Current Price : RM16.38

Target Price : [ TP5: RM25 - TP6 RM30 ]

Last target : RM35 (Mac-2021 - Last target depend on COVID-19 situation)

* All target prices has been revised from 6.05 - 6.10 Buycall.(

Old Target )

* My previous blogs :

STOCK 2 : HARTALEGA HOLDINGS BERHAD

Current Price : RM12.20

Target Price : [ TP5: RM18 - TP6 RM23 ]

Last target : RM30 (Mac-2021 - Last target depend on COVID-19 situation)

* All target prices has been revised from 6.38 - 6.40 Buycall.(

Old Target )

* My previous blogs :

STOCK 3 : KOSSAN RUBBER INDUSTRIES BERHAD

Current Price : RM8.98

Target Price : [ TP5: RM12 - TP6 RM18 ]

Last target : RM25 (Mac-2021 - Last target depend on COVID-19 situation)

* All target prices has been revised from 5.05 - 5.10 Buycall.( Old Target )

* My previous blogs :

STOCK 4 : SUPERMAX CORPORATION BERHAD

Current Price : RM8.88

Target Price : [ TP5: RM12 - TP6 RM15 ]

Last target : RM23 (Mac-2021 - Last target depend on COVID-19 situation)

* All target prices has been revised from 1.50 - 1.60 Buycall.( Old Target )

* My previous blogs :

Additional my selected Small Gloves as follow :

STOCK : HLT GLOBAL BERHAD

Current Price : 0.88 cents

Target Price : TP1: RM1.20 - TP2 RM1.50

Last target : RM2 (Mac-2021 - Last target depend on COVID-19 situation)

*This stock need to wait next quater result release then I will comeback to write/ideas.

* Short-term play not same as my Big-4 gloves. Take note and trade with cautiously.

WHAT KIM SAID ABOUT GLOVES SECTOR NOW?

BULLISH & UPTRENDING

1. "TOMORROW FLY TO RECORD A NEW HIGH AGAIN"

1. - (Covid-19) 7,000,000 mil hits global cases. Heading to 10M.

2. - (Covid-19) 2,000,000 mil hits Uncle Sam cases. Heading to double.

3. - KLCI flying with 40 intensive worth 35B.

4. - CMCO extended to 30 August by Govt.

5. - Top Glove done (ESOS) big amount. Refreshing and will lead all gloves movement.

6. - IB's will revise their new target after they done 2 days tricky. Accumulated lowest.

7. - I say time to aggressive fly. You wont get cheap prices on Gloves sector this June. Playing high target on gloves this week also awaiting excellent and superb Top Gloves result on Thursday.

2. "GRAB THIS OPPORTUNITY IN JUNE. NO CHEAP PRICES ON JULY"

1. - Expect Covid-19 heading to 10,000,000 within another 3 months

2. - Expect Covid-19 heading to 5,000,000 within another 3 months

3. - Most Gloves cw's not expiring on June. So my predicting is another flying call warrants in the making

4. - Business allowed to operate full capacity soon. Its mean Government had allowed rubber glove industry to run at full capacity and service providers as well as raw materials and packaging suppliers in the rubber glove industry can continue operating. So the production can fullfill all ordered and demand received. Its good move because Malaysia is expected to produce 220 billion pieces of rubber gloves this year.

3. "MARGIN LIMITING/CAPPING BY IB'S"

1. - Good ideas from IB's by capping the margin account.

I am forsee start from June all gloves movements will going stablize and continue to be next rally. Dont worries about "Correction" because correction always did when you are panics selling with no reason such like "margin capping issue". So on 1st and 2nd June, from my view, I just base on 2 big gloves. Top Glove and Harta. By looking at trend sell & buy. Both are defending at certain level, where i can see both are creating new supports and can't go lower. With Harta last minute big push gapped -12 bids. So i assume next day new support will be created again. So Harta will standback at @13.0 and Top Glove @15.0. However impossible the force sell to stop immediately but it still. So 70% of my view, I am forsees nextday will have a balancing before the force sell to stop.

2. - Investment banks (IB'S) could have done this for two reasons :-

Firstly, they feared glove overvalued. By then trying to avoid losses later by margin calls

Secondly, they are losing too much money in issuing too many glove call warrants. As call glove stocks continue going up while they are suffering tremendous losses from call warrants.

So, from my view and my side they are playing something now, but I am not saying they are cheating but 'smarting". Since Malaysia is a free market they should let free trading decide by limiting margin only showing banks are now weak and vulnerable."Maybe".

3. - What a Margin Capping's this? Just an example. Lets see 2 Ib's for study :

A. MayBank Investment Bank Bhd (Top Glove)

Target Price : RM20.00

Margin account Capping at RM9.41

B. RHB Investment Bank Bhd (Supermax)

Target Price : RM10.50

Margin a/c Capping at 35% or RM5.00

So, I belief they issued too many European structure call warrant especially Supermax and Top Glove call warrant and never expect also imagine Supermax and Top Glove. Both gap up and flew sky high in a very short time and caught them off guard. So they take immediate action with tis new rules.

