--Lionind 4235 估计2017年6月财年可净利20 sen(eps),pe=8,股价=rm1.60

--Lionind 当全年eps=20sen,目前1元交易其本益比(pe)才5倍,明显被低估了,

同行如annjoo 在9倍交易.随着季報的報喜,股价会反应合理价值的.

--这行业正复苏,現市场投资气氛良好,股价要急下須有負面因素,而目前我看到lionind是利好展现,钢 材保護税重新延長三年,净利持续等。只是进入等侍丰收。

--中国己对许多商品有绝对的定价权,螺蚊钢就是其中一项,一帶一路下, 产能减等是支持钢价利好。看 來将有一些年的好景。

--公司于6-2-2017 止共累计37105,300股为库存.

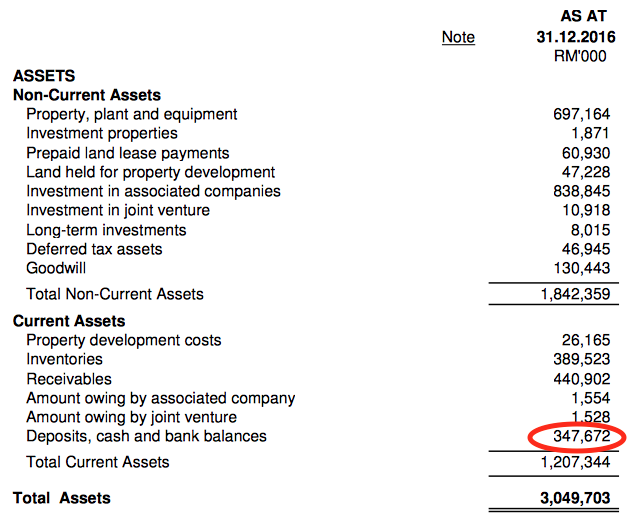

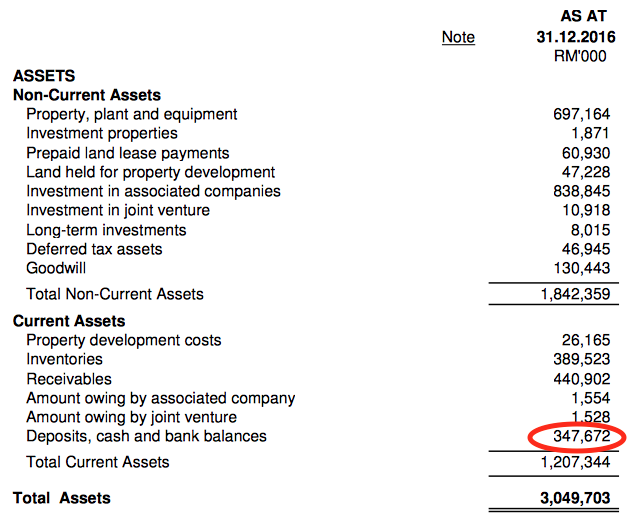

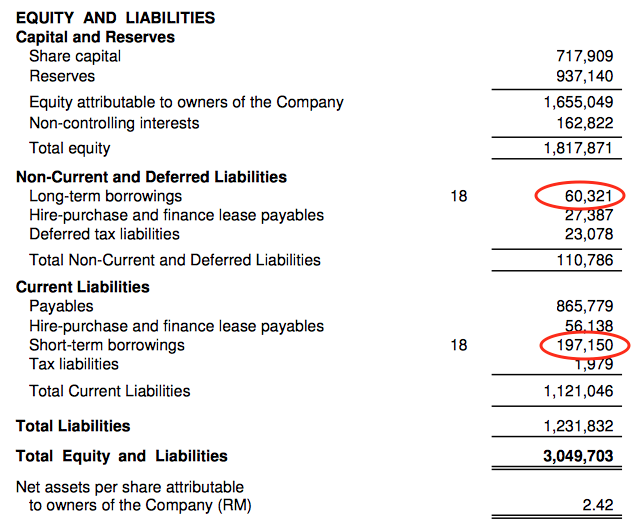

--公司于31-12-2016 的库存有3.89亿零吉,應收款为4.4亿,長短期借贷为2.57亿,总负债为12.3亿,

现金有3.47亿,累计净利有3.88亿,总资产为30.4亿,nta=rm2.42

--公司于30-9-2016的30大股东共持有484157,000股份(67.44%),总股数为717,909m

第三大股东 Lembaga Tabung Haji 持有47,430,700 股 (6.87%),

现在(9-5-2017) 仍有44472,700股,只减少2958,000股,依然对公司有信心。

只供参考,进出自负。

转贴:谢谢以下大大(icon8888,leo ting,李文龙, ming jong tey,的用心功课,感恩.

