homeriz Q4 业积月底公布,估计股息有2 sen,在全年亮眼的业积下,股价有机会到rm1.10~1.20 ,供參考,投资有风险,进出自负!

转贴 ;

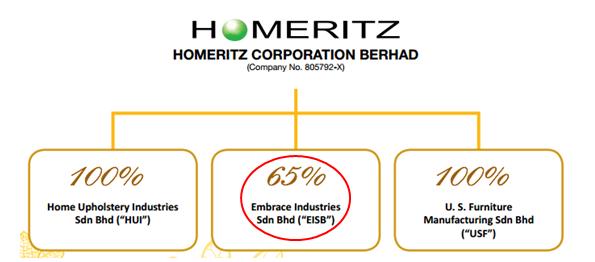

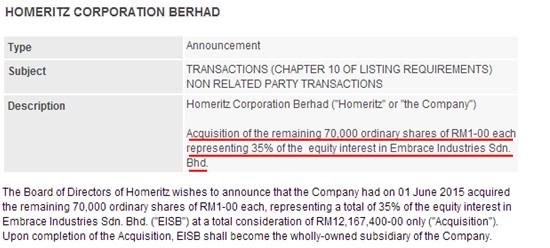

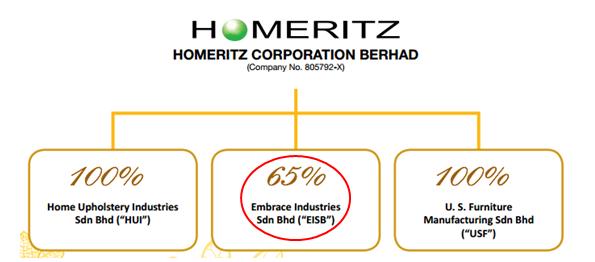

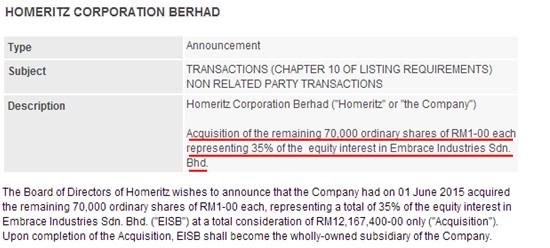

*On June 2015, HOMERIZ had acquired the remaining 35% of EISB and EISB had become HOMERIZ wholly-owned subsidiary

Principal activities

Ø Design, manufacture and sale of upholstery furniture products, comprising leather and fabric-based sofas, dining chairs and bed frames

Ø Has a diverse customer base spanning across more than 40 countries, including Europe, Australia, New Zealand, North and South America, etc.

Ø HOMERIZ own brand of lifestyle furniture series under “Eritz”

Financial Highlights

From FY11 to FY14, HOMERIZ revenue had a compound annual growth rate (“CAGR”) of 12.29% while its net profit had a CAGR of 23.26%! Based on the FY15 first three quarters, HOMERIZ revenue and net profit are very likely to achieve a new high.

The excellent financial results are probably because of higher sales volume and strengthening of USD.

*as at 31 May 2015

HOMERIZ net cash on hand had increased 7 times from 2011 to 2014! It is definitely a cash rich company with almost MYR50m on hand. It totally reflects HOMERIZ financial strength. Cash is king during hard time.

Company Highlight

June 2015

Ø Acquisition of the remaining 35% of equity interest in Embrace Industries Sdn. Bhd. for MYR12.17m