4. So, for Me as I said :-

1. "Yes, It's Hot; But No, Your Gas Tank Won't Explode If You Fill It Up"

2. "When you put the tight CAP in hot bottles. The explode will come"

3. "Spectacular example, simply put some dry ice in an empty soda bottle, screw the cap on tightly, and stand back. As the dry ice sublimates, the bottle will fill (and then overfill) with CO2 gas. When a critical pressure is reached, the soda bottle will give out, and the makeshift pressure bomb will detonate"

4."Boom for Gloves in the making waves 3"

WHAT A KEY POTENTIAL FOR DOWNSIDE RISKS? AND WHEN YOU SHOULD WORRIES YOUR HOLDINGS?

1. Trading at a historic high PER of more than 40x for the industry

2. Implementation of wind fall tax by the government

3. A successful development of vaccine and must official announcement by WHO

4. A sharp decline in global daily covid-19 cases

THIS JUNE - I WOULD LIKE TO RECALL ABOUT HARTALEGA

Hartalega Holdings Berhad (HARTA) is an established Malaysia-based investment holding company founded by Kuan Kam Hon and is headquartered in Kuala Lumpur. HARTA is primarily involved in the business of producing latex and nitrile gloves. It has grown to be the world’s largest nitrile glove producer with the capability of manufacturing 34 billion gloves per year and with plans to progressively expand to 44.7 billion gloves in 2020.

HARTA was listed on Bursa Malaysia’s Main Market on 17 April 2008. The group has continued the technological innovations that help to ensure their gloves are manufactured with equal emphasis on efficiency and quality, a key reason why they are trusted as the Original Equipment Manufacturer (OEM) for some of the world’s biggest brands.

The company has a workforce of 7,800 people based in 8 dedicated manufacturing facilities. It has won many prestigious accolades in both local and international front. The latest was in 2019 for Gold in Export Excellence, Exporter of The Year and The Edge Billion Ringgit Club Corporate Awards. It has also received recognition from Forbes Asia, KPMG and Asia Money.

HARTA provides a comprehensive range of products known for its superior quality and critical protection. Examples include nitrile gloves, latex gloves, surgical gloves and laboratory gloves.

As the most automated glove production company, its automated process not only improves efficiency but also eliminates product contamination resulting from human contact. HARTA produces soft stretchy nitrile gloves that emulate the properties of natural rubber latex. The nitrile gloves also eliminate the chances of protein allergy risks that are usually associated with rubber latex.

All gloves produced by HARTA are purchased by healthcare practitioners, food processing workers, lab workers and other professionals. Presently, HARTA’s export markets span across North America, Europe, Asia Pacific, Africa, Russia and Middle East.

World Live StatsTotal Cases7.146.770Total Deaths407.412Total Recovered3.486.497

FINANCIAL REVIEW

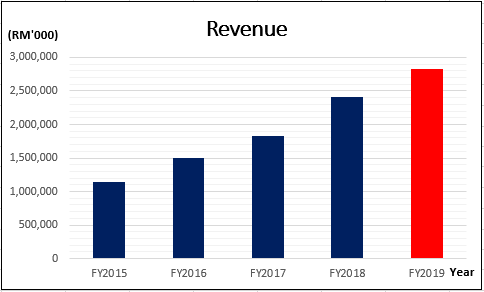

Based on past 5 financial years’ revenue chart above, its revenue grew year-on-year (y-o-y) from FY2015 (+3.51%), FY2016 (+30.75%), FY2017 (+21.59%), FY2018 (+32.04%) to FY2019 (+17.52%). On a CAGR basis, HARTA has grown 20.62% based on 5 years. The group’s strong revenue was achieved on the back of improved sales volume which grew by 10.1% year-on-year to 28 billion pieces of gloves. The US and European Union remain key export markets accounting for 54% and 25% of their total exports respectively.