2)

1. Principal Business Activities

Lion Industries has three major business operation :-

(a) Amsteel Mill in Klang manufactures long products such as bars, rods, etc;

(b) Antara Steel Mill in Johor manufactures light sections such as angle bars, flat bars and U-channels; and

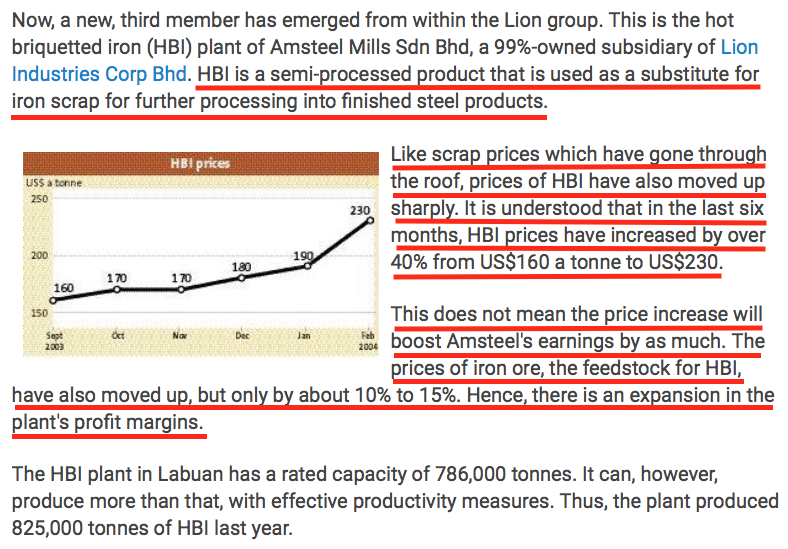

(c) Hot Briquetted Iron plant in Labuan which converts iron ore into HBI, a substitute for iron scrap.

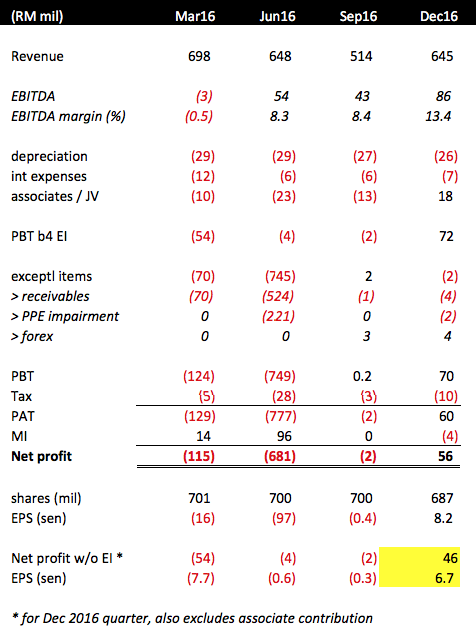

2. Strong December 2016 Quarter

On 23 February 2017, Lion Industries released a strong set of result for the quarter ended December 2016 (Note : March 2017 quarterly result yet to be announced).

Key observations :-

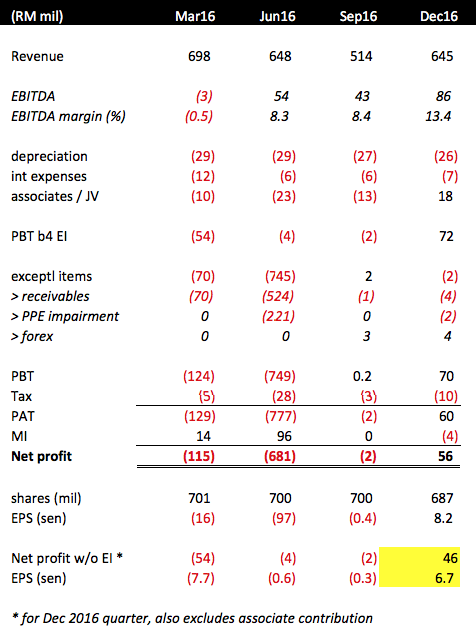

(a) Lion Industries' turnaround started in June 2016 quarter. Its EBITDA turned positive. However, due to huge impairment losses, the group reported huge loss of RM681 mil.

The impairment of receivables was mostly due to amount owing by Megasteel, which has since ceased operation. The group is not expected to register similar huge impairment going forward.

(b) The group's performance continued to stabilise in September 2016 quarter. With the absence of exceptional items, it broke even in that quarter.

(c) The group's performance improved substantially in the December 2016 quarter. Revenue grew while EBITDA margin widened susbtantially to 13.4%.

