这篇文章的理念与我接近,与大家分享-

网页取自;http://leo1300177.blogspot.com/

pwroot Q2业积只净利494万,4个月的业积来算是少了些,Q1+Q2共净利1428万,eps=4.7sen

个人估算全年净利Q1+Q2+Q3+Q4=3千出万,

EPS=10 SEN ,现RM1.48 ,PE=14.8倍交易是机会,

合理的PE=17倍,价位=RM1.70

Q2 股息3.5 SEN ,估计Q4股息4.5SEN ,全年共 8 sen,目前rm1.48进入,dy(周息率)=5.4%

是不错的选择,又有资本增长机会.我今天再加码rm1.45

前景;

----PWROOT债务只有1293万,现金有6266万,扣除后还有4973万,相等于每股16 sen的现金,

是净现金公司,因此有能力派出高息

----现价位rm1.46(估计今年8sen计算)周息率(dy)=5.4% ,深具吸引力.

--pwroot是行业中股价最低的,上市七年未发送红股,每年赚钱,现股价rm1.46 ,pe只是14.6倍 .(估计全年eps=10 sen)

--Cimb bank ceo 的弟弟(M0hamed nizam bin abdul razal)依然有2398,000 股(0.79%),

为第23大股东,也就是首相纳吉的胞弟,因此在某些决策上非常方便.

风险;1)原料价格--咖啡豆的价格起落对公司的净利有些影响,近期巴西干旱造成咖啡豆

的价格上升,其他产区如非洲,印尼也有出口咖啡豆,但相信很快可恢复正常的价格,

随着国内外销售的增长,可以抵消部分原材料上升造成的利润侵蚀,

必要时公司可提高产品售价,整体影响小。

2)滙率风险--对外貿易主要是用美元,随着美国经济好转,中長期美元走势看升,

公司的营销有3成多是出口部分,因此对公司有利。

3)经济风险--公司的产品大部分是走中价路线,是一般平民有能力消费的产品,

就算经济转差影响也是很小的。

4)政治风险--国内发生暴动机率小,外国如之前的埃及动乱,对公司的销售单造成

减少,但只是短期的影响,很快又恢复正常的销量了。

综合明白了这些风险,对公司所造成的伤害很小,因此,RM1.46是很好的进场机会.

目前的价格是抱着中長期的打算策略,须要多看Q3,Q4的情况而定,

个人进出价位不同,要看你的获得几多而定,自行考虑风险才决定.

只供参考,进出自负.

2014年11月30日星期日

分享ccbteoh兄的文章,谢谢他的功课(pwroot)--

大家好,我有一些看法想表达.关于pwroot的财务报告所有大大都讨论过了,但我想以“生意"的角度去研究.

其实早在看到余大的分享前,我已经在反弹区进货了.(现在暂时住了套T__T).因为我对这间公司一直有关注,也觉得很有信心。

关于other expenses的増加,我觉得有一部分是因为公司在开发新的产品,来开阔市场的需要.

请大家看最新的report, Per'l Xlim 是专注在女性市场的产品,含有Oligofructose和collagen。我也去google 了一下是什么东东来的.

总的来说,就是能够为女性达到减肥和美白效果的植物成分.

个人觉得其实管理团队是不错的.尤其在上面提到Focus on GCC and UAE的生意.大马一直以来和中东国家的生意来往是很好的,因为都是回教国的关系.想深一点,如果要大的市场,为什么不去专注人口大国如中国,印尼,印度?(虽然pwroot的确有sales去很多国家)我想这些地方都已经是红海一片,竞争激烈的地方.但是中东还是一个市场很新的区域,人口也不可小观.加上pwroot有 HALAL和ISO 的很多quality Assurance(请上他的网站看),回教信徒其实都很注重饮食有没有HALAL的。还有,世界上最多信徒的宗教,还是回教莫属。所以,我反而期待更多是在他的export市场,多过本地的市场.