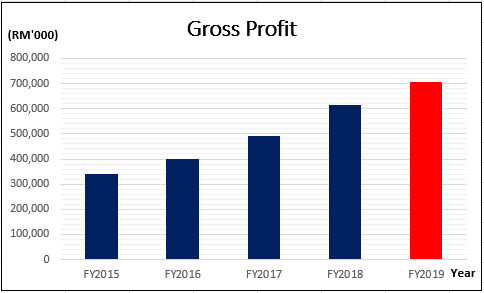

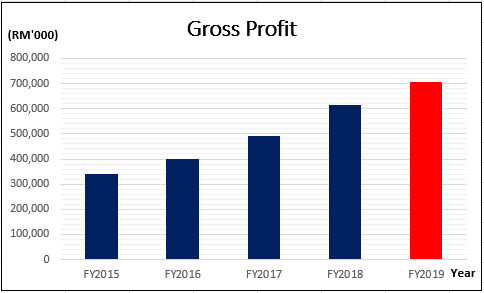

HARTA has recorded a RM93.441 million increase in gross profit, translating to a growth of 15.20% from RM614.762 million in FY2018 to RM708.203 million in FY2019. Based on 5 years CAGR basis, the gross profit has grown 13.99%. The increase in gross profit for HARTA was supported by increased contribution from the United States and Europe in tandem with the growing global demand for nitrile gloves. The group was well-positioned to meet this demand growth given their continuous expansion in production capacity via their Next Generation Integrated Glove Manufacturing Complex (NGC).

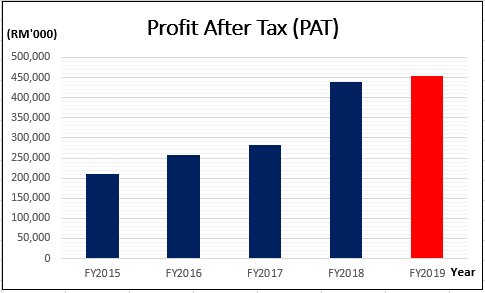

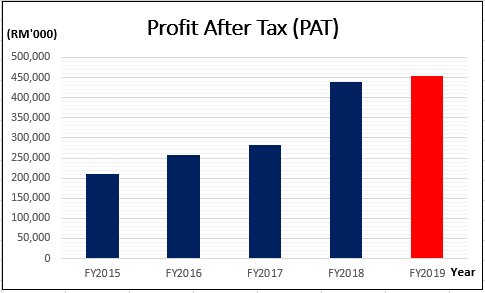

The Profit After Tax (PAT) of HARTA rose 3.48% from RM439.632 million in FY2018 to RM454.938 million in FY2019. On a CAGR basis, the Profit After Tax (PAT) grew by 14.29% which was in line with the growth in revenue and gross profit.

CASH FLOW STATEMENT

The net cash from operating activities has provided a positive cash flow of RM627.399 million in FY2019 as compared to RM403.949 million in FY2018 indicating that the company is healthy and has enough cash to use for business expansion. The net cash from investing activities in FY2019 (-RM428.602 million) was mainly due to the additions to capital work-in-progress (RM398.412 million), additions to Property, Plant and Equipment (PPE) (RM33.057 million) and additions to intangible assets (RM1.459 million). The negative cash flow indicates that the firm is investing in its business for growth. The net cash from financing activities in FY2019 (-RM206.644 million) was mainly due to dividend paid (RM286.177 million) and interest paid (RM10.620 million).

COMPANY ABLE TO PAY BACK ITS LIABILITIES?

Based on liquidity ratio calculation, HARTA has a current ratio of 2.179 times in FY2019 indicating that the company does not face any liquidity issues as it is capable of paying back its liabilities (411.889 million) if any unforeseeable circumstances occur. HARTA is able to do so by using current assets such as inventories, trade & other receivables, tax assets, cash, bank balances and short-term investments amounting to RM897.442 million.

PROSPECT AND CHALLENGES

HARTA has allocated RM630 million for Plant 6 and Plant 7 at their Next Generation integrated Glove Manufacturing Complex (NGC) in Sepang as well as RM115 million to integrate the Industry 4.0 technologies for all activities related to gloves production and manufacturing by connecting to computers for data analytics and artificial intelligence (AI).

HARTA said the NGC Plant 5 was fully commissioned during the quarter while first line of Plant 6 was expected to begin commissioning in Q1 2020 with annual installed capacity of 4.7 billion pieces. For Plant 7, which has commenced construction, would cater to small orders focusing more on specialty products with an annual installed capacity of 3.4 billion pieces. (Source: New Straits Times, 5 November 2019). According to managing director Kuan Mun Leong, the company’s annual installed capacity allows it to ramp up the output from the current 36.6 billion pieces of gloves to 44.7 billion pieces per annum by FY2022.

HARTA has launched the world’s first non-leaching antimicrobial glove (AMG) in United Kingdom. The unprecedented innovation provides active protection against healthcare-associated infections (HAIs). The antimicrobial glove is developed in collaboration with antimicrobial Research and Development (R&D) company Chemical Intelligence UK, which has built-in antimicrobial technology proven to kill micro-organisms in order to prevent the spread of infections.

This product is set to be available in hospitals around the world and is being produced at a lower cost in order to reduce the barriers to access. With this technology, the bacteria coming into contact will be exposed to the antimicrobial activity, which in independent testing, achieved up to a 5-log (99.999 per cent) kill rate within just 5 minutes of contact.