July 2015

Ø Bonus issue 1:2 with free warrants on the basis of 1:4

Ø Acquisition of an agriculture land at Johor for MYR7.68m

Weakening Of MYR

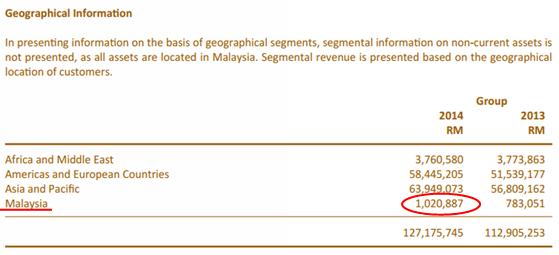

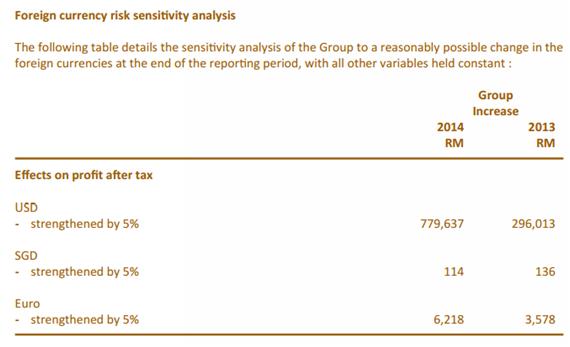

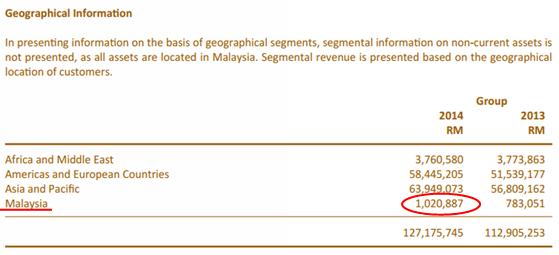

Based on the geographical information, only 0.8% of HOMERIZ revenue is from Malaysia while 99.2% are exported out to other countries!

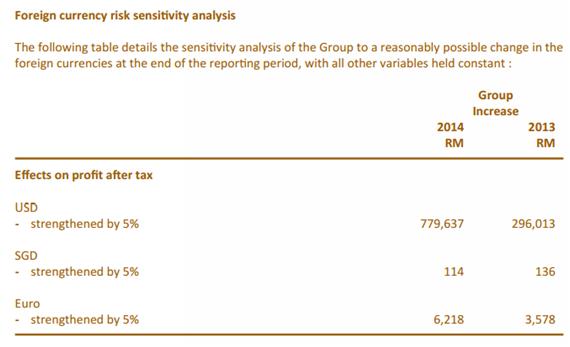

Weakening of MYR against USD, SGD and Euro will benefit HOMERIZ! So far, MYR had depreciated about 22% against USD. That’s mean if other factors remain constant, theoretically HOMERIZ will have extra MYR3m+! That’s a lot!

Expansion Plan

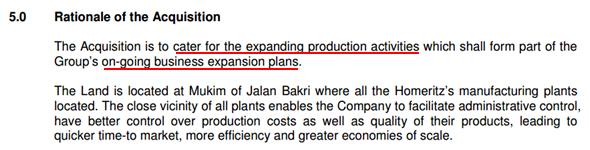

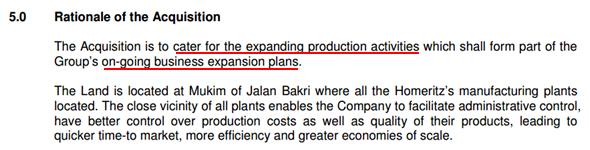

On July 2015, HOMERIZ had acquired a piece of land at Johor for MYR7.68m whereby its existing manufacturing plants are located at the same place too. To expand its business. HOMERITZ had proposed to establish a factory on the land.

Definitely, this will be a good news for HOMERIZ even though it was just the first stage. With almost MYR50m cash on hand, HOMERIZ can easily make internal funding and borrowing for this new factory.

Since the land had been acquired, there should be no obstacle for HOMERIZ to set up the new factory. By the time the factory establishes, HOMERIZ production capacity will also increase.