The company did not provide detailed explanation for the dramatic improvement. My guess is that it has benefited from higher iron ore price.

As shown in table above, during the quarter, iron ore price increased from USD55 per MT to USD80 per MT.

How would that benefit Lion Industries ?

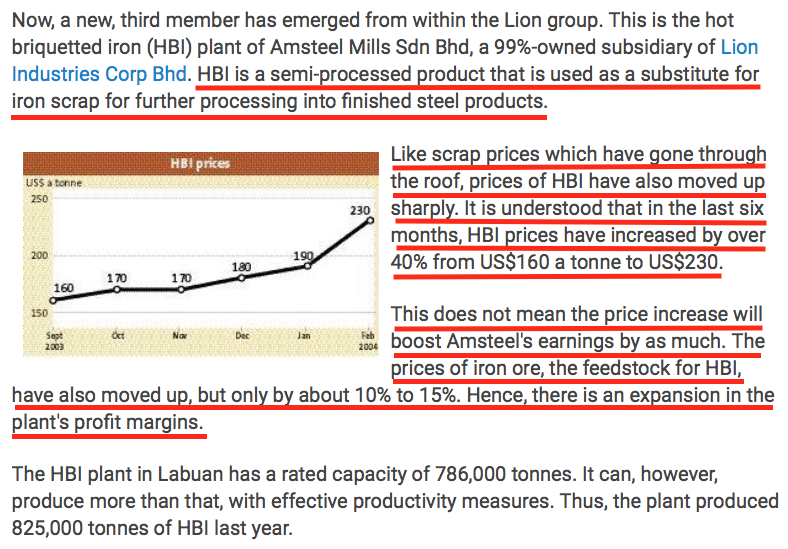

This is because as iron ore price increases, scrap price also increases. The Hot Briquetted Iron ("HBI") produced by Lion Industries' Labuan plant is substitute for scrap. As such, its price will also go up.

Scrap price will usually increase faster than iron ore price as there is infinite amount of iron ore in the ground but supply of scrap is more limited.

As a result, when iron ore price goes up, even though Lion Industries' operating cost will increase, if the selling price of its HBI has gone up faster, it will be in a position to reap windfall gain.

I didn't cook up all these information. It was based on an article dated 2004 posted on The Star. The article might be a bit old, but the concept should still be valid.

(d) Lion Industries has a 23% stake in Parkson Holdings Bhd. In the December 2016 quarter, Parksons reported net profit of RM73 mil due to gain on disposal. This has resulted in RM18 mil positive contribution to Lion Industries' P&L. To be prudent, we should exclude this item.

(e) After making the necessary adjustments, Lion Industries' core earning for the December 2016 quarter should be RM46 mil, which translates into EPS of 6.7 sen.

