NOTION – A 2020 Gem Stock that fulfils Mr. Fong’s RUG Criteria

Hi, i3 members. I am Another Perspective.

Here, I humbly share my first i3 article with you.

This article is strictly for sharing purpose only.

There is no buy or sell recommendation.

Any constructive feedback is welcomed.

Let’s dive in.

1) What are Mr. Fong’s stock selection criteria?

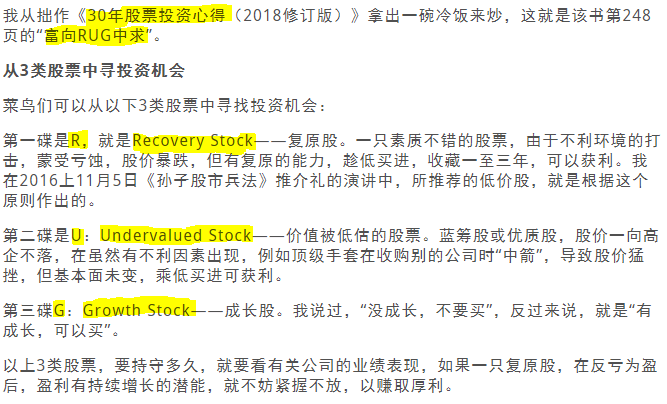

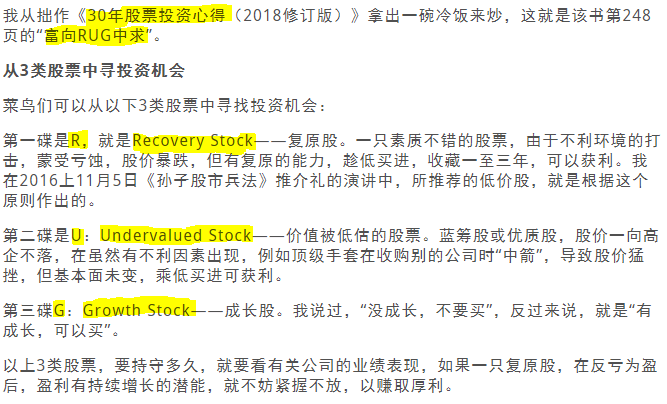

According to one of the Malaysia’s top investor, Mr. Fong Siling, investors can look for great investment opportunities in RUG stocks:

2) How does Notion fits Mr. Fong’s RUG stock selection criteria?

3) How much is Notion’s stock worth?

4) Is there any prominent investor believing in Notion?

5) What does Notion’s chart suggest?

6) Are there risks buying Notion?

Yes. No matter how good a company is, it is not risk-proof.

7) Conclusion?

a. Notion fulfils the RUG stock selection criteria.

c. By investing in Notion, investors should expect business and market risks.

Is Notion a worthwhile investment? You decide.

This article is strictly for sharing purpose only.

There is no buy or sell recommendation.

Any constructive feedback is welcomed.

Thanks,

Hi, i3 members. I am Another Perspective.

Here, I humbly share my first i3 article with you.

This article is strictly for sharing purpose only.

There is no buy or sell recommendation.

Any constructive feedback is welcomed.

Let’s dive in.

1) What are Mr. Fong’s stock selection criteria?

According to one of the Malaysia’s top investor, Mr. Fong Siling, investors can look for great investment opportunities in RUG stocks:

- R (Recovery Stock) – Companies that have good fundamentals but suffer from temporary setbacks may have extremely depressed stock prices. As long as the company can recover, we can buy the stock at depressed prices and keep them for 1-3 years. The investment returns should be good.

- U (Undervalued Stock) – Companies that are undervalued.

- G (Growth Stocks) – As long a company is growing, we should hold its stock.

2) How does Notion fits Mr. Fong’s RUG stock selection criteria?

- R (Recovery Stock) - Notion’s stock price has been severely impacted due to a series of incidents, including a fire at its main manufacturing facility in Klang in October 2017. After nearly two years, Notion has fully restored its operations in September 2019.

- U (Undervalued Stock) – Notion has an NTA of RM1.24. As a precision part manufacturer, its manufacturing equipment and facilities should fetch a value similar to, if not higher than the NTA. If even a non-operational Notion is worth RM1.24, how could Notion be worth at RM1.05 when there are management team and employees generating earnings in a business with high barrier of entry? If you check Notion’s peers, namely ATAIMS, VS and SKPRES, you will notice they are trading at stock prices much higher than NTAs.

