估计2016 eps=10 sen,pe=11,stock price=rm1.10

1)

3)

4)

1)

[FAtTA (发达)] Stocks To Watch on 10/10/2016 - HOMERIZ (5160) & FLBHD (5197)

Author: pinko4988 | Publish date: Mon, 10 Oct 2016, 08:06 AM

HOMERIZ Daily Chart

HOMERIZ (5160) closed with 1 good bar with 1 good volume in the latest session with Bollinger Band (BB) opened wider and middle BB, which is also the 10-days Moving Average turning upwards and HOMERIZ also broke above and closed above the 65-days Moving Average line (light blue solid line) indicating HOMERIZ may trend higher in medium term.

Another strong signal that HOEMRIZ might move higher in the medium term; at least, is the strong support at MYR0.86 which was formed since 29/3/2016, where this level never even being broke down since then implying HOMERIZ should trade any price above this level in the future.

If what anticipated is correct, the next target HOMERIZ would testing is MYR0.925 and MYR1.01.

2)

Traders Brief - Cautious tone to prevail ahead of BOJ and FOMC meetings outcome

Author: kltrader | Publish date: Tue, 20 Sep 2016, 04:32 PM

Market review

- After plunging 2.3% last week, the MSCI Asia Pac index rose for a 2nd day with a 0.9% gain to 138.4 ahead of the widely focused BOJ (21 Sep) and Fed (22 Sep) policy meetings. Investors were split over what action the BOJ will undertake while bets on a potential rate hike from the Fed remain low at ~20% despite a higher-than-expected US inflation data last Friday.

- Following a 2% rout last week, KLCI jumped as much as 8.9 pts on technical rebound but all the gains were erased and the index eventually fell 1.3 pts to 1651.7. Overall, sentiment remained muted as investors await policy reviews from key central banks. Market breadth was negative with 333 gainers as compared to 444 losers while daily volume dropped 14% to 1.147bn shares.

- The Dow soared as much as 130 pts in the early session, lifted by a rebound in oil prices and a surge in home-builder confidence index. However, all the gains evaporated and the index fell 3 pts as skittishness returned ahead of the BOJ and FOMC policy reviews. Although the probability of a hike this week appears low, investors are more worried about a hawkish statement slated for a potential rate hike in Dec.

Technical view

- Oversold with key support near 1640

- Following last week’s rout, KLCI outlook has turned decisively bearish after breaching multiples key supports. Given the steeply oversold slow stochastic reading, we expect KLCI to find a floor near 1640 (23.6% FR) levels. If this support falters, KLCI will correct further towards 1600-1611 zones. Immediate resistances are 1664-1670.

Market Strategy

- Mirroring last week’s pattern, we expect selling pressure on Bursa Malaysia to prevail as investors await further clues from key central banks’ policy review. Sentiment will also be clouded by choppy oil prices, weakening RM and uncertainty ahead of the 8 Nov US presidential election following recent polls showed that Donald Trump (perceived as less market friendly) has led Hillary Clinton.

- Portfolio (FIG4). We had closed our position on HOMERIZ (1.1% loss) due to expiry and took profit on SENDAI (13.2% gain) after hitting above R2 target yesterday.

- Stock on radar. We recommend FLBHD (Trading Buy) as we believe the stock will play catch up with its peers (i.e. HEVEA/EVERGREEN). A decisive breach above resistance of RM1.60 could take the next leg up towards RM1.72-1.80 levels. Key supports are RM1.42-1.47. Cut loss at RM1.41.

3)

Homeritz Corporation - 3QFY16 Results – Above expectations

Author: kltrader | Publish date: Fri, 29 Jul 2016, 02:01 PMResults

- Homeritz’s 9MFY16 revenue of RM123.64m (+14% yoy) was translated into Adj PATAMI of RM23.28m (+47% yoy). This came in above our expectation, which accounted for 86% of HLIB full year estimate. Deviations

- We deem the earnings above our expectations. The deviation is mainly caused by stronger US$ vs our assumption of RM3.80/US$.

Dividends

- A first interim single tier tax-exempt of 2.0 sen was declared in 3Q.