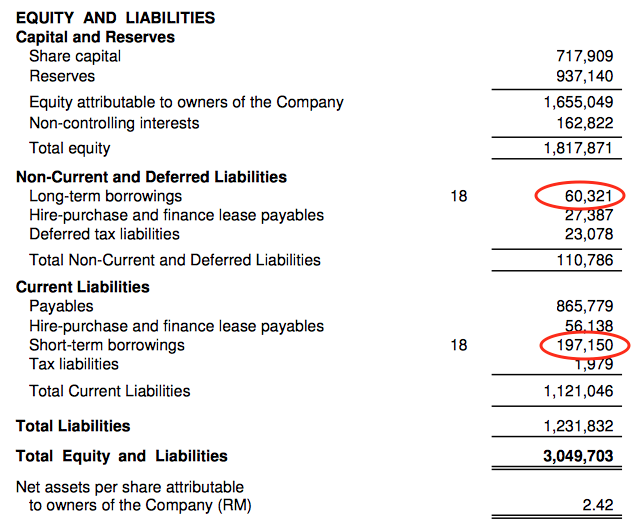

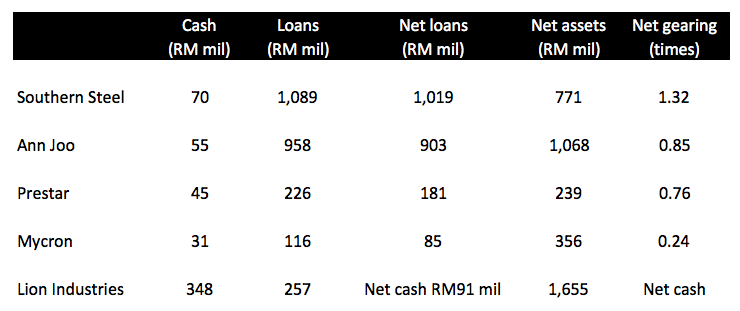

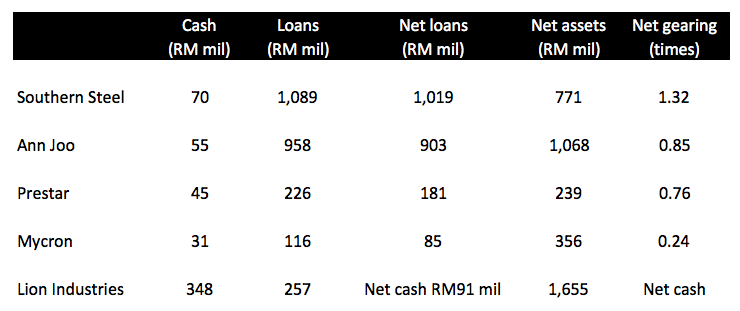

3. Surprisingly Strong Balance Sheets

I always have this impression that the Lion group of companies are mired in debt. I rubbed my eyes in disbelief when I went through Lion Industries' balance sheets. The group has net cash of RM91 mil !!!

Compared to other industry players, Lion Industries' balance sheet is considered very strong.

With such balance sheet strength, the group is in position to pay out high dividend now that it has returned to profitability. Will it do so ? We will soon find out in coming quarters.

4. What To Expect In Coming Quarter ?

I am cautiously optimistic about the coming quarter's result. Iron ore price remained strong in the three months ended March 2017 (major correction started in April 2017). If my hypothesis in Section 2 above is correct, the group's HBI division should continue to do well.

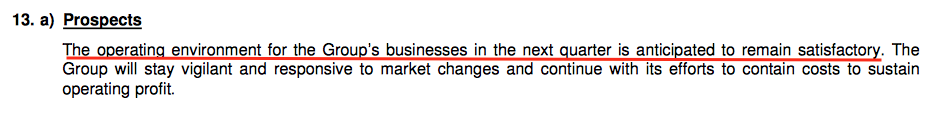

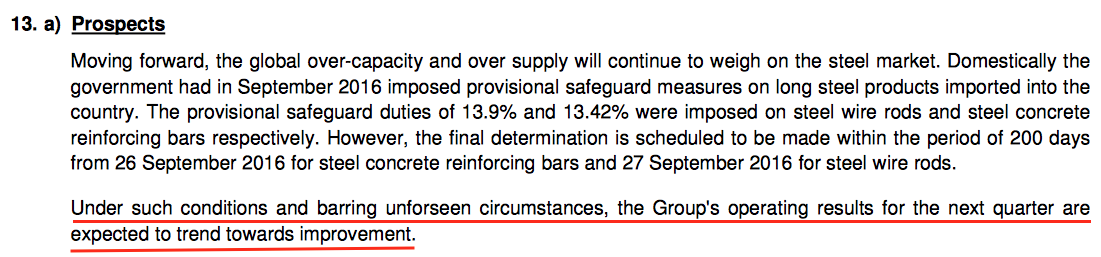

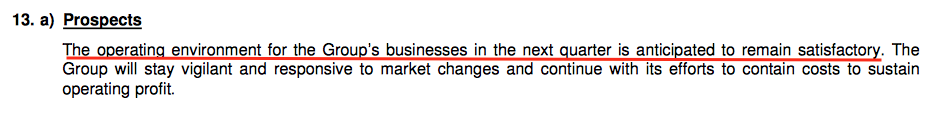

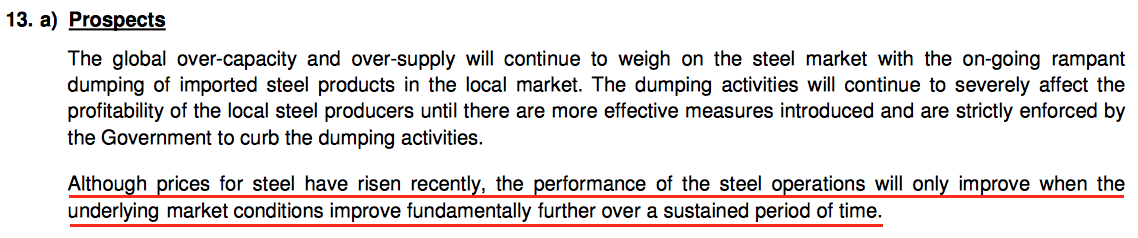

In the December 2016 quarterly report, this is what management said about prospects :

(Source : December 2016 quarterly report)