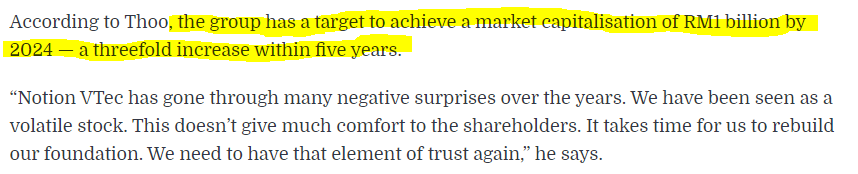

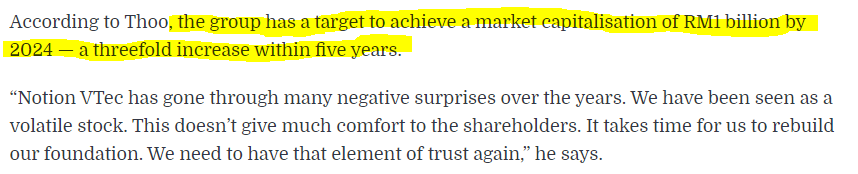

- G (Growth Stock) – Notion’s three business segments, namely HDD, EBS and EMS, are all growing. Notion targets to reach a market capitalisation of RM1 billion by 2024 – a 3x increase in market capitalisation within five years. With a healthy Current Ratio of 4.41, Debt-to-Equity ratio of 0.16 and expected insurance claims, Notion should able to expand rapidly, without overstretching itself financially.

- HDD (Hard Disk Drive) – Their HDD parts precision manufacturing business is growing, due to the extensive application of Shingled Recording (SMR) and helium drives.

- EBS (Electronic Braking System) - Many people are not aware that Notion is one of the largest auto braking plunger suppliers in the world. Notion produces 30 million pieces of plungers annually for 15 million cars, as each braking system would need two plungers. Given that the global production of cars is about 90 million annually, it essentially means that one in every six cars in the world has plungers is made by Notion. Their clients include world-class automotive brands, including Mercedes-Benz, BMW, Audi, Volkswagen, Mitsubishi. Notion’s parts are being supplied to everywhere in the world. Recently, Notion had secured three new automotive customers, namely Delphi Technologies, Hilite International and BorgWarner, with orders expected to start coming in 1H2020.

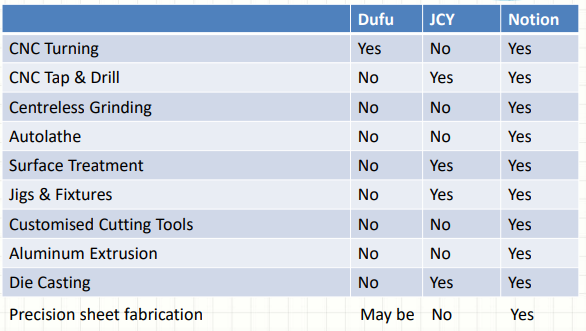

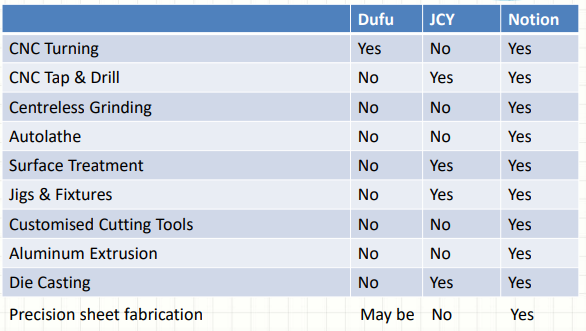

- EMS (Electronic Manufacturing Service) – This is Notion’s main growth driver. Notion is the specialist in metal parts, especially the aluminium parts. In 2H2019, it has secured a European EMS client to which it will supply the metal parts — both machine and fabricated parts — for its products. The client stated they are impressed by Notion’s capability and quick response. It is highly likely that the European EMS client is Dyson. Why? VS, SKPRES AND ATAIMS, which serve Dyson, are based in Johor. Their stock prices have soared ever since they started serving Dyson. If you notice, Notion’s EMS plant is based in Johor too. Secondly, they have comprehensive engineering capabilities. Refer table below, sourced from Notion’s Investor Relation slides (You may view them at Notion’s website).

- Let’s focus on Notion’s big picture. Underpinned by encouraging R, U, G factors, Notion targets to reach a market capitalisation of RM1 billion by 2024 – a 3x increase in market capitalisation within five years. It would be helpful to derive a stock price based on this input.

- With a market capitalisation of RM1 billion by 2024 and a total outstanding 335,821,905 stock units, each stock would be worth RM2.98 by 2024. Applying a sufficiently huge margin of safety of 50%, the stock would still be worth RM1.49 by 2024.

- EMS players, namely ATAIMS, SKPRES and VS have PERs of 16-20x. Assuming Notion is valued at just a PER of 15x, a stock price of RM2.98 is equivalent to an EPS of RM0.20 and annual earnings of RM66.7 million.

- Is this Notion able to achieve this target? No one can give an exact answer - We have no crystal balls. We shall monitor their performance from time to time, to see whether they underdeliver, deliver or overdeliver.

