and lottery information and last but not least visit this page for the current gambling news in South America.

Largest Casino in South America

In South America you will find the country of Argentina to have more casinos than any other country in South America, with 79 casinos and 12318 slots.

The largest casino in the continent of South America is Casino de Tigre which is located in Tigre, Argentina. Casino de Tigre has 74 table games and 1700 casino slot machines / video poker games

(or other video terminal gaming machines).

South American casinos

South American casinos are quite popular and today offer luxurious new locations for people to gamble, meet and enjoy. Usually food and beverages here are priced much lower to lure common customers to the place and make them play the game.

The largest casino in the continent of South America is which is located in , . has table games and casino slot machines / video poker games (or other video terminal gaming machines).Is RGB really penetrated South America market as at 30 June 2016?

Based on their Corporate Presentation for 1H2015 below, RGB partner for casino equipment & parts is GPI. SHFL, Cartamundi, Suzo and many.

CORPORATE PRESENTATION - 1H2015

If we look at RGB latest Corporate Presentation for 1H2016 below, we will notice "IGT", the new partner appear in RGB latest corporate presentation as one of the product distributor.

Who is IGT?

International Game Technology PLC (IGT), formerly Gtech S.p.A. and Lottomatica S.p.A., is a multinational gaming company that produces slot machines and other gaming technology. The company is headquartered in London, with major offices in Rome, Providence, and Las Vegas. It is controlled with a 51 percent stake by De Agostini.[4]

Lottomatica acquired Gtech Corporation, a U.S. gaming company, in August 2006, and later changed its own name to Gtech. This transaction created one of the world's leading gaming solutions providers, with significant global market share and the broadest portfolio of technology, services, and content solutions. Gtech managed many state and provincial lotteries in the United States and also had contracts with local and national lotteries in Europe, Australia, Latin America, the Caribbean, and Asia.

In 2015, the company acquired American gaming company International Game Technology and again adopted the acquired company's name as its own. CORPORATE PRESENTATION - 1H2016

Further investigate revealed that IGT have been promoting their products in Argentinasince 2014 at the only gaming show in Argentina, SAGSE Argentina.

From, SAGSE website, we can see IGT have been participating SAGSE since 2014.

SAGSE website:

http://monografie.com/sagselatam/eng/?page_id=35854#listado-2014

http://monografie.com/sagselatam/eng/?page_id=35854#listado-2015

http://monografie.com/sagselatam/eng/?page_id=35854#listado-2016

CONCLUSION:

Will RGB able to derive significant revenue for South America?

Time will tell.

CORPORATE PRESENTATION - 1H2015

5)

RGB is triumphing the next casino capital of the world, Nepal.

Author: excelyou | Publish date: Mon, 17 Oct 2016, 03:05 PMRGB is triumphing the next casino capital of the world, Nepal.

RGB aims to expand its markets by growing geographically as well as through strategic partnership and acquisitions.Nepal seem likely will be RGB next crown of jewel.

| REVENUE BY COUNTRY | FYE 2015 | FYE 2014 |

| RM | RM | |

| The Philippines | 156,297,963 | 169,357,671 |

| Cambodia | 28,008,785 | 27,153,150 |

| Malaysia | 12,022,206 | 2,842,351 |

| Laos | 12,439,270 | 8,946,076 |

| Macau | 765,57 | (184,531) |

| Vietnam | 17,620,484 | 3,054,765 |

| Timor Leste | 3,260,859 | 171,078 |

| Nepal | 844,567 | - |

| Other countries | 301,516 | 3,305,977 |

| Total | 233,005,831 | 214,646,537 |

SOURCE:

Fri, 4 Sep 2015-07:35am , dna

With the gambling industry in India estimated to be over $60 billion despite the ban, Nepal, touted to be the next casino capital of the world, has aggressively started targeting the growing Indian middle class to its shores.

To start with, Nepal's national carrier, Nepal Airlines, has restarted direct services connecting Mumbai with capital Katmandu from Friday. The airline has already started flights from Delhi and Bengaluru and has plans to fly from Kolkata and even several tier-2 cities. It has also tied up with travel agents to offer travel packages for the same.

