1)

TTES's PAT shows CAGR of 88.5% from 2011 to 2013, though PAT in 2013 was just RM1.02mil.

http://bursadummy.blogspot.com/2015/06/frontken-profit-guarantee-in-ttes.html

2)本帖最后由 cchleong 于 2015-5-29 12:28 编辑

此股的台湾子公司,荣众科技,近期业绩应该不错。虽然,比去年12月的业绩下降了很多,但比之去年第一季的业绩却增长了不少。从以下的图表来看,去年第一季的每月营收皆不超过6千万新台币,但今年首三月,每月的营收皆超过了6千万新台币。因此Frontken在半导体的业绩应该会很不错,不过在油气业务方面就不得而知了

3) Frontken up as much as 9%, sees continued interest from Apple chip demand

By Shalini Kumar / theedgemarkets.com | April 22, 2015 : 3:09 PM MYT

Share on facebookShare on twitter

Printer-friendly versionSend by emailPDF version

KUALA LUMPUR (April 22): Frontken Corp Bhd ( Financial Dashboard) rose as much as 9% during the morning trade today, possibly on continued positive investor interest after news that Apple Inc had awarded nearly a third of its A9 chip orders to Taiwan Semiconducting Manufacturing Co (TSMC).

Frontken (fundamental: 1.8; valuation: 0.3) has a 57.79% stake in Taiwan-listed Ares Green Technology Corp, which counts TSMC as one of its clients.

Ares Green provides ultra-cleaning services, anodising treatment, electro and chemical polishment and other reburshiment services for the semiconductor and optoelectronic products.

A remisier told theedgemarkets.com that the recent run up in Frontken’s share price could be due to the news, but he believes it has already been priced in.

“Since TMSC has beat out its competition to secure the chip orders for the new iPhones, the entire value chain has benefitted from the spillover effects,” he said.

At 2.44 pm, the stock was two sen or 7.27% higher at 29.5 sen after some 132.07 million changed hands, making it the most actively-traded counter across the bourse. The current price gives it a market capitalisation of RM314.54 million.

Over the last year, the stock has risen 114.29%; it gained some 71.43% since April 7 alone.

Frontken was also recently featured in the Stocks with Momentum column in The Edge Financial Daily on April 13.

Frontken: Profit Guarantee In TTES Acquisition - Bursa Dummy

Author: Tan KW | Publish date: Sat, 20 Jun 2015, 04:50 PM

Saturday, 20 June 2015

In my last post, I wrote about Frontken mainly because one blog reader asked for my opinion on it.

I must admit that I didn't study the company in detail. I am too busy with work lately, feeling a bit frustrated and thus, have not much time and mood in stock market.

As stated in my previous post, I always think that Frontken is a good stock even though I lost track with it since mid-2013. I missed the news of its Tanjung Bin contract.

I did hesitate whether to invest in Frontken in early 2015, when the stock was made popular by fellow contributors in i3investor.

I studied it briefly and finally, the lack of major contract after Tanjung Bin and the gloomy O&G industry caused me to shy away from it.

However, I missed one important information, which is the profit guarantee in the acquisition of 45% in TTES which was acquired in May 2014.

I wish to apologize to readers about this mistake, and feel obliged to write another article to correct it.

The rest of the story is, I missed the opportunity to make a good profit in a short time.

About the profit guarantee, it is stated in the SPA that the cumulative audited PAT of TTES for the financial years ending 31 Dec 2014 and 2015 shall not be less than RM8mil. If not, the vendor shall compensate Frontken for the shortfall.

Since Frontken holds 45% of TTES, then Frontken should get at least RM3.6mil net profit. Who knows TTES can deliver more than RM8mil in that period of time?

TTES's PAT shows CAGR of 88.5% from 2011 to 2013, though PAT in 2013 was just RM1.02mil.

As the vendor is so confident to give such profit guarantee, I think there must be some big contracts on-going and pending.

The acquisition by Frontken was just completed on 23 May 2014. Does it mean that Frontken will not get the profit before 23 May in 2014?

If this is the case, the amount should be very small anyway.

