1)购美佳资产.无承担债务.金狮工业强化钢铁地位

Sinchew Fri, Jul 06, 2018

(吉隆坡5日讯)金狮工业(LIONIND,4235,主板工业产品组)指出,该公司收购美佳钢铁(Megasteel)旗下的扁钢资产,将得以扩大旗下钢铁生产范畴,包括扁钢产品,同时可以较低的投资成本,加强在大马钢铁工业的地位。

透过这项收购,该公司业务扩展至扁钢业务,每年约可生产320万公吨热轧钢卷及70万公吨冷轧钢卷。

该公司澄清,有关计划只是纯粹收购扁钢资产,没有承接美佳的任何债务或赔偿责任。

此项建议是由金狮工业进行协商的交易,该公司对收购担保资产的价格是5亿3773万令吉,而卖主2017年6月30日提出的是19亿4786万令吉(已稽查)净账面价值及2018年4月30日提出的18亿3914万令吉(未稽查)净账面价值。

金狮工业相信,此建议将能够为集团未来的盈利做出正面的贡献。

2)

Building materials and construction services will not be subject to the Sales and Service Tax (SST), Finance Minister Lim Guan Eng said today. (File pix)

PUTRAJAYA: Building materials and construction services will not be subject to the Sales and Service Tax (SST), Finance Minister Lim Guan Eng said today.

He said this will be a departure from the Goods and Services Tax (GST) regime, which applied a six percent levy on basic building materials such as bricks, cement and sand, among others.

“This had led to increased construction costs under the GST era, including an increase in house prices.

“The pressure on house prices, as well as industrial and commercial buildings, is expected to ease with the abolition of the GST and exemption of the SST,” he said in a statement, adding that materials which will be exempted include iron, cement and other materials.

Lee added that the federal government hopes that construction costs will therefore be reduced, and that both developers and buyers will benefit from the reduced tax burden.

Customs director-general Datuk Seri Subromaniam Tholasy had previously said that the SST comprises three categories: zero per cent, five per cent and 10 per cent, with most goods falling into the zero per cent category (or being zero-rated).

The SST will be implemented on Sept 1. On Aug 1, the GST website was converted to an SST website and featured a list of zero-rated goods.

3)

3)

LIONIND – The massive 900,000 ton Hot Briquetted Iron (HBI) Plant 100% EXPORT at PE = 1

Author: FutureEyes | Publish date:

To appreciate this article, it is important for readers to understand the difference between Iron making and Steel making.

"Part 1" is the only hardest part, once you understood this all others will be like kacang putih!

You will then be a Steel Guru for life.

PART 1: The simple Iron Making process and how the spike in Scrap Iron price against Iron Ore makes HBI producer the ultimate winner?

PART 2: The turnaround in Lion’s HBI plant in 2017 and what will happen in 2018 considering raw material-Iron ore price is declining and product HBI price sky-rocketing with Scrap Iron?

PART 3: Strong supporting facts for the possibility of above 60 cents EPS derivation in Part 2 , 2nd scenario.

PART 4: What could other Steel making plants of Lionind offer on EPS going forward?

PART 5: Concluding statement

at the best of my knowledge,

FutureEyes

4)

"Part 1" is the only hardest part, once you understood this all others will be like kacang putih!

You will then be a Steel Guru for life.

PART 1: The simple Iron Making process and how the spike in Scrap Iron price against Iron Ore makes HBI producer the ultimate winner?

For a layman to understand one can view their difference in terms of Carbon content. From Iron Ore (having the highest carbon content), Iron Making plants works to produce intermediate products Iron having lesser Carbon content suitable for further processing to make Steel.

IRON ORE (very high carbon content) --> IRON (high carbon content) --> STEEL (very low carbon content)

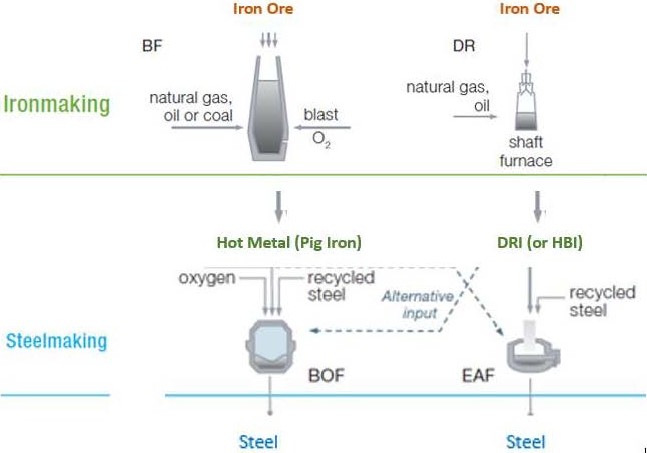

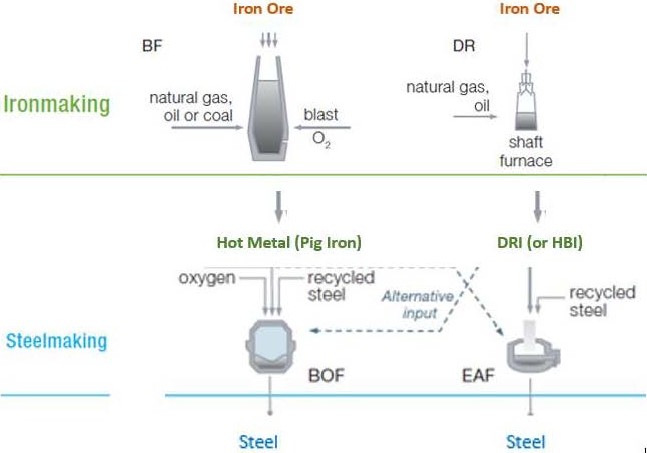

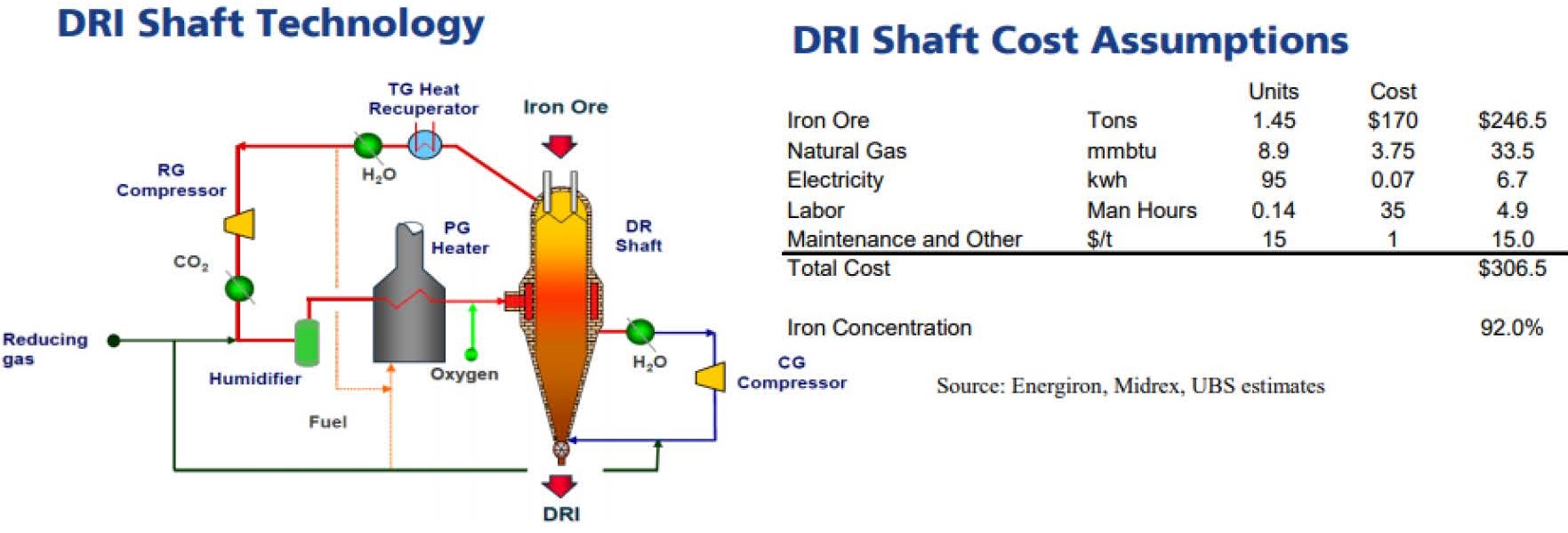

Schematic Diagram for Ironmaking and Steelmaking below:

You need to memorize the above, this is the only hardest thing in this article!

this is the only hardest thing in this article!

Once you have done that, you can proceed to the below sections.

1.1: THE IRON MAKING

Referring to the above schematic diagram Iron making plants can be divided into 2 types:

1. Blast Furnace (BF) , shown at top left above

2. Direct Reduced Iron (DR), shown at top right above

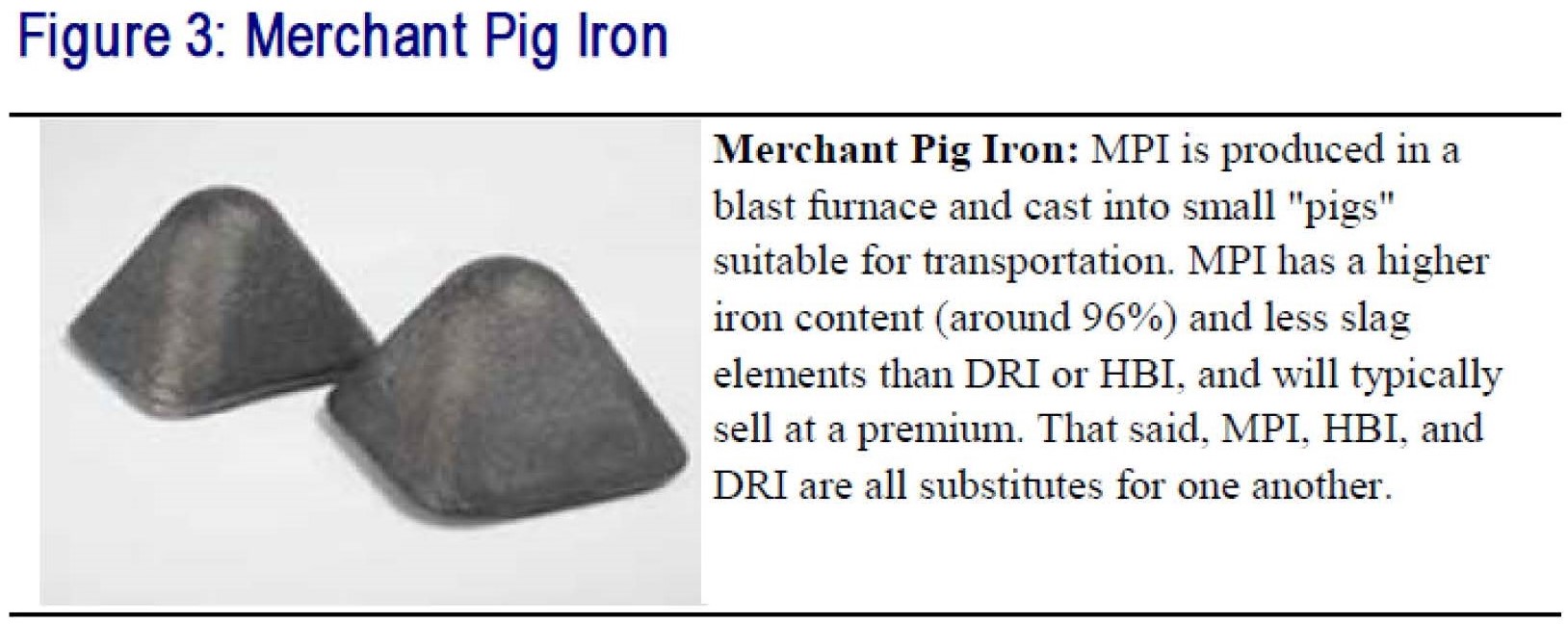

BF plant uses Iron Ore, Coal and Natural Gas to produce Iron referred as Hot Metal and in transportable form is called Pig Iron, whereas