最近我去AEON,Tesco,KKMArt ,MAMAK 等等的地方survey,的确感觉这个行业越来越竞争。连PAPArich也来出即溶咖啡了!加上来势凶猛的印尼老大KOPIKO,SUPER,少说也有10个Brand....也可以看到,ALICAFE的摆设,往往被忽略的摆在下面的劣等位。短期来看,我可以感觉是会很难有好成绩。。可是,我相信管理程的能力,可以突破这个过度期。因为我察觉,pwroot很会做Branding 和 Marketing Strategy.在竞争的行业尤其更加需要。小弟是做广告行业的,所以稍微有一些心得体会。。。比如说卖鸡饭,突然很多人开挡在你旁边,你要如何去和人竞争呢?如果拼价钱,大家到最后谁也占不到好处。。所以这时候,你要学会如何sale你的鸡饭,用故事来告诉顾客你的产品有什么特别。(如:我用的是kampung鸡。芽菜是Ipoh运来的 )然后用广告效应来卖。而且在大马,fnb 是很容易被人贪心忘旧的。就好象my kuali的白加哩面,刚开始的时候很风光,抢到断货,价钱直彪。渐渐产能越来越大时,反而消费者变得越来越冷淡了。现在就必须和old town合作关系,达到双嬴。。。当然亞发白咖啡的广告刚出时,也唱得大街小巷无人不晓,销量很好。不过当然也逃不过冷淡期,但是最重要的是管理程如何在想办法,开拓市场策略。而且,我很欣赏的是他们在ALICAFE 的市场行销成功。毕竟大马的友族同胞是最大的市场,亞发我倒觉得是他们探测市场的一部分而已。市场其实是需要时间和实验的,关键是找到对的人卖对的产品,而不只是单靠数量和资本雄厚吧了。Pwroot一直都有在强调,混合东南亚特产Herbs :Tongkat Ali and Kacip Fatimah (请在他的website看,都是为男女性加强性功能的

)然后用广告效应来卖。而且在大马,fnb 是很容易被人贪心忘旧的。就好象my kuali的白加哩面,刚开始的时候很风光,抢到断货,价钱直彪。渐渐产能越来越大时,反而消费者变得越来越冷淡了。现在就必须和old town合作关系,达到双嬴。。。当然亞发白咖啡的广告刚出时,也唱得大街小巷无人不晓,销量很好。不过当然也逃不过冷淡期,但是最重要的是管理程如何在想办法,开拓市场策略。而且,我很欣赏的是他们在ALICAFE 的市场行销成功。毕竟大马的友族同胞是最大的市场,亞发我倒觉得是他们探测市场的一部分而已。市场其实是需要时间和实验的,关键是找到对的人卖对的产品,而不只是单靠数量和资本雄厚吧了。Pwroot一直都有在强调,混合东南亚特产Herbs :Tongkat Ali and Kacip Fatimah (请在他的website看,都是为男女性加强性功能的  )在产品当中,比普通饮品多了保健作用。而且口味是很个人的,我们喝了觉得不好喝的产品,友族同胞可能可以接受,还要看销量数据才知道卖不卖得。

)在产品当中,比普通饮品多了保健作用。而且口味是很个人的,我们喝了觉得不好喝的产品,友族同胞可能可以接受,还要看销量数据才知道卖不卖得。

关于pwroot有不务正业的一面,我也有一套看法。他拥有Medan Multimedia sdn.bhd 的 50%,进军电影业也是有策略的。其实一整年的广告制作费是很庞大的数目,尤其是公司外包给广告公司。通过半收购投资multimedia公司,一来可以减少很多cost,二来又能透过本地艺人在制作电影的过程中达到宣传的效果。(当然那些电影是很烂一下-___-|||),何乐而不为呢?。。。。。关于pwroot在地产的发展,我觉得也只是占营业额一小部分而已,可以在年报的other income 看到,只是小数目,还不至于不误正业,最多是贪赚额外钱。

Anyway,这只是我的看法。不是要叫大家买或賣,我自己也是套牢了.但是我不后悔不埋怨,如果以后事实证明我的看法是错的,就认了它。只是在这里做个分享记录,让以后的朋友交流学习.套句冷眼大师的话:

1)如果一只股票在你买入后,你还有信心加码吗?

我的答案:是 。但短期会继续留意大势走向,和继续观察公司每一季的财报和业绩。我这次犯的错误 就是过于乐观,在PE还没够便宜的时候就入场,以为来临的业绩会很好。。结果估计错误.

我也是打工一族而已,赚钱也不容易。被套捞的股当然也心疼,不过还不至于悲观.希望将来pwroot不会带我去Holland咯 哈哈!也谢谢各位大大在这里的分享。

--大馬的即溶咖啡市場如今由雀巢咖啡、舊街場(OLDTOWN,5201,主板貿服組)的舊街場白咖啡以及PWROOT公司(PWROOT,7237,主板消費品組)的阿發白咖啡所引領。

--pwroot rm1.51 机会进场,成长与价值股.

--pwroot 为

其实早在看到余大的分享前,我已经在反弹区进货了.(现在暂时住了套T__T).因为我对这间公司一直有关注,也觉得很有信心。

关于other expenses的増加,我觉得有一部分是因为公司在开发新的产品,来开阔市场的需要.

请大家看最新的report, Per'l Xlim 是专注在女性市场的产品,含有Oligofructose和collagen。我也去google 了一下是什么东东来的.

总的来说,就是能够为女性达到减肥和美白效果的植物成分.