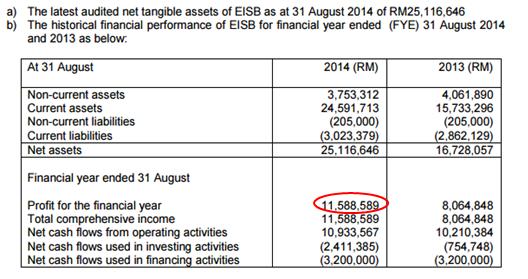

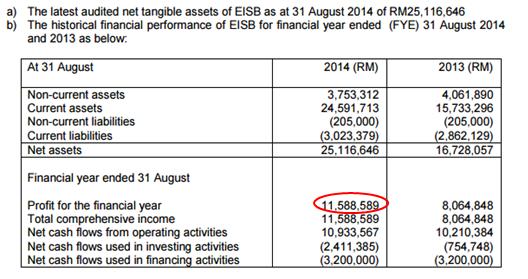

Acquisition of Remaining Interest in EISB

On June 2015, Homeritz had acquired the remaining 35% of the equity interest in Embrace Industries Sdn. Bhd.

That’s mean upon completion, EISB will become wholly-owned companies of HOMERIZ. EISB total net profit will fully contribute to EISB and no longer with 65% only.

On FY14, EISB net profit was MYR11.6m.

Let’s assume EISB net profit for FY15 is MYR13m. An additional 35% profit will contribute additional MYR4.5m to HOMERIZ financial result! It is equivalent to additional MYR1m+ net profit a quarter!

The acquisiton had completed on September. HOMERIZ upcoming quarter result is expected to achieve higher!

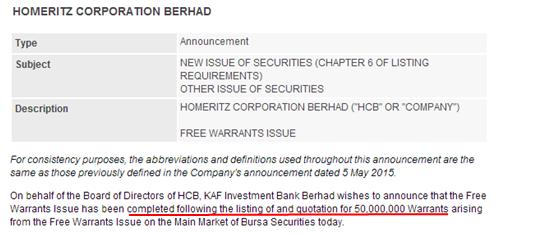

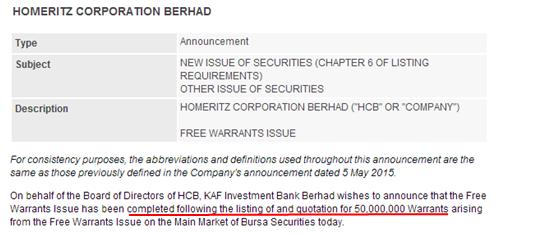

Dilution of Earnings

On July 2015, HOMERIZ had issued 50m warrants,HOMERIZ-WA 2015/2020, to the market.

If the warrant is in-the-money, it is possible that every single warrants will be exercise. If this situation happens, HOMERIZ will need to issue another 50m ordinary shares to the market. By that time, HOMERIZ outstanding shares will be 350m!

In the words, originally a grand prize is shared by 30 person, but now it needs to be share by 35 person! The portion that a person get definitely will be smaller compared to previously.

Price Estimation

HOMERIZ cash flow on year 2013 was MYR18.6m while on year 2014 was MYR29.6m, equivalent to increase of 28%. To recall again, HOMERIZ net profit CAGR for the past three years was 23.26%. For a pessimistic scenario, operating cash flow of MYR30m will be used in year 1 and CAGR of only 5% will be used! Since the Beta for HOMERIZ is 1.26, interest rate of 7% will be used.

Discount Cash Flow (“DCF”) model

*since we can’t take forever cash flow into account, so assumption of HOMERIZ will only sustain for another 12 years after year 10 will be taken.

PE estimation

On next financial year, EISB revenue will 100% contribute to HOMERIZ financial result.

USD will continue to strengthen since FED is likely to hike interest rate soon.

All the factors are positive to HOMERIZ, so its future earnings are estimated as below:

Technical Chart

To make it simplify, only candlesticks and RSI indicator will used. HOMERIZ had a strong resistance line at MYR1.01 and a strong support line at MYR0.90.

Currently, HOMERIZ is moving side way and retests the resistance line. It is an uncertainty whether it will break through or continue moving side way.

