转贴,谢谢网友功课。

浅谈Elsoft (0090)

转贴,谢谢网友功课。

Elsoft Research AGM

Elsoft Research Berhad carries out research, design, and the development of test and burn-in systems. These test systems are used by its customers to test their opto-electronic devices such as light-emitting diodes (LEDs), image sensors, and automotive lighting before the products are released into the market. The name of the company is derived from two words, namely electronics and software that symbolise its core competency in electronics design and software innovation. It also operates a butterfly farm through its 30.9%-owned associate, Butterfly House (PG) Sdn. Bhd. (Entopia), which was loss-making in 2018.

As I entered the meeting hall, I was a little surprised by the turnout for the AGM as it was held in the industrial area of Bayan Lepas on Penang Island. Approximately 70 shareholders and proxies turned up for the annual general meeting.

Here are seven things I learned from the 2019 Elsoft Research AGM:

1. Revenue increased 26.5% year-on-year to RM78.2 million and net profit increased by 54.7% year-on-year to RM34.8 million in 2018. Both revenue and net profit bottomed out in 2009 when Elsoft ventured into development of an LED total test solution during the global financial crisis before reaching historical highs in 2018. Meanwhile the improvement in financials in 2018 was due to higher demand from the smartphone segment where LED flash testers were released to cater for a major brand’s new smartphone product line. In 2018, the smart devices and automotive segments accounted for 59% and 27% of total revenue respectively. From 2005 to 2018, revenue has increased at a compound annual growth rate (CAGR) of 6.8% and net profit has increased at a CAGR of 6.3% over the same period.

2. A shareholder raised his concerns that a lighting solutions multinational company along with its suppliers collectively accounted for 75% of Elsoft’s 2018 revenue. CEO Tan Cheik Eaik shared that the customer is one of the top five LED manufacturers in the world. It is an LED conglomerate with a presence in the smartphone, automotive, and general lighting business segments. Tan added that Elsoft has fostered a value-added long-term relationship with the customer for more than 15 years. For instance, Elsoft helps the customer to be more competitive by upgrading its machine speed which differentiates itself from its competitors. However, Elsoft has also invested for more than five years and diversified into the medical devices industry to mitigate customer concentration risk. At the same time, Tan candidly told shareholders that there is a good prospect but not huge potential in the medical devices industry.

3. The same shareholder was interested to know more about the impact of the U.S.-China trade war on Elsoft. In Tan’s opinion, the trade war has turned into a war on business technology.Some of its customers have become more risk-averse and conservative on capital expenditure for existing products. However, some are still aggressively pushing for delivery of new products in 2019 and 2020. Amidst a tough business environment, Tan reckoned that it would not be wise to increase prices to compensate for the potential shortfall in revenue, even though it may see a reduction of about 20-40% in a worst-case scenario. Elsoft would continue to play a supportive role to help customers get through the tough times by launching new products at similar prices.

4. A shareholder noted that other investments surged by 49.9% year-on-year to RM62.3 million in 2018.Tan explained that the company regularly invests its additional cash in unit trusts and bond funds to generate better yields. He added that unit trusts with greater exposure to stocks were affected by a mediocre stock market performance in 2018, but the dividend received from unit trusts and bond funds remained consistent. Elsoft also owns a 0.3% stake (equivalent to about 1.7 million shares) in Aemulus Holdings Berhad, a listed entity that manufactures automated test equipment. Elsoft has been gradually reducing its stake in Aemulus from 3.1 million shares since 2015 and recovered the cost of its initial investment according to Tan.

5. The same shareholder enquired about the increase of RM2.4 million in inventories to RM5.8 million in 2018.Tan answered that the build-up was mainly due to orders of medical devices. The orders were processed initially but had not been delivered as of 1Q 2019. Some other machine orders were piled up too.

6. Tan said that Elsoft will continue to spend about RM8 million on research and development (R&D) annually. The company will not save money on R&D as new products invented would generate revenue in years to come. R&D spending is relatively fixed and accounts for about 15% of Elsoft’s revenue during bad times and about 10% during good times.

7. A subsidiary has been granted pioneer status and its income will be tax exempted between 2015 and 2020. The tax incentive can be extended for another five years. Tax-exempt income under the pioneer status amounted to RM10.0 million in 2018 that translated to 24.9% of 2018 profit before tax.

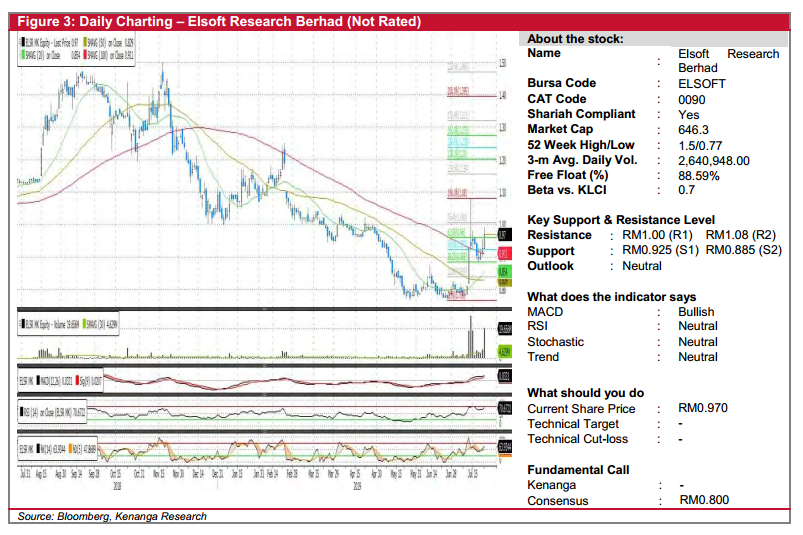

Daily Technical Highlights – (ELSOFT, CARIMIN)

Author: kiasutrader Publish date: Wed, 24 Jul 2019, 9:59 AM

ELSOFT (Not Rated)

- Yesterday, ELSOFT gained 4.5 sen (+4.86%) to close at RM0.970.