个人觉得其实管理团队是不错的.尤其在上面提到Focus on GCC and UAE的生意.大马一直以来和中东国家的生意来往是很好的,因为都是回教国的关系.想深一点,如果要大的市场,为什么不去专注人口大国如中国,印尼,印度?(虽然pwroot的确有sales去很多国家)我想这些地方都已经是红海一片,竞争激烈的地方.但是中东还是一个市场很新的区域,人口也不可小观.加上pwroot有 HALAL和ISO 的很多quality Assurance(请上他的网站看),回教信徒其实都很注重饮食有没有HALAL的。还有,世界上最多信徒的宗教,还是回教莫属。所以,我反而期待更多是在他的export市场,多过本地的市场.

最近我去AEON,Tesco,KKMArt ,MAMAK 等等的地方survey,的确感觉这个行业越来越竞争。连PAPArich也来出即溶咖啡了!加上来势凶猛的印尼老大KOPIKO,SUPER,少说也有10个Brand....也可以看到,ALICAFE的摆设,往往被忽略的摆在下面的劣等位。短期来看,我可以感觉是会很难有好成绩。。可是,我相信管理程的能力,可以突破这个过度期。因为我察觉,pwroot很会做Branding 和 Marketing Strategy.在竞争的行业尤其更加需要。小弟是做广告行业的,所以稍微有一些心得体会。。。比如说卖鸡饭,突然很多人开挡在你旁边,你要如何去和人竞争呢?如果拼价钱,大家到最后谁也占不到好处。。所以这时候,你要学会如何sale你的鸡饭,用故事来告诉顾客你的产品有什么特别。(如:我用的是kampung鸡。芽菜是Ipoh运来的

关于pwroot有不务正业的一面,我也有一套看法。他拥有Medan Multimedia sdn.bhd 的 50%,进军电影业也是有策略的。其实一整年的广告制作费是很庞大的数目,尤其是公司外包给广告公司。通过半收购投资multimedia公司,一来可以减少很多cost,二来又能透过本地艺人在制作电影的过程中达到宣传的效果。(当然那些电影是很烂一下-___-|||),何乐而不为呢?。。。。。关于pwroot在地产的发展,我觉得也只是占营业额一小部分而已,可以在年报的other income 看到,只是小数目,还不至于不误正业,最多是贪赚额外钱。

Anyway,这只是我的看法。不是要叫大家买或賣,我自己也是套牢了.但是我不后悔不埋怨,如果以后事实证明我的看法是错的,就认了它。只是在这里做个分享记录,让以后的朋友交流学习.套句冷眼大师的话:

1)如果一只股票在你买入后,你还有信心加码吗?

我的答案:是 。但短期会继续留意大势走向,和继续观察公司每一季的财报和业绩。我这次犯的错误 就是过于乐观,在PE还没够便宜的时候就入场,以为来临的业绩会很好。。结果估计错误.

我也是打工一族而已,赚钱也不容易。被套捞的股当然也心疼,不过还不至于悲观.希望将来pwroot不会带我去Holland咯 哈哈!也谢谢各位大大在这里的分享。

--大馬的即溶咖啡市場如今由雀巢咖啡、舊街場(OLDTOWN,5201,主板貿服組)的舊街場白咖啡以及PWROOT公司(PWROOT,7237,主板消費品組)的阿發白咖啡所引領。

--pwroot rm1.51 机会进场,成长与价值股.

--pwroot 为

清真股;http://www.sc.com.my/wp-content/uploads/eng/html/icm/sas/sc_syariahcompliant_141128.pdf

2014年11月26日星期三

[转帖] 人不成熟的五個特徵!!!不成長永遠無法向上爬…

pwroot 于4-11-2014 rm1.78 ,之后公布Q2后 26-11-2014 下降

至 rm 1.52 ,你看还有下降的机会吗?机遇小,pwroot 最高价为rm2.44,

巳下降近90 sen,因此我昨天又加码了,机会不常有,善用手中资金,使资本增值最大化.

心动不如行动,继续加倉--

Client code / name : ER KONG SENG

Remisier : ENK

Type Contract No Stock Cd Price Quantity Amount Delivery Dt Payment Dt

Purchase B411PG01948700 PWROOT 1.50 26/11/2014 26/11/2014

想登上山峰,要問那些爬到山頂的人,

千萬不能問沒有爬過山的人。

這裡不是說別人的建議不要去聽,

你可以去參考,但是你要記住,

你做這個事是為了實現你的夢想,實現你自己的價值。

這才是最重要的!

以上人不成熟的五個特徵,我們自己去對照,

哪一個特徵是自己有的,一定要在最短的時間裡改正。

只要你相信你自己能夠戰勝自己的不成熟,

至 rm 1.52 ,你看还有下降的机会吗?机遇小,pwroot 最高价为rm2.44,

巳下降近90 sen,因此我昨天又加码了,机会不常有,善用手中资金,使资本增值最大化.