However, if HOMERIZ is able to break through the resistance line, the buy in signal will be form. HOMERIZ will move up to another price region.

据CSIL (Centre for Industrial Studies)研究报告,软垫家具全球需求放眼稳健增长。 同时,业务受惠于美元强势,美元对马币每10sen的升值将提升HOMERIZ 2015财政年盈利6%。此外,产品原料成本降低让HOMERIZ享有更高的盈利率(profit margin),是提高公司盈利的另一个催化剂。

转贴 ;

(RICHE HO) Homeritz - Home ERITZ

Author: RicheHo | Publish date: Mon, 5 Oct 2015, 09:57 PM

*On June 2015, HOMERIZ had acquired the remaining 35% of EISB and EISB had become HOMERIZ wholly-owned subsidiary

Principal activities

Ø Design, manufacture and sale of upholstery furniture products, comprising leather and fabric-based sofas, dining chairs and bed frames

Ø Has a diverse customer base spanning across more than 40 countries, including Europe, Australia, New Zealand, North and South America, etc.

Ø HOMERIZ own brand of lifestyle furniture series under “Eritz”

Financial Highlights

REVENUE RM'000

| |||||

| Year/ Quarter |

2011

|

2012

|

2013

|

2014

|

2015

|

| 1 |

24,459

|

26,863

|

25,028

|

35,687

|

33,365

|

| 2 |

19,477

|

24,485

|

23,512

|

28,641

|

37,848

|

| 3 |

20,107

|

23,121

|

28,391

|

29,611

|

37,094

|

| 4 |

25,783

|

28,777

|

35,974

|

33,237

| |

89,826

|

103,246

|

112,905

|

127,176

|

108,307

| |

NET PROFIT RM'000

| |||||

| Year/ Quarter |

2011

|

2012

|

2013

|

2014

|

2015

|

| 1 |

3,439

|

3,174

|

2,827

|

5,792

|

4,261

|

| 2 |

1,702

|

2,860

|

2,214

|

4,611

|

6,562

|

| 3 |

1,756

|

2,977

|

3,127

|

4,652

|

6,087

|

| 4 |

3,914

|

5,689

|

6,950

|

5,192

| |

10,811

|

14,700

|

15,118

|

20,247

|

16,910

| |

From FY11 to FY14, HOMERIZ revenue had a compound annual growth rate (“CAGR”) of 12.29% while its net profit had a CAGR of 23.26%! Based on the FY15 first three quarters, HOMERIZ revenue and net profit are very likely to achieve a new high.

The excellent financial results are probably because of higher sales volume and strengthening of USD.

| Year |

2011

|

2012

|

2013

|

2014

|

2015*

|

| Net borrowings, RM’000 |

4,565

|

3,021

|

2,672

|

2,306

|

2,008

|

| Free cash flow, RM |

11,705

|

24,471

|

34,710

|

51,585

|

50,415

|

| Net cash, RM |

7,140

|

21,450

|

32,038

|

49,280

|

48,407

|

HOMERIZ net cash on hand had increased 7 times from 2011 to 2014! It is definitely a cash rich company with almost MYR50m on hand. It totally reflects HOMERIZ financial strength. Cash is king during hard time.

Company Highlight

June 2015

Ø Acquisition of the remaining 35% of equity interest in Embrace Industries Sdn. Bhd. for MYR12.17m

July 2015

Ø Bonus issue 1:2 with free warrants on the basis of 1:4

Ø Acquisition of an agriculture land at Johor for MYR7.68m

Weakening Of MYR

Based on the geographical information, only 0.8% of HOMERIZ revenue is from Malaysia while 99.2% are exported out to other countries!

Weakening of MYR against USD, SGD and Euro will benefit HOMERIZ! So far, MYR had depreciated about 22% against USD. That’s mean if other factors remain constant, theoretically HOMERIZ will have extra MYR3m+! That’s a lot!

Expansion Plan

On July 2015, HOMERIZ had acquired a piece of land at Johor for MYR7.68m whereby its existing manufacturing plants are located at the same place too. To expand its business. HOMERITZ had proposed to establish a factory on the land.

