--Masteel Rm1.34 趁低買入,小而美,红股后调整完,随着鋼价的上升,它拥4亿多价值庫存己增

值,短期目標价Rm1.55。

--長钢四支都可进,个人觉得论公司股数,成交,股价,masteel更具赚副,兩季度EPs=10sen,估 计2017年12月止的财年可赚EPs=15sen,取pe=12,股价=RM 1.80 。

--原材料将维持现状,中国为最大钢铁生产与消费国,现有很大权力的定价权,未來1,2年钢价可企穩,国 内钢铁在反倾销税保护下,业者可保净利水平,公司存货与生产是並行的,之前的货现可卖到好价,masteel是被低估股票。合理价rm1.80

--现在股价rm1.34只是在本益比(pe)8.9倍交易,取2017全年eps=15sen计算.

--于30-6-2017公司CASH=3078万, 贷款=3.49亿, NTA=RM1.84

--库存为4.33亿 /3.10亿股数=RM1.39(个人简单计算).

--4%赚副,(个人简单计算): 年营业约12亿 乘以4%=48m ,

48M/310M 股数=RM0.15 ,PE=12,股价=RM1.80

--受益于马来西亚政府施加13.42%螺纹钢一种保障税率和线材13.9%,螺纹钢的线圈。

只是分享,投资请三思且自负。

--Prospects

Strong international steel prices driven by tight supply of finished goods and increase of raw materials costs have yet to be fully reflected in local steel prices. The local demand for steel remains subdued while the roll out of many mega project is expected to only materialize in the next few quarters. The high price of imported steel together with increasing costs of raw materials present a potentially conducive condition for the margins of the Company's products to improve in the near term.

http://klse.i3investor.com/servlets/stk/5098.jsp

http://www.malaysiastock.biz/Corporate-Infomation.aspx?securityCode=5098

http://www.masteel.com.my/

a)

b)

值,短期目標价Rm1.55。

--長钢四支都可进,个人觉得论公司股数,成交,股价,masteel更具赚副,兩季度EPs=10sen,估 计2017年12月止的财年可赚EPs=15sen,取pe=12,股价=RM 1.80 。

--原材料将维持现状,中国为最大钢铁生产与消费国,现有很大权力的定价权,未來1,2年钢价可企穩,国 内钢铁在反倾销税保护下,业者可保净利水平,公司存货与生产是並行的,之前的货现可卖到好价,masteel是被低估股票。合理价rm1.80

--现在股价rm1.34只是在本益比(pe)8.9倍交易,取2017全年eps=15sen计算.

--于30-6-2017公司CASH=3078万, 贷款=3.49亿, NTA=RM1.84

--库存为4.33亿 /3.10亿股数=RM1.39(个人简单计算).

--4%赚副,(个人简单计算): 年营业约12亿 乘以4%=48m ,

48M/310M 股数=RM0.15 ,PE=12,股价=RM1.80

--受益于马来西亚政府施加13.42%螺纹钢一种保障税率和线材13.9%,螺纹钢的线圈。

只是分享,投资请三思且自负。

--Prospects

Strong international steel prices driven by tight supply of finished goods and increase of raw materials costs have yet to be fully reflected in local steel prices. The local demand for steel remains subdued while the roll out of many mega project is expected to only materialize in the next few quarters. The high price of imported steel together with increasing costs of raw materials present a potentially conducive condition for the margins of the Company's products to improve in the near term.

http://klse.i3investor.com/servlets/stk/5098.jsp

http://www.malaysiastock.biz/Corporate-Infomation.aspx?securityCode=5098

http://www.masteel.com.my/

a)

MASTEEL – Top 4 Rebar Manufacturer in Malaysia - Davidtslim (Part 2)

Author: davidtslim | Publish date:

Reinforcing steel bars (rebar) are used to help concrete withstand tension forces. Recent two years Malaysia has started (some going to start) many big infrastructure projects boosted the demands of rebars. Let see following news for the China's Steel Exports Drop over 20% for 3 Consecutive Months

http://www.zhongliangang.com/en/freeShow.do?flag=2&id=0000251094

Source: http://www.zhongliangang.com/en/freeShow.do?flag=2&id=0000251094

Source: http://www.zhongliangang.com/en/freeShow.do?flag=2&id=0000251094

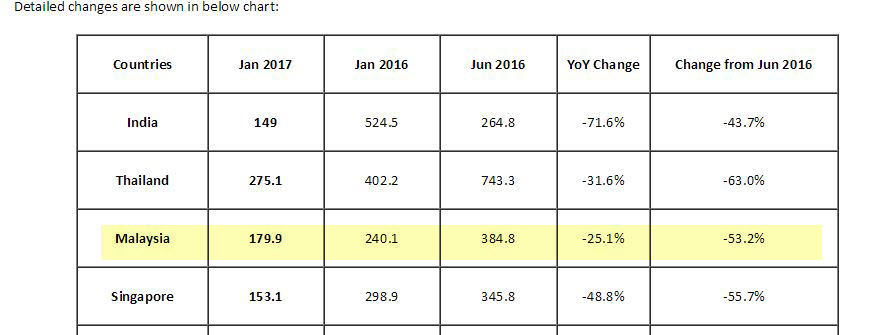

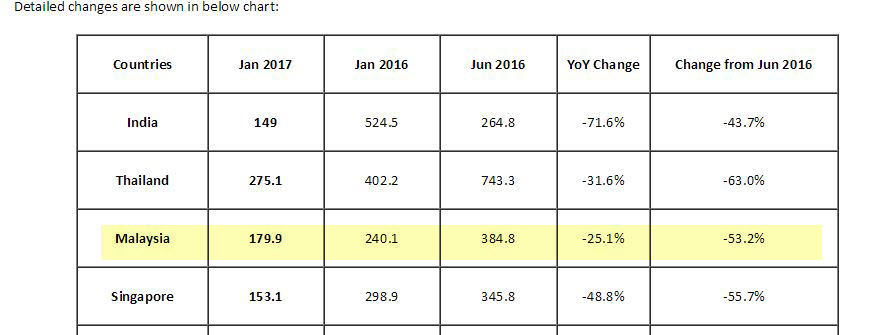

From the news, China steel export to Malaysia has dropped 53.2% since June 2016.