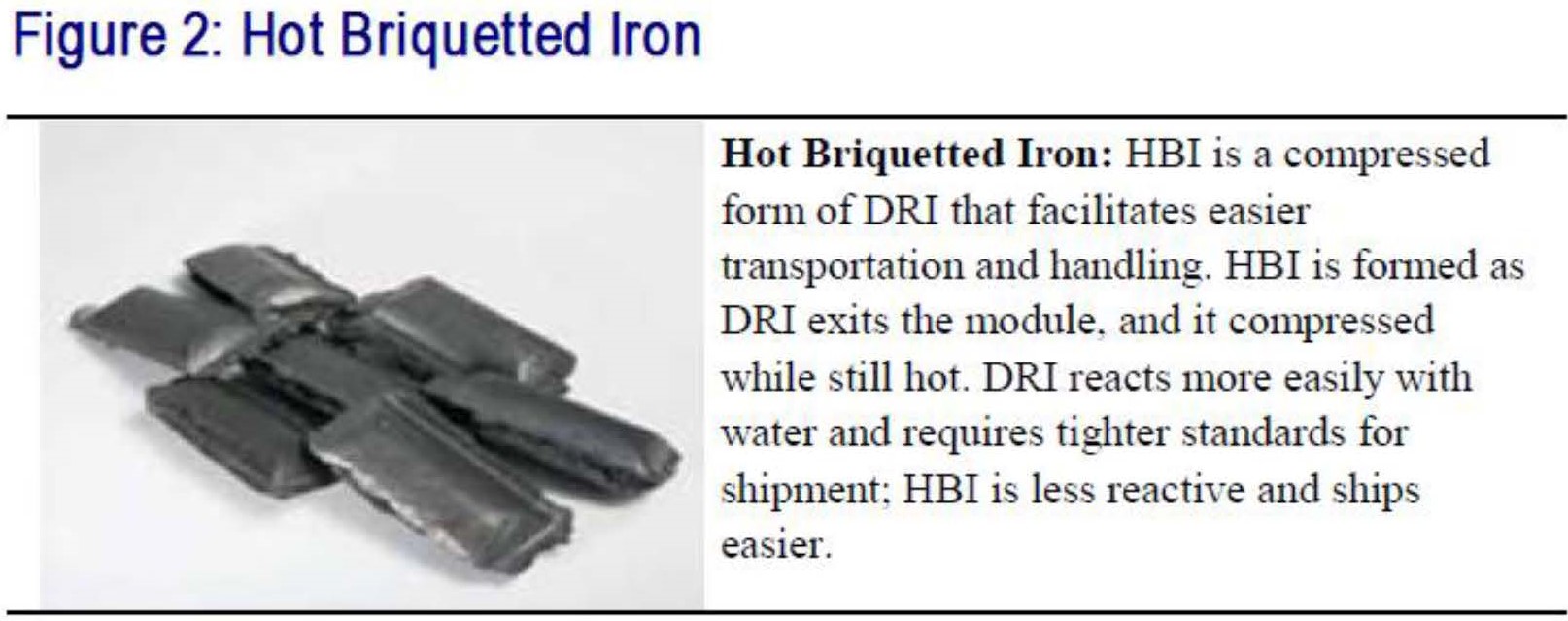

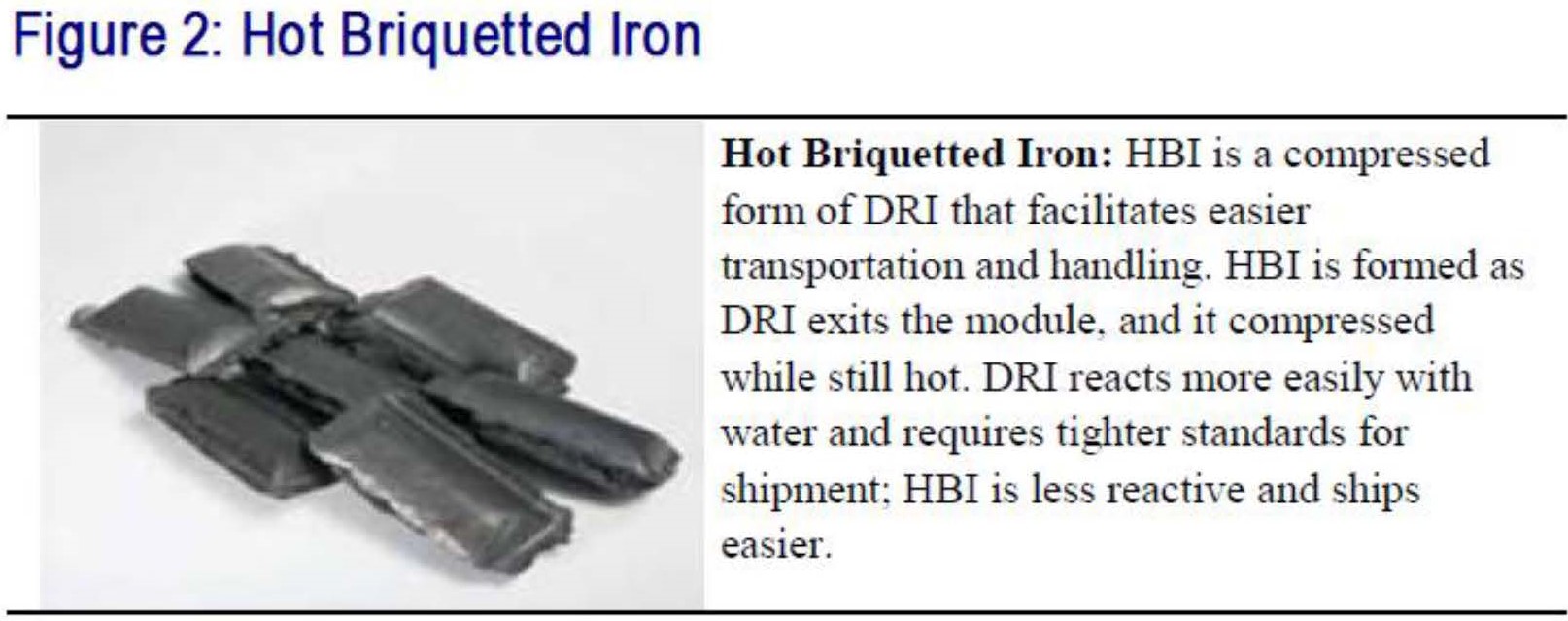

DR plant uses only Iron Ore and Natural Gas to produce DRI, and in a compacted premium form for Export shipment it is called as Hot Briquetted Iron (HBI).

The major difference in their process is that BF actually melts the Iron Ore using Coal in the process of removing its Carbon while DRI as the name itself says, it ‘reduces the carbon content’ without melting ‘directly’ using energy from Natural Gas only without Coal usage.

Images of BF products Pig Iron:

Images of DR products HBI:

The only Malaysian manufacturer who makes Iron via BF route is ANNJOO and via DRI route is LIONIND. The rest of the manufacturers do not even make Iron but Steel with their raw material being Scrap Iron mixed with certain fraction of these DRI and Pig Irons.

1.2 : THE STEEL MAKING:

Referring to the schematic diagram, briefly for Steel making all the reader needs to know now is that:

1. For BOF method, their raw material is Hot Metal (Pig Iron in liquid molten form)

2. For EAF method, their raw material is Scrap Iron (recycled steel) and substitutes such as Pig Iron and Direct Reduced Iron referred as HBI if imported via sea shipment

These 3 materials - referred as Irons, compete among each other as raw material in Electric Arc Furnace (EAF) Steel making plants.

EAF is the current trend in Steel Making process in China to reduce pollution emissions for Environmental reason as it only uses Electricity to melt them.

The Basic oxygen furnace (BOF) method does not have ability to melt Iron. This process (BOF) must be combined with Blast Furnace Iron Making to receive the Pig Iron in hot molten form referred as Hot Metal as its raw material.

Since Blast Furnace (BF) uses Iron Ore & Coal combustions as raw material, it causes significant pollution, as such this method is discouraged and were the targets of steel capacity reduction in China. The same applies to Natural Gas combustion to produce DRI/HBI.

These factors had contributed to selective demand for Scrap Iron instead of Iron Ore (which is the raw material for Blast Furnace) and had caused significant spike in Scrap Iron price and reduced demand for Iron Ore and Coke.

Note: we had already witness Huaan’s recent results due to this.

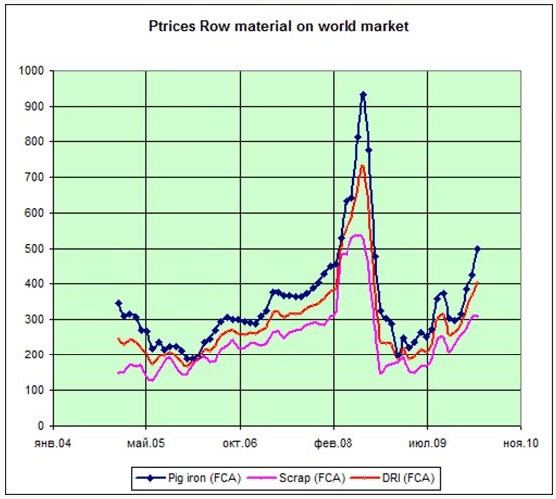

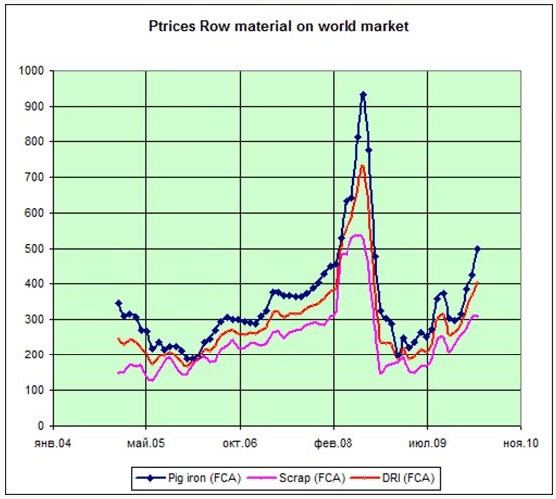

The same factor above had caused the regional price of Scrap Iron competitors, Pig Iron and DRI to shoot up significantly.