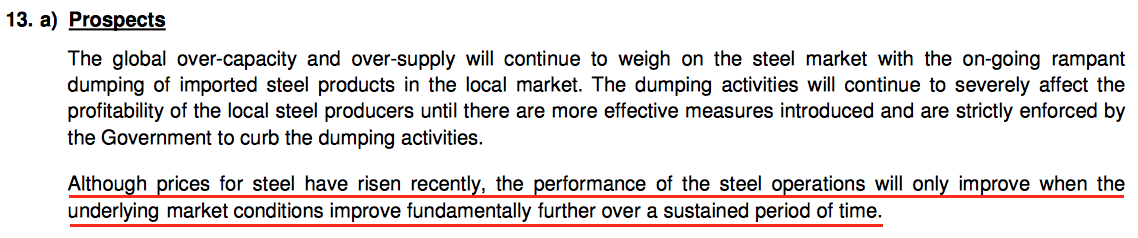

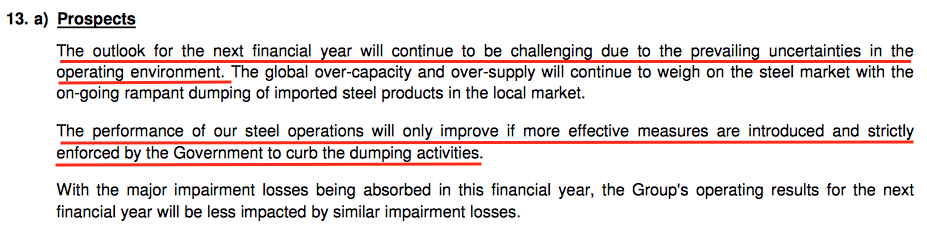

To have a feel of whether management was serious about what they said, or they simply put in something to entertain shareholders, I dug out past few quarters' commentaries on prospects.

(Source : March 2016 quarterly report)

(Source : June 2016 quarterly report)

(Source : September 2016 quarterly report)

Well, I would say that managment passed my little test with flying colour. Everything they said in the past 3 quarters closely reflected what followed subsequently.

In March and June 2016 quarters, they cautioned that operating environment remained challenging, and the results subsequently validated what they said.

In September 2016 quarter, they guided for better performance and that was exactly what happened when December 2016 result was revealed.

It seemed that they were quite careful with their words. What do you think ?

5. Should We Worry About June 2017 Quarter ?

If you take a careful look at the iron ore chart in Section 2 above, you will notice that iron ore price has declined substantially in April 2017. How will that affect Lion Industries' profitability ? Should we be concerned ?

In my opinion, the decline should result in lower profitability at HBI division (no more windfall gain). However, Lion Industries' milling division (Amsteel mill and Antara mill) should benefit from lower input cost.

The steel industry is very complicated. It is affected by many factors which changed from time to time. I simply don't have the resources and expertise to predict how the group will perform in the June 2017 quarter.

However, I believe the group will still report healthy profit. Southern Steel does not have an HBI division to benefit from. However, in the latest March 2017 quarter, it still reported a sterling set of result (even when scrap price was so high). With stronger balance sheets (and hence lower interest expenses), there is no reason that Lion Industries cannot achieve the same performance going forward.

6. Ann Joo's Pretension

In its latest annual report, Ann Joo bragged profusely about its blast furnace (it also has electric arc furnace, just like everybody else). Most steel players use scrap as raw matertial. When scrap price is high, Ann Joo's blast furnace provides it with the flexibility to switch to iron ore, which is usually cheaper.

Because of that, recently Ann Joo's share price has run ahead of other industry players - the Ann Joo Premium.

Sorry to burst your bubble, Ann Joo. It turns out that you are not the only one with that flexibility. Lion Industries' HBI plant serves the same purpose. Furthermore, Lion Industries' balance sheets is much stronger than you.

How about some Lion Premium, huh ?

(I put in the above for fun. Ann Joo shareholders please don't be offended)

7. Concluding Remarks

I am relatively late to the steel industry re-rating. There were previously many uncertainties that stopped me from putting serious money in the sector. However, the government recently imposed a 3 year anti dumping duty on foreign steel import. With that, the industry's operating environment has improved substantially. I believe we are far from approaching the end of the positive cycle and it is still not late to take position.

Lion Industries attracted my attention because of its strong core EPS of 6.7 sen in previous quarter. At current price of RM1.00, even if EPS halved in subsequent quarters, I believe the stock will not collapse in a big way.

It also has strong balance sheet. With a bit of luck, shareholders might even enjoy some dividend going forward.

After taking into consideration the above, I would like to nominate Lion Industries as the TOP PICK for steel play.

Target price of RM1.50 by end 2017.

3)

安裕在2017年70岁了,年纪大吗?

那狮子几岁了呢? 答案是93岁了!

