跟官大師同船,省下许多分析,他有分析師定时跟进持有的股,

有充足资金逢股价低加码与支撑,之前许多人对公司诚信没把握,从官老爺入股笫二大股,

这对公司是信心加分,未來股息派发可增加,管理上将更加出色,今年股东大会也许会见到官先生

(如vs 一样),2015 年eps 个人估计达rm0.50,pe=12 ,股价=rm6.00 ,红股派发机会大.

Eps=rm0.50,只属保守算,rmo.55~0.60不会出奇,美元走高,销量增加,选 Liihen为良策 ,10 sen股息 拿先,

资本增值在后!将捎來佳积,丰衣足食.

供参考,进出自负.

官有缘(KOON YEM YIN)买进9.6%Lii Hen

共5761,400shares!

由于超过了5%,不久将会向市场公布!

到时股价很可能直追RM4时官有缘就买入的Latitude (Latitude现价六块三毛多)

A)

點看全文: http://biz.sinchew.com.my/node/115080?tid=8#ixzz3ZoOy9yjL

B)

Lii Hen Industries may continue to trend higher after extending its climb above the MYR4.20 level to mark a new high. Traders may buy as a bullish bias could be present above this level, with a target price of MYR4.69, followed by MYR4.97. The stock may pull back to take a breather if it falls back below the MYR4.20 mark. In this case, further support is anticipated at MYR3.83, where traders can exit upon a breach to avoid further correction.

有充足资金逢股价低加码与支撑,之前许多人对公司诚信没把握,从官老爺入股笫二大股,

这对公司是信心加分,未來股息派发可增加,管理上将更加出色,今年股东大会也许会见到官先生

(如vs 一样),2015 年eps 个人估计达rm0.50,pe=12 ,股价=rm6.00 ,红股派发机会大.

Eps=rm0.50,只属保守算,rmo.55~0.60不会出奇,美元走高,销量增加,选 Liihen为良策 ,10 sen股息 拿先,

资本增值在后!将捎來佳积,丰衣足食.

供参考,进出自负.

官有缘(KOON YEM YIN)买进9.6%Lii Hen

共5761,400shares!

由于超过了5%,不久将会向市场公布!

到时股价很可能直追RM4时官有缘就买入的Latitude (Latitude现价六块三毛多)

A)

利興工業管理和業績行嗎?

Author: Tan KW | Publish date: Mon, 11 May 2015, 03:16 PM

2015-05-10 19:21

彭亨讀者佩馨問:

利興工業(LIIHEN,7089,主板消費組)的公司管理和業績如何?公司是否有淨現金?以出口傢俱板塊,此股目前的價位值得投資嗎?目前市場給的合理價格大概是多少?

答:要看公司管理層如何,從該公司過去15年以來的業績表現與記錄,相信可窺視一二。從2000至2014年的15年裡,該公司每年都是有利可圖,從來沒有虧損過,即從最低的70萬6千令吉(2006年)至最高的2千820萬2千令吉(2014年),並且在12年中(除了2006/07/08三年)都有派發股息。相信這很大程度上,可顯示出公司管理層的能力。

至於該公司的最新業績,截至2014年12月31日為止第四季,該公司淨利增至830萬8千令吉(每股淨利為13.85仙),前期淨利為368萬令吉(每股淨利為6.13仙)。該公司季度營業額為1億零297萬8千令吉,比較前期為8千373萬9千令吉。

2014年全年淨利則為2千820萬2千令吉(每股淨利為47仙),前期淨利為1千776萬令吉(每股淨利為29.54仙);而全年營業額為3億9千792萬8千令吉,前期為3億1千587萬6千令吉。

該公司的每股資產值為3令吉17仙。

美元走高造就標青業績

該公司取得標青業績,主要是美國經濟復甦推動公司家具產品的出口量,及美元兌馬幣匯率走高,使它淨利在轉為令吉計時有增無減。

截至2014年12月31日為止,該公司的現金及等同現金額為5千742萬3千446令吉,而同期的借貸總額為2千907萬6千令吉。

截至2015年4月29日,該公司的收市價為3令吉83仙,若以2014年財政年每股淨利47仙為准,它的本益比為8.15倍。惟有必要留意,這是該公司有史以來最佳的業績,能否維持或持穩尚有待觀察,所以,它的8.15倍本益比雖具有吸引力,惟還要附帶於程度的折價為妙。是否值得投資,自行決定。

