战乱一起,油价爆升。

美国经济很好,亚太新兴市场过去几年经济成長良好,近期的货幣下跌还不至于引起股災,因此想要见到的大股災还不成气候。

小小见解。

个人分享,買卖自负。

个人分享,買卖自负。

https://cj.sina.cn/article/norm_detail?url=http://finance.sina.com.cn/money/future/nyzx/2018-09-11/doc-ihiycyfx1340473.shtml&source=hfquote&vt=4

转贴,谢谢teoct的功课:

https://klse.i3investor.com/m/blog/teoct_blog/173618.jsp

转贴,谢谢teoct的功课:

https://klse.i3investor.com/m/blog/teoct_blog/173618.jsp

Hibiscus - undervalued?

Author: teoct | Publish date:

Hibiscus Petroleum Bhd – undervalued?

Summary

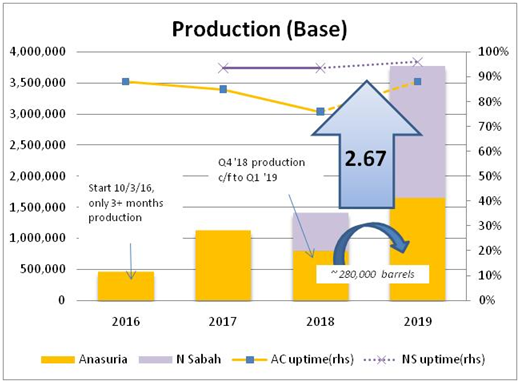

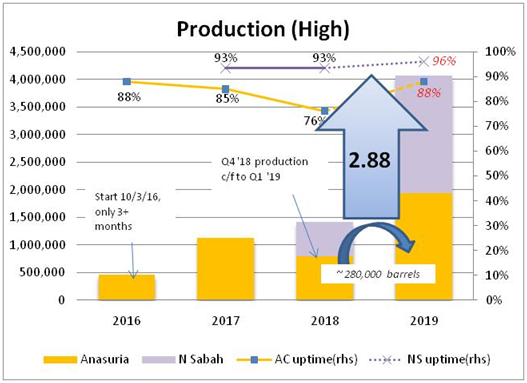

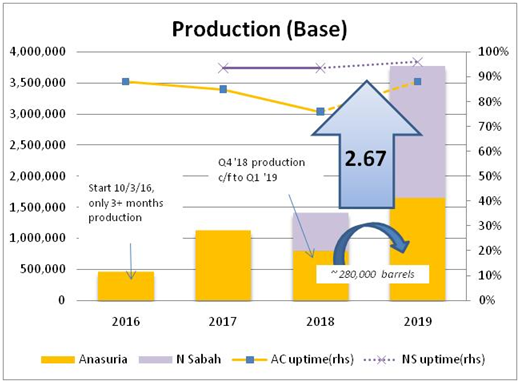

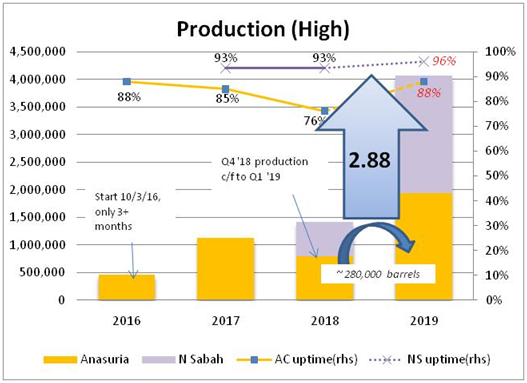

Further study indicated that the Anasuria Cluster is naturally depleting at around 4% annually. So the GUA-P2 side-track (P2 ST) came at the right time. Two scenarios were taken, one with 1,000 bpd from P2 ST and the other, high case, 2,000 bpd from P2 ST. These production levels assumed an up-time of 88%.

Unfortunately or fortunately there isn’t sufficient data to estimate the depletion rate for North Sabah. The estimated production is revised down to 5,800 bpd from 6,100 bpd for financial year 2019 with an up-time of 96%.

Both production levels are shown in the next two graphs:

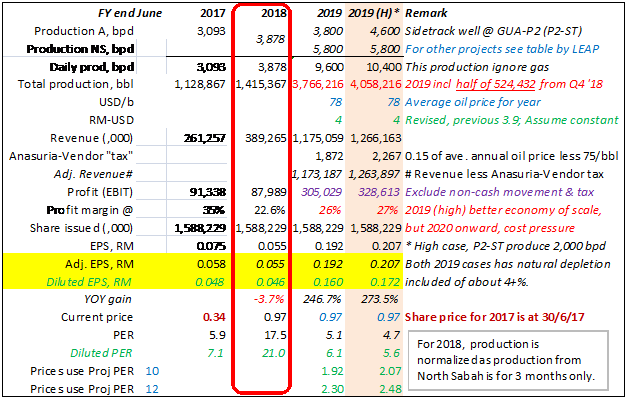

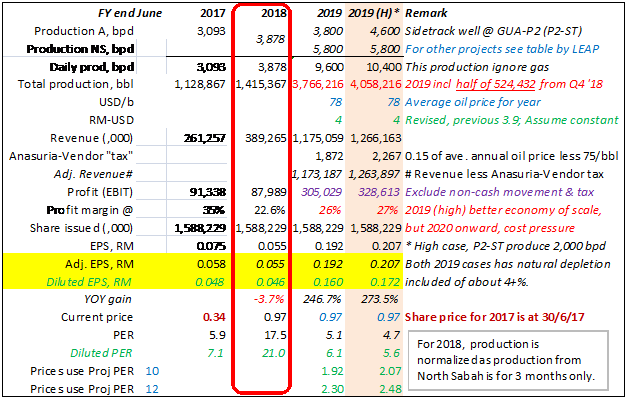

The financial figures are as shown below:

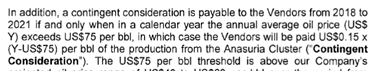

Take note the Anasuria-Vendor “tax” included where it become payable should oil price exceed US 75/b.

Source: Hibiscus: Page 4 of circular to shareholder dated 20/1/16

The reason tax was not included was the complexity of it. The focus of the valuation is on how good Management is in extracting oil at the lowest cost possible.

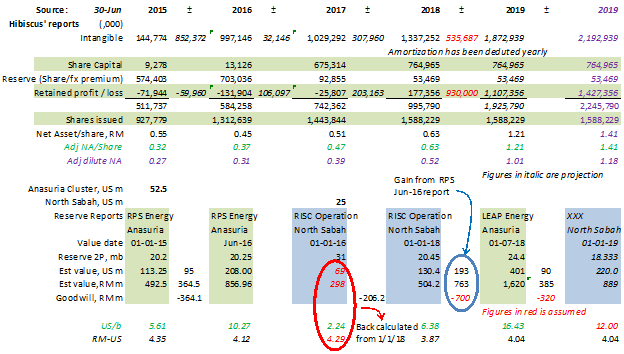

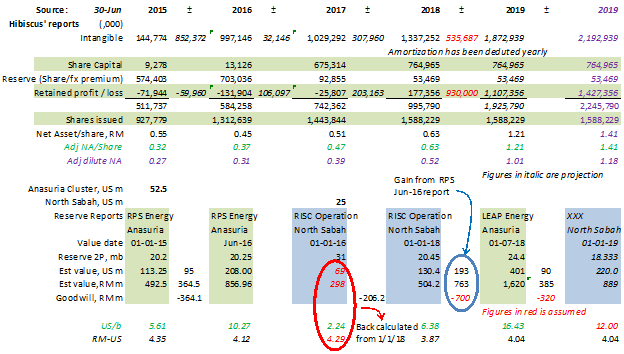

Also with current accounting rules, the frequent (re)valuation of assets (tangible & intangible) are creating a lot of impairment, write-back as well as negative goodwill. Other than negative goodwill, all impairment and write-back has been ignored in the assessment of book value shown below.

North Sabah was bought for US 25 million, the P2 reserve was given as 31 million barrels. That mean US$ 0.80 per barrel; if the reserve figure taken is correct (the RISC’s report is not available).

North Sabah was bought for US 25 million, the P2 reserve was given as 31 million barrels. That mean US$ 0.80 per barrel; if the reserve figure taken is correct (the RISC’s report is not available).

LEAP valued Anasuria Cluster at US$ 16.43 per barrel while the latest North Sabah (1/1/18) was valued at only US$ 6.38 per barrel. Therefore, there might be another revaluation during the financial year 2019 resulting in a potential Net Tangible Asset (NTA) of RM 1.41 per share.

There could be a perfectly rational reason why North Sabah should be valued lower than North Sea, thus, a lower US$ 12 per barrel and P2 reserve of 18.3 mb (20.45 less 1 year production) was assumed for the potential revaluation.

Today, paying RM 0.97 per share for potentially a RM 1.12 (diluted RM 1.01) NTA is a discount of 13% (diluted 4%).

While retained profit appears high, a lot of it is from the negative goodwill and not distributable. Should the oil price fall below US$ 70 per barrel, there might be impairment and this will be backed out of the retained profit. Therefore, the EPS being estimated in the above table ignored this (negative goodwill).

Oil (& gas) exploration / production companies the world over had their reserve valued and parked under intangible asset. Hibiscus is no different.

And as oil (& gas) is produced, amortization is deducted; currently this is around US$ 41 per barrel (sold).

Risk

In some form of order (not strictly) of severity, the risks are;

The P2-ST will more than replace the natural depletion of the Anasuria Cluster production. A base case (1,000 bps) and a high case (2,000 bpd) production from P2-ST were considered.

North Sabah was reviewed and revised down to 5,800 bpd from 6,100 bpd.

These revisions would result in a potential 2.67 to 2.88 time increase in production compared with 2018 that will result in much improve cash flow that could cause (identified) projects to be brought forward to further improve production as well as productivity.