南钢54岁,马钢50岁了。

当然,公司存在不是为了比命长,

而是为了竞争和赚钱。

钢铁在可见的未来100年,不会消失。

对比银行业可能被网上付费系统给替代,

石油能源业可能被新发明的科技取代,

科技业则新的发明消灭旧的科技。

就算有一天,人类发明了新的物质,

不需要钢筋水泥的建筑物,

和钢制产品,钢铁也不会消失。

因为钢铁是军工业的必须品,

一艘艘军舰,一辆辆坦克,

枪枝大炮都是钢铁制成品。

写得实在有够远,

希望我们这一代不会见到战争的杀戮。

这张图是长钢4家公司过去18年的表现。

呈现了循环的周期,基本跟大马股市同周期,

除了最近一波2013-2016年的低谷,

是中国过剩的钢铁倾销造成的。

在图里以橙色格子圈起来的地方,

长钢业者亏损了大约20亿马币。

如果加上扁钢业者包括Megasteel,

损失了大约50亿马币。

在同时,停业和下市的钢铁大公司有

Lioncor, Perwaja.

还在急救中的有Kinsteel.

此外有几家还陷在泥沼里。

在股市里,有那几个行业可以亏损这个数目,

而还可以站得起的呢? 屈指可数。

设想一下,这几年没有中国廉价钢铁倾销,

钢铁业者没有亏了这50亿马币。

那钢铁股现在应该值多少钱呢?

答案是比手套4大天王还高很多。

钢铁股是重工业,高资本的行业,

所以,几乎每家公司的NTA都很高。

因为机器,厂房设备,生产线都极为昂贵。

比起轻工业手套业都高,

更是服务业不能比的。

这些是外部的因素。在上一个上升周期的时候,

狮子和南钢的优势明显,而安裕落后一些马钢则比较弱。

在资本开销方面,狮子押注了扁钢厂,Megasteel.

南钢则是购买了能够使用废铁生产HRC的机械。

安裕投资了小型高炉,而马钢投资了新的扎钢厂。

所以在这个钢铁上升周期,各家开始面对了它们之前的决策。

狮子在注销的Megasteel厂停业的损失,

南钢注销了生产HRC机械的投资,

安裕在享受投资扩大的盈利,

马钢准备正常化它的新扎钢厂。

大致来说,狮子,南钢和安裕的营业额会很接近了,

而马钢也会进一步缩小跟前3的差距。

在这个上升周期内,

狮子会慢慢恢复元气,

南钢需要一些时间赚回亏损掉的投资。

安裕和马钢会累积盈利和资本来面对下一波的竞争。

如果收购,谁也收购不了谁,合并还有一些可能。

丰隆集团的南钢和安裕会有比较充裕的资金扩张,

而狮子和马钢也许可以联盟2018年开业的联合钢铁,

策略性的经营,当铁砂便宜时跟联合钢铁买billet,

如果铁砂昂贵时,自己熔废铁。

总的来说,2017年这4家长钢商的销售在80亿-100亿之间。

至于可以从这笔数目化多少成为净利。

就等时间来证明了。

--Lionind 当全年eps=20sen,目前1元交易其本益比(pe)才5倍,明显被低估了,

同行如annjoo 在9倍交易.随着季報的報喜,股价会反应合理价值的.

--这行业正复苏,現市场投资气氛良好,股价要急下須有負面因素,而目前我看到lionind是利好展现,钢 材保護税重新延長三年,净利持续等。只是进入等侍丰收。

--中国己对许多商品有绝对的定价权,螺蚊钢就是其中一项,一帶一路下, 产能减等是支持钢价利好。看 來将有一些年的好景。

--公司于6-2-2017 止共累计37105,300股为库存.

--公司于31-12-2016 的库存有3.89亿零吉,應收款为4.4亿,長短期借贷为2.57亿,总负债为12.3亿,

现金有3.47亿,累计净利有3.88亿,总资产为30.4亿,nta=rm2.42

--公司于30-9-2016的30大股东共持有484157,000股份(67.44%),总股数为717,909m

第三大股东 Lembaga Tabung Haji 持有47,430,700 股 (6.87%),

现在(9-5-2017) 仍有44472,700股,只减少2958,000股,依然对公司有信心。

只供参考,进出自负。

1)[转贴] 讲股之~半睡半醒的狮子 - SungaiPinang Capital

Author: Tan KW | Publish date:

http://klse.i3investor.com/blogs/kianweiaritcles/122723.jsp转贴:谢谢以下大大(icon8888,leo ting,李文龙, ming jong tey,的用心功课,感恩.