Even though crude oil price tumbled soon after the acquisition, and Petronas capex is reduced, Frontken will still bag the profit guarantee.

In general, Frontken seems to be a growing company since taken over by a German.

Taiwan's Ares Green is expanding. Even if TTES does not do well in 2015, it certainly will when the O&G industry rebound.

With ample cash, Frontken might acquire another assets or business in the future.

Who knows another big contract is on the way?

So, I think shareholders of Frontken need not worry too much about its long-term prospect.

On whether it is the right time to buy its shares, it depends on your own judgement and confidence.

On whether it is the right time to buy its shares, it depends on your own judgement and confidence.

2)本帖最后由 cchleong 于 2015-5-29 12:28 编辑

此股的台湾子公司,荣众科技,近期业绩应该不错。虽然,比去年12月的业绩下降了很多,但比之去年第一季的业绩却增长了不少。从以下的图表来看,去年第一季的每月营收皆不超过6千万新台币,但今年首三月,每月的营收皆超过了6千万新台币。因此Frontken在半导体的业绩应该会很不错,不过在油气业务方面就不得而知了

By Shalini Kumar / theedgemarkets.com | April 22, 2015 : 3:09 PM MYT

Share on facebookShare on twitter

Printer-friendly versionSend by emailPDF version

KUALA LUMPUR (April 22): Frontken Corp Bhd ( Financial Dashboard) rose as much as 9% during the morning trade today, possibly on continued positive investor interest after news that Apple Inc had awarded nearly a third of its A9 chip orders to Taiwan Semiconducting Manufacturing Co (TSMC).

Frontken (fundamental: 1.8; valuation: 0.3) has a 57.79% stake in Taiwan-listed Ares Green Technology Corp, which counts TSMC as one of its clients.

Ares Green provides ultra-cleaning services, anodising treatment, electro and chemical polishment and other reburshiment services for the semiconductor and optoelectronic products.

A remisier told theedgemarkets.com that the recent run up in Frontken’s share price could be due to the news, but he believes it has already been priced in.

“Since TMSC has beat out its competition to secure the chip orders for the new iPhones, the entire value chain has benefitted from the spillover effects,” he said.

At 2.44 pm, the stock was two sen or 7.27% higher at 29.5 sen after some 132.07 million changed hands, making it the most actively-traded counter across the bourse. The current price gives it a market capitalisation of RM314.54 million.

Over the last year, the stock has risen 114.29%; it gained some 71.43% since April 7 alone.

Frontken was also recently featured in the Stocks with Momentum column in The Edge Financial Daily on April 13.

4)

| 半仙買進並行使 前研科技憑單有利可圖

溫世麟-窩輪資本總執行長

www.warrants.com.my

前研科技(FRONTKN,0128,主要板貿服)的股價在4月9日開始攀升。

成交量也從每天數百萬股飆升到上周每天平均超過1億股。

該公司股價在這期間也從18仙左右上升到上週五閉市時的25.5仙。

前研科技這一輪漲勢是發生在該公司憑單前研科技-WA屆滿后一個多月,

使得眾多持有前研科技-WA的朋友無法享受這個遲來的春天。

我在2月初曾經在本專欄提出,當時以0.5仙交易的前研科技憑單前研科技

-WA是否值得一博。

如果投資者是不願行使的話就血本無歸了。但如果投資者行使的話就有利可圖。

根據大馬交易所資料顯示,也有不少憑單持有人在3月初憑單屆滿前夕,

行使憑單成為新股;總共有4153萬前研科技新股在3月上市。

在3月17日開始交易的最后一批新股數量也達到2802萬股,是不是這批

新股推低該股的走勢呢?這或許會是,但前研科技的業績大幅度上升應該使得 該股具有上升的條件。

另外一種說法是沒有持有任何前研科技-WA的前研科技德國大股東,

是要在憑單滿期后才願意使公司價值兌現,以便他們的股權不受價內憑單行使人沖淡。

前研科技在2013年承受虧損,在之前2012年和2011年的淨利也只最高只

有380萬令吉。不過該公司在2014年獲得1877萬令吉的淨利,和該公司2008年 創下的1879萬令吉淨利高峰只差一個馬鼻。

由于該公司主要涉及的半導體行業在這一兩年的業務看俏,公司業務有一大半

是在海外,相信公司業績有望在2015年創新高。

若股價和業績有直接關聯,前研科技的股價或許也會挑戰當年最高峰期的40仙左右。

5)