Definitely, this will be a good news for HOMERIZ even though it was just the first stage. With almost MYR50m cash on hand, HOMERIZ can easily make internal funding and borrowing for this new factory.

Since the land had been acquired, there should be no obstacle for HOMERIZ to set up the new factory. By the time the factory establishes, HOMERIZ production capacity will also increase.

Acquisition of Remaining Interest in EISB

On June 2015, Homeritz had acquired the remaining 35% of the equity interest in Embrace Industries Sdn. Bhd.

That’s mean upon completion, EISB will become wholly-owned companies of HOMERIZ. EISB total net profit will fully contribute to EISB and no longer with 65% only.

On FY14, EISB net profit was MYR11.6m.

Let’s assume EISB net profit for FY15 is MYR13m. An additional 35% profit will contribute additional MYR4.5m to HOMERIZ financial result! It is equivalent to additional MYR1m+ net profit a quarter!

The acquisiton had completed on September. HOMERIZ upcoming quarter result is expected to achieve higher!

Dilution of Earnings

On July 2015, HOMERIZ had issued 50m warrants,HOMERIZ-WA 2015/2020, to the market.

If the warrant is in-the-money, it is possible that every single warrants will be exercise. If this situation happens, HOMERIZ will need to issue another 50m ordinary shares to the market. By that time, HOMERIZ outstanding shares will be 350m!

In the words, originally a grand prize is shared by 30 person, but now it needs to be share by 35 person! The portion that a person get definitely will be smaller compared to previously.

Price Estimation

HOMERIZ cash flow on year 2013 was MYR18.6m while on year 2014 was MYR29.6m, equivalent to increase of 28%. To recall again, HOMERIZ net profit CAGR for the past three years was 23.26%. For a pessimistic scenario, operating cash flow of MYR30m will be used in year 1 and CAGR of only 5% will be used! Since the Beta for HOMERIZ is 1.26, interest rate of 7% will be used.

Discount Cash Flow (“DCF”) model

| Interest rate | 7% | |||||||||

| Year |

1

|

2

|

3

|

4

|

5

|

6

|

7

|

8

|

9

|

10

|

| Est. OCF |

30,000

|

31,500

|

33,075

|

34,729

|

36,465

|

38,288

|

40,203

|

42,213

|

44,324

|

558,478

|

0.935

|

0.873

|

0.816

|

0.763

|

0.713

|

0.666

|

0.623

|

0.582

|

0.544

|

0.508

| |

28,037

|

27,513

|

26,999

|

26,494

|

25,999

|

25,513

|

25,036

|

24,568

|

24,109

|

283,902

|

| Total, MYR’000 |

518,172

|

| (divided) Number of shares, ‘000 |

300,000

|

| Value per share, MYR |

1.35

|

PE estimation

On next financial year, EISB revenue will 100% contribute to HOMERIZ financial result.

USD will continue to strengthen since FED is likely to hike interest rate soon.

All the factors are positive to HOMERIZ, so its future earnings are estimated as below:

| Est. net profit, MYR’000 | |||

| Q1 |

6,500

| ||

| Q2 |

7,000

| ||

| Q3 |

7,500

| ||

| Q4 |

8,000

| ||

29,000

| |||

| Est. EPS |

0.10

| ||

| Est. PE |

10

|

12

|

15

|

| Est. Price |

0.97

|

1.16

|

1.45

|

To make it simplify, only candlesticks and RSI indicator will used. HOMERIZ had a strong resistance line at MYR1.01 and a strong support line at MYR0.90.

Currently, HOMERIZ is moving side way and retests the resistance line. It is an uncertainty whether it will break through or continue moving side way.

However, if HOMERIZ is able to break through the resistance line, the buy in signal will be form. HOMERIZ will move up to another price region.

I will be writing some stock analysis report to earn some pocket money.