2)

(Icon) Lion Industries - Top Pick For Steel Recovery Play

Author: Icon8888 | Publish date:

1. Principal Business Activities

Lion Industries has three major business operation :-

(a) Amsteel Mill in Klang manufactures long products such as bars, rods, etc;

(b) Antara Steel Mill in Johor manufactures light sections such as angle bars, flat bars and U-channels; and

(c) Hot Briquetted Iron plant in Labuan which converts iron ore into HBI, a substitute for iron scrap.

2. Strong December 2016 Quarter

On 23 February 2017, Lion Industries released a strong set of result for the quarter ended December 2016 (Note : March 2017 quarterly result yet to be announced).

Key observations :-

(a) Lion Industries' turnaround started in June 2016 quarter. Its EBITDA turned positive. However, due to huge impairment losses, the group reported huge loss of RM681 mil.

The impairment of receivables was mostly due to amount owing by Megasteel, which has since ceased operation. The group is not expected to register similar huge impairment going forward.

(b) The group's performance continued to stabilise in September 2016 quarter. With the absence of exceptional items, it broke even in that quarter.

(c) The group's performance improved substantially in the December 2016 quarter. Revenue grew while EBITDA margin widened susbtantially to 13.4%.

The company did not provide detailed explanation for the dramatic improvement. My guess is that it has benefited from higher iron ore price.

As shown in table above, during the quarter, iron ore price increased from USD55 per MT to USD80 per MT.

How would that benefit Lion Industries ?

This is because as iron ore price increases, scrap price also increases. The Hot Briquetted Iron ("HBI") produced by Lion Industries' Labuan plant is substitute for scrap. As such, its price will also go up.

Scrap price will usually increase faster than iron ore price as there is infinite amount of iron ore in the ground but supply of scrap is more limited.

As a result, when iron ore price goes up, even though Lion Industries' operating cost will increase, if the selling price of its HBI has gone up faster, it will be in a position to reap windfall gain.

I didn't cook up all these information. It was based on an article dated 2004 posted on The Star. The article might be a bit old, but the concept should still be valid.

(d) Lion Industries has a 23% stake in Parkson Holdings Bhd. In the December 2016 quarter, Parksons reported net profit of RM73 mil due to gain on disposal. This has resulted in RM18 mil positive contribution to Lion Industries' P&L. To be prudent, we should exclude this item.

(e) After making the necessary adjustments, Lion Industries' core earning for the December 2016 quarter should be RM46 mil, which translates into EPS of 6.7 sen.

3. Surprisingly Strong Balance Sheets

I always have this impression that the Lion group of companies are mired in debt. I rubbed my eyes in disbelief when I went through Lion Industries' balance sheets. The group has net cash of RM91 mil !!!

Compared to other industry players, Lion Industries' balance sheet is considered very strong.

With such balance sheet strength, the group is in position to pay out high dividend now that it has returned to profitability. Will it do so ? We will soon find out in coming quarters.

4. What To Expect In Coming Quarter ?

I am cautiously optimistic about the coming quarter's result. Iron ore price remained strong in the three months ended March 2017 (major correction started in April 2017). If my hypothesis in Section 2 above is correct, the group's HBI division should continue to do well.

In the December 2016 quarterly report, this is what management said about prospects :

(Source : December 2016 quarterly report)

To have a feel of whether management was serious about what they said, or they simply put in something to entertain shareholders, I dug out past few quarters' commentaries on prospects.

(Source : March 2016 quarterly report)

(Source : June 2016 quarterly report)

(Source : September 2016 quarterly report)

Well, I would say that managment passed my little test with flying colour. Everything they said in the past 3 quarters closely reflected what followed subsequently.

In March and June 2016 quarters, they cautioned that operating environment remained challenging, and the results subsequently validated what they said.

In September 2016 quarter, they guided for better performance and that was exactly what happened when December 2016 result was revealed.

It seemed that they were quite careful with their words. What do you think ?

5. Should We Worry About June 2017 Quarter ?

If you take a careful look at the iron ore chart in Section 2 above, you will notice that iron ore price has declined substantially in April 2017. How will that affect Lion Industries' profitability ? Should we be concerned ?

In my opinion, the decline should result in lower profitability at HBI division (no more windfall gain). However, Lion Industries' milling division (Amsteel mill and Antara mill) should benefit from lower input cost.

The steel industry is very complicated. It is affected by many factors which changed from time to time. I simply don't have the resources and expertise to predict how the group will perform in the June 2017 quarter.

However, I believe the group will still report healthy profit. Southern Steel does not have an HBI division to benefit from. However, in the latest March 2017 quarter, it still reported a sterling set of result (even when scrap price was so high). With stronger balance sheets (and hence lower interest expenses), there is no reason that Lion Industries cannot achieve the same performance going forward.