Author: YiStock | Publish date: Fri, 19 Jun 2015, 05:38 PM

Add on: 20 Jun 2015

Hi All Value Investors, Recent sell down in Frontkn must have jeopadised confidence in many investors. While some "anxiously" waiting to average down.. i believe some have concern on a blog written by Bursa Dummy pertaining to the "up coming" Q results due to the end of RM 110.6 mil contracts in April 2015. http://klse.i3investor.com/blogs/kianweiaritcles/78538.jsp Bursa Dummy has been one of the most respected blogger in i3, at least for me. I learned great deal of things from him via his comprehensive write up and opinion on many companies. Perhaps, allowed me continue the story, which i personally think "may" help ease the mind of many value investors. Let see below:

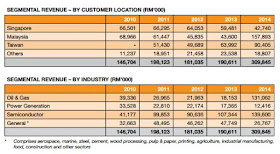

I tried to breakdown the Revenue Contribution from each country/ segment, noticeable the main contributor is MY, followed by Taiwan, SG, Philipine, Indonesia & lastly, China. The revenue from FY 2014 Q2 to FY 2015 Q1, clearly shows that the effect from the RM 110.6 million contract work awarded to Frontken in Mid 2013 for 20 months, which roughly to end in first Q of 2015. Please also note that the contribution from Taiwan has increased significantly too. I used the CAGR of 11% to rougly estimate the 2015Q2,Q3 & Q4, I estimate the Revenue from Taiwan segment should reach RM 110.4 million for full FY 2015. Ares Green has on 1 Jun 2015 annouced to further expand current capacity due to customer's demand. I assumed the above figures for 2015 is achieveable and FY 2016 should see the semi-conductor segment to contribute even greatly to Fronkn's topline. Revenue from SG, Philipine are comparable while Indonesia and china continue to contribute the least. Fronken has eliminated the China segment due to heavy losses. See below the tables which is the main part of the continue Story from Bursa Dummy's blog. The Operating Profit Contribution part.

The higher operating margin in semi-conductor segment (15%) compared to Oil & Gas segment (8%) has attracted me the most. While the Revenue from enginnering segment remain high, but the margin is not up to satisfactory just yet. Lower oil price will surely eat into the margin quite substatially in near future. Management has on April 2014 acquired about 45% shares in TTES which has main customers such as Petronas, Exxon Mobil, Talisma and etc. One Importaint point to note on this deal: althought current TTES profit stood at RM 1 million, there is a RM 8 Million Profit Guaranteed for FY 2014 & FY 2015 for this deal! Do search back the deal in bursa anouncement made some where in April 2014. I do not know if the RM 8 milion net profit has been factored into FY 2014 as it mentioned cummulative. My own guess is NOT YET by looking at the 2014 profit trend on quarterly basis. So this RM 8 million is very likely to be seen in FY 2015. This RM 8 million may be the sum that will fill up the vacumm for 2015 engineering segment. Plus 2015Q1 engineering segment's operating profit of RM 5.5 million. The finaly operating profit may touch RM 13 mil from engineering segment for FY 2015. Slightly more that FY 2014 full year Engineering segment. The lose making from china has been discontinued, i think the indonesia could likely be the next one to be chopped off. My very own personal view: 1) RM 8 millon profit guaranteed will filled up the "operating profit gap" for FY2015 malaysia engineering segment on top of any new contract that may be acquired in near future. 2) Contribution from SG, and Philippine to stay reasonable. 3) Taiwan segment continue to prosper in high speed. 4) Enginnering segment guaranteed to good. 5) Loss making segment chopped. 6) RM 8 million profit guarantee will further strengthen the Cash Flow. 7) The profit-filled is buying time for the Taiwan Segment to quickly prosper to propel company total operating profit. My estimation will be about RM 35.4 million for FY 2015. And i hope the Revenue and Profit will continue to surge for 2016 onwards where Semi-Con segment may 独当一面! 8) TTES has good customer base. I certainly wish to see the enginnering part to continue do well in Malaysia. 9) I personally hope that Frontkn can fully convert into Semi-conductor industry. At least this is the segment that will continue to boom whereby smart devices usage has been gaining tremendous momentum in many part of our life. 10) My short term TP remained unchanged at RM 0.37. 11) MY 2 year TP is at RM 0.51 (about 100% up site potential) Lastly, I must salute Fronken management for the well planned path. Anyone going to AGM, please say a big thank you on behalf of me! YiStock 5:30 pm Note: This is not a recommendation to buy or sell or trade above mentioned stock! It is for sharing purposely of what i am doing. To all value investors, Remember i always mentioned to listen only to KCChongnz and MR OTB? In chinese, 师傅领进门, 修行在个人。。 Please dont blame Mr OTB or Mr KCchongnz if you lose money in bursa. While saying this, i m also still learning. My previous article titled " Fronken - Could it be another heart-wrenching stock like Inari"? http://klse.i3investor.com/blogs/frontkn/75546.jsp Please note that the part that i want to emphasis is "HEART-WRENCHING", not saying Frontken will become Inari! Of course, if there is such event, then we are blessed. Cheers! 6) Frontken: Will It Get Better in 2015? - Bursa DummyAuthor: Tan KW | Publish date: Wed, 17 Jun 2015, 09:37 AM