PART 2: The turnaround in Lion’s HBI plant in 2017 and what will happen in 2018 considering raw material-Iron ore price is declining and product HBI price sky-rocketing with Scrap Iron?

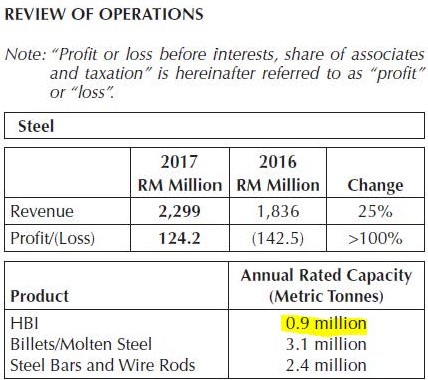

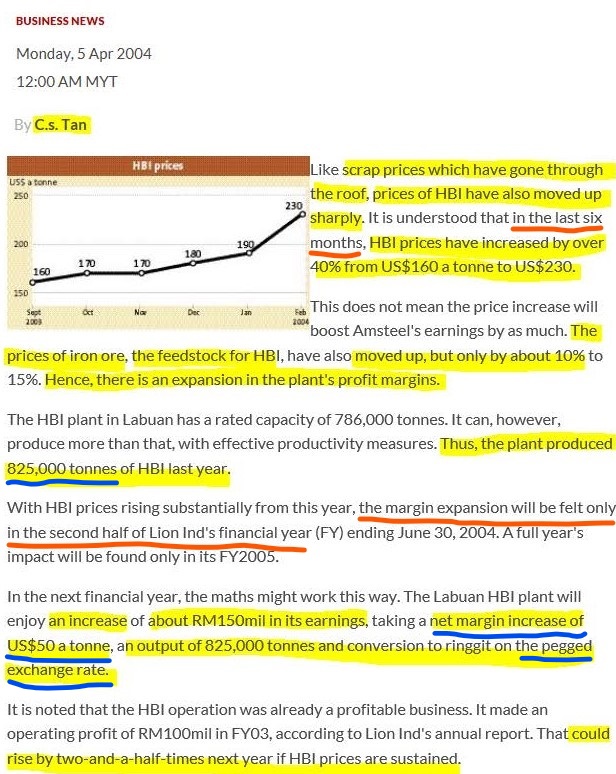

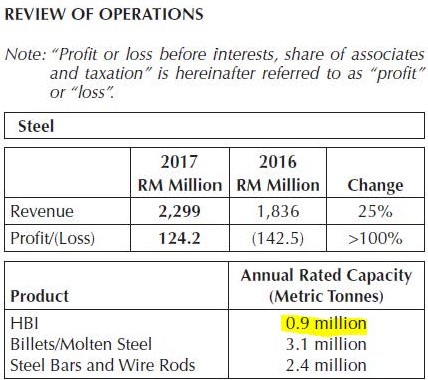

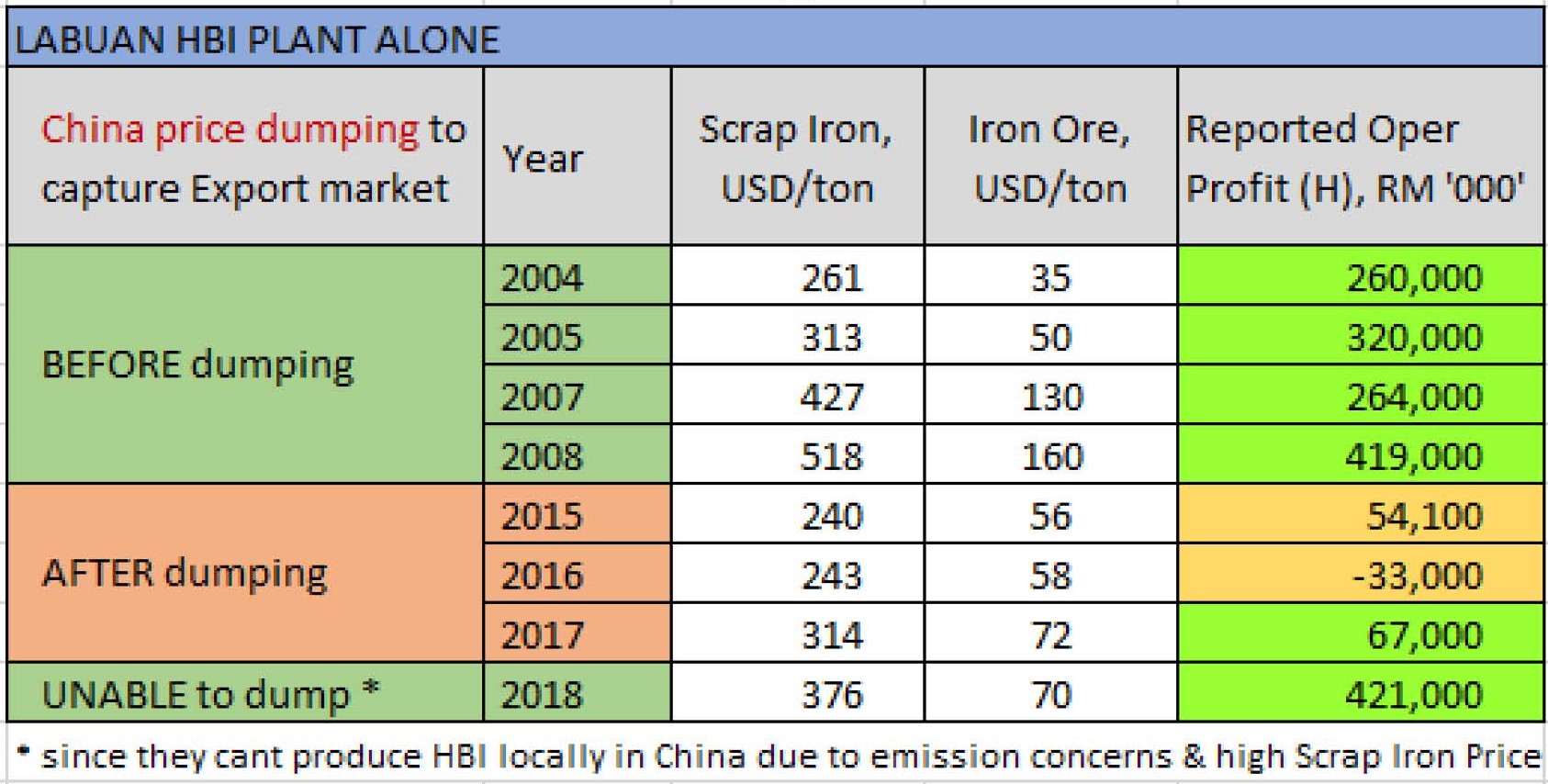

The Labuan HBI plant has a rated capacity of 900,000 tons HBI per annum. During the time before China’s dumping of export steel, the plant used to operate at 92% of its capacity at 825,000 tons per annum (refer table in annual reports and TheStar news in 2004 provided below):

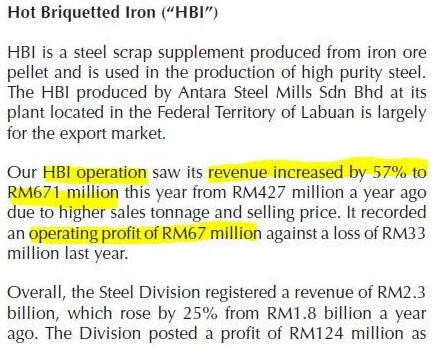

Extract from 2017 AR, page 40:

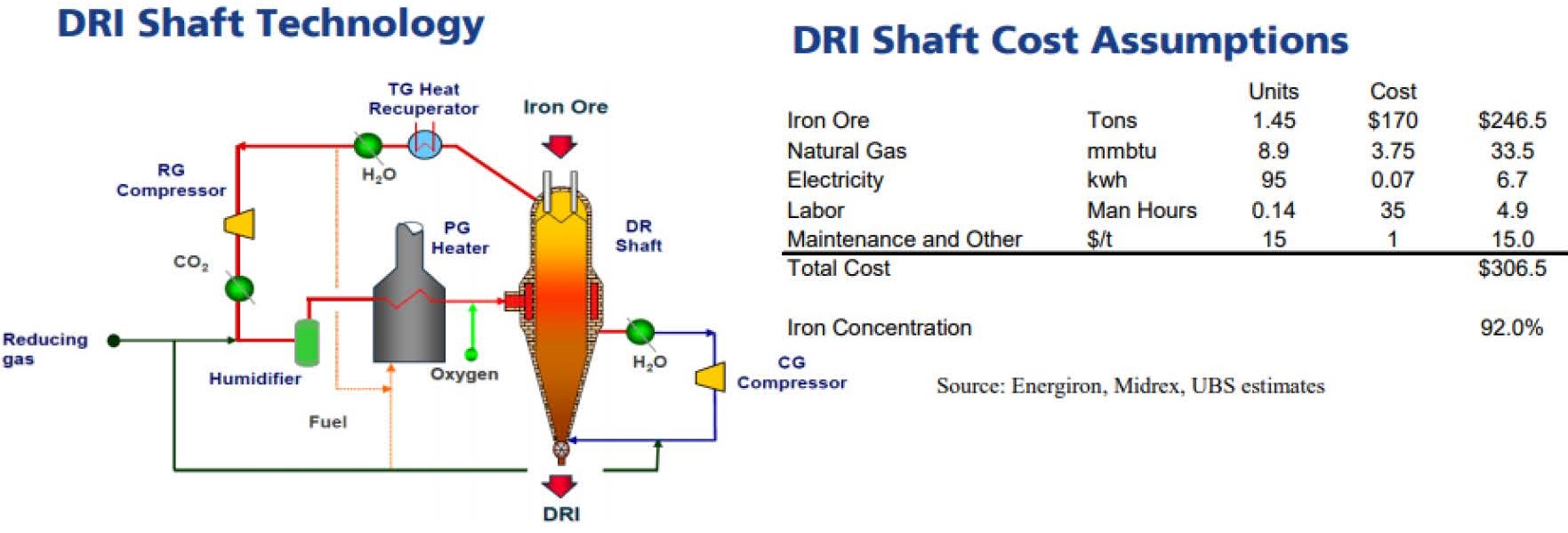

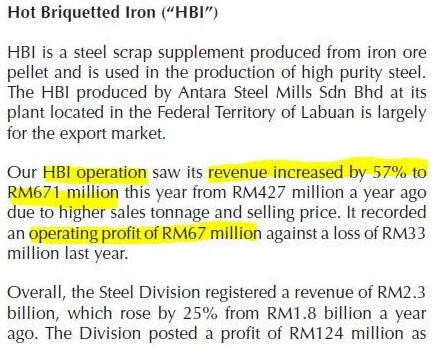

The technology employed is Midrex as shown by the links below. We can see what is the Cost of production of DRI the un-compacted form of HBI as per below link and snapshot from Page 5:

The amount of Iron Ore, Natural Gas and Electricity required per ton production of HBI is fixed for any process.