心动不如行动,继续加倉--

Client code / name : ER KONG SENG

Remisier : ENK

Type Contract No Stock Cd Price Quantity Amount Delivery Dt Payment Dt

Purchase B411PG01948700 PWROOT 1.50 26/11/2014 26/11/2014

[转帖] 人不成熟的五個特徵!!!不成長永遠無法向上爬…

Author: Tan KW | Publish date: Wed, 26 Nov 11:10

人不成熟的五個特徵!!!不成長永遠無法向上爬…

(網路文章 圖片來源:newshtml.iheima.com)

你做老闆,你做生意,你開店,你做夜場,你辦廠,你做服務業,等等,

不管你做那一行,看完這篇文章,理解透了,就等於你清華大學 MBA 畢業了····

人不成熟的第一個特徵:就是立即要回報

他不懂得只有春天播種,秋天才會收穫。

很多人在做任何事情的時候,剛剛付出一點點,馬上就要得到回報。

(學鋼琴,學英語等等,剛開始就覺得難,發現不行,立即就要放棄。)

很多人做生意,開始沒有什麼成績,就想著要放棄,

有的人一個月放棄,有的人三個月放棄,有的人半年放棄,有的人一年放棄,

我不明白人們為什麼輕易放棄,

但是我知道,放棄是一種習慣,一種典型失敗者的習慣。

所以說你要有眼光,要看得更遠一些,眼光是用來看未來的!

對在生活中有放棄習慣的人,有一句話一定要送給你:

"成功者永不放棄,放棄者永不成功"。

那為什麼很多的人做事容易放棄呢?

美國著名成功學大師拿破崙希爾說過: 窮人有兩個非常典型的心態:

1、永遠對機會說:“不”;

2、總想“一夜暴富”。

今天你把什麼機會都放到他的面前,他都會說“不”。

就是今天你開飯店很成功,你把你開飯店的成功經驗,

發自內心的告訴你的親朋好友,讓他們也去開飯店,

你能保證他們每個人都會開飯店嗎?是不是照樣有人不干。

所以這是窮人一個非常典型的心態,他會說:“你行,我可不行!”。

一夜暴富的表現在於,你跟他說任何的生意,

他的第一個問題就是“掙不掙錢”,你說“掙錢”,

他馬上就問第二個問題“容易不容易”,你說“容易”,

這時他跟著就問第三個問題“快不快”,你說“快”!

這時他就說“好,我做!”

呵呵,你看,他就這麼的幼稚!

大家想一想,在這個世界上有沒有一種: “又掙錢,又容易,又快的”,

沒有的,即使有也輪不到我們啊,所以說在生活中,我們一定要懂得付出。

那為什麼你要付出呢?

因為你是為了追求你的夢想而付出的,人就是為了希望和夢想活著的,

如果一個人沒有夢想,沒有追求的話,那一輩子也就沒有什麼意義了!

在生活中你想獲得什麼,你就得先付出什麼。

你想獲得時間,你就得先付出時間,你想獲得金錢,你得先付出金錢。

你想得到愛好,你得先犧牲愛好。

你想和家人有更多的時間在一起,你先得和家人少在一起。

但是,有一點是明確的,你在這個項目中的付出,將會得到加倍的回報。

就像一粒種子,你把它種下去以後,然後澆水,施肥,鋤草,殺蟲。

最後你收穫的是不是幾十倍,上百倍的回報。

在生活中,你一定要懂得付出,你不要那麼急功近利,馬上想得到回報,

天下沒有白吃的午餐,你輕輕鬆松是不可能成功的。

一定要懂得先付出!

人不成熟的第二個特徵:就是不自律

不自律的主要表現在哪裡呢?

一、不願改變自己:

你要改變自己的思考方式和行為模式。你要改變你的壞習慣。

其實,人與人之間能力是沒有多大區別,區別在於思考方式的不同。

一件事情的發生,你去問成功者和失敗者,

他們的回答是不一樣的,甚至是相違背的。

我們今天的不成功是因為我們的思考方式不成功。

一個好的公式是:當你種植一個思考的種子,你就會有行動的收穫,

當你把行動種植下去,你會有習慣的收穫,當你再把習慣種植下去,

你就會有個性的收穫,當你再把個性種植下去,就會決定你的命運。

但是如果你種植的是一個失敗的種子,你得到的一定是失敗,

如果你種植的是一個成功的種子,那麼你就一定會成功。

很多人有很多的壞習慣,如:看電視,打麻將,喝酒,泡舞廳,

他們也知道這樣的習慣不好,但是他們為什麼不願意改變呢?

因為很多人寧願忍受那些不好的生活方式,也不願意忍受改變帶來的痛苦。

二、願意背後議論別人:

如果在生活中,你喜歡議論別人的話,有一天一定會傳回去,

中國有一句古話,論人是非者,定是是非人。

三、消極,抱怨:

你在生活中喜歡那些人呢?