在過去至少6個月裡,沒有證券研究進行剖析及提供合理目標價。(星洲日報/投資致富‧投資問診‧文:李文龍)

點看全文: http://biz.sinchew.com.my/node/115080?tid=8#ixzz3ZoOy9yjL

B)

Lii Hen Industries may continue to trend higher after extending its climb above the MYR4.20 level to mark a new high. Traders may buy as a bullish bias could be present above this level, with a target price of MYR4.69, followed by MYR4.97. The stock may pull back to take a breather if it falls back below the MYR4.20 mark. In this case, further support is anticipated at MYR3.83, where traders can exit upon a breach to avoid further correction.

C)

Insider Asia’s Stock Of The Day: Lii Hen

Author: Tan KW | Publish date: Tue, 24 Mar 2015, 11:58 AM

INSIDER ASIA has featured quite a few wood-based furniture manufacturers over the past months. By and large, the industry has fared very well, thanks to a confluence of factors including the weakening of the ringgit that favours exporters. Having caught the upcycle early, we believe there is more upside to the sector, with the recovery in the US still in nascent stage.

Lii Hen (Fundamental score: 2.5/3, Valuation score 2.4/3), for instance, is still priced at attractive valuations. The stock is trading at 1.2 times book value and a single-digit PER of only 8.2 times.

The company is backed by solid underlying fundamentals — it is sitting on net cash, pays consistent and fairly generous dividends and delivers double-digit return on equity.

In its latest 2014 results, sales totaled RM397.9 million, up 25.9% y-y, driven by a 30% sales increase from the US — Lii Hen’s single largest market, which accounted for 80% of sales. Sales to its second largest market, Asia, grew 20.7% y-y while demand from the remaining markets remained steady.

Net profit was up an outsized 58.7% y-y to RM28.2 million last year, lifted in part by one-off insurance claims amounting to RM7.2 million, which more than offset asset write-offs.

The company also gained from the depreciation of the ringgit. Total foreign exchange gains more than doubled to RM5.3 million in 2014.

In January 2015, Lii Hen recognised a revaluation surplus totalling RM34.9 mil, boosting net assets per share by approximately RM0.58. Most of the revalued land and buildings are manufacturing plants located in Johor.

The company is sitting on net cash of RM36.1 million.

Lii Hen has consistently paid dividends, with payout ratio ranging from 30% to 50% of net profit.

Dividends totaled 14.5 sen per share in 2014, giving a higher than market average yield of 3.7% at the current price.

D)