Nepal Airlines had exited its operations from India about a decade back due to lack of enough aircraft and other operational reasons. At present, Air India, Jet Airways and IndiGo fly to Nepal, with only Jet Airways serving Mumbai.

"Casinos are picking up again in Nepal, and, hence, we expect to attract a lot of Indian tourists," said Saroj Kasaju, director, commercial department, Nepal Airlines.

All the casinos were shut about one-and-a-half year ago due to certain law compliance issues and political reasons, but they have reopened recently.

Nepal's thrust to promote casinos is backed by a report released last month by leading global gaming investment company, Union Gaming Securities Asia Limited, which states that the opening of Singapore's two casino resorts in 2010 coincided with a sharp rise in the number of Indian visitors to that city-state.

The report further states that India produces approximately $10 billion a year in gross gaming revenue, which includes both legal and illegal gambling coming from casino and non-casino gaming. In addition, most middle-class people in India are familiar with several forms of gambling but don't have places to play in. Another positive sign is that Nepal casinos are allowed to accept bets in Indian rupees.

Nepal already attracts tourists from India for religious, adventure and business tourism, though the number declined drastically by about 25% since the devastating earthquakes which rocked the Himalayan country earlier this year.

Gambling is considered auspicious by Indians during Diwali, when hundreds of crores of rupees are said to be won/lost during day-night-long illicit sessions of card games, such as teen patti and poker among others. It is banned in India by a law first enacted in the 19th century, except in Goa, Daman and Sikkim.

Globally, Las Vegas, Macau, Singapore and, to an extent, Malaysia and South Africa are prominent gambling venues, where rich Indians are know to splurge in the game of chance.

Source:

This article first appeared in digitaledge Daily, on September 3, 2015.

KUALA LUMPUR: RGB International Bhd, an electronic gaming machine operator, plans to enter the gaming sector in Nepal, spurred by the introduction of a new charter on gaming rules and regulations that will help attract more gaming operators into the country.

“We can see the potential there. We are now in talks with some of the bigger casino operators in Kathmandu, to work on a strategic partnership," RGB chief operating officer Steven Lim told digitaledge DAILY yesterday after an analyst briefing on its first-half 2015 (1HFY15) results.

“It would be premature for me to share the details as nothing has been signed yet ... but we are very confident that we are getting there,” he said.

He noted that while the gaming sector in Nepal is regulated, the country does not have a specific government body to govern the sector.

“Right now, they (Nepal) have introduced a charter on gaming rules and regulations … I think this is a very exciting market for us to look into as RGB’s strength has always been to look at emerging markets,” he said.

Lim noted that Nepal’s close proximity to India also means that it will be able to attract customers from India, the world's second most populous country after China.

Lim said RGB’s compliance with the US Foreign Corrupt Practices Act (FCPA) since July 1 has enhanced the group’s reputation among its clients — the gaming operators, giving it the credibility to drive expansion into developed gaming markets such as Macau and South Korea, which it had difficulty penetrating in the past.

RGB’s markets have typically been confined to the Philippines, Macau, Cambodia, Singapore and Malaysia.

“With that (FCPA compliance), we are able to do bigger things with bigger companies that want to expand into Asia, to be their strategic partner.

“Because of this strategic exercise that we have done, companies are now more comfortable with RGB and we are given more opportunities to do more work in the region,” said Lim. This is evident from the increased sales of machines in Laos and Goa, India.

Apart from Nepal, RGB is also eyeing the South Korean market, where Jeju Island has the potential to be an attractive gaming and tourism destination.

“There are more opportunities, meaning we foresee better income and better revenue for RGB moving forward,” said Lim.

For the second quarter ended June 30, 2015 (2QFY15), RGB saw its net profit decline 12.9% to RM6.56 million from RM7.53 million a year ago, dragged down by lower revenue for its sales and marketing (SSM) division.

RGB group executive director Mazlan Ismail said revenue for its SSM division fell 34% year-on-year as the group sold fewer machines during 2QFY15.

He added that 300 machines were on trial, which will only contribute to the group's revenue in 3QFY15.

In 1HFY15, RGB sold 387 SSM machines. It targets to sell 1,500 units for the full year. The group sold a total of 1,452 SSM machines last year.

“We have some machines that are still on trial … we are very confident that all those trials will be converted into sales,” Mazlan said.