是那些整天愁眉苦臉,整天抱怨這個抱怨哪個的人?

還是喜歡那些整天開開心心的人?

如果你在生活中是那些抱怨的,消極的人的話,你一定要改變你性格中的缺陷。

如果你不改變的話,你是很難適應這個社會的。你也是很難和別人合作的。

生活當中你要知道,你怎樣對待生活,生活也會怎樣對待你,你怎樣對待別人,別人也會怎樣對待你。

所以你不要消極,抱怨。

你要積極,永遠的積極下去,

就是那句話:成功者永不抱怨,抱怨者永不成功。

人不成熟的第三個特徵:經常被情緒所左右

一個人成功與否,取決於五個因素:

(1)學會控制情緒

(2)健康的身體

(3)良好的人際關係

(4)時間管理

(5)財務管理

如果你想成功,一定要學會管理好這五個因素,

為什麼把情緒放在第一位呢?把健康放在第二位呢?

是因為如果你再強的身體,如果你情緒不好,就會影響到你的身體,

現在一個人要成功 20% 靠的是智商,80% 靠的是情商,

所以你要控制好你的情緒,情緒對人的影響是非常大的。

人與人之間,不要為了一點點小事情,就暴跳如雷,這樣是不好的。

所以在生活中,你要養成什麼樣的心態呢?

你要養成 “三不”,“三多”:

不批評、不抱怨、不指責;多鼓勵、多表揚、多讚美。

你就會成為一個受社會大眾歡迎的人。

如果你想讓你的伙伴更加的優秀,很簡單,永遠的激勵和讚美他們。

即使他們的確有毛病,那應該怎麼辦呢?

這時是不是應該給他們建議,在生活中你會發現有這樣一個現象,

有人給別人建議的時候,別人能夠接受,但是有建議的時候別人就會生氣。

其實建議的方式是最重要的,就是“三明治” 讚美,建議,再讚美!

想一想,你一天讚美了幾個人,

有的人可能以為讚美就是吹捧,就是拍馬屁。

讚美和吹捧是有區別的,讚美有四個特點:

(1)是真誠的

(2)是發自內心的

(3)被大眾所接受的

(4)無私的

如果你帶有很強的目的性去讚美,那就是拍馬屁。

當你讚美別人時候,你要大聲的說出來,

當你想批評別人的時候,一定要咬住你的舌頭!

人不成熟的第四個特徵:不願學習,自以為是,沒有歸零心態

其實人和動物之間有很多的相似之處,動物的自我保護意識比人更強(嬰兒與小豬)

但是,人和動物最大的區別在於,

人會學習,人會思考。

人是要不斷學習的,你千萬不要把你的天賦潛能給埋沒了,

一定要學習,一定要有一個空杯的心態。

我們像誰去學習呢?就是直接向成功人士學習!

你要永遠學習積極正面的東西,不看,不聽那些消極,負面的東西。

一旦你吸收了那些有毒的思想,它會腐蝕你的心靈和人生的。

在這個知識經濟的時代裡,學習是你通向未來的唯一護照。

在這樣一個速度,變化,危機的時代,

你只有不斷的學習你才不會被這個時代所拋棄,

一定要有學習,歸零的心態。

去看每一個人的優點,“三人行,必有我師也”!

人不成熟的第五個特徵:做事情不靠信念,靠人言。

我們說相信是起點,堅持是終點。

很多人做事不靠信念,喜歡聽別人怎麼說。

對自己所做的事業,沒有100%的信心。

相信和信念是兩個不同的概念:相信是看得見的,信念是看不見的。

很多人做事不靠信念,喜歡聽別人怎麼說。

對自己所做的事業,沒有100%的信心。

相信和信念是兩個不同的概念:相信是看得見的,信念是看不見的。

很多人做事,不是靠信念,而是要聽別人怎麼說,這是不對的。

信念是人類的一種態度,為了夢想而不斷地堅持的態度,

我們做事情一定靠信念去支持我們一直走下去,

而不要輕易聽信別人的話而中途放棄。

信念是人類的一種態度,為了夢想而不斷地堅持的態度,

我們做事情一定靠信念去支持我們一直走下去,

而不要輕易聽信別人的話而中途放棄。

想登上山峰,要問那些爬到山頂的人,

千萬不能問沒有爬過山的人。

這裡不是說別人的建議不要去聽,

你可以去參考,但是你要記住,

你做這個事是為了實現你的夢想,實現你自己的價值。

這才是最重要的!

以上人不成熟的五個特徵,我們自己去對照,

哪一個特徵是自己有的,一定要在最短的時間裡改正。

只要你相信你自己能夠戰勝自己的不成熟,

你就會逐漸地成長,成熟起來,

你就會得到你想要的那種生活,你就會實現你的人生夢想!