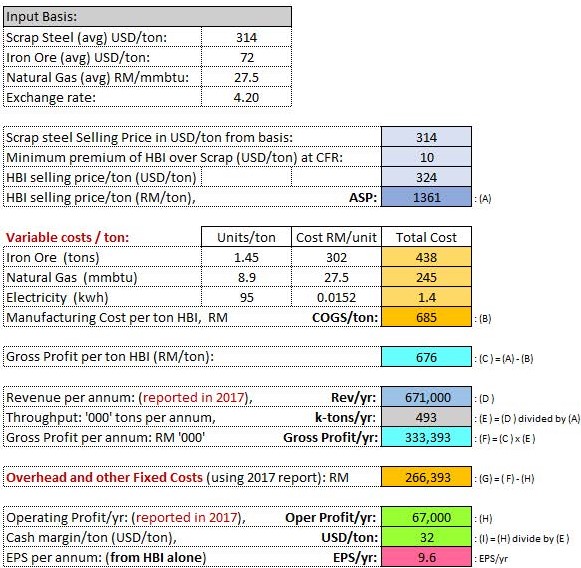

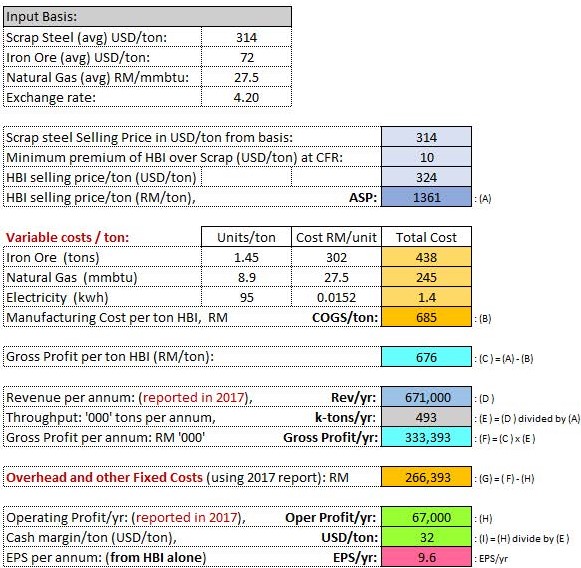

As such, using the above same Midrex technology employed by Antara Labuan plant, we can derive the following Costs of Production (refer Table 1 below) and Gross Margin per ton based on the Reported Revenue and Operating Profit of 671M and 67M respectively in 2017.

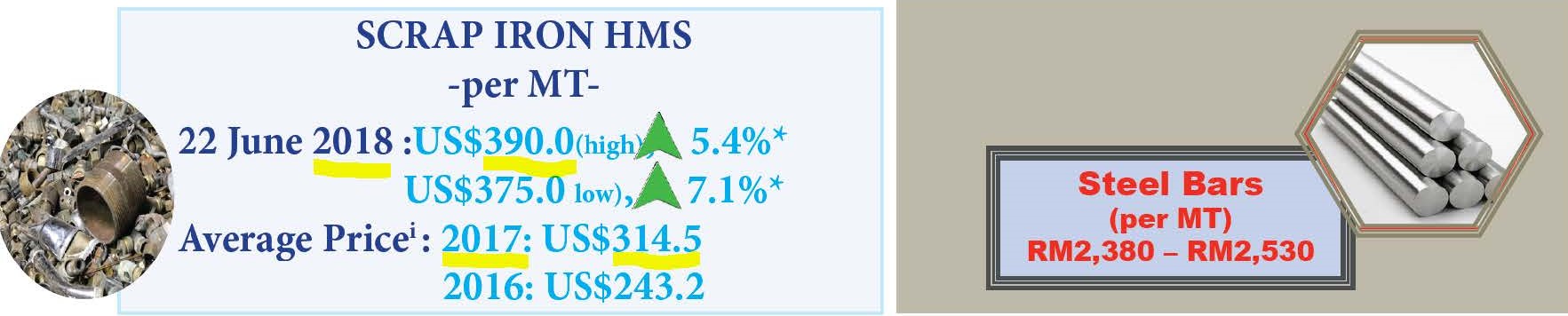

From Miti publications linke below, we could obtain the following:

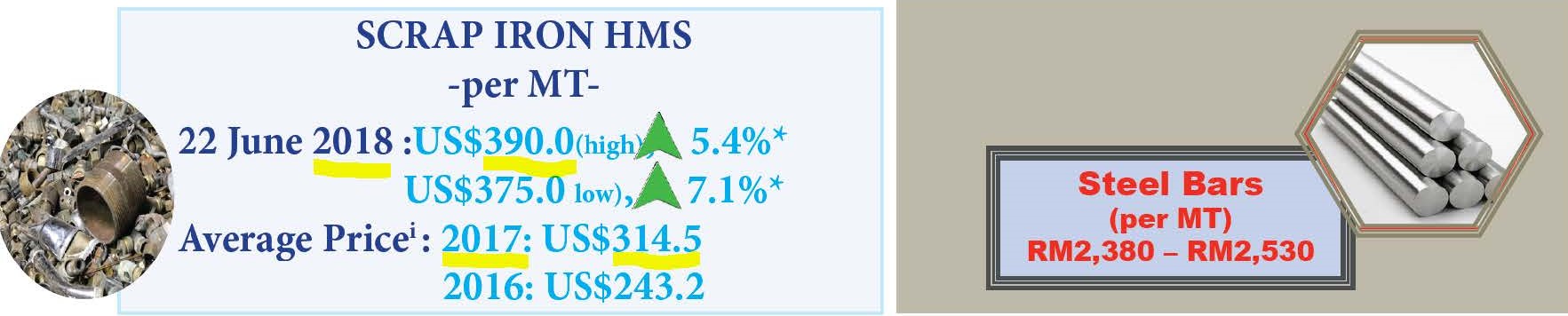

Average Scrap Iron price in 2017 : 314 USD/ton

Average Scrap Iron price in 2018 : 376 USD/ton todate ( a rise of 62 USD/ton!)

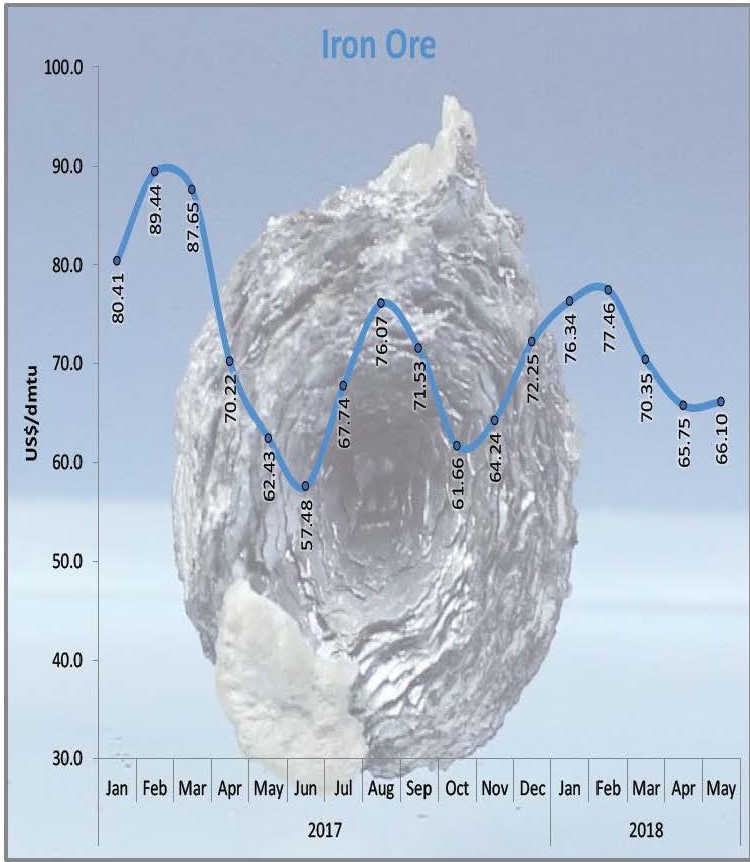

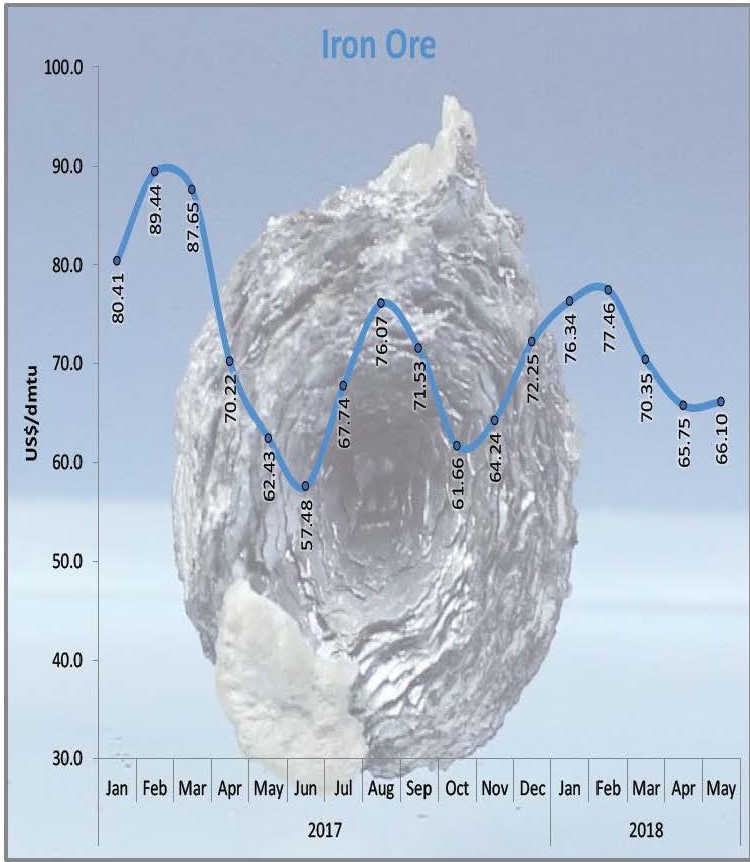

Average Iron Ore price in 2017 : 72 USD/ton

Average Iron Ore price in 2018 : 70 USD/ton todate ( a decline of 2 USD/ton)