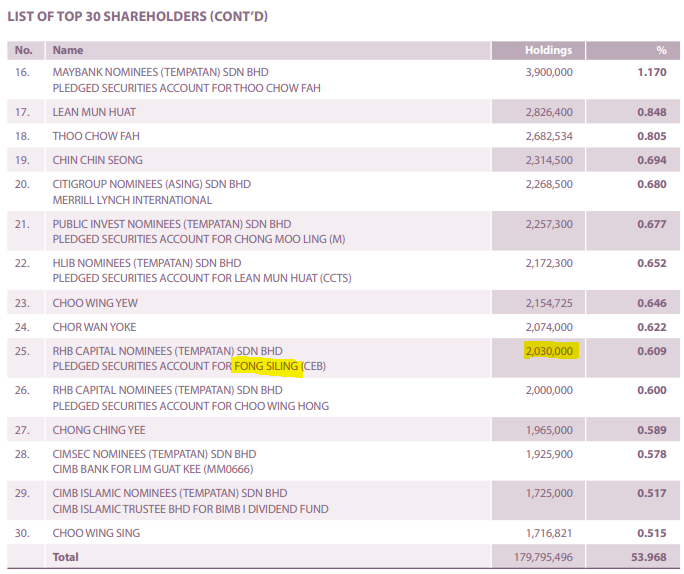

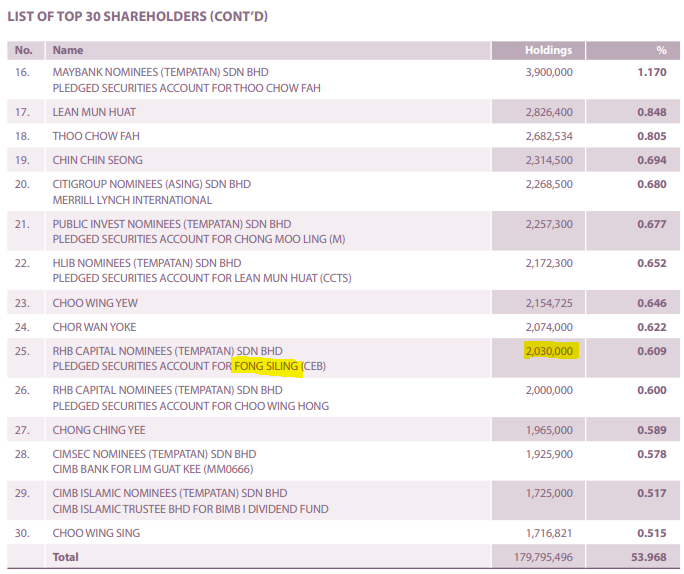

4) Is there any prominent investor believing in Notion?

Here’s the interesting part – Yes. The most practical way to exhibit belief in a company is by buying its stocks. Based on Notion’s latest 2018 annual report, Mr. Fong Siling holds 2.03 million units of Notion stocks. Yes, Mr. Fong himself. Notion seems to fulfil his own RUG stock selection criteria. Not sure whether he is still holding now, but that is not a major concern. At a price below NTA, Notion is clearly undervalued.

5) What does Notion’s chart suggest?

- At RM1.05, Notion is standing as its 1-year high. However, it is still 16% lower than its NTA of RM1.24. Notion’s peers, namely ATAIMS, VS and SKPRES, you will notice they are trading at stock prices much higher than NTAs.

- Notion has been uptrend stock since the October 2019, right after it has fully recovered from the fire incident in 2017- Positive signs for value + trend investors.

6) Are there risks buying Notion?

Yes. No matter how good a company is, it is not risk-proof.

- Business Risk - Notion may not hit its target - a 3x increase in market capitalisation within five years due to different reasons, such as termination of client projects, or incidents like floods and fire.

- Market Risk – In the short term, anything can happen to the stock market. Notion’s stock price could fluctuate with respect to changing market sentiments.

7) Conclusion?

a. Notion fulfils the RUG stock selection criteria.

- R (Recovery) – Notion has fully recovered its operation in September 2019.

- U (Undervalued) – Notion’s current stock price is 14% below NTA, while its peers are traded at prices much higher than their NTAs.

- G (Growth) – All growth drivers combined (HDD, EBS, EMS); Notion targets a 3x increase in market capitalisation by 2024. If achieved, with a total outstanding 335,821,905 stock units and a PER of 15x, each Notion stock would be worth RM2.98 by 2024. Applying a sufficiently huge margin of safety of 50%, the stock would still be worth RM1.49 by 2024.

c. By investing in Notion, investors should expect business and market risks.

Is Notion a worthwhile investment? You decide.

This article is strictly for sharing purpose only.

There is no buy or sell recommendation.

Any constructive feedback is welcomed.

Thanks,

Another Perspective

https://klse.i3investor.com/blogs/anotherperspective/2020-01-19-story-h1482841839-NOTION_A_2020_Gem_Stock_that_fulfils_Mr_Fong_s_RUG_Criteria.jsp

上述为转贴,谢谢分享人。

以下为个人观点:

😂大戶看到物有所值,肯定大收藏了。最少3元的价值,notion有牌照口罩可外销欧美,迟点回教国家也会批准,外加科技业的確是錦上添花。在全民拥口罩与外国疫情严重下,这支股沒有三元都不用卖。

只是分享,買卖自负。

没有评论:

发表评论