Highlights

- 9MFY16 review… Homeritz registered a higher revenue of RM123.64m (up by 14% yoy) while PATAMI improved by 42% yoy (from RM12.9m to RM22.5m) mainly due to strong US$ against MYR and higher sales volume.

- 3QFY16 review… Although the company recorded a 9% yoy increase in revenue to RM40.5m, qoq basis revenue dropped by 5%. PATAMI weakened sequentially to RM6.2m (-20% qoq) due mainly to higher labour cost, slightly lower sales volume (-4% qoq) and weaker USD against MYR (- 6% qoq)

- Our house projected a weakening bias in MYR within the range of RM4.00-4.20. Our sensitivity analysis shows that every RM0.10/US$ depreciation in ringgit will boost net profit by circa 7%.

Risks

- USD weakness against RM; high raw material prices; high labour costs; unexpected economic downturn; and production or operational risks.

Forecasts

- FY16-17 net profit forecast is raised by 15.5% and 8.3% to RM31.2m and RM29.2m to reflect our latest MYR assumption of RM4.00/US$ and RM3.90/US$ respectively for FY16 & FY17 (vs. RM3.80 previously)

Rating

- Maintain BUY, TP: RM1.09

- Positives: 1) the company would benefit from strong US$; (2) lower leather price which will boost its margin; (3FY16 DY of 5.9%, based on 50% payout ratio.

Valuation

- We maintain our BUY recommendation with a higher target price of RM1.09 (previously RM1.01) after incorporating latest forecasts based on unchanged P/E multiple of 11x of CY17 EPS.

4)

Holistic View of Homeritz with Fundamental Analysis & iVolume Spread Analysis (iVSAChart)

Author: Joe Cool | Publish date: Thu, 14 Jul 2016, 02:40 PM

Background

Founded in 1997, Homeritz is an integrated designer, manufacturer and exporter of a complete range of upholstered home furniture, comprising leather and fabric-based sofas, dining chairs and bed frames. The Group primarily undertakes Original Design Manufacturing (ODM) and Original Equipment Manufacturing (OEM) activities whereby ODM part of the business contributing at least 85% of its revenue. Homeritz has also created its own brand of lifestyle furniture series under the name of “Eritz”.

To date, Homeritz has built a diverse customer base spanning across more than 50 countries, including Europe, Australia, New Zealand, North and South America, South Africa and the Middle East. The Group has various accolades in recent years, including the Golden Bull Award in 2008 (ranking 1st out of 100 outstanding SMEs), the Enterprise 50 Award for 2 consecutive years in 2008 and 2009; and the ‘Product Excellence Award’ and ‘Asian Furniture Leadership Award’ at the Malaysian Furniture Leadership Awards in 2009.

Based on Financial Year (FY) 2015 full year results, Homeritz achieved RM 146 million turnover, which is considered to be a small enterprise. Other aspects of the company’s latest financial results are illustrated in the table below.

Financial Brief

Since FY2011, Homeritz’s revenue has been in a continuous growing trend till FY2015 from RM 90 million to RM 146 million per annum. This represents a 63% increase in 5 years or an average year to year increase of 13%.

Similarly, in net profit, it has been on an increasing trend for these 5 years from RM 10 million to RM 23.5 million, which translates to a 2.3 times increase in 5 years or average year to year increase of 21%. Having a higher growth trend in net profit as compared to revenue is one of the most desirable characteristic of a growing company as it shows sound cost management and growing net margin of the company’s product.

Net profit margin wise, Homeritz scores a good 16% as well as having an excellent Return of Equity at 26.76%.

On company’s debt, Homeritz has very low total debt to equity ratio of 0.02, signifies that the company has extremely little borrowings as compared to its shareholder equity value. The company’s current ratio of 5.15 is extremely high and a fantastic cash ratio of 2.98.