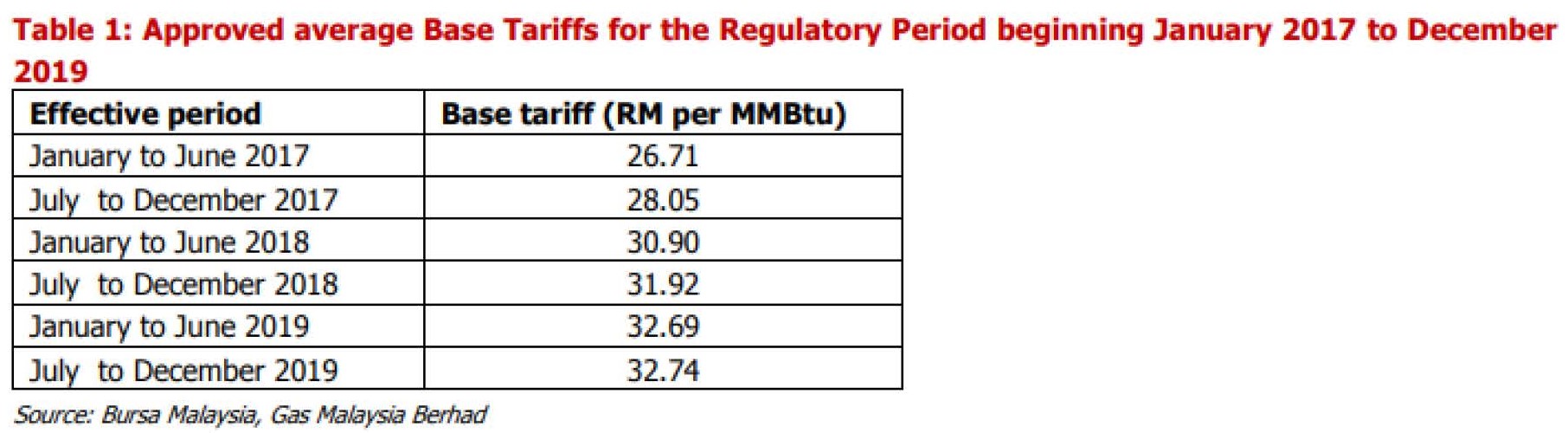

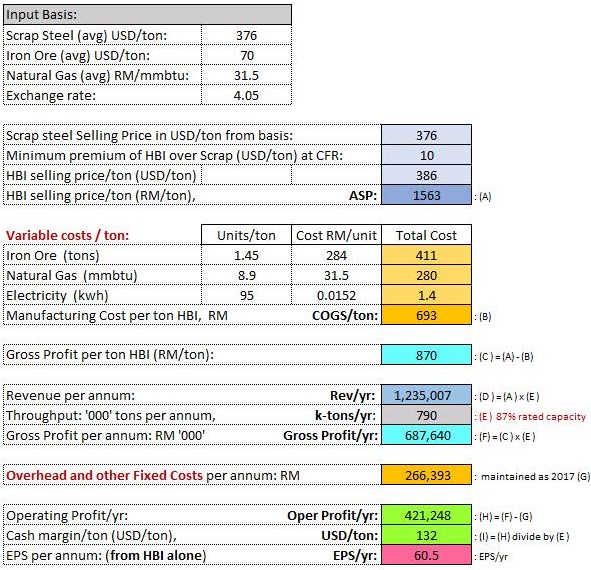

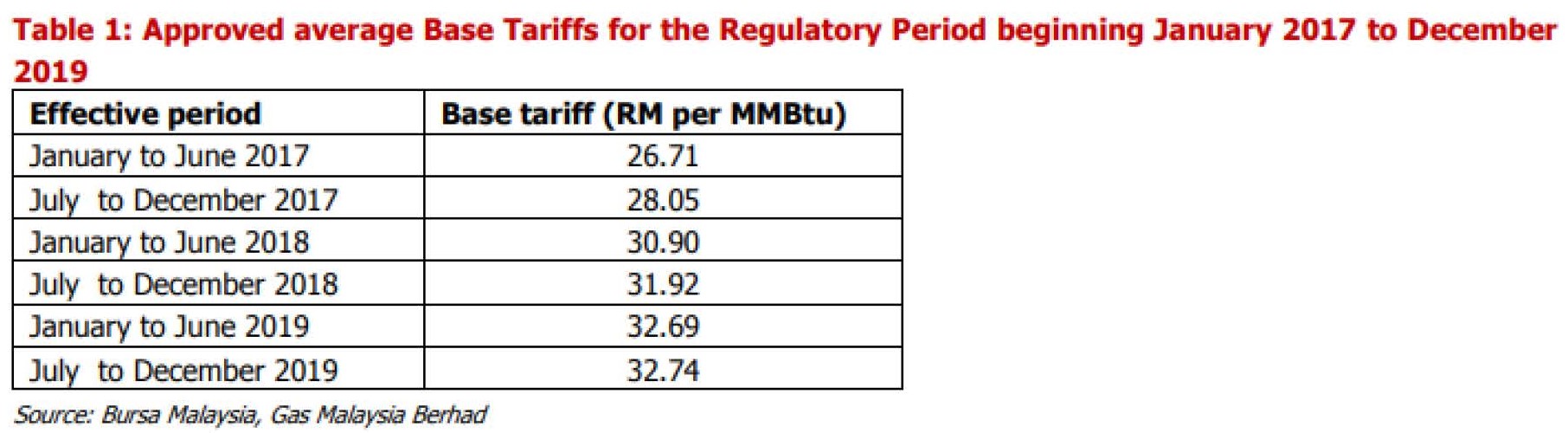

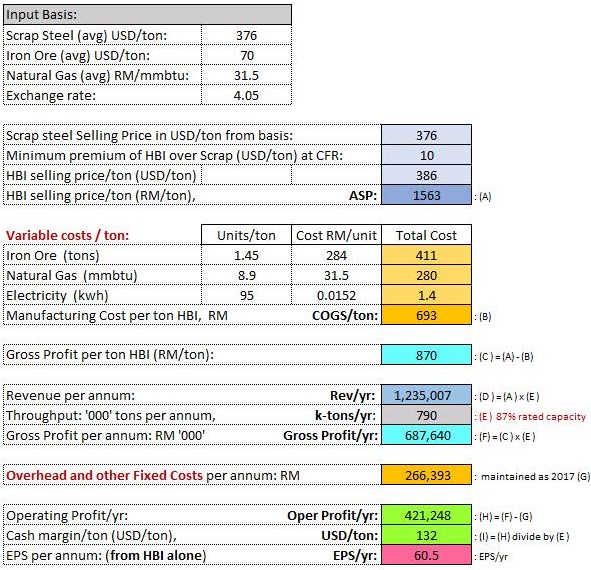

Natural Gas was RM 27.5/mmbtu and expected to rise to RM 31.5/mmbtu average in 2018.

The above figures were used as inputs on the below Table 1 to derive all other parameters which are self explanatory.

Table 1: Actual 2017 performance of HBI plant, Labuan:

Note that we can derive the throughput achieved in 2017 (refer (E) on Table 1, if we know the Average Selling Price of HBI which we can estimate to be at a premium against Scrap Iron average price during the year.

From the below link and chart, we know HBI is a premium form of raw material for the Electric Arc Furnace (EAF) steel making plants to produce much higher quality steel. HBI always sells at a higher price than Scrap Iron ~ 10 USD/ton:

Refer chart below extracted from this link: http://www.urm-company.com/production/dri

I

With that we can approximate the Average Selling Price (ASP) of HBI in 2017 as derived on Table above as RM 1361/ton.

The throughput is simply the reported Revenue of 671M divided by the ASP above, giving = 493 tons for 2017

The COGS using the reported raw material price was, RM 685/ton with Iron Ore average cost of 72 USD/ton.

Refer snapshots on MITI publications below showing the Input Basis on above Table 1:

http://www.miti.gov.my/index.php/pages/view/3060?mid=73

Using the same throughput derived above for 2017, let us see the implication on Gross Profit in 2018 with current Scrap Iron price and rise in Natural Gas and Exchange rate as per below:

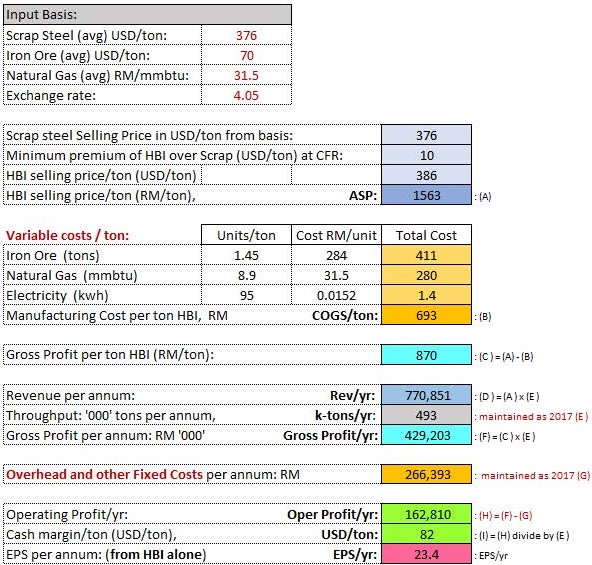

In 2018 Scrap Iron had moved to an average of 376 USD/ton with Iron Ore averaging at 70 USD/ton. Natural Gas cost used were based on scheduled hike implemented by government above at average of RM31.5/mmbtu.

2018 1st Scenario Table: Maintained Throughput at 493 tons/yr

We would be easily achieving an EPS of 24 cents from this HBI alone!

Meaning you can assume all other plants in west Malaysia ceased operation, and yet it would be trading at PE = 3 with the Labuan Export product.

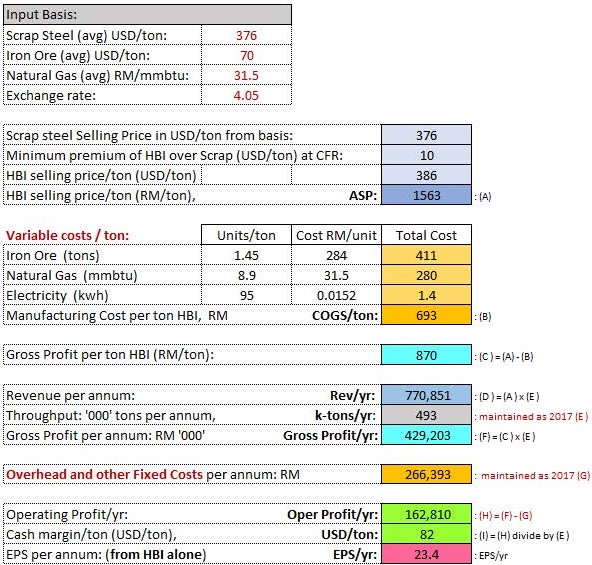

Now what happens if the throughput is risen to just 87% rated capacity at 790,000 tons/annum instead of their usual 92% at 825,000 ton/annum as reported during 2004 maintaining all other parameters the same:

2018 2nd Scenario Table: Raised throughput to 790 tons/yr

That is 60 cents from this HBI alone. All they need to do is raise their throughput to 87% utilization!