An Anasuria Vendor “tax” was included in the financial model to reflect the agreement entered into back in 2015.

With the LEAP Energy’s report on the Anasuria Cluster reserve valued at US$ 16.43 per barrel, the North Sabah reserve could be revalued this financial year 2019 resulting in a potential NTA of RM 1.41/share (RM 1.18 diluted).

IS HIBISCUS NOT UNDERVALUED?!?

Thank you for reading.

Disclosure: I and my family own shares in Hibiscus.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Buy / sell at your own risk.

Summary

- Anasuria Cluster reserve upgraded to 24.4 mmb and valuation now USD 410 million

- Side-track at GUA-P2 completed on 3/9/18 and test flow-rate net to Hibiscus is 2,375 bpd

- NTA is potentially RM 1.12 to 1.41 for FY 2019

Further study indicated that the Anasuria Cluster is naturally depleting at around 4% annually. So the GUA-P2 side-track (P2 ST) came at the right time. Two scenarios were taken, one with 1,000 bpd from P2 ST and the other, high case, 2,000 bpd from P2 ST. These production levels assumed an up-time of 88%.

Unfortunately or fortunately there isn’t sufficient data to estimate the depletion rate for North Sabah. The estimated production is revised down to 5,800 bpd from 6,100 bpd for financial year 2019 with an up-time of 96%.

Both production levels are shown in the next two graphs:

The financial figures are as shown below:

Take note the Anasuria-Vendor “tax” included where it become payable should oil price exceed US 75/b.

Source: Hibiscus: Page 4 of circular to shareholder dated 20/1/16

The reason tax was not included was the complexity of it. The focus of the valuation is on how good Management is in extracting oil at the lowest cost possible.

Also with current accounting rules, the frequent (re)valuation of assets (tangible & intangible) are creating a lot of impairment, write-back as well as negative goodwill. Other than negative goodwill, all impairment and write-back has been ignored in the assessment of book value shown below.

North Sabah was bought for US 25 million, the P2 reserve was given as 31 million barrels. That mean US$ 0.80 per barrel; if the reserve figure taken is correct (the RISC’s report is not available).

North Sabah was bought for US 25 million, the P2 reserve was given as 31 million barrels. That mean US$ 0.80 per barrel; if the reserve figure taken is correct (the RISC’s report is not available).LEAP valued Anasuria Cluster at US$ 16.43 per barrel while the latest North Sabah (1/1/18) was valued at only US$ 6.38 per barrel. Therefore, there might be another revaluation during the financial year 2019 resulting in a potential Net Tangible Asset (NTA) of RM 1.41 per share.

There could be a perfectly rational reason why North Sabah should be valued lower than North Sea, thus, a lower US$ 12 per barrel and P2 reserve of 18.3 mb (20.45 less 1 year production) was assumed for the potential revaluation.

Today, paying RM 0.97 per share for potentially a RM 1.12 (diluted RM 1.01) NTA is a discount of 13% (diluted 4%).

While retained profit appears high, a lot of it is from the negative goodwill and not distributable. Should the oil price fall below US$ 70 per barrel, there might be impairment and this will be backed out of the retained profit. Therefore, the EPS being estimated in the above table ignored this (negative goodwill).

Oil (& gas) exploration / production companies the world over had their reserve valued and parked under intangible asset. Hibiscus is no different.

And as oil (& gas) is produced, amortization is deducted; currently this is around US$ 41 per barrel (sold).

Risk

In some form of order (not strictly) of severity, the risks are;

- Implementing risk (for projects) – over budget, delay in the completion

- Demand risk – trade war could shrink demand leading to softer oil prices

- Reservoirs risk – higher natural depletion rate, higher water oil ratio, higher gas oil ratio, etc.

- Manpower risk – pinching of (production) staffs leading to productivity issues

- Regulator risk – government nationalizing oil fields (very low), change in tax regimes, increase already stringent safety rules, etc

- Have not thought of, Murphy’s Law.

The P2-ST will more than replace the natural depletion of the Anasuria Cluster production. A base case (1,000 bps) and a high case (2,000 bpd) production from P2-ST were considered.

North Sabah was reviewed and revised down to 5,800 bpd from 6,100 bpd.

These revisions would result in a potential 2.67 to 2.88 time increase in production compared with 2018 that will result in much improve cash flow that could cause (identified) projects to be brought forward to further improve production as well as productivity.

An Anasuria Vendor “tax” was included in the financial model to reflect the agreement entered into back in 2015.

With the LEAP Energy’s report on the Anasuria Cluster reserve valued at US$ 16.43 per barrel, the North Sabah reserve could be revalued this financial year 2019 resulting in a potential NTA of RM 1.41/share (RM 1.18 diluted).

IS HIBISCUS NOT UNDERVALUED?!?

Thank you for reading.

Disclosure: I and my family own shares in Hibiscus.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Buy / sell at your own risk.

没有评论:

发表评论