6. Ann Joo's Pretension

In its latest annual report, Ann Joo bragged profusely about its blast furnace (it also has electric arc furnace, just like everybody else). Most steel players use scrap as raw matertial. When scrap price is high, Ann Joo's blast furnace provides it with the flexibility to switch to iron ore, which is usually cheaper.

Because of that, recently Ann Joo's share price has run ahead of other industry players - the Ann Joo Premium.

Sorry to burst your bubble, Ann Joo. It turns out that you are not the only one with that flexibility. Lion Industries' HBI plant serves the same purpose. Furthermore, Lion Industries' balance sheets is much stronger than you.

How about some Lion Premium, huh ?

(I put in the above for fun. Ann Joo shareholders please don't be offended)

7. Concluding Remarks

I am relatively late to the steel industry re-rating. There were previously many uncertainties that stopped me from putting serious money in the sector. However, the government recently imposed a 3 year anti dumping duty on foreign steel import. With that, the industry's operating environment has improved substantially. I believe we are far from approaching the end of the positive cycle and it is still not late to take position.

Lion Industries attracted my attention because of its strong core EPS of 6.7 sen in previous quarter. At current price of RM1.00, even if EPS halved in subsequent quarters, I believe the stock will not collapse in a big way.

It also has strong balance sheet. With a bit of luck, shareholders might even enjoy some dividend going forward.

After taking into consideration the above, I would like to nominate Lion Industries as the TOP PICK for steel play.

Target price of RM1.50 by end 2017.

3)

Wednesday, 10 May 2017

钢铁第6报告之长钢争霸!

安裕在2017年70岁了,年纪大吗?

那狮子几岁了呢? 答案是93岁了!

南钢54岁,马钢50岁了。

当然,公司存在不是为了比命长,

而是为了竞争和赚钱。

钢铁在可见的未来100年,不会消失。

对比银行业可能被网上付费系统给替代,

石油能源业可能被新发明的科技取代,

科技业则新的发明消灭旧的科技。

就算有一天,人类发明了新的物质,

不需要钢筋水泥的建筑物,

和钢制产品,钢铁也不会消失。

因为钢铁是军工业的必须品,

一艘艘军舰,一辆辆坦克,

枪枝大炮都是钢铁制成品。

写得实在有够远,

希望我们这一代不会见到战争的杀戮。

这张图是长钢4家公司过去18年的表现。

呈现了循环的周期,基本跟大马股市同周期,

除了最近一波2013-2016年的低谷,

是中国过剩的钢铁倾销造成的。

在图里以橙色格子圈起来的地方,

长钢业者亏损了大约20亿马币。

如果加上扁钢业者包括Megasteel,

损失了大约50亿马币。

在同时,停业和下市的钢铁大公司有

Lioncor, Perwaja.

还在急救中的有Kinsteel.

此外有几家还陷在泥沼里。

在股市里,有那几个行业可以亏损这个数目,

而还可以站得起的呢? 屈指可数。

设想一下,这几年没有中国廉价钢铁倾销,

钢铁业者没有亏了这50亿马币。

那钢铁股现在应该值多少钱呢?

答案是比手套4大天王还高很多。

钢铁股是重工业,高资本的行业,

所以,几乎每家公司的NTA都很高。

因为机器,厂房设备,生产线都极为昂贵。

比起轻工业手套业都高,

更是服务业不能比的。

这些是外部的因素。在上一个上升周期的时候,

狮子和南钢的优势明显,而安裕落后一些马钢则比较弱。

在资本开销方面,狮子押注了扁钢厂,Megasteel.

南钢则是购买了能够使用废铁生产HRC的机械。

安裕投资了小型高炉,而马钢投资了新的扎钢厂。

所以在这个钢铁上升周期,各家开始面对了它们之前的决策。

狮子在注销的Megasteel厂停业的损失,

南钢注销了生产HRC机械的投资,

安裕在享受投资扩大的盈利,

马钢准备正常化它的新扎钢厂。

大致来说,狮子,南钢和安裕的营业额会很接近了,

而马钢也会进一步缩小跟前3的差距。

在这个上升周期内,

狮子会慢慢恢复元气,

南钢需要一些时间赚回亏损掉的投资。

安裕和马钢会累积盈利和资本来面对下一波的竞争。

如果收购,谁也收购不了谁,合并还有一些可能。

丰隆集团的南钢和安裕会有比较充裕的资金扩张,

而狮子和马钢也许可以联盟2018年开业的联合钢铁,

策略性的经营,当铁砂便宜时跟联合钢铁买billet,

如果铁砂昂贵时,自己熔废铁。

总的来说,2017年这4家长钢商的销售在80亿-100亿之间。

至于可以从这笔数目化多少成为净利。

就等时间来证明了。

没有评论:

发表评论