I will be writing 5 stock analysis reports and 1 comparison of same industry company report a month for a fee of MYR120/month. It will be a simple, easy to read and understandable report. It had included fundamental and also technical analysis.

For full sample report of HOMERITZ, you may download and have a look, as below:

https://www.dropbox.com/s/8b5nlfg9l5i4fm0/Homeritz%2001%2010%202015.pdf?dl=0

You may also refer some of my articles as below:

1. Export-Oriented Company Not Necessarily Benefit From Weakening Of MYR --> Tongher

2. How to Spot Unfavourable Factors of a Company? --> AYS

3. Consistently Profit Making Company Not Necessarily Is Good --> London Biscuit

4. The Art Of Investing – How To Survive During Market Downturn

In addition, you may request to carry out a research on a specific company that you wish to know, for a fee of MYR25/report. For those who subscribe monthly, there will be no extra charges.

For those who are interested, you may contact me at richeho_92@hotmail.com or 016-9392726. Or you may leave your email below, so that I can contact you.

Thanks!

转贴;

Tuesday, June 30, 2015

7月潜能股:#1 HOMERIZ(5160)

主要业务是设计、制造与出口高级软垫家具,是国内两家针对国际市场的中高级软垫家具制造商之一。除了原厂设计制造(ODM)自身品牌-Eritz,公司也从事代工生产(OEM)。HOMERIZ的客户遍布全球55个国家,其中亚太(主要是澳洲)和欧洲是主要出口市场。

从基本面上点评,HOMERIZ自上市以来业绩表现稳健,从未面对亏损。公司手握47.441百万(RM)现金,总负债只有13.664百万(RM),是净现金公司(net cash),整体财务状况非常健康。

据CSIL (Centre for Industrial Studies)研究报告,软垫家具全球需求放眼稳健增长。 同时,业务受惠于美元强势,美元对马币每10sen的升值将提升HOMERIZ 2015财政年盈利6%。此外,产品原料成本降低让HOMERIZ享有更高的盈利率(profit margin),是提高公司盈利的另一个催化剂。

值得一提的是,Q2对HOMERIZ来说是传统季节性的淡季(圣诞节、新年、华人农历新年),但今年4月公布的Q2业绩是续2013财政年后表现最亮眼的季度盈利,表现逆势而上,这一点绝对是可圈可点。淡季都能获得如此抢眼表扬,那么这个月公布的Q3业绩盈利是否有望突破历史新高是值得期待的?

看看2014年报中的30大股东。原来大马著名投资者- 冷眼先生是HOMERIZ的第4大股东。而排在第12位的也是大马华人的另一位骄傲、鼎鼎大名的官有缘先生(Gamuda、IJM和Mudajaya的创办人之一)。

HOMERIZ即将执行每2股送1红股以及每4股送1张免费凭单计划。Ex-date于03/07/2015,Entitlement日期于07/07/2015。一旦该企业活动计划完成,HOMERIZ在市场的流动量将提升。

近期也提成收购Embrace工業剩余的35%股份,HOMERIZ目前已持有该公司65%股份,一旦收购完成,Embrace工業將成為HOMERIZ獨資子公司。Embrace于2014财政年对HOMERIZ贡献有8.79百万(RM),比起2013年提升了整整50%。难怪投行正面看待此收购,因这能把家丽资机构的净利提升17%。同时,也能让2014至2016财年的税后盈利和少数股东权益(PATAMI),取得21%的年均复增,比收购前的14%來得高。 届时,HongLeong Investment Bank Research给予Homeriz目标价:RM 1.82。

技术面

支撑:RM 1.40, RM 1.32

阻力:RM 1.51

今日出现看涨讯号,短期或有望挑战突破历史新高。

后语:HOMERIZ乃符合游击队个人所创的H&M选股法的股票之一。配合今日市场情绪暂时稳定,不排除在季报出炉前有望出现10-20%的拉升。

共勉之~

KLSE游击队

01.07.2015

01.07.2015

没有评论:

发表评论