浅谈PWROOT 7237 力之源的笫2季业绩--

--Q2业积只净利494万,4个月的业积来算是少了些,Q1+Q2共净利1428万,eps=4.7sen ,

派息3.5sen ,算是安慰了,但从報告中显示公司的债务于30-9-14 减少至1293万(30~5~14 为2113万).

扣除债后现金有4973万(30~5~14为4672万),细看之下是改善了 ,守住等待下半年的佳积.

--从同行oldtown Q2业积仍然有11m,生产成本影响小,pwroot 应是其他支出多(暫时的),如抽奬,广告等,

消费情绪好,中低价位产品大众化,现价位1,52反而是机会进.

--老板今天从 rm1.50~1. 52 買回股票 637.000,都说了rm1.48是底线,至今共累计1660.000的股票,

很明显市场太慌了,公司依然充滿希望,股东信心買回足以见證,幸福的未來看的到,准備继续加码 .

--己进入超賣了(rsi=8),長线投资者可以行动了.

--PWROOT公司現透過子公司Power Root成功打開35個國際市場,

令海外市場佔總營業額比重下降至31%。(之前是35%),国内佔69%

--PWROOT债务只有1293万,现金有6266万,扣除后还有4973万,相等于每股16 sen的现金,

是净现金公司,因此有能力派出高息.

--产业发展费用己达2973万,由2013年6月的報告,共计64间的店铺己出售47间,相信另17个单位至今也完全出售,

每个单位售价约马币80万,共计5120万,取赚副25-30%计可得1280-1536万,贡献每股净利为4.2-5 SEN

这些收益会在2015年的财政年显示,因此,现在RM1.52是机会进场,幸福的未来己看到.

只供参考,进出自负.

--

分享JIMMYT兄的解读--

--原料开销没增加很多吧。原料开销42967(这季的42.71%;上季好像是41.96%)

-- 营业额也增加了不少吧。也有推出3种新品牌。暂时性的开销增大。如果未来中东的销售很好呢,还是有机会增加盈利的。

-- 行政开销花了 40,222 (现季营业额的39.98%;上次没记错是32.99%),的确增加了很多;不过个人觉得事出必有因吧。 集团展望也有说会维持致力做市场宣传和完成阿拉伯国的行销链;

以及专注GCC国家的出口.

--展望也有说本地市场疲弱,竞争强;她去了中东,个人偏见觉得更好,伊xx人嘛可以多个老婆,也喜欢多老婆,tongkat ali对他们来说是宝。哈哈

2014年11月25日星期二

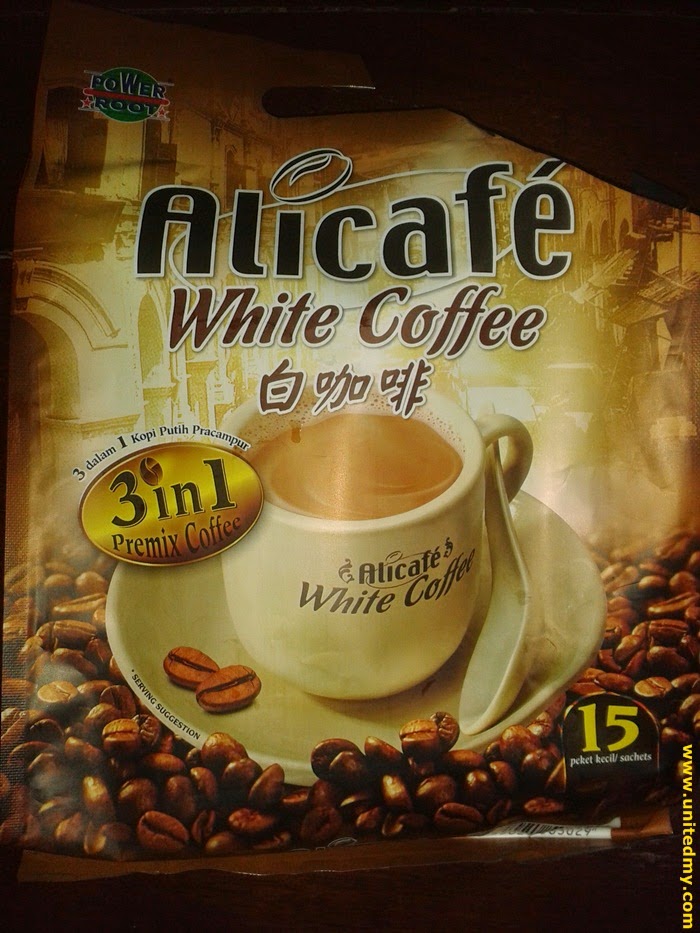

转自Roberts兄;Power Root Alicafe is product of Malaysia--

Robert's Google+

Energize your day with one cup hot Alicafe today. Go to work carry a smile

- Product : Alicafe White Coffee, Power Root

- Calories : 40g or one sachets = 189 KCAL for , 28g Carbohydrate, 1.5g Protein, 7.5g Fat