Or hope for Malaysian ringgit to depreciate further

PART 3: Strong supporting facts for the possibility of above 60 cents EPS derivation in Part 2 , 2nd scenario.

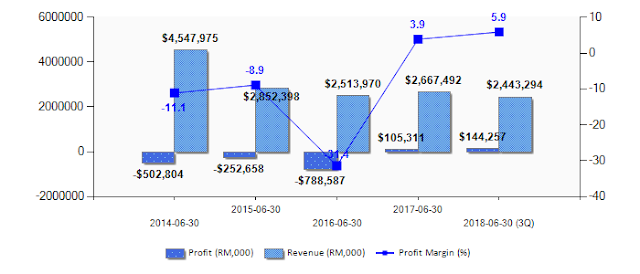

3.1 Historical performance of HBI plant:

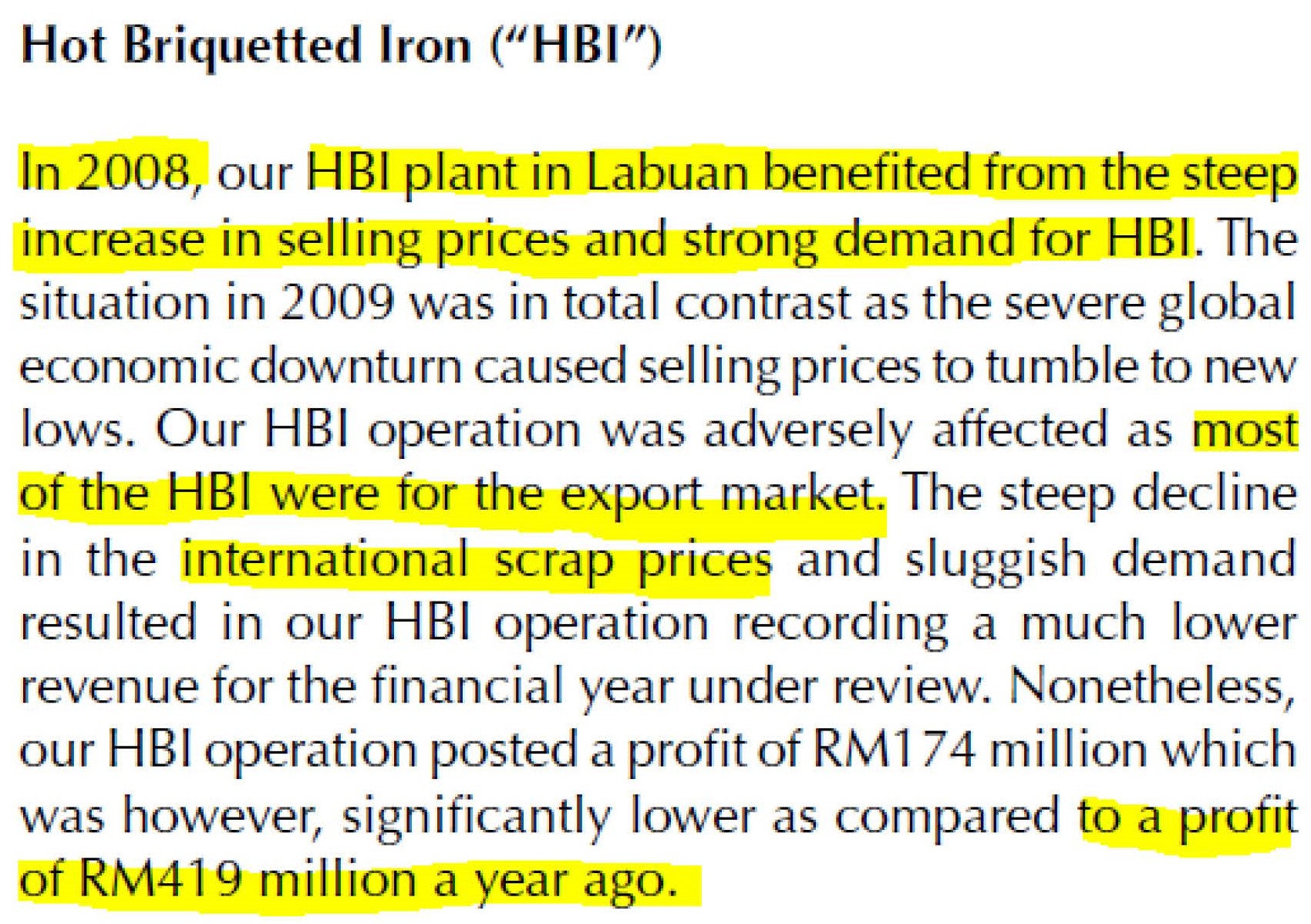

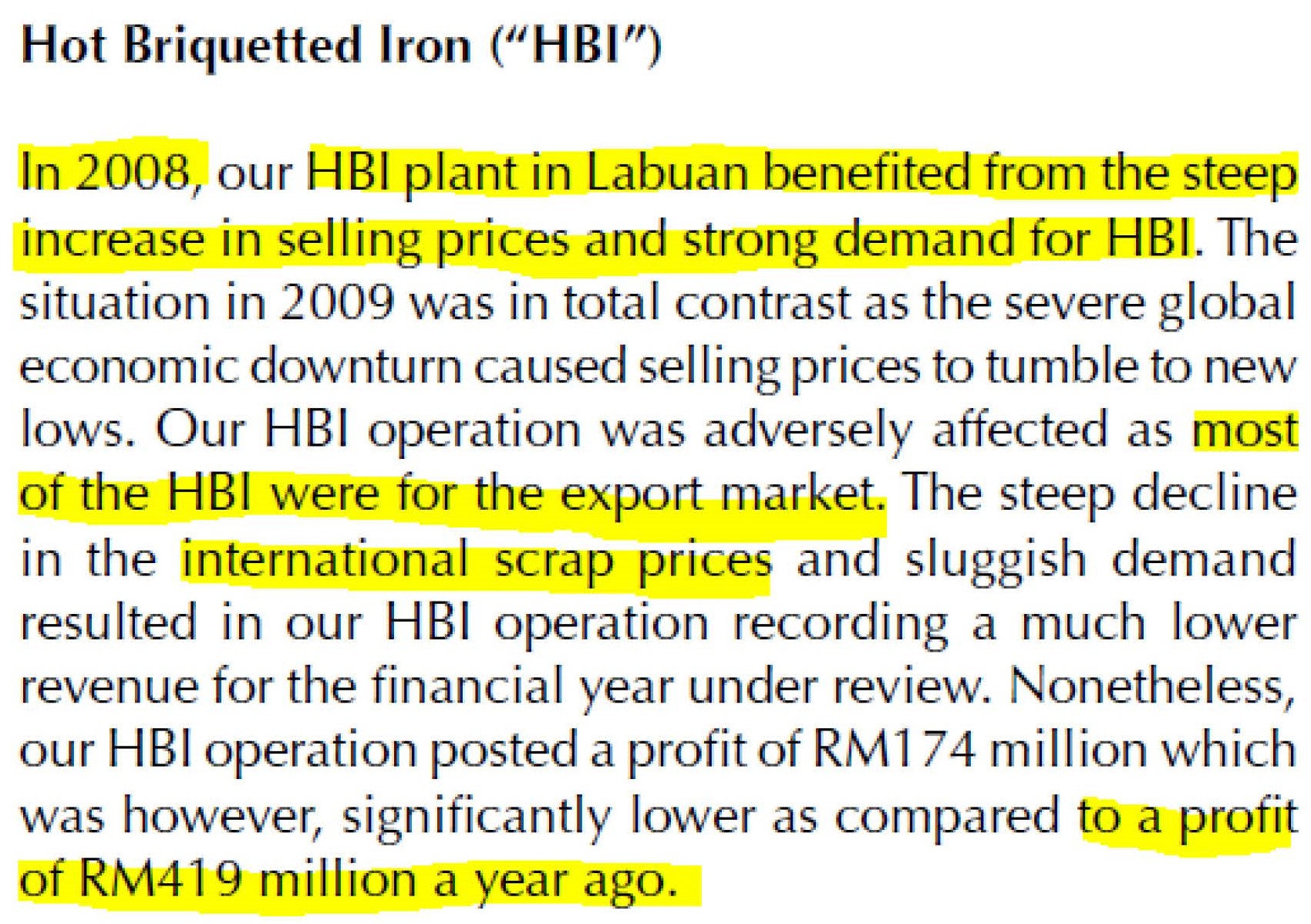

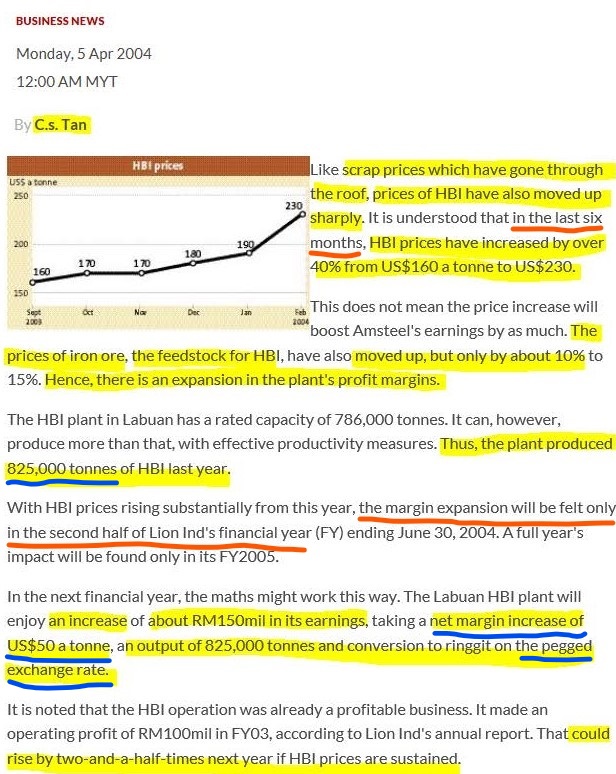

We can see from numerous annual report data the HBI plant used to report such fantastic earnings. Refer 2009 annual report extract below which shows it had reported a Profit of 419 million in 2008:

Actual Operating profit of HBI plant alone, reported on their Annual Report 2004 till 2008 before China dumping is shown in Table below which is self-explanatory:

The Scrap Iron prices were obtained from historical publishing. Note if one goes through these annual reports, operation at 90% of its rated capacity was a norm before China dumping.