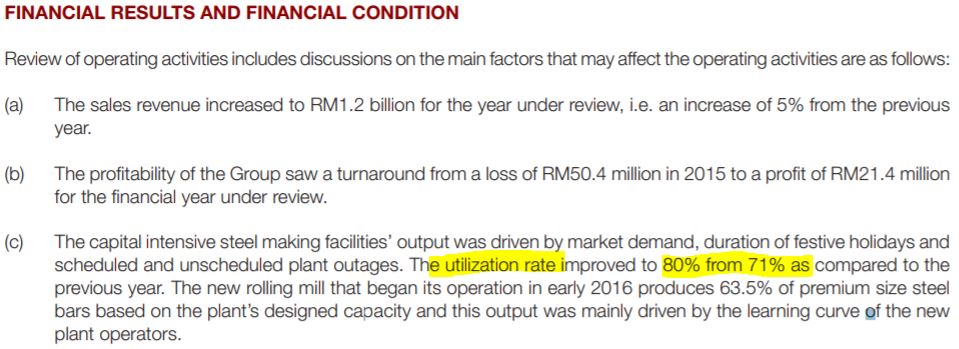

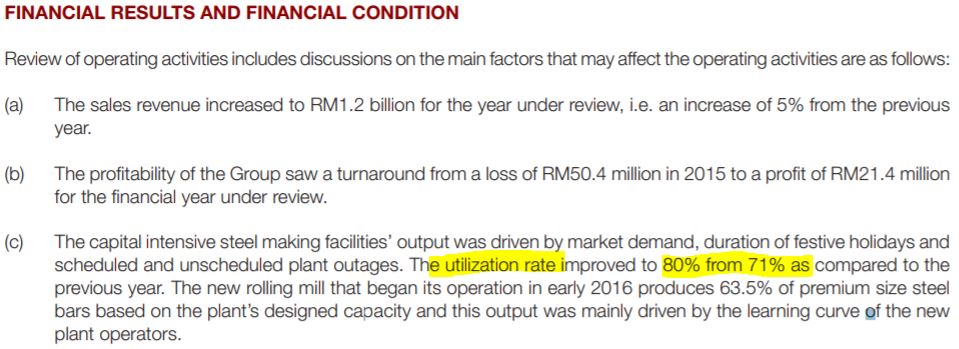

Let go back to one of the Malaysia top 4 rebar manufacturers, Masteel. Masteel main products are steel billets and steel bars, with annual production capacity of 700,000 MT for billets and 600,000 MT for steel bars. Let see the following statement from Masteel annual report 2016 for its current utilization rate.

Source: Annual report 2016

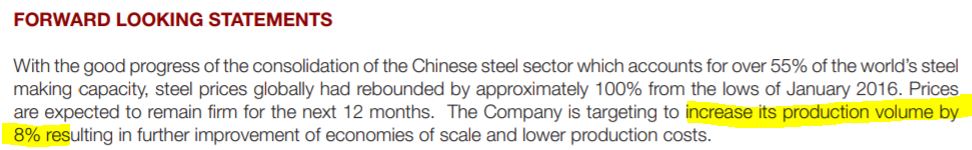

According to annual report in 2016, the utilization rate of Masteel is around 80%. From last quarter report, Masteel has an inventory value of RM433 mil. This inventory value is considered HIGH if compared to its revenue (around 300 mil) and market capital (406 mil). In fact, the inventory value is even higher than the whole Masteel market capital. With high ASP (average selling price) and good demand in Q3 (July – Sept), it is very likely Masteel may increase their production as their plants utilization rate is still stand at 80% in FY 2016. Let see Masteel’s management team Forward Looking Statements from their 2016 annual report as below:

Source: Annual report 2016

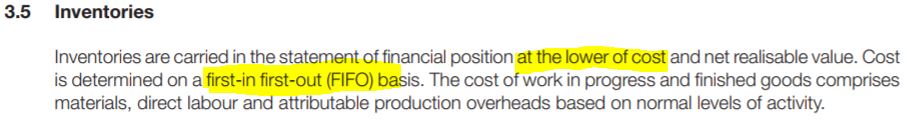

Let us see how the Masteel valued its inventories in their annual report 2016 as below:

Source: Annual report 2016

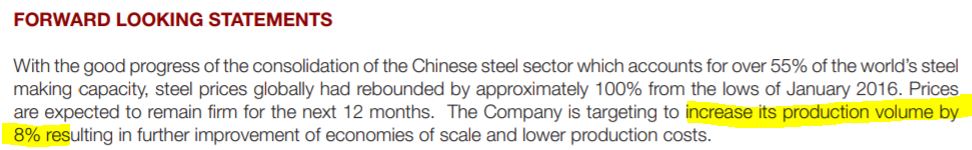

The key here is first-in-first-out (FIFO) basis – this mean the cost of inventories (majorities are raw material) used in the production of rebar during Q3 will be likely lower than my earlier part 1 article estimation (as most raw material purchased in Q2 at lower cost). Refer my part 1 article at https://klse.i3investor.com/blogs/david_masteel/132103.jsp

The (FIFO) method of inventory valuation is a cost flow assumption that the first good purchased is also the first good sold.

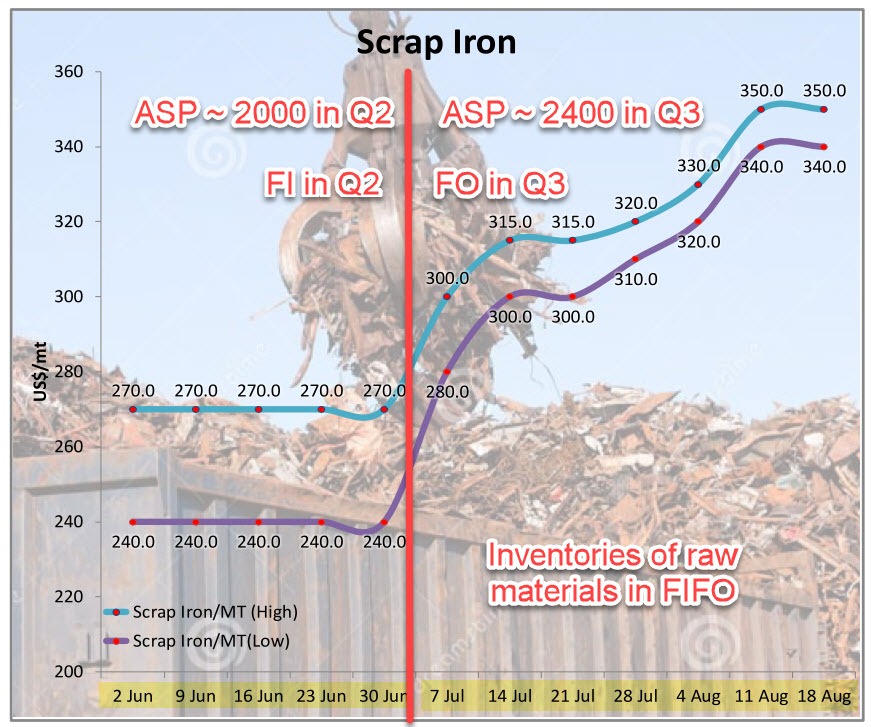

For clearer illustration of FIFO, let us go through the following figure where most of their raw materials (scrap metal, electrode etc) were purchased in Q2 (April to June) at lower price (FI – first-In) and then they have fabricated the rebar to be sold in Q3 (FO – first-out). In this case, I believe their cost of sales should be lower due to most of their raw materials were purchased in Q2.