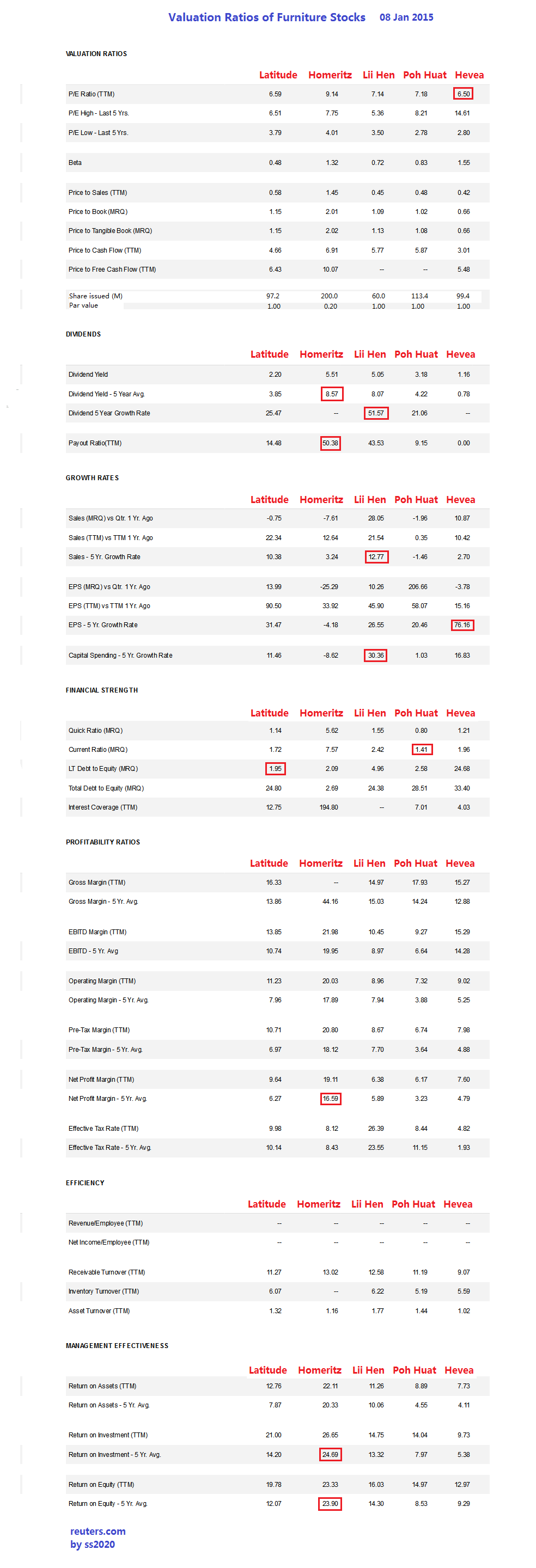

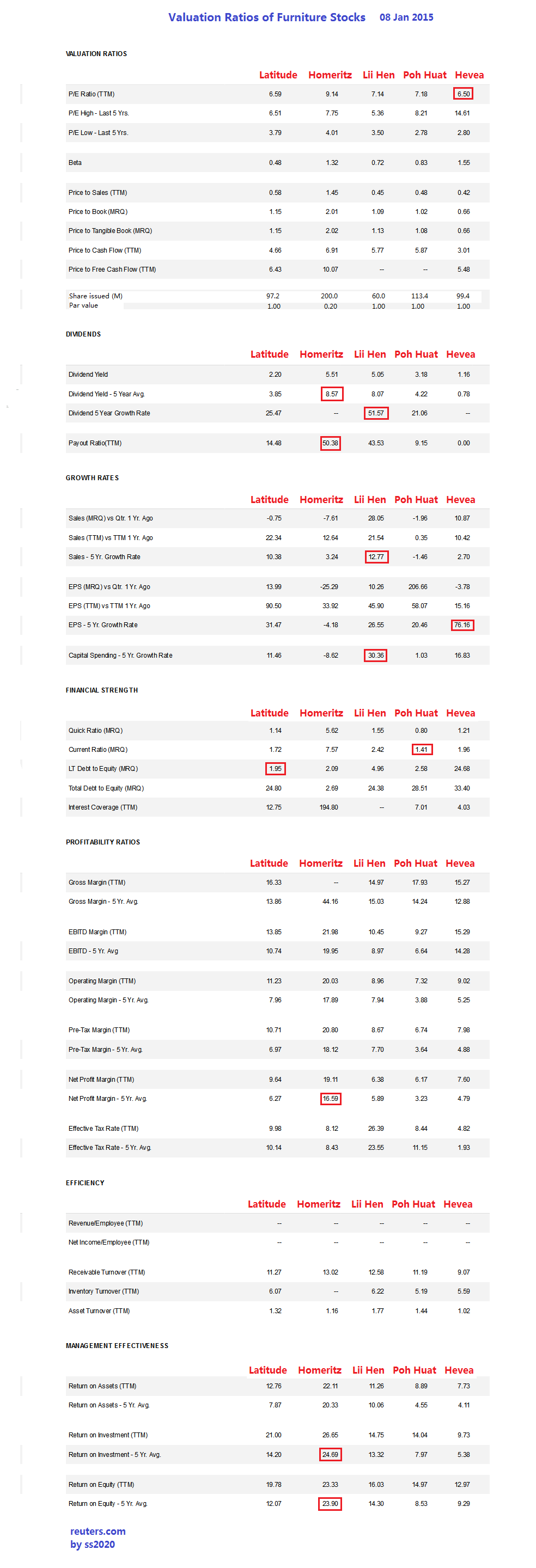

Valuation Ratios of Furniture Stocks

Author: ss20_20 | Publish date: Mon, 12 Jan 2015, 12:49 PM

Valuation Ratios of Selected Furniture Stocks:

请问这间公司是生产什么产品的?要去哪里找资料?谢谢

回复删除