- Chart-wise, yesterday, the stock has formed a long bullish candlestick and remains above its key 100-day SMA.

- Its 20- and 50-day SMAs have also formed a “Golden Cross” formation which leads us to believe that the share could test its previous swing high of RM1.08.

- Key levels of resistance to look out for are RM1.00 (R1) and RM1.08 (R2). Meanwhile, support levels can be found at RM0.925 (S1) and RM0.885 (S2).

- 转贴:

[12Invest] 壹贰讲股- 2019七月 - 浅谈Elsoft (0900)

Author: 12investpublic Publish date: Mon, 15 Jul 2019, 1:33 PM

浅谈Elsoft (0900)

这家公司跟Pentamaster,ViTrox 共同加入 Forbes’s Asia’s 200 Best Under a

Billion list 之后,股价从RM 0.80 左右一度冲上RM 1.08 ,两天内直接涨了一个30%

左右,先恭喜之前买到的朋友咯!

我有点太早放了,但是我没后悔,毕竟是遵从自己的投资规则的!

那么如果你是在当天RM 1.00 以上被套,下个星期可以解套吗?还是,这家公司可以

长期持有吗?

对于第一个问题,我个人是回答不到你,除非你去问神 ,但是第二个问题,我就可以

跟你分享我的个人看法,我也不介意先给你答案:我本身完全不介意持有5 – 10年,

你想知道为什么的话,就读下去吧!

在我们分析一家公司是否值得买入的时候,第一个必须考虑的事情就是公司最主要的生

意到底是做什么的,到底是朝阳工业,还是夕阳工业?

上次我们去i-sTone 探访时,他们老板跟我们分享了Industry 4.0 的一些最基本的观

念,我就用四样东西解释给你听吧。

他们就是:

- Automation(自动化)

- Robotic(机械化)

- Cloud(云端)以及

- Big data(大数据)

所谓的automation,就是把工业生产过程自动化。相信不少读者有看过很多工作已经

被机器人代替了吧

这已经是一种无法抵挡的趋势了,首先自动化会为公司减少长期性的成本,减少出错,

以及增加效率。

一个人 跟一架机器 , 哪一个可以一个星期七天不断,工作20小时以上呢?答案是显

而易见的。

工业4.0 ,已经是抵挡不住的趋势了。

那么回来今天的主题,为什么Elsoft 会提到automation 这样东西呢?原因很简单,他

们最主要的生意就是做Automated Test Equipment(ATE)的,最layman 的说话

就是把inspection 货 QC自动化,最大化的增加效率。

Elsoft 服务的客户群包括automotive(汽车行业),smart devices(智能设备),

以及general lighting(比如说LED)。

那么他们公司会做的就是提供自动测试化的机器给这些客户。试想一下,光是一个

automative的车头灯,就有不少东西需要被测试了,人为来test 的话需要用多久的时

间来完成一大批货?

残忍一点来讲,制造业现在在很努力的淘汰基本劳工,设法把生产线自动化。

对于员工来说不是一件好事,但是对于股东来说,难道你不想自己的公司减少成本 增

加效率吗?

有点离题了,不过我想带出的重点是 – Automation 这个趋势已经无法被抵挡了,而

Elsoft 本身的生意最专注就是这个,你觉得未来他们几年表现会差吗?

以他们从2009 年到2018年的成绩来说,平均一年的业绩成长33.28%,Net Profit成

长42.36%,如果你注意到的话他们的净利率正在成长中,我就算砍一半的成长率,

21% 的年增长率,这样的公司会差吗?(可以看看下面的图)

这个是很个人的,但是我觉得这公司真的是值得长期拥有的。但是在我们之前live 的时

候,已经提醒过大家Q1,Q2业绩会下滑(但是比我想象中严重啦),也说过了股价会

跌,但是这个Forbes’s Asia’s 200 Best Under a Billion list 真的是杀了我一个措手

不及,害我要提早卖了。

不过,回到一开始的问题,如果你真的被套,现在股价又卡在RM 0.935,加上下一个

QR 又不会美,肯定是会有cut loss 的想法。

但是如果是我的话,我会放着拿股息(不要忘记他们的dividend yield 现在是5% 左

右,比FD 更好),然后等下个QR 出炉再average down。

美国股市昨晚又破新高,如果星期一你可以解套的话固然是好,但是不能的话,可以等

等八月(Q2成绩出炉)再看看有没有机会买入吧!

当然,中间如果trade war 再出现,他们业绩肯定会受到打击!要注意这个风险咯!

———— Check us out ————

———— Check us out ———— WEBSITE • @12ingroup

WEBSITE • @12ingroup

公司于31/3/2019的现金为448万,无任何债务,现价(RM0.99)进其周息率为6.5%,ROE为31%,赚副为51%。

决定永远是你自己,買卖自负。

决定永远是你自己,買卖自负。

达成的,大约有86%,之前提到的中国

达成的,大约有86%,之前提到的中国 则占13%,剩下的1% 公司没有说是哪里的。

则占13%,剩下的1% 公司没有说是哪里的。

没有评论:

发表评论