Source: MITI Aug bulletin

Source: MITI Oct bulletin (page 11)

Source: UOB Thestar news report.

Let see the past records in their Annual Report 2016 which shows that most of the inventories are consist of raw materials.

Source: Annual report 2016

The high level of raw materials in their inventories level indicates that these inventories maybe enough for 4-5 months productions of rebar.

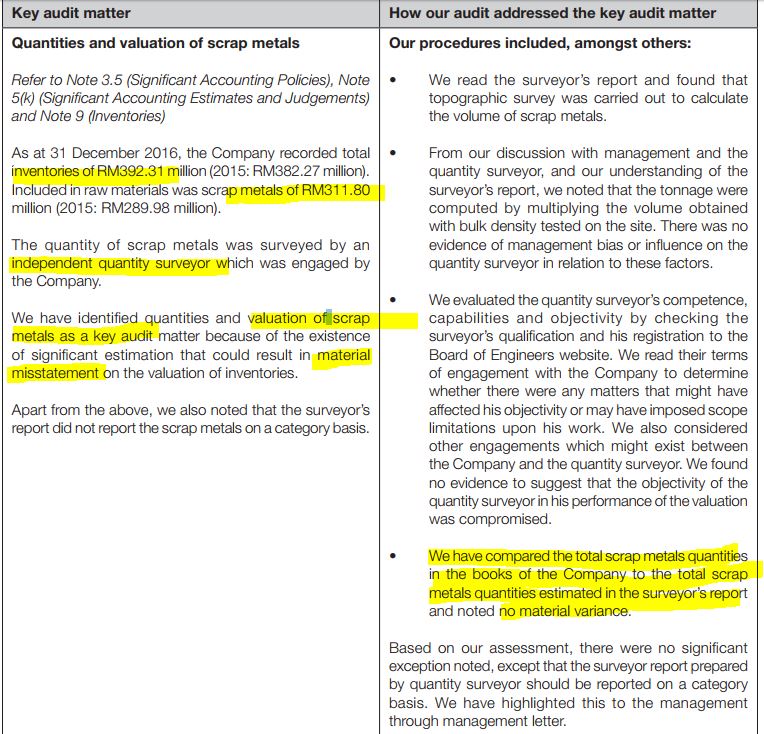

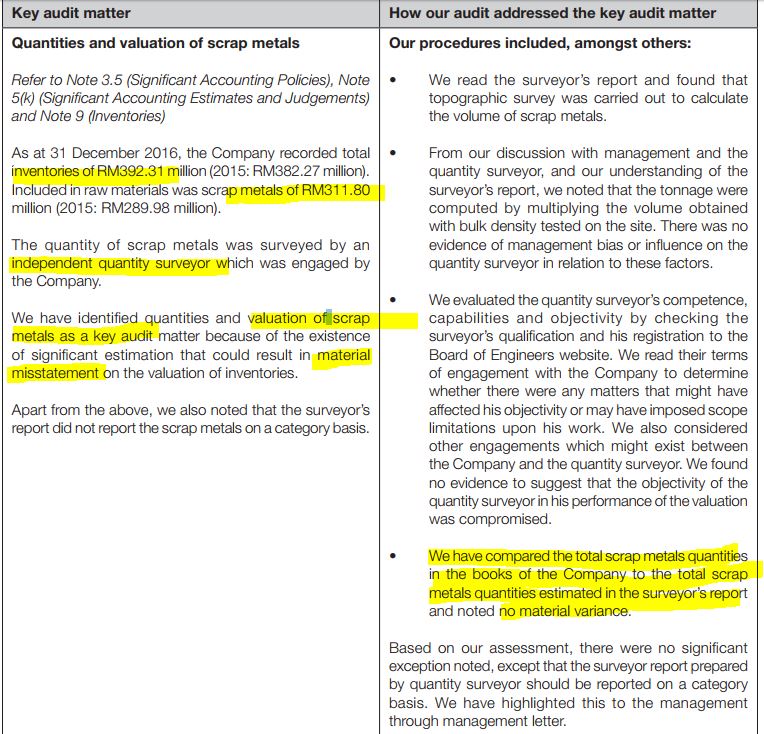

It is worth noting that the inventory value is verified by Independence auditor as shown in their annual report 2016 as below (anyway this is for inventories up to 31 Dec 2016).

Source: Annual Report page 113

In short, if Masteel manage to increase its production capacity utilization by 8% and most of its raw materials were purchase in Q2 (April – June), then I would expect higher revenue and higher profit margin can be generated in Q3.

Let assume their cost of production increased by about 5% and 12% in August and September respectively due to lower FIFO inventories cost (original assumptions are 8% and 15%) as shown in the table below:

New Coming quarter Profit Forecast for Q3’17 (July-Sept 2017)

Based on the new average gross profit margin percentage, let me have a new forecast analysis for their coming profit for its Q3’17 (to be released in Nov) based on recent rebar price movement.

Calculation of profit (using inventories which are mainly raw materials):

The new estimated average gross profit margin is as shown in the table below:

I expect revenue should break new high as the ASP of rebar is breaking new high in August and September. Let assume low side of RM330 mil revenue, the gross profit generated is about RM55.37mil based on profit margin of 16.78%(part 1 article is 15.8%). This new estimated RM55.37 mil is more than 100% improvement of gross profit of Q2’17 (RM24.2 mil).

Let see how much the operating expenses and finance cost from Masteel Q2’17 quarter report as below:

New Gross Profit = RM55.37 mil

New Estimated operation expenses = RM14.19 mil (take Q2 figure + 10% assume higher cost)

Estimated finance cost = RM4.8 mil (take Q2 figure)

Estimated other income (mainly forex gain) = RM2.4 mil (take 40% of Q2 other income)

Net Profit before tax = 55.37 – 14.19 – 4.8 + 2.4 = RM38.78 mil

From Q2 report, their income tax rate is 15.3% (relatively low). I assume coming quarter tax rate 20% is due to I wish to be conservative.

