-成長中的业务,基本面好,

Profit margin%:6.5

Roe:4.4

NtA:Rm0.25

Net cash:2124万

Tp:Rm 0.40

😂買在股价未爆冲前,成交量未增加时。

💪🌈0100 Esceram技术点评:Macd 己拉开,双牛🐂🐂走势,这仑武汉疫情拉升手套须求,短期破52周的Rm0.265后,目標价40仙

阻力,32,35,40仙

💪🌈esceram 0100 二个季度己赚1仙,全年估计净利2仙,pe=25倍,股价=50仙,只供参考。

转贴:

LIMIT UP! most upside potential stock. A Look back at SARS

Author: share4u2019 Publish date: Tue, 28 Jan 2020, 12:33 AM

Hi to all investors and traders!

Today I would like to share my thoughts to the following counter:

ES CERAMICS TECHNOLOGY BHD or ESCERAM (Code 0100, ACE Market, Industrial Products & Services)

1. ABOUT ESCERAM

Their website can be referred at http://www.esceramics.com.my/

Some Description of the products:

The usage of the ceramic hand formers sets it apart from the conventional ceramic products. Ceramic hand formers are for continuous industrial use under heavy-duty conditions, to withstand the complex processes involving heat and chemicals to produce gloves, the formers need to have a high degree of resistance to industrial chemicals, exceptional mechanical strength, high thermal shock resistance & a very narrow range of dimensional fluctuations. Therefore, a substantial amount of raw materials in use to produce the ceramic formers are also raw materials for advance ceramics. All these requirements differentiate the ceramic hand formers from other ceramic products. That it is being applied under very complex processes to produce the end products that are important to produce various types of gloves like medical glove, surgical glove, industrial glove and, house hold glove.

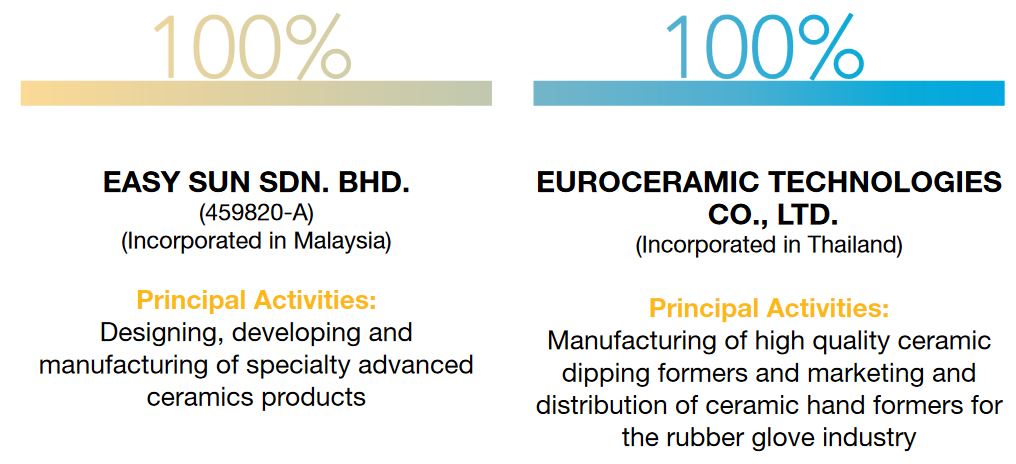

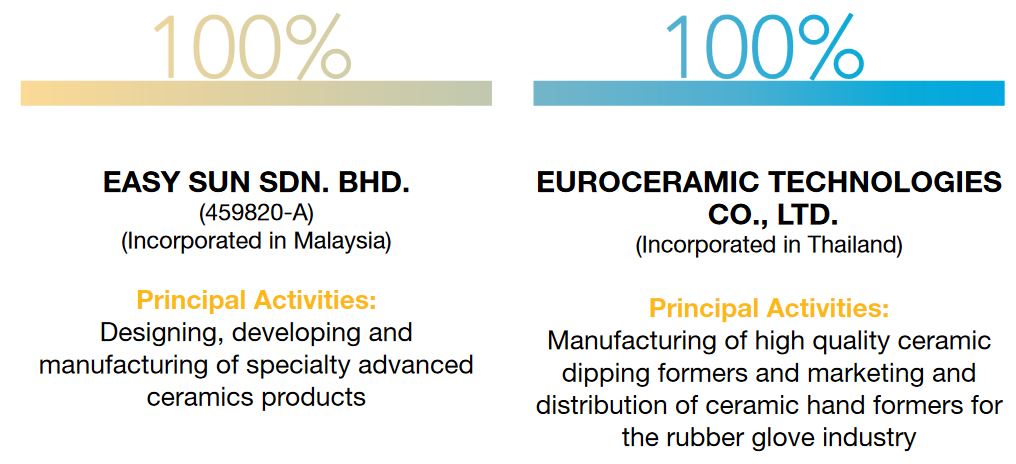

subsidiary:

2. Why Esceram?

By looking at VIS(0120) which keep breaking high, I actually would like to find a stock which is support by fundamental and technical like VIS, it is better if it also fulfill the market sentiment pick, here is the requirement:

3. Result and technical charting

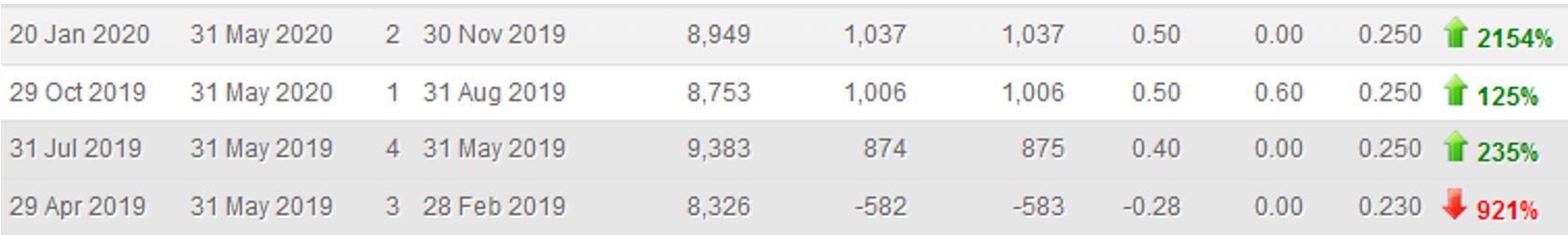

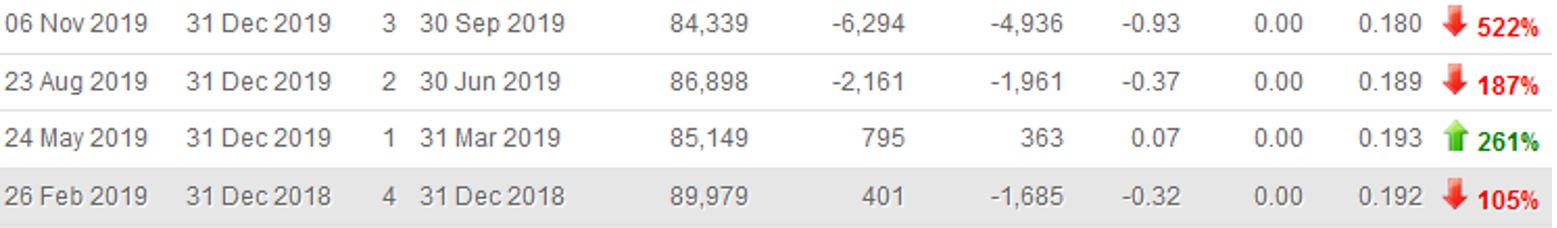

First we look at the result of ESCERAM, the recent 3 QR it made improvement and show the signal of come back, the stock price should start to rise to response to these result.