SOURCE:

The Star, Monday, 1 August 2016

RGB eyes new markets in Europe, S. America

GEORGE TOWN: Electronic gaming machine and equipment maker is eyeing new businesses in Europe and South America, as the company seeks to expand its market reach.

RGB derives 95% of its sales from the Asia-Pacific region.

“We want to move away from our traditional markets to broaden the revenue base for the group,” said group managing director Datuk Chuah Kim Seah (pic).

The company, he said had secured orders for 700 units of gaming machines valued at RM80mil for the first half 2016.

About 500 units had been delivered to customers.

“The remaining 200 will be delivered in the third quarter. With the delivery of the 700 units, we are projecting double-digit percentage growth over last year’s net profit,” he told StarBiz.

The sales of gaming machines made up about 70% of the group’s revenue, while the remainder was contributed by the RGB’s gaming concession programme, which included the leasing of machines and equipment.

Chuah said the group was targeting to sell more machines than last year’s 1,300 units, which generated RM145mil in revenue.

For the second half, the group had 400 more gaming machines with an estimated market value RM45mil to deliver before the end of the year.

“The total undelivered units to date is 600, which includes the 200 yet to be delivered units secured in the first half.

“To surpass last year’s goal, we need to secure sales for 300 more units,” he said.

On RGB’s concession business, the leasing of the machines in the Asia region is expected to generate RM7.6mil per month for 2016, compared with RM7mil in 2015.

RGB leases its gaming machines to customers in Indochina, the Philippines, Timor Leste and Nepal.

“The Philippines is one of the largest markets for us,” he said.

Chuah said the group would be leasing machines soon under its concession programme to Kathmandu, which is a new market for the group.

“The machines are ready to be shipped out and should be operational by the fourth quarter,” he said.

RGB reported a 37% increase in net profit to RM5.9mil in the first quarter ended March 31, as revenue improved 45% to RM56mil.

Meanwhile, the group has settled the remaining RM27mil debts owed under the Commercial Papers Medium Term Notes (CPMTN) programme ahead of the scheduled final payment due in 2019.

“The group has more than RM60mil cash in hand, after settling the CPMTN debts,” Chuah said.

This cashpile will come in handy as the group explores opportunities in new markets.

Conclusion:Will Nepal be the next "The Philippines" market for RGB?

6)

RGB - Siding with the top bookies

Author: Stockify | Publish date: Mon, 19 Dec 2016, 06:42 PM

Introduction

The history of RGB involvement in the gaming industry began way back in 1986 (through RGB Sdn Bhd, its wholly owned subsidiary today). To date, RGB has been in the industry for 30 years, being known as a leading supplier of electronic gaming machines and casino equipment in Asia region (known as SSM in later part of this article). It is also a major machine concession programmes operator in Asia (known as TSM in later part of this article).

RGB, the Group, was incorporated on 16 January 2003, listed on MESDAQ on 13 January 2004, and successfully transferred to the Main Market of BURSA on 31 January 2008. Just when everything seemed to be going well, Cambodian Prime Minister Hun Sen's decision to cease the operations of slot clubs in Cambodia came as a shock to the Group, resulting in its first loss in FY08 ever since listed.

Just like the biography of every great man, their stories would not have been as interesting and inspiring without enduring the hardships. And this is how we would like to tell our story on RGB.

Business

In an industry with relatively few competitors, RGB is one of the industry leader in Asian region. The operations of RGB can be mainly classified into two main segments, i.e Sales Support & Marketing (SSM) and Technical Support & Management (TSM), which is illustrated as below.

SSM Segment distributes electronic gaming machines, amusement machines, casino equipment accessories & slot management system in Asia including Malaysia, Philippines, Macau, Singapore, Vietnam, Cambodia and Nepal. The brands including in house brand RGBGAMES, R.Franco, Scientific Games, Aristocrat, GPI, IGT and Suzo Happ. In this segment, RGB holds no interest in the gaming machines, only as a distributor to sell the machines. Based on latest trailing twelve month (3QFY16), SSM Segment contributed 66% to the Group total revenue.