Net Profit after tax = RM31.02 mil --> EPS of 9.99 sen (after bonus issue dilution)

9.99 sen is more than 100% improvement of QoQ (4.38 sen) and over 1800% improvement YoY (0.51 sen)

It is worth noting that 9.99 sen EPS already considered the recent bonus issue and private placement shares dilutions (based on total 310.6 mil shares).

2016 and 2017 Quarter Profit Comparison (after bonus and private placement dilution)

The demands and domestic consumption of steel bar and billets in Q4’17 should be able to sustain due to a pick-up in the construction of mega projects (MRT2, LRT3, Tun Razak Exchange building, Pan Borneo Highway Sarawak, and ECRL). The current high rebar price should be sustainable due to rebar supply in domestic is lower than the consumption and also some export opportunities (like Singapore, Australia etc). The estimated EPS of 5.9 sen in Q4’17 is based on assumption of the same RM2650 ASP price but with 20-25% increment of their materials cost.

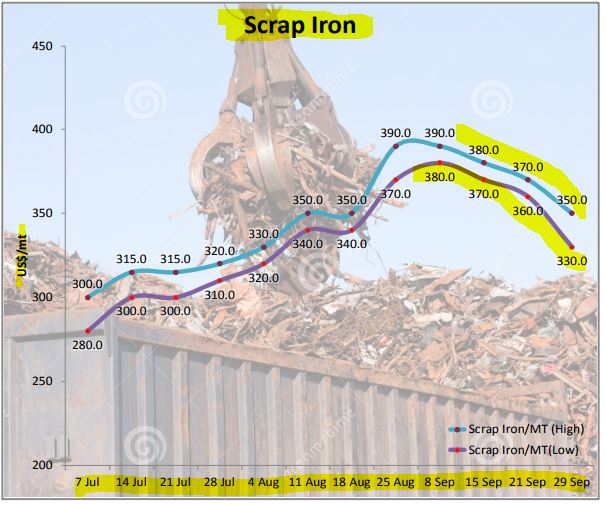

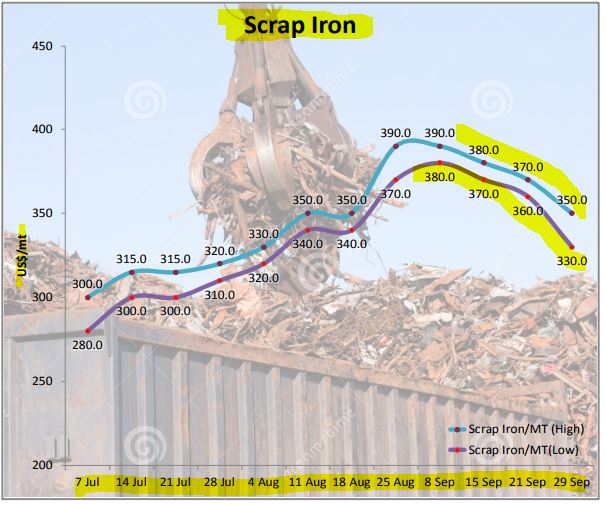

Recently, one of their main raw materials (scrap metal) prices have been dropping based MITI newsletter data as shown in the graph below (as compared to my part 1 article scrap Iron price):

Source: MITI weekly bulletin

Based on current price of RM1.34 with a possible 23.37 sen EPS, Masteel forward 6-month fair PE (result released in Feb 2018) could drop below 6x. Most of the steel counters’ PE can reach 8 -10 which imply possible target price for Masteel is in the range of RM1.89 (PE 8x) and RM2.34 (PE 10x) which included bonus issue and private placement dilutions.

Risk

1. Higher scrap iron price locally and internationally which may affect their cost per ton

2. Recent there is a shortage and price hike of Graphite Electrode which is one of their materials for producing rebar or steel. Grap. Electrode (used in electric arc furnace) can provide high level of conductivity and able to sustain high level of generated heat. The price hike in graphite electrode may increase their production cost per ton by RM200 (about 10-12%).

3. Unplanned break down of their machines which affect their utilization rate of their production capacity.

4. Higher transportation cost due to rising fuel cost in Malaysia in recent two months. Masteel factory is located in Bukit Raja which is closer to LRT project which provides some advantage to its transportation cost as compared to its Peers.

Summary

1. Most of their inventories are made of raw materials (based on data from AR2016) and this will benefit Masteel in Q3 due to higher ASP rebar price. Their inventories management is based on FIFO basis which may drive Q3 profit higher than my Masteel part 1 article’s estimation.

2. Current Masteel’s inventories level (RM433 mil) is even higher than its whole market capital. If Masteel increase their production utilization rate to 90% (from 80% in 2016), then its revenue and profit should break new high (YoY and QoQ) due to higher ASP price of rebar (around RM2350 to 2400 in Q3 and RM2550 in Q4 per ton).

3. Masteel will be benefited from recent rebar price rally from RM2000 to RM2600++ (Sept and Q4) (Possible EPS of 9.99 sen in coming quarter).

4. It is a mid capital rebar counter which the weak Q3’16 and Q4’16 results indicate that it still has big room of improvement in term of EPS or PE ratio. If next quarter can deliver 9.99 sen EPS, then Masteel’s possible fair value could be RM1.89 (PE 8x) and RM2.34 (PE 10x, after bonus).

5. China has implemented steel production cut in Q4, high domestic rebar demands, export market opportunities and low inventory in local rebar manufacturers provide sustainability of high rebar average selling price in Q4’17.

You can get my latest update on share analysis at Telegram Channel ==> https://t.me/davidshare

Disclaimer:

This writing is based on my own assumptions and estimations. It is strictly for sharing purpose, not a buy or sell call of the company.

http://www.zhongliangang.com/en/freeShow.do?flag=2&id=0000251094

Source: http://www.zhongliangang.com/en/freeShow.do?flag=2&id=0000251094

Source: http://www.zhongliangang.com/en/freeShow.do?flag=2&id=0000251094From the news, China steel export to Malaysia has dropped 53.2% since June 2016.

Let go back to one of the Malaysia top 4 rebar manufacturers, Masteel. Masteel main products are steel billets and steel bars, with annual production capacity of 700,000 MT for billets and 600,000 MT for steel bars. Let see the following statement from Masteel annual report 2016 for its current utilization rate.