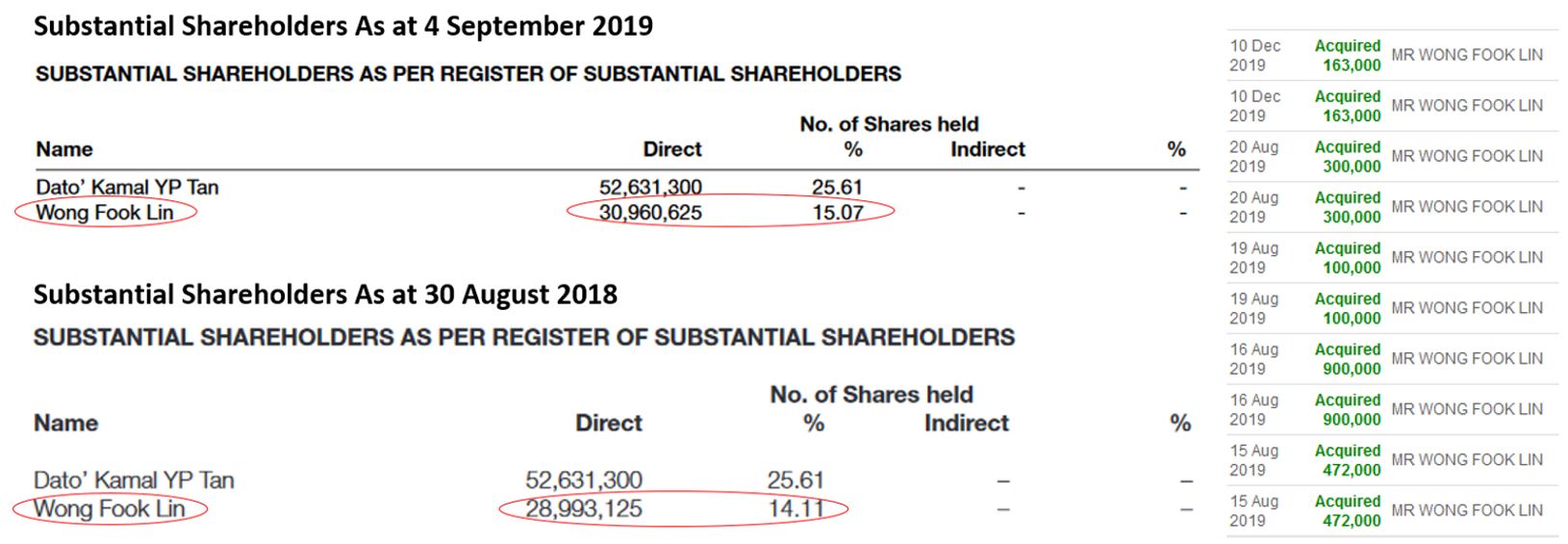

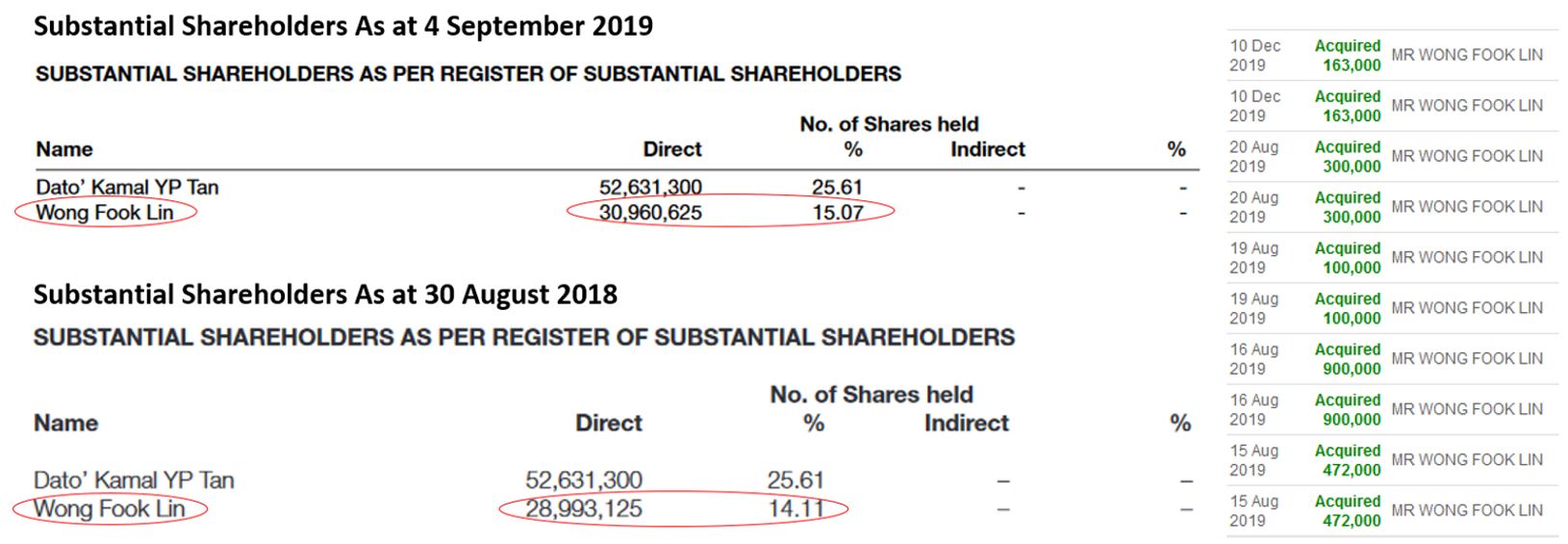

Also, one of the major Shareholder actually keep buying the share over a year, see the difference from Annual report 2018 and 2019, if the future is bad, why the Shareholder increase the shares?

Now we look at the chart, the share price fall from 0.6 to 0.15 for the past few years, and now starting to rise to 0.26, this form a CUP with U shape turning uptrend, once breakout 0.3 it will fly very high. With result and technical support, the price now still consider very cheap and undervalue, it should trade at higher price.