TSM Segment partners up with investors & gaming license holders by placing electronic gaming machines at concession venues (slot halls & casinos) mostly in Cambodia & Philippines. Partnership model includes i) Providing lease-to-own packages ii) Gaming machines profit-sharing iii) Providing management services for a fee. As reported in AR FY15, RGB has more than 6,000 units of machines in operation across 37 concession venues in Philippines, Cambodia, Lao PDR and Vietnam. (Timor Leste, Nepal, and Kathmandu). Based on latest trailing twelve month (3QFY16), SSM Segment contributed 33.86% to the Group total revenue.

Going forward, the Group aims to expand its markets by growing geographically as well as through strategic partnership and acquisition. While having presence in more than 8 countries, RGB derives 95% of its revenue from Asia-Pacific region. As published in The Star Online on 1st August 2016, RGB group managing director Datuk Chuah said that the Group is eyeing new markets in Europe and South America. We believe it will be the growth driver for RGB. The Group will also continue to identify viable partners to grow its TSM business.

In the same article, it was mentioned that the group will soon start its first TSM concession in Kathmandu, we see this as the opportunity to tap into a bigger market, as opposed to usual Southeast Asia market by the Group, given Nepal’s close proximity to India also means that it will be able to attract customers from India, the world's second most populous country after China. By expanding the TSM Segment, RGB's revenue and net profit will be more consistent as the income from TSM Segment is on recurring basis. Besides that, the profit margin of the Group will overall be improved, due to the high profit margin in TSM Segment (5 year average of 21.49% in TSM Segment vs 5 year average of 9.54% in SSM Segment, both excluding unallocated expenses).

However, we would like to remind investors that by involving more in TSM Segment, RGB also increases its risk sharing with the gaming license holders. Speaking of profit margin, in SSM Segment, which RGB acts as a distributor of gaming machines, RGB managed to secure a decent profit margin compared to traditional distributors who always have razor-thin margin. We suppose it is attributable to the on going Technical Support Services and Parts & Services provided by the Group to its customers and investment partners which gives them the peace of mind to buy and partner up with them. The Technical Support Services of the Group renders technical services, system maintenance services and consultation that support all brands under its distributorship as after sales service and service to all its TSM Sites. The Parts & Services department supplies low costs and high quality parts and components to its partners and customers, and even refurbish old machines for future use or sell. Such services can provide peace of mind to the customers and partners, and cost savings on a longer term, therefore manage to have them to prefer sticking with RGB, even maintaining a higher margin.

Management

Back in 2008, RGB was having its greatest time of all time. The business was experiencing tremendous growth, from FY03 to FY07, the Group managed to achieve CAGR of 35.92% in revenue and CAGR of 31.88% in net profit. The share price hit all time high at RM 0.60 in Nov 2007 (after adjustment for bonus issue), and successfully converted to Main Market in 31 January 2008. Intended to ride on the trend, in FY07 alone, the Group has placed additional 2,200 units of machines throughout all locations of operations, an upsurge of 65% from 3,400 machines previous year, funded by the additional borrowings RM 72.5 mil (+106% in borrowings compared to FY06) taken in that year. The Group also spent CAPEX as high as RM 120 mil (+97% compared to FY06), and 90% of the CAPEX was spent in Cambodia.

And just like the myth of Icarus, who flew too high and the sun melted his wings, the sudden regulatory changes in Cambodia towards operations of slot clubs in December 2008 was a nightmare to the Group, forcing 1,500 units of machines were removed from operations in following the closure of 23 clubs. Two months later, following a directive issued on 26 Feburary 2009 which decreed that all slot clubs in Cambodia to cease operations, a further 21 slot clubs with 1,800 units of machines were closed. Given their large exposure to Cambodia during that time (Cambodia segment contributed 37% to the total revenue and 52.62% to total assets in FY07), the regulatory issues in Cambodia caused the Group to incur first losses in FY08 and also subsequent years.

The losses were mainly caused by 3 reasons:

1) Lower revenue contribution from Cambodia (loss of revenue from 3,300 machines)

2) High mobilisation costs i.e. removal, storage, relocation and reinstallation for affected machines to other TSM concessions.

3) Impairment costs of the affected machines that failed to rearrange to new TSM concessions.