Source: Annual report 2016

According to annual report in 2016, the utilization rate of Masteel is around 80%. From last quarter report, Masteel has an inventory value of RM433 mil. This inventory value is considered HIGH if compared to its revenue (around 300 mil) and market capital (406 mil). In fact, the inventory value is even higher than the whole Masteel market capital. With high ASP (average selling price) and good demand in Q3 (July – Sept), it is very likely Masteel may increase their production as their plants utilization rate is still stand at 80% in FY 2016. Let see Masteel’s management team Forward Looking Statements from their 2016 annual report as below:

Source: Annual report 2016

Let us see how the Masteel valued its inventories in their annual report 2016 as below:

Source: Annual report 2016

The key here is first-in-first-out (FIFO) basis – this mean the cost of inventories (majorities are raw material) used in the production of rebar during Q3 will be likely lower than my earlier part 1 article estimation (as most raw material purchased in Q2 at lower cost). Refer my part 1 article at https://klse.i3investor.com/blogs/david_masteel/132103.jsp

The (FIFO) method of inventory valuation is a cost flow assumption that the first good purchased is also the first good sold.

For clearer illustration of FIFO, let us go through the following figure where most of their raw materials (scrap metal, electrode etc) were purchased in Q2 (April to June) at lower price (FI – first-In) and then they have fabricated the rebar to be sold in Q3 (FO – first-out). In this case, I believe their cost of sales should be lower due to most of their raw materials were purchased in Q2.

Source: MITI Aug bulletin

Source: MITI Oct bulletin (page 11)

As we can observe from the figure (MITI Oct bulletin) above, ASP (average selling price) in Q3 (July – Sept) stood around RM2350 to RM2400 for rebar. One of the reports by UOB investment bank also shows that rebar price has breach RM2600 in Sept (http://www.thestar.com.my/business/business-news/2017/10/10/steel-prices-to-inch-upwards/) Here is some excerpt from UOB thestar report.

Source: UOB Thestar news report.

Let see the past records in their Annual Report 2016 which shows that most of the inventories are consist of raw materials.

Source: Annual report 2016

The high level of raw materials in their inventories level indicates that these inventories maybe enough for 4-5 months productions of rebar.

It is worth noting that the inventory value is verified by Independence auditor as shown in their annual report 2016 as below (anyway this is for inventories up to 31 Dec 2016).

Source: Annual Report page 113

In short, if Masteel manage to increase its production capacity utilization by 8% and most of its raw materials were purchase in Q2 (April – June), then I would expect higher revenue and higher profit margin can be generated in Q3.

Let assume their cost of production increased by about 5% and 12% in August and September respectively due to lower FIFO inventories cost (original assumptions are 8% and 15%) as shown in the table below:

| July (RM) | Aug (RM) | Sept (RM) | |

| ASP per ton |

~2200

|

~2450

|

~2600

|

| Cost per ton |

~1900 (maintain cost as old inventory)

|

~1995 (+5% vs +8% in part 1 report )

|

~2128 (+12% vs +15% in part 1 report)

|

| Gross Profit Margin (GPM %) |

13.6

|

18.57

|

18.15

|

| AverageGross profit margin in 3 months (%) |

16.78

| ||

New Coming quarter Profit Forecast for Q3’17 (July-Sept 2017)

Based on the new average gross profit margin percentage, let me have a new forecast analysis for their coming profit for its Q3’17 (to be released in Nov) based on recent rebar price movement.

Calculation of profit (using inventories which are mainly raw materials):

The new estimated average gross profit margin is as shown in the table below:

| Projected Revenue | 330 mil | 400 mil | 450 mil |

| Gross profit based on 16.78% (RM) |

16.78%

-->55.37mil

|

16.78%

-->67.1mil

|

16.78%

-->75.5mil

|

Let see how much the operating expenses and finance cost from Masteel Q2’17 quarter report as below:

New Gross Profit = RM55.37 mil

New Estimated operation expenses = RM14.19 mil (take Q2 figure + 10% assume higher cost)

Estimated finance cost = RM4.8 mil (take Q2 figure)

Estimated other income (mainly forex gain) = RM2.4 mil (take 40% of Q2 other income)

Net Profit before tax = 55.37 – 14.19 – 4.8 + 2.4 = RM38.78 mil

From Q2 report, their income tax rate is 15.3% (relatively low). I assume coming quarter tax rate 20% is due to I wish to be conservative.

Net Profit after tax = RM31.02 mil --> EPS of 9.99 sen (after bonus issue dilution)

9.99 sen is more than 100% improvement of QoQ (4.38 sen) and over 1800% improvement YoY (0.51 sen)

It is worth noting that 9.99 sen EPS already considered the recent bonus issue and private placement shares dilutions (based on total 310.6 mil shares).

2016 and 2017 Quarter Profit Comparison (after bonus and private placement dilution)

2016 (mil, EPS in sen)

|

2017 (mil, EPS in sen) Included dilution of bonus & private placement

| |

| Q1 |

5.0, 2.1

|

14.08, 4.27

|

| Q2 |

10.68, 4.41

|

10.6, 3.21

|

| Q3 |

1.2, 0.51

|

estimated (~31.02,~9.99)

|

| Q4 |

4.03, 1.67

|

?? estimated about 20.44, 5.9 sen

|

| Total |

21.03, 8.69

|

Estimated(~76.14, ~23.37 sen)

|

Recently, one of their main raw materials (scrap metal) prices have been dropping based MITI newsletter data as shown in the graph below (as compared to my part 1 article scrap Iron price):

Source: MITI weekly bulletin

Based on current price of RM1.34 with a possible 23.37 sen EPS, Masteel forward 6-month fair PE (result released in Feb 2018) could drop below 6x. Most of the steel counters’ PE can reach 8 -10 which imply possible target price for Masteel is in the range of RM1.89 (PE 8x) and RM2.34 (PE 10x) which included bonus issue and private placement dilutions.

Risk

1. Higher scrap iron price locally and internationally which may affect their cost per ton

2. Recent there is a shortage and price hike of Graphite Electrode which is one of their materials for producing rebar or steel. Grap. Electrode (used in electric arc furnace) can provide high level of conductivity and able to sustain high level of generated heat. The price hike in graphite electrode may increase their production cost per ton by RM200 (about 10-12%).