In terms of dividend, Homeritz pays a high 4.54% dividend yield which translates to 4 cents per share in FY2015

In conclusion, although Homeritz is a small scale SME, its financial figures are top notch and very consistent from year to year. Therefore, the decrease in its share price from its 52 week high of RM1.23 to current level of around RM0.865 is likely due to overall bearish market and negative global economy sentiments instead of due to bad company performance. Outlook of the company’s performance remains positive as this export driven company will benefit should the strengthening of US dollar against Ringgit continue for the foreseeable future.

Whether is now a good opportunity to invest in Homeritz, from fundamental analysis point of view is definitely a big yes as the company’s financials are strong and year to year performance is consistent. Moreover, current price is already very close to 52-week low of RM0.86 and PE ratio is at a good 8.89. Homeritz share price will likely get a boost and reflect its true value during the next quarterly announcement provided that it comes with good set of results.

Next quarterly results announcement should be on the month of Jul 2016 for Q3 results.

iVolume Spread Analysis (iVSA) & comments based on iVSAChart software – Homeritz

Based on Homeritz 6-month weekly chart, the market has been congesting for over 4-5 months with early Jun 2016 failure to breakout comes in conjunction with strengthening of Ringgit. There is also a support at around RM0.86 level.

Currently, there is another Sign of Strength (green arrow) detected in early July 2016 and there seems to be some evidence of smart money accumulation around RM0.86 - RM0.88 levels.

Consider to accumulate at these level if you are aggressive trader/investor. But if you wish to seek confirmation before you enter this trade, then enter after Homeritz breaks above RM0.90 with volume. Either way, do remember always to set your stop loss level and position sizing for prudent risk management before you enter any trades.

5)

Founded in 1997, Homeritz is an integrated designer, manufacturer and exporter of a complete range of upholstered home furniture, comprising leather and fabric-based sofas, dining chairs and bed frames. The Group primarily undertakes Original Design Manufacturing (ODM) and Original Equipment Manufacturing (OEM) activities whereby ODM part of the business contributing at least 85% of its revenue. Homeritz has also created its own brand of lifestyle furniture series under the name of “Eritz”.

To date, Homeritz has built a diverse customer base spanning across more than 50 countries, including Europe, Australia, New Zealand, North and South America, South Africa and the Middle East. The Group has various accolades in recent years, including the Golden Bull Award in 2008 (ranking 1st out of 100 outstanding SMEs), the Enterprise 50 Award for 2 consecutive years in 2008 and 2009; and the ‘Product Excellence Award’ and ‘Asian Furniture Leadership Award’ at the Malaysian Furniture Leadership Awards in 2009.

Based on Financial Year (FY) 2015 full year results, Homeritz achieved RM 146 million turnover, which is considered to be a small enterprise. Other aspects of the company’s latest financial results are illustrated in the table below.

Financial Brief

Homeritz (5160.KL)

|

FY 2015 (RM’000)

|

| Revenue (RM’000) |

146,419

|

| Net Earnings (RM’000) |

23,551

|

| Net Profit Margin (%) |

16.08

|

| Return of Equity (%) |

26.76

|

| Total Debt to Equity Ratio |

0.02

|

| Current Ratio |

5.15

|

| Cash Ratio |

2.98

|

| Dividend Yield (%) |

4.54

|

| Earnings Per Share (RM) |

0.099

|

| PE Ratio |

8.89

|

Since FY2011, Homeritz’s revenue has been in a continuous growing trend till FY2015 from RM 90 million to RM 146 million per annum. This represents a 63% increase in 5 years or an average year to year increase of 13%.

Similarly, in net profit, it has been on an increasing trend for these 5 years from RM 10 million to RM 23.5 million, which translates to a 2.3 times increase in 5 years or average year to year increase of 21%. Having a higher growth trend in net profit as compared to revenue is one of the most desirable characteristic of a growing company as it shows sound cost management and growing net margin of the company’s product.

Net profit margin wise, Homeritz scores a good 16% as well as having an excellent Return of Equity at 26.76%.

On company’s debt, Homeritz has very low total debt to equity ratio of 0.02, signifies that the company has extremely little borrowings as compared to its shareholder equity value. The company’s current ratio of 5.15 is extremely high and a fantastic cash ratio of 2.98.