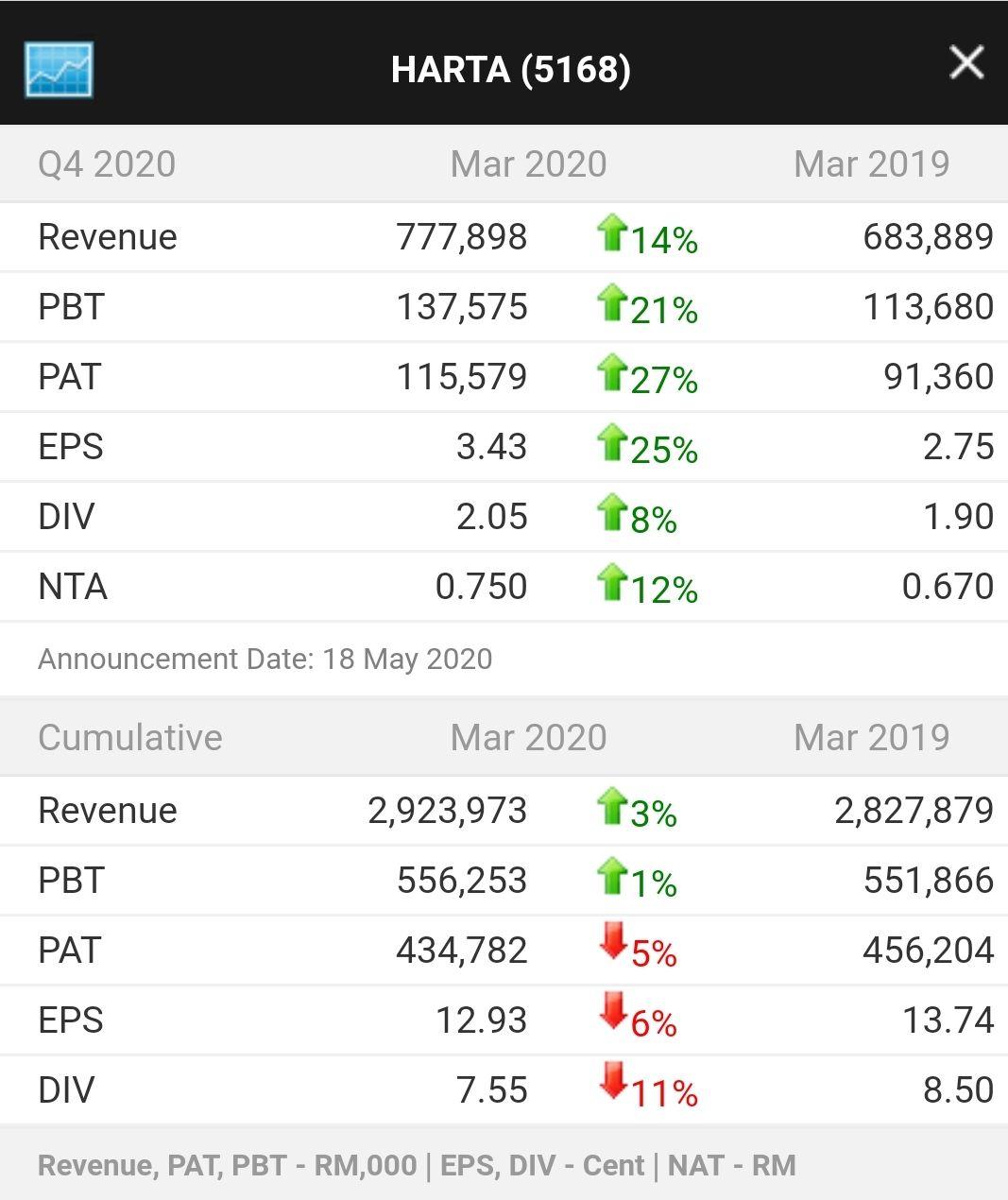

LATEST FINANCIAL RESULT

INSIGHT

In conclusion, HARTA has achieved a strong performance in FY2019 with the highest revenue, gross profit and profit after tax over the past 5 years. Its prospect remains bright as the expansion of Next Generation Integrated Glove Manufacturing Complex (NGC) is set to increase capacity from RM36.6 billion to RM44.7 billion pieces of gloves per annum by FY2022 boosted by the adoption of Industry 4.0 technologies, Internet of Things and integrated manufacturing operations. The demand growth is expected to continue particularly in the near-term given the ongoing COVID-19 outbreak across the globe.

Also Harta will get FDA’s approval on their antimicrobial gloves soon. Would be a big catalyst to fly.Kuan says he is expecting US Food and Drug Administration (FDA) approval for the antimicrobial glove soon.

“We just started selling to about 20 countries now and the quantity is not yet significant and is very small. We will see a pick-up after we get the FDA certification. The FDA certification is key and we are targeting for it within the next one year. This is our target,” he says.