3. Unplanned break down of their machines which affect their utilization rate of their production capacity.

4. Higher transportation cost due to rising fuel cost in Malaysia in recent two months. Masteel factory is located in Bukit Raja which is closer to LRT project which provides some advantage to its transportation cost as compared to its Peers.

Summary

1. Most of their inventories are made of raw materials (based on data from AR2016) and this will benefit Masteel in Q3 due to higher ASP rebar price. Their inventories management is based on FIFO basis which may drive Q3 profit higher than my Masteel part 1 article’s estimation.

2. Current Masteel’s inventories level (RM433 mil) is even higher than its whole market capital. If Masteel increase their production utilization rate to 90% (from 80% in 2016), then its revenue and profit should break new high (YoY and QoQ) due to higher ASP price of rebar (around RM2350 to 2400 in Q3 and RM2550 in Q4 per ton).

3. Masteel will be benefited from recent rebar price rally from RM2000 to RM2600++ (Sept and Q4) (Possible EPS of 9.99 sen in coming quarter).

4. It is a mid capital rebar counter which the weak Q3’16 and Q4’16 results indicate that it still has big room of improvement in term of EPS or PE ratio. If next quarter can deliver 9.99 sen EPS, then Masteel’s possible fair value could be RM1.89 (PE 8x) and RM2.34 (PE 10x, after bonus).

5. China has implemented steel production cut in Q4, high domestic rebar demands, export market opportunities and low inventory in local rebar manufacturers provide sustainability of high rebar average selling price in Q4’17.

You can get my latest update on share analysis at Telegram Channel ==> https://t.me/davidshare

Disclaimer:

This writing is based on my own assumptions and estimations. It is strictly for sharing purpose, not a buy or sell call of the company.

转贴:

@ 强势板块里淘宝找强势股 找出潜在40%涨幅牛股

12/10/2017

@ 强势板块里淘宝找强势股 找出潜在40%涨幅牛股

12/10/2017

大马股票交易所大市虽疲弱,不过中小型股却有轮流炒作活动,工业制造指数更连续八天创新高,该板块里的优质股,料随大市水涨船高,未来三至六个月展望良好,股价存在上涨潜能。

《九点股票》编辑室本身的看法和做法将专注於强势板块,找出基本面强劲,公司盈利持续成长,估值合理的上市公司。编辑室经过一轮筛选,找出3家公司进行研究,并分享研究报告给白金会员。

《九点股票》编辑团队列为首选股名单的上市公司为:

马钢铁(MASTEEL 5098)

辉高(FAVCO 7229)

两发钢铁(LEONFB 5232)

辉高(FAVCO 7229)

两发钢铁(LEONFB 5232)

《九点股票》从工业制造指数板块里,筛选出这三家公司,认为它们的估值合理,过去数个季度盈利呈现成长,今年的盈利也比去年更好,因此列进首选股名单。我们根据自设的基本面计算方式,发现有关股项的潜在空间有40%以上。

无论如何,以上股项需要持有一段时间,我们不进行对敲交易,同时也不认为一两个星期就可以出现涨势。

以下是我们将执行的投资计划:

马钢铁(MASTEEL 5098):

《九点股票》会在1.32-1.35令吉买进,我们计算的目标价格是1.85令吉,止损价格为85仙。我们将持有它六个月,等待价值出现。

《九点股票》会在1.32-1.35令吉买进,我们计算的目标价格是1.85令吉,止损价格为85仙。我们将持有它六个月,等待价值出现。

c)

[转贴] 大马钢厂MASTEEL – 马币走强的主要受惠者 - RH Research

Author: Tan KW | Publish date:

MASTEEL创办于1971年,在2005年上市于大马主要板。成立初期,集团在雪兰莪Petaling Jaya经营一家轧钢厂,主要生产低碳钢筋 (Steel Bars)。在1998年,作为提高生产赚幅的战略之一,MASTEEL在巴生Bukit Raja建设一座熔炼厂,主要用于生产钢坯 (Steel Billet) 。这厂房是当地最现代化的熔炼厂之一,年产能达700,000吨。

在2013年,MASTEEL对于其下游业务进行扩展,在Bukit Raja建设一座新的轧钢厂,并已在2015年10月正式投产。在这之前,MASTEEL把Bukit Raja生产的钢坯送往Petaling Jaya进行加工,导致必须承担一笔运输费用。目前,集团可直接在Bukit Raja加工,省时又省钱。

在2013年,MASTEEL对于其下游业务进行扩展,在Bukit Raja建设一座新的轧钢厂,并已在2015年10月正式投产。在这之前,MASTEEL把Bukit Raja生产的钢坯送往Petaling Jaya进行加工,导致必须承担一笔运输费用。目前,集团可直接在Bukit Raja加工,省时又省钱。

整体而言,MASTELL目前拥有有3家厂房,包括两家轧钢厂和一家熔炼厂,地点分别坐落在巴生Bukit Raja和Petaling Jaya,地理上的优势让集团多年来始终在巴生河流域地区钢铁市场中占有重要地位。

根据多年前的统计,MASTEEL分别占钢胚和钢筋市场的8%及5%。值得一提,小规模使得集团占有市场优势,主要是在争取中小型订单方面。另一方面,其厂房的优越地理位置使得集团拥有成本优势,运输成本仅每吨RM20-22左右,较竞争者的每吨RM40-45节省约50%。集团在近年成功夺取更高的钢筋市场份额,主要因为地理靠近巴生谷大型基建项目以及吉隆坡主要发展计划。

业绩方面, MASTEEL在今年Q1及Q2一共交出RM24.7m盈利,超越FY16全年表现,主要归功于显著的外汇收益。集团的主要收入来自本地市场,占FY16营业额的89%,而其余11%贡献来自出口。

由于美金兑马币在今年初从4.45逐渐下滑至目前的4.26,作为受惠者的MASTEEL在FY17首两个季度一共录得RM10.8m的外汇收益,占了整体盈利的44%。若剔除外汇收益,集团的近两个季度的核心盈利为RM13.9m。

在业务发展上,通过未来5年陆续推出的大型基础设施项目,MASTEEL放眼把东马的销售量进一步提高。集团将瞄准更多新兴终客户,如政府关联企业、西马主要承包商以及东马的新经销商。为了提升销售量15%,MASTEEL正在西马地区积极营销其产品,并预计可从2017-2022年进行中的Pan Borneo大道项目受益。