In terms of dividend, Homeritz pays a high 4.54% dividend yield which translates to 4 cents per share in FY2015

In conclusion, although Homeritz is a small scale SME, its financial figures are top notch and very consistent from year to year. Therefore, the decrease in its share price from its 52 week high of RM1.23 to current level of around RM0.865 is likely due to overall bearish market and negative global economy sentiments instead of due to bad company performance. Outlook of the company’s performance remains positive as this export driven company will benefit should the strengthening of US dollar against Ringgit continue for the foreseeable future.

Whether is now a good opportunity to invest in Homeritz, from fundamental analysis point of view is definitely a big yes as the company’s financials are strong and year to year performance is consistent. Moreover, current price is already very close to 52-week low of RM0.86 and PE ratio is at a good 8.89. Homeritz share price will likely get a boost and reflect its true value during the next quarterly announcement provided that it comes with good set of results.

Next quarterly results announcement should be on the month of Jul 2016 for Q3 results.

iVolume Spread Analysis (iVSA) & comments based on iVSAChart software – Homeritz

Based on Homeritz 6-month weekly chart, the market has been congesting for over 4-5 months with early Jun 2016 failure to breakout comes in conjunction with strengthening of Ringgit. There is also a support at around RM0.86 level.

Currently, there is another Sign of Strength (green arrow) detected in early July 2016 and there seems to be some evidence of smart money accumulation around RM0.86 - RM0.88 levels.

Consider to accumulate at these level if you are aggressive trader/investor. But if you wish to seek confirmation before you enter this trade, then enter after Homeritz breaks above RM0.90 with volume. Either way, do remember always to set your stop loss level and position sizing for prudent risk management before you enter any trades.

5)

[转贴] 浅谈四间《家私股》—— SHH, HOMERIZ, POHUAT, LIIHEN - KaI

Author: Tan KW | Publish date: Mon, 6 Jun 2016, 11:43 AM

2016年6月5日星期日

净利率方面,家丽资大胜其他公司,而且18.75%的成绩还真不简单!吸金排名第二的堡发在净利率榜里就名落孙山了,而且净利率不到10%。

接下来看看复利率(CAGR),利兴这10年的复利率还真恐怖!销售方面就平均每年成长18.50%,净利就达到平均每年成长63.83%!这进步的速度也太快了吧。新兴的销售方面其实不会很好,它早在以前每年的销售和净利都一直在跌,而且净利多数都是负数的,不过在这几年就咸鱼翻身了。

接下来这点就重要了,股息是唯一能让股东们不用花钱就能降低自己的average cost price,是非常适合长期投资者的。从上图看,全部都有非常不错和满意的周息率,唯有家丽资的2.58%就没那么吸引人了。新兴是一年派息一次;家丽资是一年派息两次;堡发目前是一年派息四次(以前没那么频密);利兴是一年派息四次。

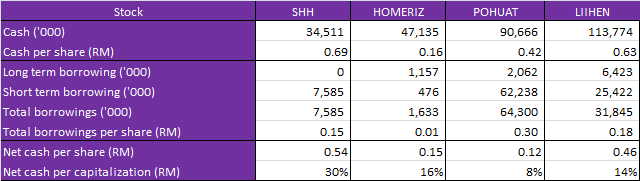

看了周息率,然后就看现金这项目了。现金的排行榜和吸金能力一模一样,也是利兴举冠。不过来到每股现金就不同故事了,排名最后的新兴在这每股现金这项目大获全胜,秒杀家丽资和堡发!

银行贷款方面就是红股王堡发举冠了,其二是吸金王利兴,不过这冠军不是很好戴的。家丽资的每股贷款是离奇的少,每股只是区区达到RM 0.01。接下来的每股净现金的冠军就是新兴了,现金这项目还真是它的强项,而且它单单净现金就占了本身市值的30%!

接下来还是看现金,不过是自由运用的现金流量。这图的数据不是根据公司目前最新的updates,而是属于去年的。上图可见利兴去年的自由现金流量是非常地高,而且是新兴的17倍呢!