4. Sentiment Analysis and the History of SARS

The WUHAN Coronavirus is the recent hot news, it is very similar to the incident of SARS happened during 2013, this WUHAN coronavirus has the average 10 days incubation period, because of this incubation period, the outbreak is just the beginning, you can refer to the data below retrieved from the website of National Health Commission of the People's Republic of China, the data show that the number of new patients added actually rapidly increase, the worst is yet to come, and will be getting more serious in the coming months.

Data from: National Health Commission of the People's Republic of China. http://en.nhc.gov.cn/

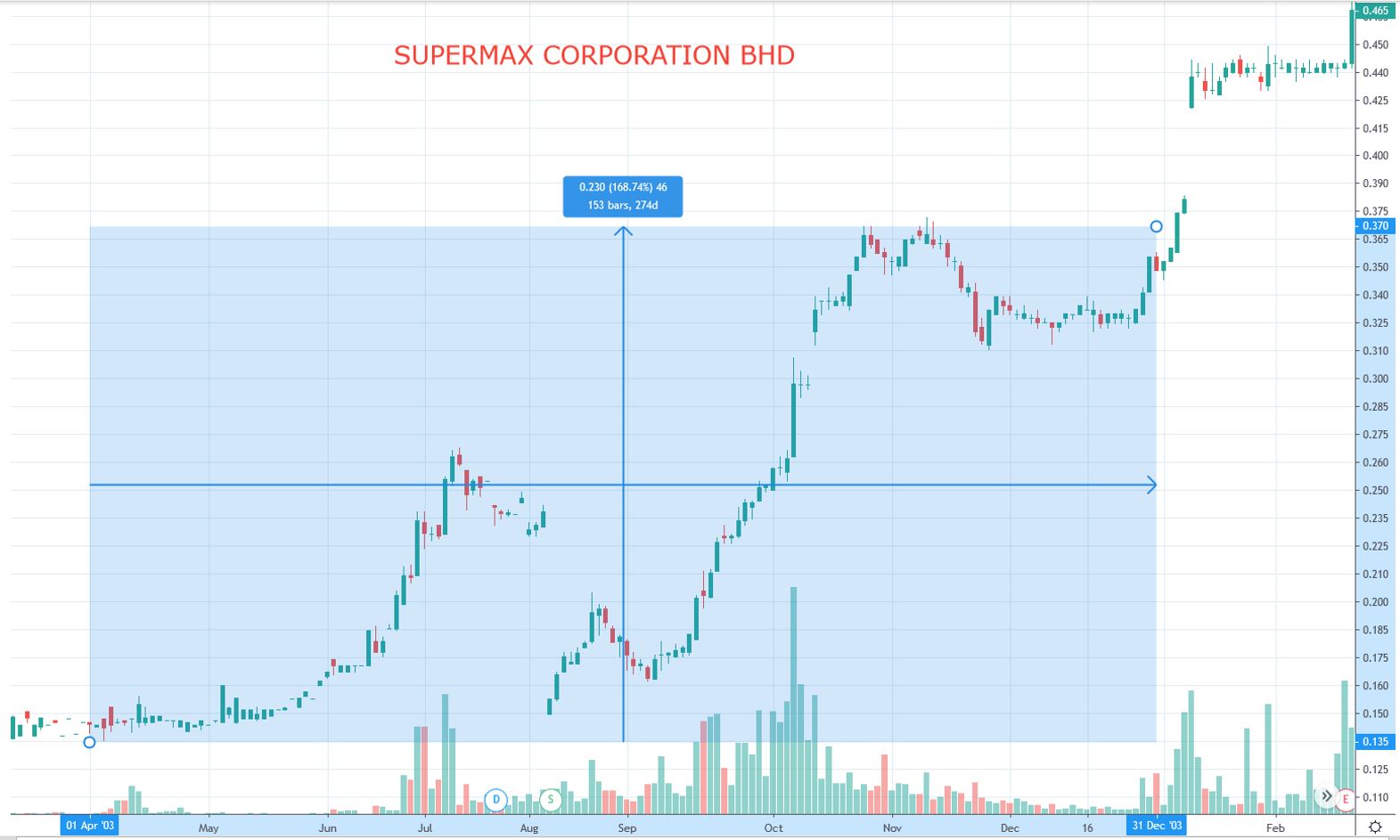

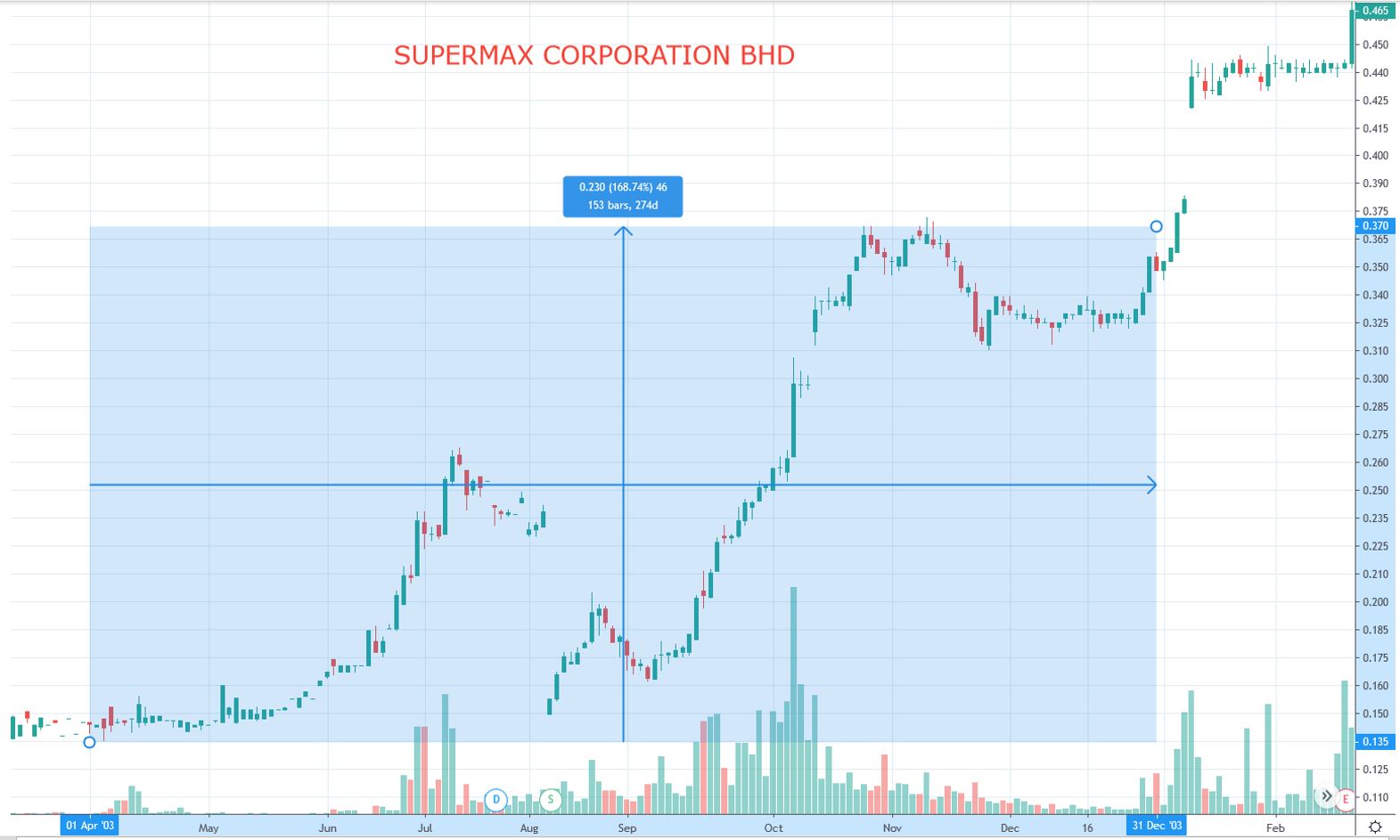

So how the glove stocks performing during the SARS incident happened at April 2003? We will study the BIG 3 glove stocks in the market, TOPGLOV(7113), KOSSAN(7153), and SUPERMX(7106). The HARTA(5168) still not listing during the 2003, so we exclude it. I will give you the summary, you can also refer to the charts below:

During April 2003 – Dec 2003

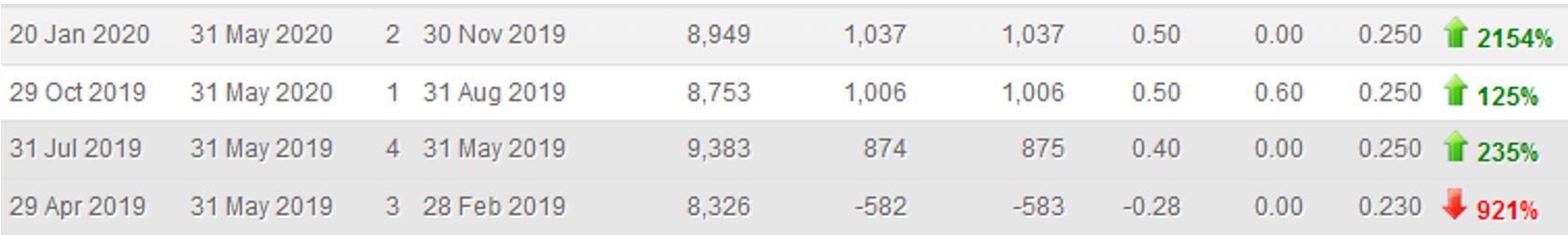

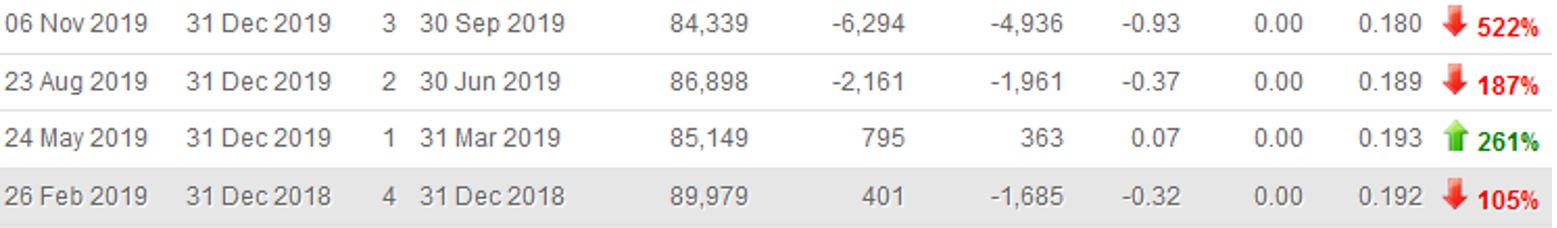

Thus, for this WUHAN Coronavirus, it is also possible for small cap glove stock to take advantage to expand the business, before and during the 2003, the KOSSAN, SUPERMX and TOPGLOV all have some result supported, you can refer the QR below which retrieve from KLSE screener, it is clear that the result show improvement of the business.

CAREPLS(0163) and ESCERAM(0100) are 2 ACE market counters related to glove, both are small cap stocks, I strongly confident ESCERAM will be the pick because it just deliver good result last week, and CAREPLS has no result deliver, you can see below how bad the CAREPLS result is, it is difficult to move far and sustain, not to mention next month (FEB) is the result month for CAREPLS.

5. CONCLUSION

For all the reasons above, I believe ESCERAM will be the best pick for the future, the QR improving, technical uptrend, and if you look at how SARS bring up the BIG 3 of glove stocks, TOPGLOV(Rm0.07 to 5.54), KOSSAN(Rm0.07 to 4.75), SUPERMX(Rm0.135 to 1.61), sadly ESCERAM listed on 2005 which is after the SARS incident and can not enjoy the share price rise that time, so the current time it is the big opportunity for ESCERAM and also for all the investors, TP1 is RM 0.5, TP2 RM1 above.

谢谢网友功课,感恩。

Today I would like to share my thoughts to the following counter:

ES CERAMICS TECHNOLOGY BHD or ESCERAM (Code 0100, ACE Market, Industrial Products & Services)

1. ABOUT ESCERAM

Their website can be referred at http://www.esceramics.com.my/

Some Description of the products:

The usage of the ceramic hand formers sets it apart from the conventional ceramic products. Ceramic hand formers are for continuous industrial use under heavy-duty conditions, to withstand the complex processes involving heat and chemicals to produce gloves, the formers need to have a high degree of resistance to industrial chemicals, exceptional mechanical strength, high thermal shock resistance & a very narrow range of dimensional fluctuations. Therefore, a substantial amount of raw materials in use to produce the ceramic formers are also raw materials for advance ceramics. All these requirements differentiate the ceramic hand formers from other ceramic products. That it is being applied under very complex processes to produce the end products that are important to produce various types of gloves like medical glove, surgical glove, industrial glove and, house hold glove.

subsidiary:

2. Why Esceram?

By looking at VIS(0120) which keep breaking high, I actually would like to find a stock which is support by fundamental and technical like VIS, it is better if it also fulfill the market sentiment pick, here is the requirement:

- Consecutive QR improvement (a come back), have dividend, potential heading to a price breakout, with an uptrend.

- Technical Rebound, a Cup with U shape turning up and breakout.

- Right Sentiment, the recent hot topic is about the WUHAN Coronavirus, it is good if the business can get advantage from it.