据管理层说,MASTEEL的钢筋产能将在今年提升,有望带动其收入额外增长RM150m,相等于12.5%的增幅。当然,这前提是钢筋需求持续走高。集团位于Bukit Raja的新轧钢厂使用率达到63.5%,主要生产优质小直径的钢筋Y10、Y12和Y16。未来,多个生产技术将陆续安装在这厂房上,届时有望提高其生产效率。

虽然在过去5年皆创造可观的营运现金流,但是MASTEEL却在业务扩展上投入不少资金,导致派息率非常低。即便在FY16创造RM38m的净现金流,集团也仅建议派发每股0.85仙的股息,引起股东们不满。在今年股东大会上,高达97.5%的股东不通过这笔股息的提案,非常罕见。

展望下个业绩,美金兑马币在Q3从4.30跌至4.20。MASTEEL预计可在Q3继续录得RM3-5m的外汇收益。然而,投资者必须非常小心。若美金兑马币突然暴涨,这势必为集团未来的盈利表现带来极大的影响。本专页相信市场对于MASTEEL的盈利预期非常大,但是其核心盈利却不是大家想象中那么高。

排除外汇因素,本专页预测MASTEEL全年核心盈利为RM30m。若包括外汇收益,其全年盈利可达RM45-50m之间。值得一提,

未来一旦美金兑马币走势趋稳,集团将失去外汇收益的优势。

d)

根据多年前的统计,MASTEEL分别占钢胚和钢筋市场的8%及5%。值得一提,小规模使得集团占有市场优势,主要是在争取中小型订单方面。另一方面,其厂房的优越地理位置使得集团拥有成本优势,运输成本仅每吨RM20-22左右,较竞争者的每吨RM40-45节省约50%。集团在近年成功夺取更高的钢筋市场份额,主要因为地理靠近巴生谷大型基建项目以及吉隆坡主要发展计划。

业绩方面, MASTEEL在今年Q1及Q2一共交出RM24.7m盈利,超越FY16全年表现,主要归功于显著的外汇收益。集团的主要收入来自本地市场,占FY16营业额的89%,而其余11%贡献来自出口。

由于美金兑马币在今年初从4.45逐渐下滑至目前的4.26,作为受惠者的MASTEEL在FY17首两个季度一共录得RM10.8m的外汇收益,占了整体盈利的44%。若剔除外汇收益,集团的近两个季度的核心盈利为RM13.9m。

在业务发展上,通过未来5年陆续推出的大型基础设施项目,MASTEEL放眼把东马的销售量进一步提高。集团将瞄准更多新兴终客户,如政府关联企业、西马主要承包商以及东马的新经销商。为了提升销售量15%,MASTEEL正在西马地区积极营销其产品,并预计可从2017-2022年进行中的Pan Borneo大道项目受益。

据管理层说,MASTEEL的钢筋产能将在今年提升,有望带动其收入额外增长RM150m,相等于12.5%的增幅。当然,这前提是钢筋需求持续走高。集团位于Bukit Raja的新轧钢厂使用率达到63.5%,主要生产优质小直径的钢筋Y10、Y12和Y16。未来,多个生产技术将陆续安装在这厂房上,届时有望提高其生产效率。

虽然在过去5年皆创造可观的营运现金流,但是MASTEEL却在业务扩展上投入不少资金,导致派息率非常低。即便在FY16创造RM38m的净现金流,集团也仅建议派发每股0.85仙的股息,引起股东们不满。在今年股东大会上,高达97.5%的股东不通过这笔股息的提案,非常罕见。

展望下个业绩,美金兑马币在Q3从4.30跌至4.20。MASTEEL预计可在Q3继续录得RM3-5m的外汇收益。然而,投资者必须非常小心。若美金兑马币突然暴涨,这势必为集团未来的盈利表现带来极大的影响。本专页相信市场对于MASTEEL的盈利预期非常大,但是其核心盈利却不是大家想象中那么高。

排除外汇因素,本专页预测MASTEEL全年核心盈利为RM30m。若包括外汇收益,其全年盈利可达RM45-50m之间。值得一提,

未来一旦美金兑马币走势趋稳,集团将失去外汇收益的优势。

d)

价格看涨 估值落后聚美两发中钢有赚头

NanyangTue, Oct 10, 2017 - 2 days ago

(吉隆坡10日讯)分析员看涨本地钢铁价格,更建议投资者留意估值及股价表现落后的股票,

如聚美(CHOOBEE,5797,主板工业产品股)、中钢大马(CSCSTEL,5094,

主板工业产品股)和两发(LEONFB,5232,主板工业产品股)。

如聚美(CHOOBEE,5797,主板工业产品股)、中钢大马(CSCSTEL,5094,

主板工业产品股)和两发(LEONFB,5232,主板工业产品股)。

根据国际贸易与工业部(MITI),9月国内钢条价格按年激增45.5%,按月起6.2%,

达每公吨2642令吉,再创新高水平,而钢坯价格则分别按年上升53.6%,按月增6.5%,

达2363令吉。

达每公吨2642令吉,再创新高水平,而钢坯价格则分别按年上升53.6%,按月增6.5%,

达2363令吉。

这带动今年第三季钢条价格走高至2417令吉,按季增长16.4%,超越今年首季高峰水平

的2233令吉。

的2233令吉。

大华继显分析员说,由于中国建筑活动季节性放缓,当地钢铁价格将会在末季放缓。

由于中国钢坯价格开始放缓,今年9月中国与大马钢坯差价从8月的18%,收窄至12%。

不过,分析员认为,中国限产及实施更严格的环境控制措施,将带动国际钢铁价格继续走高。

“至于大马市场,政府颁发更多基建及大型项目,特别是轻快铁第三路线(LRT3)工程,

将带动国内需求增长及扶持价格。”

将带动国内需求增长及扶持价格。”

分析员对建材领域抱着乐观看法。由于国内及全球营运环境良好,所以预计今年下半年盈利

将显著胜于上半年。

将显著胜于上半年。

首选安裕资源

此外,分析员指出,第三季钢铁领域的偏低单位数本益比、大型项目的建筑活动增加,

将推动本地需求,加上目前缺乏诱人的替代投资,所以建议投资者加强留意钢铁股。

将推动本地需求,加上目前缺乏诱人的替代投资,所以建议投资者加强留意钢铁股。

“随着钢铁公司采取有效资本管理措施,我们亦相信估值将进一步走高。”

分析员的首选股是安裕资源(ANNJOO,6556,主板工业产品股),而其他值得留意

估值及股价表现落后的钢铁股,包括聚美、大马钢厂(MASTEEL,5098,主板工业产品股)、两发、中钢大马及鸿达资源(PRESTAR,9873,主板工业产品股)。

估值及股价表现落后的钢铁股,包括聚美、大马钢厂(MASTEEL,5098,主板工业产品股)、两发、中钢大马及鸿达资源(PRESTAR,9873,主板工业产品股)。

e)

PETALING JAYA: Analysts are bullish on the local steel sector and expect prices to continue on an upward trend this year on the back of higher infrastructure contract awards.