- Net Weight : 40g x 15 sachets

- Status : Halal , Made in Malaysia, ISO9001, HACCP, GMP, ISO 22000:2005

- Manufacturer : Power Root Manufacturing Sdn Bhd

- Flavor : White coffee

- Value (2014) : RM 13.90 (Giant)

- Imported by : Nil

- Website : www.powerroot.com.my

- Phone : 07-386-6688

The above chart acted as reminder for you that one should maintain their weight and advised not to consume exceeding 2000 KCAL a day. A cup of Alicafe is about 200KCAL.

Besides Nestle Nescafe, Alicafe is preferable choice for everyday coffee in Malaysia. Most of you do not know that it is under the company Power Root. The company is so successful they decided to have it public listed to enable Malaysian invests some of their hard earned cash for a profitable return. The share is currently RM 2.39 per share on July 8, 2014.

The success of the company does reflect people trusted this company. It has to be clear this company are holding various beverage and one of them is Alicafe. Moreover, power root have been mass campaigning to the local. You must be familiar with their slogan "Anda boleh jadi Jutawan " . A rise and fall of the company very much depend on their marketing strategy.

It is true that Alicafe is made in Malaysia. However, the price tag said a different story. Look at the price tag of a Nestle Nescafe which is an international brand is relatively lower than the a pack of 15 sachets Alicafe. You could prove me wrong with that statement but I am not seeing a big difference in the price tag.

|

| Sorry for the upside down image |

Despite that, Alicafe sachets is much bigger in size. A 40g of white coffee powder inside. The normal Nestle Nescafe or Nestle Milo has a smaller size compared to Alicafe sachets. If you do the math right, you would know that Alicafe, Nestle's Nescafe and Nestle Milo have no big gap in thier price tag. Why would not Alicafe become much cheaper ??

My personal review on Alicafe is that it not that sweet even though there were 40g powder. It has a cream taste. It worth a try !!

If you do not like prepare yourself, there are readily available Alicafe in nearest local stores. Grab one of them today !!

Categories: Coffee, Food and Beverage, Made in Malaysia, malaysia product, Power root, White Coffee

转贴;东南亚传统药物制造商的灵方妙药--

在雅加达的雨天里,一个像Emi这样的街边小贩能卖出两打的包装草药感冒药Tolak Angin给患有感冒的上班族及工人。

Emi说:“草药对人的身体有益,因为它是天然的东西。”包含姜、丁香和薄荷叶的Tolak Angin的售价为每包0.25美元也对这个行业有利:生产Tolak Angin的公司于上周挂牌上市,其市值大约为8亿5,000万美元。

印尼公司PT Industri Jamu dan Farmasi Sido Muncul(以下简称“Sido Muncul”)的股价于2013年12月18日上市时上升了多达24%,Sido Muncul是第一家在雅加达上市的草药生产公司。随着中国的同行目前正以溢价交易,Sido Muncul这只新加入市场的东南亚传统药品股票将可在投资兴趣浓烈的情况下增长。

包括辉瑞(Pfizer)和罗氏制药集团(Roche Holding AG)等全球制药商早已确认亚洲为未来的增长来源。东南亚的传统药品市场也将会蓬勃起来,因为区域内的中等收入群越来越注重健康。

研究公司欧瑞国际(Euromonitor International)表示,声称可医治从风湿以至性功能障碍等疾病的东南亚传统药品的市值估计将在2017年之前增加至39亿美元,比今年的市值高出近50%。

虽然传统药品的成份标榜为天然元素,并在亚洲拥有悠久历史,但它们并不受到全球认可。例如,英国的健康监管机构已警告,一些传统药品的水银含量非常高,而动物保护组织也说一些药品的成份取自濒临绝种的动物。

然而,除了Tolak Angin (意思指抵抗寒风)的生产商之外,区域内的企业如新加坡的余仁生国际(Eu Yan Sang International)和马来西亚的Power Root都吸引到了投资者的注意。

余仁生国际和Power Root的股价分别以18.75倍及15.05倍的最新盈利交易。这远低于中国8家传统药品生产商的76.38平均倍数(根据汤森路透StarMine的数据)。