另外,Free Cash Flow per Revenue是指自由现金流占销售量的百分比。每间公司的销售量都需要一定数量的现金流在里头转动,而最重要的是utilized后所剩下的自由现金量,高额的数量可证明公司在现金流这规则里完全没问题,可面对各种的风险。在这项目,利兴也一样是举冠的。

然后接下来的是自由现金流量占市值的百分比,这项目其实高过5%算是及格了,不过有10%就更好了。基本上四间都及格,堡发和利兴在这项目是取得佳绩的!

这次凯想浅谈4间以家私为主业务的公司,分别是新兴(7412, SHH)、家丽资(5160, HOMERIZ)、堡发(7088, POHUAT)和利兴(7089, LIIHEN)。四间都有共同点把家私出口至国外,大多数都是出口至美国,除了堡发主要出口至越南。浅谈前,凯想表明一点,那就是以下的数据都是累计最新四季的财务状况,这样就能公平比较各公司的基本面。讲明是浅谈了,所以就干脆skip掉公司一切的背景以及近况解释了,直接入主题XD

起先,比较吸金能力的话,利兴是第一的。如果比较新兴和利兴的目前的销售以及净利,还真是小巫见大巫。然后翻开历史的话,以上四间都有最少发过一次红股,而且四间里面就有三间在去年发送红股了,唯独新兴不参与(其实它早在2003年发送红股)。

以往至今天,堡发不止发送一次红股,它曾经在2003、2009以及去年的2015发送红股。咦?2003、2009、2015,这不是平均6年派一次红股吗?那么下一次红股会不会在2021年呢?

净利率方面,家丽资大胜其他公司,而且18.75%的成绩还真不简单!吸金排名第二的堡发在净利率榜里就名落孙山了,而且净利率不到10%。

接下来看看复利率(CAGR),利兴这10年的复利率还真恐怖!销售方面就平均每年成长18.50%,净利就达到平均每年成长63.83%!这进步的速度也太快了吧。新兴的销售方面其实不会很好,它早在以前每年的销售和净利都一直在跌,而且净利多数都是负数的,不过在这几年就咸鱼翻身了。

接下来这点就重要了,股息是唯一能让股东们不用花钱就能降低自己的average cost price,是非常适合长期投资者的。从上图看,全部都有非常不错和满意的周息率,唯有家丽资的2.58%就没那么吸引人了。新兴是一年派息一次;家丽资是一年派息两次;堡发目前是一年派息四次(以前没那么频密);利兴是一年派息四次。

看了周息率,然后就看现金这项目了。现金的排行榜和吸金能力一模一样,也是利兴举冠。不过来到每股现金就不同故事了,排名最后的新兴在这每股现金这项目大获全胜,秒杀家丽资和堡发!

银行贷款方面就是红股王堡发举冠了,其二是吸金王利兴,不过这冠军不是很好戴的。家丽资的每股贷款是离奇的少,每股只是区区达到RM 0.01。接下来的每股净现金的冠军就是新兴了,现金这项目还真是它的强项,而且它单单净现金就占了本身市值的30%!

接下来还是看现金,不过是自由运用的现金流量。这图的数据不是根据公司目前最新的updates,而是属于去年的。上图可见利兴去年的自由现金流量是非常地高,而且是新兴的17倍呢!

另外,Free Cash Flow per Revenue是指自由现金流占销售量的百分比。每间公司的销售量都需要一定数量的现金流在里头转动,而最重要的是utilized后所剩下的自由现金量,高额的数量可证明公司在现金流这规则里完全没问题,可面对各种的风险。在这项目,利兴也一样是举冠的。

然后接下来的是自由现金流量占市值的百分比,这项目其实高过5%算是及格了,不过有10%就更好了。基本上四间都及格,堡发和利兴在这项目是取得佳绩的!