After reaching another record high of RM2,642 per metric ton (MT) last month, analysts told StarBiz that there is room for steel prices to further surge.

Some are of the view that it could breach the RM2,650 mark by year-end or the early next year amid some easing in the construction activities in China in the current quarter.

The boost to steel prices will come from stronger demand for existing and upcoming mega infrastructure projects, analysts added. UOB Kay Hian analyst Abdul Hadi Manaf, who is bullish of the sector is maintaining his overweight stance on the sector.

“We expect investors to give due attention to the steel sector, given the sector’s cheap single-digit price-earnings (PE) multiple in the third quarter (Q3 17), rising domestic demand (amid rising construction activities of mega projects) and the dearth of alternative compelling investments.” he added.

He also believe that valuations could stretch further for companies that undertake effective capital management. “Ann Joo is our top pick, while notable stocks include Choo Bee Metal Industries

is our top pick, while notable stocks include Choo Bee Metal Industries  , MaSteel, Leon Fuat, CSC Steel and Prestar Resources,’’ he noted.

, MaSteel, Leon Fuat, CSC Steel and Prestar Resources,’’ he noted.

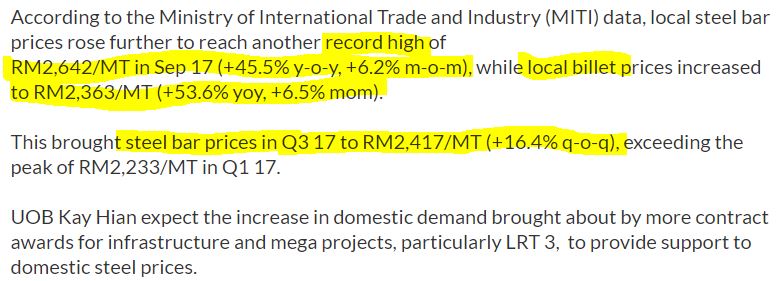

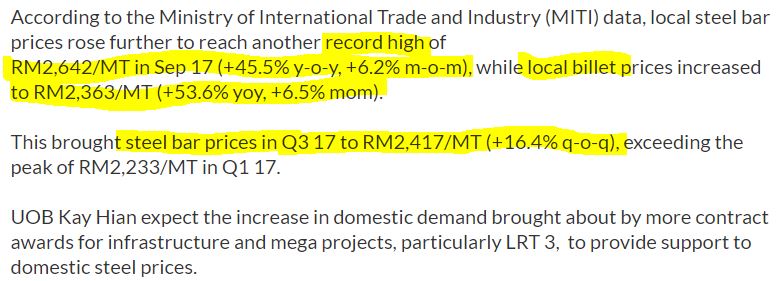

According to the Ministry of International Trade and Industry (MITI) data, local steel bar prices rose further to reach another record high of

RM2,642/MT in Sep 17 (+45.5% y-o-y, +6.2% m-o-m), while local billet prices increased to RM2,363/MT (+53.6% yoy, +6.5% mom).

This brought steel bar prices in Q3 17 to RM2,417/MT (+16.4% q-o-q), exceeding the peak of RM2,233/MT in Q1 17.

UOB Kay Hian expect the increase in domestic demand brought about by more contract awards for infrastructure and mega projects, particularly LRT 3, to provide support to domestic steel prices.

However, it noted that prices may ease in Q4 17 to reflect the seasonal slowdown in China’s construction activities. In September, China steel billets fetched a 12% price premium to local billets versus an 18% premium in August 17, as China billet prices have started to ease.

While most steel companies trade at about 10 times annualised PE, Choo Bee and MaSteel trade at only half their respective annualised price-to-book

multiples.

Leon Fuat trades at only 5.0 times 12-month trailing PE while CSC Steel’s share price has been flat since July 17. Prestar comes across as interesting, riding on the various upcoming highway projects.

After reaching another record high of RM2,642 per metric ton (MT) last month, analysts told StarBiz that there is room for steel prices to further surge.

Some are of the view that it could breach the RM2,650 mark by year-end or the early next year amid some easing in the construction activities in China in the current quarter.

The boost to steel prices will come from stronger demand for existing and upcoming mega infrastructure projects, analysts added. UOB Kay Hian analyst Abdul Hadi Manaf, who is bullish of the sector is maintaining his overweight stance on the sector.

“We expect investors to give due attention to the steel sector, given the sector’s cheap single-digit price-earnings (PE) multiple in the third quarter (Q3 17), rising domestic demand (amid rising construction activities of mega projects) and the dearth of alternative compelling investments.” he added.

He also believe that valuations could stretch further for companies that undertake effective capital management. “Ann Joo

is our top pick, while notable stocks include Choo Bee Metal Industries

is our top pick, while notable stocks include Choo Bee Metal Industries  , MaSteel, Leon Fuat, CSC Steel and Prestar Resources,’’ he noted.

, MaSteel, Leon Fuat, CSC Steel and Prestar Resources,’’ he noted.According to the Ministry of International Trade and Industry (MITI) data, local steel bar prices rose further to reach another record high of

RM2,642/MT in Sep 17 (+45.5% y-o-y, +6.2% m-o-m), while local billet prices increased to RM2,363/MT (+53.6% yoy, +6.5% mom).

This brought steel bar prices in Q3 17 to RM2,417/MT (+16.4% q-o-q), exceeding the peak of RM2,233/MT in Q1 17.

UOB Kay Hian expect the increase in domestic demand brought about by more contract awards for infrastructure and mega projects, particularly LRT 3, to provide support to domestic steel prices.

However, it noted that prices may ease in Q4 17 to reflect the seasonal slowdown in China’s construction activities. In September, China steel billets fetched a 12% price premium to local billets versus an 18% premium in August 17, as China billet prices have started to ease.

While most steel companies trade at about 10 times annualised PE, Choo Bee and MaSteel trade at only half their respective annualised price-to-book

multiples.

Leon Fuat trades at only 5.0 times 12-month trailing PE while CSC Steel’s share price has been flat since July 17. Prestar comes across as interesting, riding on the various upcoming highway projects.

没有评论:

发表评论