Lionind HBI plant earnings deteriorated after the Chinese steel dumping activity. 2017 is the year of turnaround

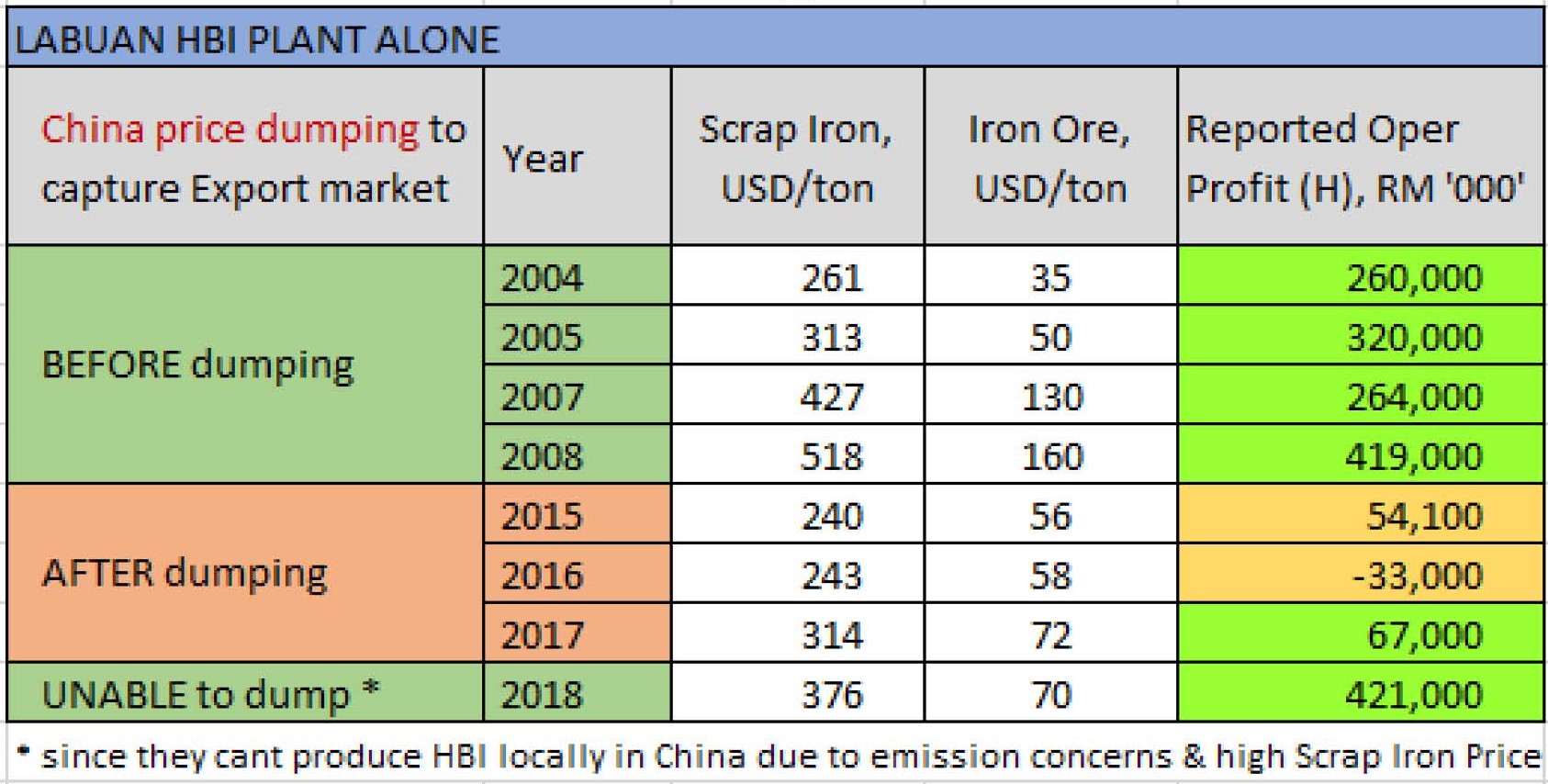

3.2 Case study on what happened in 2004 for such spectacular earnings:

It has all to do with Scrap Iron differential against Iron Ore!

We can see from below news in 2004 the Scrap Iron cost had shot up.

See the TheStar news in 2004 by C.S Tan below which validates the rise in HBI price together with Scrap Iron above.

Please read and understand every word mentioned by C.S Tan on the above news in 2004, 14 years ago!!

And do go through MITI publications on Scrap Iron price for last 7 months.

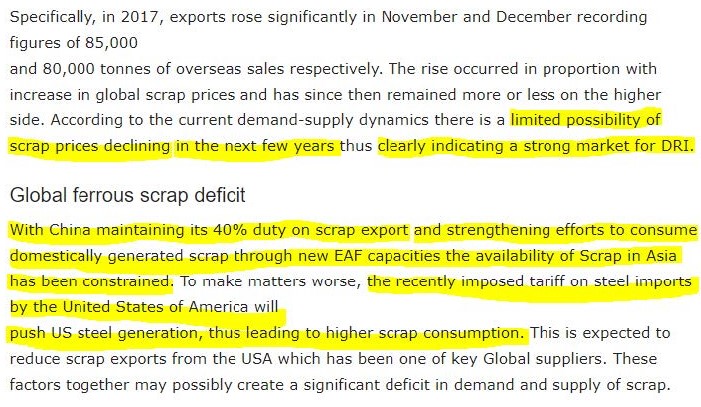

3.3 HBI demand prospect 2018:

Go through the below news: Can India cross 1 mnt in DRI exports? By 360 Editor

4 July 2018

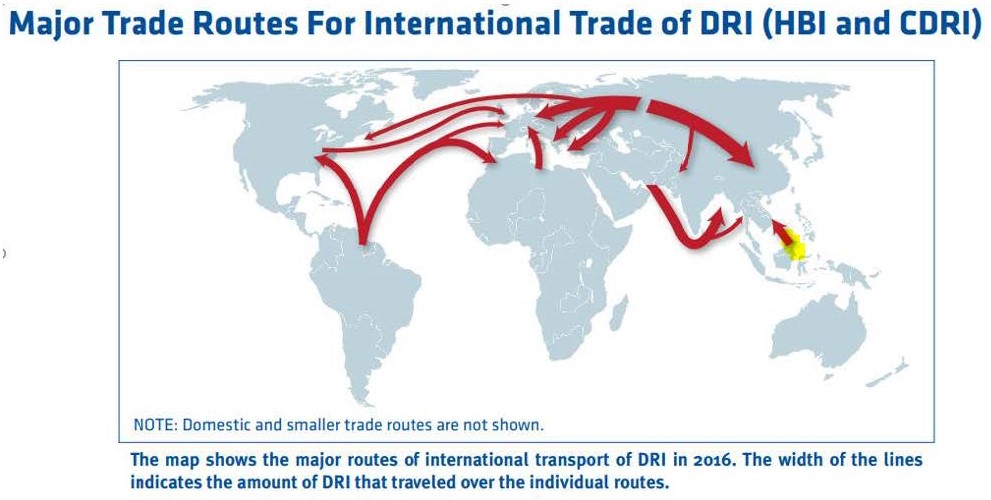

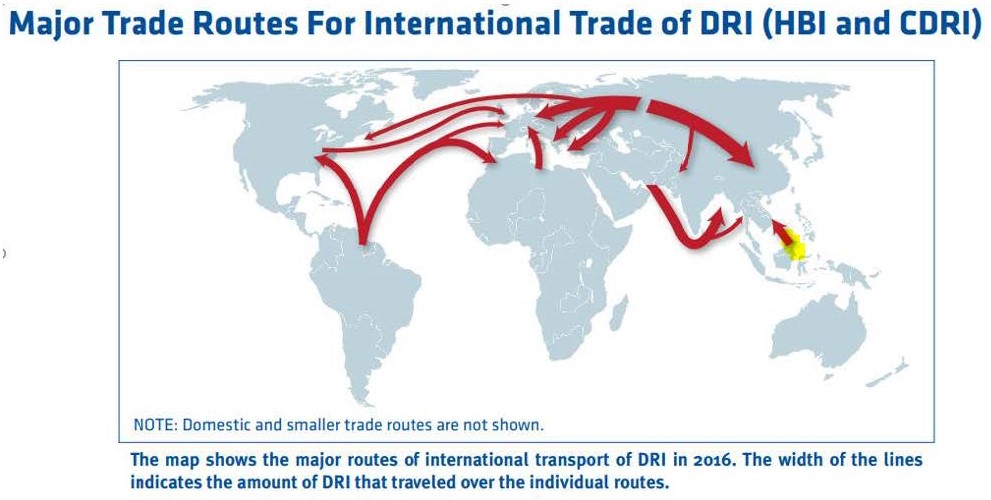

Trade routes obtained from Midrex Publications:

From the above chart, we can see that only the Labuan plant is placed strategically to cover East Asia. The Labuan plant mainly supplies to the growing EAF Steel making plants in Vietnam. The Labuan plant is pivotal to supply the East Asian region demand coming from Vietnam & China.

There is increasing demand for HBI reported worldwide and due to the rising electrode price for EAF plant which makes it more economical to use HBI instead of Scrap Iron.

Lionind would be forced to increase its throughput to its stretchable limits (825,000 tons/yr or higher) as its HBI is used in its Banting EAF plant (refer annual reports) and the plant is restarting currently.

Banting plant restart news: 26 June 2018

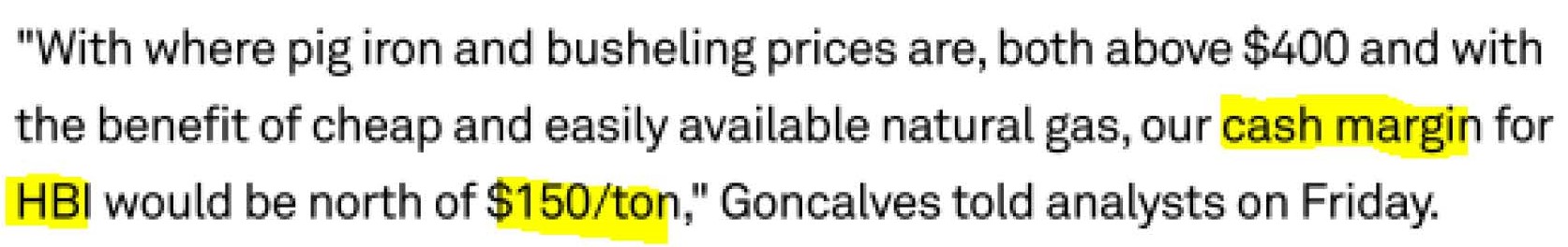

3.4 HBI profit margin prospect 2018:

Analysis: Direct reduced iron margin outlook against pig iron healthy, says US miner Cleveland-Cliffs,

23 July 2018

Note in our above derivation in 2018 2nd scenario at 87% throughput, we had only used 132 USD/ton cash margin (refer (I) on the derivation Tables).