3. Result and technical charting

First we look at the result of ESCERAM, the recent 3 QR it made improvement and show the signal of come back, the stock price should start to rise to response to these result.

Also, one of the major Shareholder actually keep buying the share over a year, see the difference from Annual report 2018 and 2019, if the future is bad, why the Shareholder increase the shares?

Now we look at the chart, the share price fall from 0.6 to 0.15 for the past few years, and now starting to rise to 0.26, this form a CUP with U shape turning uptrend, once breakout 0.3 it will fly very high. With result and technical support, the price now still consider very cheap and undervalue, it should trade at higher price.

4. Sentiment Analysis and the History of SARS

The WUHAN Coronavirus is the recent hot news, it is very similar to the incident of SARS happened during 2013, this WUHAN coronavirus has the average 10 days incubation period, because of this incubation period, the outbreak is just the beginning, you can refer to the data below retrieved from the website of National Health Commission of the People's Republic of China, the data show that the number of new patients added actually rapidly increase, the worst is yet to come, and will be getting more serious in the coming months.

| DATE | Total Confirmed cases | Total Critical Patients | Total Death | new added death | new added cases |

| 26/1/2020 | 2744 | 461 | 80 | 24 | 769 |

| 25/1/2020 | 1975 | 324 | 56 | 15 | 688 |

| 24/1/2020 | 1287 | 237 | 41 | 16 | 444 |

| 23/1/2020 | 830 | 177 | 25 | 8 | 259 |

| 22/1/2020 | 571 | 95 | 17 | 8 | 131 |

| 21/1/2020 | 440 | 102 | 9 | 3 | 149 |

So how the glove stocks performing during the SARS incident happened at April 2003? We will study the BIG 3 glove stocks in the market, TOPGLOV(7113), KOSSAN(7153), and SUPERMX(7106). The HARTA(5168) still not listing during the 2003, so we exclude it. I will give you the summary, you can also refer to the charts below:

During April 2003 – Dec 2003

- TOPGLOV – From 0.07 up to highest 0.215, 200% gained!

- KOSSAN – From 0.07 up to highest 0.145, 111% gained!

- SUPERMX – From 0.135 up to highest 0.370, 168% gained! (share split)

- TOPGLOV – Closing RM 5.54

- KOSSAN – Closing RM 4.75

- SUPERMX – Closing RM 1.61

Thus, for this WUHAN Coronavirus, it is also possible for small cap glove stock to take advantage to expand the business, before and during the 2003, the KOSSAN, SUPERMX and TOPGLOV all have some result supported, you can refer the QR below which retrieve from KLSE screener, it is clear that the result show improvement of the business.

CAREPLS(0163) and ESCERAM(0100) are 2 ACE market counters related to glove, both are small cap stocks, I strongly confident ESCERAM will be the pick because it just deliver good result last week, and CAREPLS has no result deliver, you can see below how bad the CAREPLS result is, it is difficult to move far and sustain, not to mention next month (FEB) is the result month for CAREPLS.

5. CONCLUSION

For all the reasons above, I believe ESCERAM will be the best pick for the future, the QR improving, technical uptrend, and if you look at how SARS bring up the BIG 3 of glove stocks, TOPGLOV(Rm0.07 to 5.54), KOSSAN(Rm0.07 to 4.75), SUPERMX(Rm0.135 to 1.61), sadly ESCERAM listed on 2005 which is after the SARS incident and can not enjoy the share price rise that time, so the current time it is the big opportunity for ESCERAM and also for all the investors, TP1 is RM 0.5, TP2 RM1 above.

谢谢网友功课,感恩。

Thanks for sharing this information and i m sell all type medicine in China buy now

回复删除Ritalin Pharmacy

买 NZT 48 药 在线

什么是新西兰电信?

NZT是thallanylzirconio-甲基-四氢-三氢三氧激酰胺,一种强大的新型精神药物类,融合了NDRI、NaSSA和SSRI的各种功能。 NZT 的工作原理是,通过阻断前突起 α-2 肾上腺素受体,同时阻断某些血清素受体,在突触中保持较高的 5-HT 水平,同时增加去甲肾上腺素和血清素神经传播。

NZT 如何工作?

NZT 是一种基于氮的精神药物,从多方面影响特定的大脑活动,但最重要的是通过提高海马、杏仁和纹状体之间的接收性和突触共享。 在控制剂量,在相对较短的时间过程中,NZT显著改善短期和长期记忆,记忆能力和分析性记忆。 因为它也影响同情和寄生神经系统,NZT可以改善更高的大脑功能,手眼协调,肌肉记忆,甚至身体的免疫系统。 在一些人中,NZT甚至可以诱导清醒梦,有时被称为”模糊状态”。

NZT 是否有效?