接下来就比较basic的基本面了,上图较明显的项目是current ratio,家丽资的流动资产比流动负债高6.5倍呢!另外以上四间公司的手握现金都占各流动资产的一半以上,不要是trade receivable占一半就好了,毕竟是还没收回来的钱XD

另外是不是家私股的ROE都是超过15%的?以上四间公司都取得佳绩> ROE 15%,而且有三间是超越20%的呢!最后,凯个人认为以上四间都各有优势:

另外是不是家私股的ROE都是超过15%的?以上四间公司都取得佳绩> ROE 15%,而且有三间是超越20%的呢!最后,凯个人认为以上四间都各有优势:

- 利兴是高成长股,在多项目勇夺第一。

- 堡发有点像贺特佳的类型,随时爆发(有如其名XD)。

- 家丽资就比较安静平稳,比较起来都不会特别显出自己,可能是因为刚出道5年,经验尚浅。

- 新兴就感觉是一只黑马,等时机成熟后会秒杀四方XD。

最后附上完整功课:

本文只供参考。共勉之。

http://investmentkai.blogspot.my/2016/06/shh-homeriz-pohuat-liihen.html

6)

Timber to furniture - The thing with currency, on value chain, Hevea, Homeritz & more

Author: Ricky Yeo | Publish date: Fri, 20 May 2016, 11:33 PM

It is impossible to avoid the discussion of furniture stocks without touching the topic of currency. That is understandable as they are all export stocks and any changes on currency will potentially impact their earnings.

However investor needs to selectively choose where they should put their attention on when it comes to analysis. The issues with being too obsess with analyzing currency are:

Trying to predict currency impact on earnings raises another interesting question.

If the skills required to predict currency movement = X, then

predicting currency movement + the impact on earnings + how the market will react + how big the stock price will moves is going to require 2X of skills

You get the idea. It will be harder not easier.

Going by that reasoning, if you are confident with your ability to predict currency movements, you should be trading forex because the probability of winning is higher.

Another scary thing is investors are using the most recent 2015 figures for reasoning & extrapolation. A year where thanks to MYR depreciation, everything is inflated from top to bottom. Currency depreciation improves selling price which in turn inflate revenue, operating margins, increase asset turnover, balloon ROIC, and turbocharge EPS when 'Other income' is added onto it. You are running a high chance of overestimating value by using these abnormal figures as the base year.

*******

Furniture stocks or export stocks are the common name categorization given to stocks that sells timbers or manufacture furnitures. Categorization simplify things and make it easier for us to understand but it is far from saying they are all the same.

You probably seen many investors or analysts comparing Heveaboard to Homeritz. Traditionally Hevea had always been trading at a lower multiples (P/E, P/B etc) compare to Homeritz so analysts comparing both will always makes Hevea looks undervalued.

Calling Hevea undervalued isn't the issue as long it appears so in your valuation, but trying to compare Homeritz to Hevea seems a little strange if we examine the nature of their business and their numbers.

This timber/furniture industry value chain is not precise but does the job. Here:

Upstream - Everything from planting trees to converting them into particleboard or other types of board.

Midstream - All the effort undertaken from R&D, design etc that turn particleboard into end product - Furnitures.

Downstream - Activities of selling & delivering to customers.

All of the these companies' businesses are focused along the mid & upstream of the chain. They all have marketing & distribution divisions but those are not their core operations.

Coming back to Hevea. Hevea generate around 50% of their revenue from manufacturing particleboard and the remaining from RTA or Ready to Assemble furniture. You can argue technically they are selling furniture albeit those furnitures are not assembled, customers have to do it themselves.

Homeritz on the other hand, pour all of their focus into R&D, design and manufacturing high end upholstered furnitures for their customers.

Numbers tell the story.

These are the fixed assets extracted from the reports. When you look at plant, machineries & equipments (PPE), Hevea needs around RM170 mil of PPE to generate RM503 mil of revenue, or 2.95x. In contrast, Homeritz can generate RM146 mil of revenue with only RM4 mil worth of PPE. That's 32.95x.

Is that because Hevea is inferior? No, it is simply because they are in a different business. For a particleboard manufacturer like Hevea, the amount of machineries they need to chip, flake, dry, mat forming, hot pressing, sanding, sizing, laminating, to turn timber into particleboard are a lot.