朝阳工业

Sido Muncul的Tolak Angin包装为鲜黄色,主要是通过印尼的当红明星在电视上作广告宣传。Tolak Angin在印尼多个路边摊、超市和药房售卖。

Sido Muncul的Tolak Angin包装为鲜黄色,主要是通过印尼的当红明星在电视上作广告宣传。Tolak Angin在印尼多个路边摊、超市和药房售卖。

Sido Muncul这家公司的名称意思是“实现的梦想”,它成立于1940年,刚开始由Rahmat Sulistio和其三名助手在中爪哇的日惹(Yogyakarta)以小本经营。

70多年以后,该公司推出首次公开售股(IPO)计划,获得11.4倍的超额认购。以Sido Muncul最新的交易价计算,其市值约为8亿5,000万美元。

Sido Muncul的掌舵人Irwan Hidayat (Sulistio的孙子)告诉路透社,Sido Muncul过去几年的年销售增长平均为10%左右,并希望推出含有草药的新饮品。公司计划动用大约8,700亿印尼盾(7,200万美元)的IPO收益来开发新产品及提高产能。

Hidayat在接受访问时说:“这是一个朝阳行业。如果谈到健康,总是会有需求。而印尼拥有许多的天然资源,因此原料供应不成问题。”

新加坡的私募股权公司Northstar Group 的联合创办人Patrick Walujo表示,他青睐由消费推动增长的印尼业务。他说:“含有草药的药品可能需要作出调整才能出口,但这个行业十分具吸引力。”一些传统药品生产商已经在海外市场拥有大量业务。

新加坡的余仁生国际方面,来自香港的收入占47%(截至9月的三个月),新加坡的收入占22%,其余收入则由马来西亚和澳洲的业务贡献。

余仁生国际的旗舰产品为传统中药,包括医治经痛的白凤丸和帮助孩童改善胃口不佳和其他疾病的保婴丹。目前掌管余仁生国际的第四代传人余义明说:“华人现在有能力购买更多昂贵的药材。整体而言,全球对天然保健十分感兴趣。”

余仁生国际的主要股东为余仁生的家族成员,安本资产管理(Aberdeen Asset Management) 则透过一家亚洲子公司持有余仁生国际12%以上的股份。

Power Root的表现飞进

在马来西亚,Power Root生产可帮助男性展现雄风的饮品东革阿里(Tongkat Ali)。Power Root截至2013年2月的税后盈利为3,530万令吉(1,090万美元),比去年同期多出逾一倍。

在马来西亚,Power Root生产可帮助男性展现雄风的饮品东革阿里(Tongkat Ali)。Power Root截至2013年2月的税后盈利为3,530万令吉(1,090万美元),比去年同期多出逾一倍。

其股价今年已上涨了超过60%,表现优于吉隆坡综合指数的9%升幅。Power Root表示,由于出口至中东及北非等市场的货品更强劲,其盈利升高。它也计划把业务拓展至东南亚。

但是,传统药品业已受到全球保健监管机构的密切监督。一些药品的多种成份被疑含有高量的毒素或化学品,尽管它们标榜为天然元素。今年8月,英国一家监管机构警告人们不要使用一些未经许可的传统中药,因为这些中药的铅、水银及砷(arsenic)含量极高,达到危险水平。

一些传统中药也受到动物保护组织的抨击,因为它们的成份取自濒临绝种的动物如熊胆、鳄鱼鞭和鹿茸。

世界自然基金会(WWF)的印尼保护总监Nazir Foead在发给路透社的电邮中提到:“我们要求消费者避免使用由濒临绝种动物部位制成的药品。市面上还有许多不会对生物多样性造成威胁的其他药物。”

在雅加达商业区摆摊的Emi指出,客户经常购买Sido Muncul的Tolak Angin来储备。无论是白领或蓝领,年轻或年长,许多人都说他们偏好大型制药公司生产的感冒药。

她说:“如果Tolak Angin含有化学成份,我担心我的身体将会受损,因为我自小就饮用它来治感冒。”

转贴;亚发白咖啡进入中国市场--

| 亚发白咖啡进入中国市场 |

| 栏目:原创 加入时间:2014-03-12 17:06:15 来源: |

中国市场推出其主打产品亚发白咖啡。Power Root公司成立于1999年7月23日, 总部位于马来西亚柔佛新山,成功打造了Alicafe、Alitea、Oligo、Per’l、亚发等 诸多享誉海内外市场的品牌,成为马来西亚咖啡饮品领导品牌之一。2007年5月成功在 马来西亚股票交易所上市。Power Root公司旗下另一咖啡品牌啡特力已经在 中国市场销售多年,这次亚发白咖啡的强势推出,将掀起又一白咖啡竞争浪潮。 亚发白咖啡选用上等咖啡豆及特殊的烘焙工艺,其包装是马来西亚当地人的形象设计, 现市场推出四种口味,其中包括特浓、经典、低脂及低脂无添加蔗糖。目前在华联吉买盛、 农工商及世纪联华有售。 |

订阅:

博文 (Atom)