With the loss of 3,300 machines from Cambodia, revenue of RGB's TSM segment almost halved in FY09, not to mention still having to serve the interest of more than RM 9 mil on the back of RM 147 mil borrowings, resulting in the Group suffered greatly in their bottom lines. With 3,300 idle machines, the management responded quick and decisively enough to promote the TSM concession arrangement to casino operators in Macau and Philippines, by leveraging their long-standing relationship. The Group managed to refurbish and deploy 58% of the idle machines into new concessions, while this is commendable, the cost of setting up further affected the net profit of the Group. The remaining machines failed to be arranged into new TSM concession subjected to impairment cost that further drag the Group into losses for the consecutive financial years.

We opine that the management did a fantastic job in handling the Group during turbulent times. The management took only 4 years to turn around the company to be profitable again in FY12. In fact, the EBITDA of the Group has always been positive despite in turbulent times, it was only the impairment cost from affected machines turned the Net Profit into red. More importantly, the Group has learned the lesson to be extra careful in managing its CAPEX and debts. RGB made it its first priority to pare down its borrowings in FY11, and the borrowings have been reducing significantly over the past few years, turning into a net cash position in FY15.

We believe that assessing a company's management capability and integrity is as important as assessing its business prospects, financial performance and valuation. Retail investors are always of the opinion that they are not in the position to evaluate the management of a company. The case study of RGB proved that, they can too. A management team that proved to be the veteran in the industry, able to fulfill its promise to the shareholders, did what was necessary during turbulent times and learned from their mistakes, we have no reason not to grade them as one of the top management we have come across.

Risks

Over-concentration in Cambodia back in FY07 has caused the group suffered greatly. Today, the Group seems to have diversified its operations by making its presence in more than 8 countries, but in fact, it hasn't. Based on the latest Annual Report FY15, segment from Philippines and Cambodia contributed 67% and 12% to the total revenue respectively. In terms of geographical non-current assets, Philippines and Cambodia's non-current assets made up 32% and 50% of the Group total non-current assets. When we look into the TSM Segment, where greater risks lie (due to the risk-sharing nature), most of the Group TSM concessions are located at Philippines and Cambodia. To clarify, we don't see geographical diversification as one of our checklists in making our investment decision. However, for a company like RGB that subjects to high regulatory risks, geographical diversification matters.

Besides that, more people nowadays go online in search of entertainment they used to access in other ways, and gambling is no exception. It is believed that online gambling will be taking more market share from traditional gambling, due to several advantages it offers including convenience, comfortable, anonymity, privacy etc. And compare among few forms of gaming, slotting machines are definitely more replaceable by online gambling due to the gaming nature. This is a risk investors should consider if they are planning to invest in RGB for a very long period.

Conclusion

RGB has got a top management team that is able to navigate the Group through turbulent times, and fulfill its promises to the shareholders. This is the kind of management that value investors would seek. In gambling, there is a saying: "The House Always Win". With TSM Segment expanding, investing in RGB is equivalent to siding with the House in gambling, which is a proxy to invest in typical casino business that often comes with higher valuations. We would like to see RGB to diversify away its TSM Segment from Philippines and Cambodia to mitigate its regulatory risk from these countries. In this post, even though we have quoted some figures to support our analysis, it is mainly the business analysis of RGB, aka qualitative analysis. However, good business is not equivalent to good investment, as valuations of a company plays a bigger part in value investing. In next post, we will further analyze RGB in terms of financial numbers, so that our readers can decide whether RGB is at its right valuation to invest in.

,RGB国际开始积极探索现有市场外的区域市场,能提升销售额和特许经营,推动明年表现获双位数提升。

“我们已在今年开始开拓亚洲以外的新市场,包括南美洲和欧另外,消息人士透露,公司也达到内部关键绩效指标(KPI),今年表现将取得亮眼成绩。司在首9个月的净利为2220万令吉,高于去年同期表现,因此我们很有信心今年能够得按年双位数增长。”

他也提到:“公司的基本面仍稳健,预料明财年也能取得双位数增长。”

此外,该公司销售和营销领域,已在今年成功售出超过1300架角子机,同时放眼明年销量能增10%。

目前RGB国际市场立足于亚洲数个多国家,如大马、新加坡、澳门、柬埔寨、寮国、菲律宾、越南、缅甸、东帝汶及尼泊尔。

在该公司营业额中,有90%来自国外市场,其中95%来自亚太区域。

5在国内,RGB国际的客户有云顶和丽星邮轮(Star Cruises)。

7)RGB -- 初生之犊转换变为稳重青年的成长故事

Author: 荷兰客栈 | Publish date: Tue, 11 Oct 2016, 03:38 PM

股价 – RM0.185

股数 -- 1.319bil shares

股数 -- 1.319bil shares

业务:

1) 代理销售各大名牌(主要aristocrat & shuffle master)老虎机 (2015 – 1300units)– gross profit margin ~10%

2) 出租老虎机置放在club house/casino, 收取固定租金或profit sharing (37 outlets, 6460 units – 2015) -- gross profit margin ~60%

历史:

1) 2008年之前的鼎盛时期,公司主力市场都放在柬埔寨的各地俱乐部,盈利曾经去到接近40mil和股价60分。当时的RGB犹如一只初生之犊,野心勃勃的追求快速成长。结果当时公司借贷了过亿来扩充老虎机出租生意。当时的柬埔寨,很多地方老虎机不太受政府管制。之后柬埔寨换新政府后突然禁止老虎机在俱乐部的经营,结果导致他们收入大跌。靠大笔借贷买来的老虎机突然闲置,失去收入的同时又要承受高折旧和大笔利息支出,就这样把公司打入了深渊,承受了三年严重亏损。

2) 幸好,这只小牛死不去,还重新爬起再成长。之后公司转移阵地,把机器搬到菲律宾和一些金三角地区。目前主力都在菲律宾。有了前车之鉴,公司在菲律宾的生意合作对象都是有菲律宾政府支持的。有了这一层保护网,公司的投资比较有保障。另外,现在的RGB也不再像十年前那般过度举债来扩充生意拼成长,反而是一步步稳打稳扎的利用手上资源去扩充。

买点:

1) 公司近几年的operating cash flow都基本超过50mil.每年现金流平均会拿两千多万来投资新老虎机来出租,还债千多万。

2) 今年五月,公司提前清掉一笔千多万(7% interest)的commercial paper.目前总贷款只剩7mil, 而手上现金已经去到78mil。就是说公司从net debt过亿,短短几年就变成net cash 70mil。

3) 2017开始,公司已经没有债务需要偿还,而据公司透露目前计划每年的capex还是会保持大概20mil.就是说每年会有剩余30mil以上的净现金流。公司目前没有设立任何dividend policy.但管理层透露如果有多余的钱,他们会考虑增加派息。以目前的现金流,绝对有能力派发一分以上股息(1分=13mil)

4) 贷款没了,现金多了,之前每个季度需要付的百万利息,现在可以省下,存款利息收入也会增加一点。

5) 目前老虎机出租收入平均每个月7.6mil, up from 2015 7mil.

6) 代理销售方面,2016上半年拿到700架机总共80mil订单,delivered了500架(recognized revenue 68mil)。其余200架会在Q3交货。直到八月头为止,又多拿到400架总值45mil订单。就是说公司手上还没交货的订单有600 units -- ~57mil (gross profit 5.7mil). 公司目前也在积极争取多至少300架订单以便超越去年的总订单。

7) 他今年刚在nepal开拓到新的出租市场,机器正在运过去,Q4会开始营业。

8) 据管理层回复,今年新增加的出租老虎机是250台。这些都是可以增加recurring income的重要收入。

9) 他刚拿到aristocrat(澳洲名牌)在laos和gao的独家代理权和shuffle master在新加坡的分销权。据知也已带来了一些生意。

10) 老板正在开发南美洲和东欧的SSM市场。

11) 老板去年公开说要在2018/19前把公司盈利和股价带回到2008前的高峰,目前的前进脚步也很正面

12) Mr Cool也在去年成为了其中一个大股东。

风险

1. 公司销售市场主要在菲律宾和其他一些东南亚地区,而机器售价和拿货都是以美元记价。美元的大幅波动可能会对短期业绩制造一些额外的forex loss. 美元如果起太厉害,也可能会对他们销售量或profit margin有一些影响。

2. 老虎机出租收入主要是Thai Bath和Philippines Peso.这两国对马币的变动也会影响收租的盈利。

3. 突然历史重演,出现老虎机被禁止营业的现象。(不过短期可能性不大)

没有评论:

发表评论