In comparison, the machineries you need to turn particleboard into an upholstered sofa is very little. Sanding, polishing and some cutting tools should do the work. In saying that, the workmanship needed to turn the sofa into a high-end quality product will translate into higher expenses too. Pohuat & Latitude would have more similiarities to Homeritz than Hevea, while Hevea's business is more similar to Mieco.

When you look at their operating margin it paints the same story.

Homeritz has always been the leader in profit margin. Again it isn't because Hevea is crap, it is just that they are selling undifferentiated products - particleboard. They can only achieve higher margin through operational efficiency. Whereas Homeritz can maintain a higher margin by focusing on the high end niche market. You can increase the selling price of a high-end sofa but extremely hard for particleboard.

You might have notice operating margin across all the companies increase substantially in 2015 compare to previous years, ranging from 50-100% jump in margin. Customers don't suddenly get excited by paying double for particleboard. This is how currency inflate the numbers from top to bottom. You will be up for a big surprise if you think 2015 is a new era.

When you add asset turnover into the picture, you started to grasp the full picture of how the numbers came to be.

And again you just need to be careful with the asset turnover for 2015 because the denominator of the equation (Revenue/Total assets) has already been inflated by currency. However across the 5 years ratio you will have a good sense where it should be.

When you have the profit margin and asset turnover, you will have ROE.

******

The true value of a stock does not change much from year to year. That is also the case for this industry.

Dig into the business to understand what drives the numbers and how those numbers drives valuation. When the market sentiment is awash with currency horror & excitement, understand how the business is creating value is the only thing you can anchor on. What really matters in the end is how the business adds value, not what the conversion rate is.

7)

However investor needs to selectively choose where they should put their attention on when it comes to analysis. The issues with being too obsess with analyzing currency are:

- It is something a company has no control on & it doesn't tell you a thing about management capability or industry dynamic

- Be it a forex gain or loss, it shouldn't be part of the valuation to begin with. Valuation should only be based on cash flow generated from core operations

- You are trying to predict the unpredictable. You chances of predicting it correctly is same as mine - 50/50, like a monkey throwing darts

- 10 years later when you look back, for all the gains and losses caused by currency, it will only have a drop in the ocean effect on the true value of these stocks

Trying to predict currency impact on earnings raises another interesting question.

If the skills required to predict currency movement = X, then

predicting currency movement + the impact on earnings + how the market will react + how big the stock price will moves is going to require 2X of skills

You get the idea. It will be harder not easier.

Going by that reasoning, if you are confident with your ability to predict currency movements, you should be trading forex because the probability of winning is higher.

Another scary thing is investors are using the most recent 2015 figures for reasoning & extrapolation. A year where thanks to MYR depreciation, everything is inflated from top to bottom. Currency depreciation improves selling price which in turn inflate revenue, operating margins, increase asset turnover, balloon ROIC, and turbocharge EPS when 'Other income' is added onto it. You are running a high chance of overestimating value by using these abnormal figures as the base year.

*******

Furniture stocks or export stocks are the common name categorization given to stocks that sells timbers or manufacture furnitures. Categorization simplify things and make it easier for us to understand but it is far from saying they are all the same.

You probably seen many investors or analysts comparing Heveaboard to Homeritz. Traditionally Hevea had always been trading at a lower multiples (P/E, P/B etc) compare to Homeritz so analysts comparing both will always makes Hevea looks undervalued.

Calling Hevea undervalued isn't the issue as long it appears so in your valuation, but trying to compare Homeritz to Hevea seems a little strange if we examine the nature of their business and their numbers.

This timber/furniture industry value chain is not precise but does the job. Here:

Upstream - Everything from planting trees to converting them into particleboard or other types of board.

Midstream - All the effort undertaken from R&D, design etc that turn particleboard into end product - Furnitures.

Downstream - Activities of selling & delivering to customers.

All of the these companies' businesses are focused along the mid & upstream of the chain. They all have marketing & distribution divisions but those are not their core operations.

Coming back to Hevea. Hevea generate around 50% of their revenue from manufacturing particleboard and the remaining from RTA or Ready to Assemble furniture. You can argue technically they are selling furniture albeit those furnitures are not assembled, customers have to do it themselves.