With current foreign exchange rate favoring export it is even more likely to have HBI margins expanding to generate profits seen in 2004 to 2008.

PART 4: What could other Steel making plants of Lionind offer on EPS going forward?

Lionind has other EAF Steel making plants as per the following capacity.

1. Amsteel Mills EAF and billet casting line in Banting, Selangor: 660,000 tons/year

2. Antara Steel Mill's EAF and billet casting line in Pasir Gudang, Johor: 700,000 tons/year

These plants as a minimum should be able to generate RM 180/ton Gross profit margin matching Masteel (the lowest gross profit/ton locally). If they operate both these plants at 80% of rated capacity, their throughput of products would exceed Masteel current throughput of 850k tons/yr by 25%.

A quick workout adds RM 190 Million gross profit per year on top of the HBI plant earnings. That easily translates to additional Net Profit of 135M or extra EPS of 20 cents per annum on top of HBI earnings.

3. Parkson & Megasteel acquisition prospect

It is possible for Parkson to have had completely turnaround and will start contributing positively to Lionind (even giving extraordinary gains in coming qtr results).

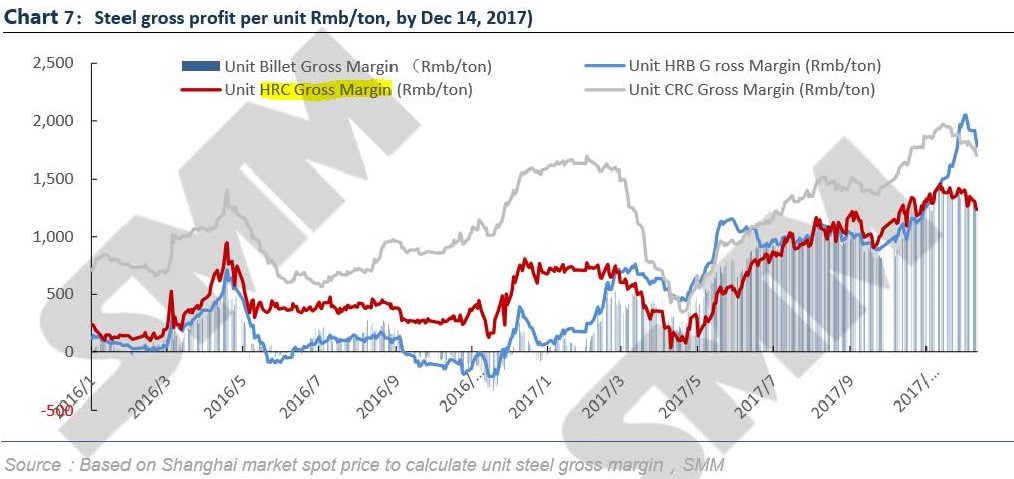

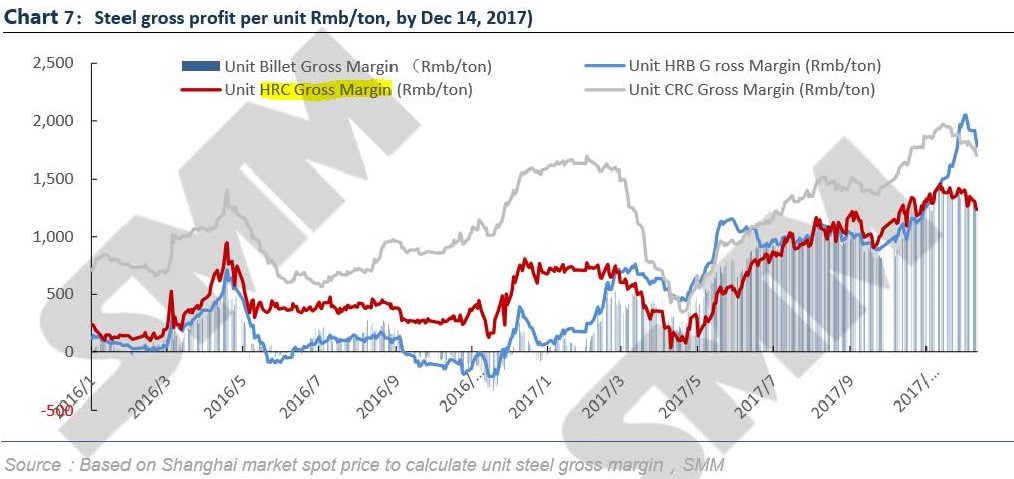

On Megasteel potential acquisition, I hope the below chart on HRC mills margins can speak a thousand word:

I

If one investigates Megasteel’s past poor performance thoroughly, the causes fall on its huge Financial cost burden, high depreciation and its ignorance on its monopolistic position effects it had to local consumers competitiveness, which eventually led to shrinking of its local HRC demand. It was further compounded by the depressed margin during the china steel dumping period.

There is nothing wrong with Megasteel EAF plant technology as such for making HRC, and that is all Lionind is buying at a cheap price. Lionind is simply acquiring a quality asset at an extremely cheap price during an attractive business prospect period as shown on above margins chart.

PART 5: Concluding statement

In my opinion market is totally unaware of the Iron Export contribution to Lionind and mistreating it just like the rest of the local Steel players.

Market has clubbed Lionind with other local steel players like Masteel, Southern Steel which do not have Iron making facilities into the same, and missed the fact that a significant portion of Lionind current bottom line contribution is already from the Export market which are unaffected by the local government policies on infrastructure HSR, ECRL and other mega projects planned by the previous government.

I believe 70% percent of the 8.9 cents EPS reported for Q1 was from the HBI Exports contribution as derived in 2018 1st Scenario Table. The contribution from Johor and Banting plant has yet to reflect on Lionind’s earnings. Also, the full effects of the steep Scrap Iron price spike in Q1-18 will only be reflected in their Q2-18 report. Refer the TheStar news in 2004 above on this time lag effect.

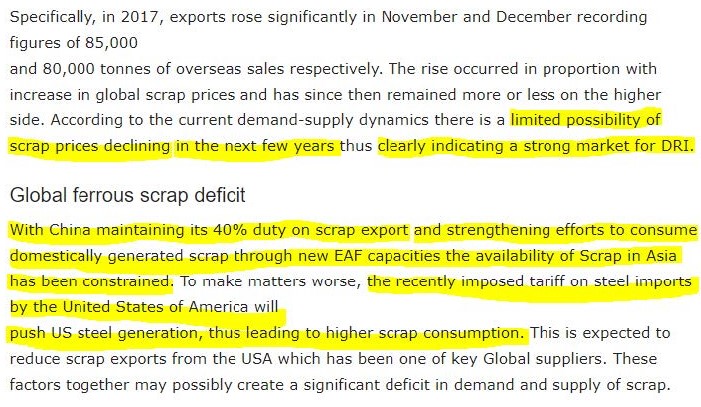

The prospect for the Scrap Iron – Iron Ore price differential to sustain or even expand further is very high due to China’s adamant Blue Sky policy which prevents HBI or Pig Iron makings using Iron Ore locally in China (or for Export regionally) and forced to rely on Scrap Iron (recycled steel) as its Steel making raw material or use Imported HBI from limited producers regionally like Lionind.

If readers understood the presentation above and the implication of the HBI price rise at current exchange rate, the insane valuation at PE = 1 should slowly start to emerge to their rational mind and, hopefully to their feelings eventually.

I am more than willing to clarify on any technical queries the reader may have.

at the best of my knowledge,

FutureEyes

4)

LIONIND - Why CHINA would be craving for HBI soon (5 min Cartoon Video)

Author: FutureEyes | Publish date:

Following my recent article below on Lionind's massive HBI plant Earnings potential due to rise in Scrap Iron price:

Link here:

http://klse.i3investor.com/blogs/Insight1/168169.jsp

Please find below link on a short 5 minute Cartoon Video made by Northern Iron Corporation of Canada in 2013.

It explains why in the future by year 2020, China will be having an insatiable demand for HBI (Hot Briquetted Iron).

Technically Scrap Iron supply in China cannot continuously be recycled (with a recycle time of 40 years) and yet provide enough supply for their increasing infrastructure demand unless they use Iron Ore or Scrap Iron subsitutes like HBI.

Since they could not rely too much on Iron Ore (due to strict emissions restriction), they will be inevitably forced to rely on Scrap Iron substitutes like HBI.

HBI was predicted to be the key ingredient China would be craving for by 2020:

HOT BRIQUETTED IRON (HBI): The New Iron Age Part 2 - Balancing Global Metallics Supply and Demand

Original video below:

https://vimeo.com/60475742

The same video can be found in YouTube below:

https://www.youtube.com/watch?v=ygRgbGy8kC4

So now in 2018, we are just witnessing the beginning.

LIONIND – The massive 900,000 ton Hot Briquetted Iron (HBI) Plant 100% EXPORT at PE = 1

Author: FutureEyes | Publish date: Sat, 4 Aug 2018, 12:09 PM :Link here:

http://klse.i3investor.com/blogs/Insight1/168169.jsp

Technically Scrap Iron supply in China cannot continuously be recycled (with a recycle time of 40 years) and yet provide enough supply for their increasing infrastructure demand unless they use Iron Ore or Scrap Iron subsitutes like HBI.

Since they could not rely too much on Iron Ore (due to strict emissions restriction), they will be inevitably forced to rely on Scrap Iron substitutes like HBI.

HBI was predicted to be the key ingredient China would be craving for by 2020:

HOT BRIQUETTED IRON (HBI): The New Iron Age Part 2 - Balancing Global Metallics Supply and Demand

Original video below:

https://vimeo.com/60475742

The same video can be found in YouTube below:

https://www.youtube.com/watch?v=ygRgbGy8kC4

So now in 2018, we are just witnessing the beginning.

lionind的合理价值rm2.收购magasteel用6.38亿,而magasteel的净賬值达18.3亿,長远是超值的,使公司集長,扁钢业务于一身。机会收票。

http://www.klsescreener.com/detail.php?code=5657

http://www.klsescreener.com/detail.php?code=4235

30/8/2018的第四季度业积只要净利36m,对比去年同季度就是10倍的大进步,加上子公司百盛近期转盈,下来业积也看好,因此股价飞涨完全可以显现。

http://www.klsescreener.com/detail.php?code=4235

30/8/2018的第四季度业积只要净利36m,对比去年同季度就是10倍的大进步,加上子公司百盛近期转盈,下来业积也看好,因此股价飞涨完全可以显现。

投资正道,短期4235上位机会大,国内基建会重开跑了,長,扁鋼通吃。

http://www.sunsirs.com/uk/prodetail-927.html

螺纹钢4370rmb 了,lionind買入在净利爆升前。lionind 之前未收购magasteel时股价己創下rm1.67 ,现己收取magasteel资产,在百盛,長,扁鋼业务净利提高后,股价突破1.67是指日可待。

只供参考,買卖自负。

没有评论:

发表评论