当按指示服用(连续七天每天服用一粒药)时,NZT 已被证明在改善记忆、手眼协调和大量认知能力方面有效 97.3%。 在NZT无效的情况下,受试者没有完成完整的治疗方案。 NZT在18至45磅的男性和女性中学习,体重为95至270磅。

谁可以服用NZT?

被认为身体健康的男性和女性——没有已知的心脏病、心肌病、脑缺血或颅内出血、肾脏或肝脏问题、躁狂或癫痫发作史的男性和女性,一般都是NZT的好人选。

NZT 需要哪些存储条件?

把你的NZT放在它进来的容器里,紧紧闭着,远离儿童。 储存在室温下,远离多余的热量和水分。 扔掉任何过期或不再需要的药物。 与您的药剂师讨论正确处置您的药物。

当我服用 NZT 时,我该期待什么?

许多人报告说,在服用NZT后30到60秒内,他们感到兴奋。 另一些人则报告说,在第一次服用NZT后24小时内,记忆(在容量和召回速度上都显著增加了)。 您将能够在很短的时间内消化大量信息,例如外语;你不仅能够记住大量的词汇,而且能记住使用规则、习语、短语、句子和情境表达。

因为NZT是一类新的大脑兴奋剂,它将减少大脑对延长休息时间的需求;即睡眠。

此外,NZT 还允许您长时间锻炼,效果更高。 你会感觉更强大,更快,更专注。

大多数继续服用NZT超过他们最初的七天疗养报告其他心理和感官增强,包括改善听力,视力,味觉和气味。 另一些人则报告说,教自己如何绘画或绘画,建造复杂的机械或体验更高的意识水平。

Great Contetnt sir and i m sell all type medicine in China online buy now

回复删除Ritalinbuy BUY 买 Ambien 在线 ONLINE 买 NZT 药

买 NZT 48 药 在线

什么是新西兰电信?

NZT是thallanylzirconio-甲基-四氢-三氢三氧激酰胺,一种强大的新型精神药物类,融合了NDRI、NaSSA和SSRI的各种功能。 NZT 的工作原理是,通过阻断前突起 α-2 肾上腺素受体,同时阻断某些血清素受体,在突触中保持较高的 5-HT 水平,同时增加去甲肾上腺素和血清素神经传播。

NZT 如何工作?

NZT 是一种基于氮的精神药物,从多方面影响特定的大脑活动,但最重要的是通过提高海马、杏仁和纹状体之间的接收性和突触共享。 在控制剂量,在相对较短的时间过程中,NZT显著改善短期和长期记忆,记忆能力和分析性记忆。 因为它也影响同情和寄生神经系统,NZT可以改善更高的大脑功能,手眼协调,肌肉记忆,甚至身体的免疫系统。 在一些人中,NZT甚至可以诱导清醒梦,有时被称为”模糊状态”。

NZT 是否有效?

当按指示服用(连续七天每天服用一粒药)时,NZT 已被证明在改善记忆、手眼协调和大量认知能力方面有效 97.3%。 在NZT无效的情况下,受试者没有完成完整的治疗方案。 NZT在18至45磅的男性和女性中学习,体重为95至270磅。

谁可以服用NZT?

被认为身体健康的男性和女性——没有已知的心脏病、心肌病、脑缺血或颅内出血、肾脏或肝脏问题、躁狂或癫痫发作史的男性和女性,一般都是NZT的好人选。

NZT 需要哪些存储条件?

把你的NZT放在它进来的容器里,紧紧闭着,远离儿童。 储存在室温下,远离多余的热量和水分。 扔掉任何过期或不再需要的药物。 与您的药剂师讨论正确处置您的药物。

当我服用 NZT 时,我该期待什么?

许多人报告说,在服用NZT后30到60秒内,他们感到兴奋。 另一些人则报告说,在第一次服用NZT后24小时内,记忆(在容量和召回速度上都显著增加了)。 您将能够在很短的时间内消化大量信息,例如外语;你不仅能够记住大量的词汇,而且能记住使用规则、习语、短语、句子和情境表达。

因为NZT是一类新的大脑兴奋剂,它将减少大脑对延长休息时间的需求;即睡眠。

此外,NZT 还允许您长时间锻炼,效果更高。 你会感觉更强大,更快,更专注。

大多数继续服用NZT超过他们最初的七天疗养报告其他心理和感官增强,包括改善听力,视力,味觉和气味。 另一些人则报告说,教自己如何绘画或绘画,建造复杂的机械或体验更高的意识水平。