Homeritz on the other hand, pour all of their focus into R&D, design and manufacturing high end upholstered furnitures for their customers.

Numbers tell the story.

These are the fixed assets extracted from the reports. When you look at plant, machineries & equipments (PPE), Hevea needs around RM170 mil of PPE to generate RM503 mil of revenue, or 2.95x. In contrast, Homeritz can generate RM146 mil of revenue with only RM4 mil worth of PPE. That's 32.95x.

Is that because Hevea is inferior? No, it is simply because they are in a different business. For a particleboard manufacturer like Hevea, the amount of machineries they need to chip, flake, dry, mat forming, hot pressing, sanding, sizing, laminating, to turn timber into particleboard are a lot.

In comparison, the machineries you need to turn particleboard into an upholstered sofa is very little. Sanding, polishing and some cutting tools should do the work. In saying that, the workmanship needed to turn the sofa into a high-end quality product will translate into higher expenses too. Pohuat & Latitude would have more similiarities to Homeritz than Hevea, while Hevea's business is more similar to Mieco.

When you look at their operating margin it paints the same story.

Homeritz has always been the leader in profit margin. Again it isn't because Hevea is crap, it is just that they are selling undifferentiated products - particleboard. They can only achieve higher margin through operational efficiency. Whereas Homeritz can maintain a higher margin by focusing on the high end niche market. You can increase the selling price of a high-end sofa but extremely hard for particleboard.

You might have notice operating margin across all the companies increase substantially in 2015 compare to previous years, ranging from 50-100% jump in margin. Customers don't suddenly get excited by paying double for particleboard. This is how currency inflate the numbers from top to bottom. You will be up for a big surprise if you think 2015 is a new era.

When you add asset turnover into the picture, you started to grasp the full picture of how the numbers came to be.

And again you just need to be careful with the asset turnover for 2015 because the denominator of the equation (Revenue/Total assets) has already been inflated by currency. However across the 5 years ratio you will have a good sense where it should be.

When you have the profit margin and asset turnover, you will have ROE.

******

The true value of a stock does not change much from year to year. That is also the case for this industry.

Dig into the business to understand what drives the numbers and how those numbers drives valuation. When the market sentiment is awash with currency horror & excitement, understand how the business is creating value is the only thing you can anchor on. What really matters in the end is how the business adds value, not what the conversion rate is.

7)

[转贴] HOMERIZ 最优秀的家私股 - Kit Zai

Author: Tan KW | Publish date: Tue, 3 May 2016, 11:36 PM

Tuesday, 3 May 2016

话说我在一月的时候写了这篇 《HOMERIZ 反向的概念》,我真的有认真考虑再买回HOMERIZ。

想了想,算了算,这么优秀的公司,没理由不买,所以我买了。

上面这些数据非常重要:

优秀在哪?在净现金 !

现金 = 49,935,000.00

全部债务 = 15,351,000.00

比起其他家私股 (LIIHEN, POHUAT, EVERGREEN 和 LATITUD), 现金流就是最优秀。

所以,当我要投资家私股时,第一个想到的就是 HOMERIZ。

想了想,算了算,这么优秀的公司,没理由不买,所以我买了。

上面这些数据非常重要:

- 52w HiLoVola 到达98%,意思是目前价位在52星期里,已经是非常低了。

- T4Q NP Margin 高达19.3%,在一众家私股里赚幅最高,最会赚钱。

- P/E 在8.84,属于健康合理。

- DY 在 4%,比定存高,这很重要。

- T4Q ROE 高达26.74%,在一众家私股里赚幅最高,证明了Homeriz的管理层很有效的利用股东们的资金获取最大的回酬于公司,也懂得利用公司的优势注重于生产高赚幅的产品,获取较高的利润。

优秀在哪?在净现金 !

现金 = 49,935,000.00

全部债务 = 15,351,000.00

比起其他家私股 (LIIHEN, POHUAT, EVERGREEN 和 LATITUD), 现金流就是最优秀。

所以,当我要投资家私股时,第一个想到的就是 HOMERIZ。

没有评论:

发表评论