Tuesday, 16 June 2015

I first invested (or speculated) in Frontken in 2009, and subscribed to its rights issue with free warrants in 2010.

This stock swung between profit and loss and somehow I manage to sell all the shares and warrants in early 2011 for some gain. I still kept a very close eye on Frontken after that as super penny stocks around 10-20sen were my favourite.

When Frontken's share price tumbled to around 6sen in year 2013, I still felt that it was a good penny stock with great potential. I planned to speculate on it again when the time was right.

Unfortunately, I lost track with Frontken after I changed my investment strategy in mid-2013. I didn't follow Frontken close enough, and so I missed its share price rally since last year.

Without shadow of a doubt, year 2014 was a magnificent year for Frontken.

Its revenue reached a record high of RM309.8mil which is 63% better than FY13. It has reversed its loss of RM2.3mil in FY13 to a PATAMI of RM18.8mil in FY14.

What a turnaround.

Its cash flow is good and it has repaid most of its bank borrowings and becomes a net cash company now.

Why does Frontken perform so well in FY2014? Will it continue to do well in 2015?

Lets check its revenue contribution in 2014.

Looking at Frontken's segmental revenue, there is no doubt that Oil & Gas and Semiconductor industries contributed massively in 2014.

Through 34.9%-owned associate company Ares Green Technology (Taiwan), Frontken is able to enjoy the robust growth in the semiconductor sector in Taiwan.

While contribution from Taiwan has increased 50% YoY in 2014, the main contributor is actually from Oil & Gas sector in Malaysia, in which its revenue increased from RM18mil to RM131mil YoY.

In September 2013, Frontken was awarded a contract by ATT Tanjung Bin Sdn Bhd as the main contractor for a hydrocarbon storage and distribution facility at Tanjung Bin.

The contract is worth RM110.6mil and the proposed date of completion of the project is 11 April 2015.

This means that after the Tanjung Bin project has been completed, its O&G annual revenue will likely to shrink significantly especially when there is a slow down in O&G sector now.

While Taiwan's Ares Green is enjoying superb growth in 2014, there is a disturbing slow down in Q1 of 2015 if compared to Q4 of 2014.

The chart below shows monthly revenue of Ares Green (blue bars) & YoY change (red line).

Ares Green Tech monthly revenue

Though monthly revenue in year 2015 has reduced significantly, fortunately they are still higher compared to previous year's corresponding periods.

However, if there is no "revenue spike" in Q4 of 2015, then Frontken's revenue from Taiwan in 2015 may not show significant growth.

Last year Frontken has acquired 45% stake in TTES Team & Specialist Sdn Bhd which has expertise in turbo machinery and rotating equipment engineering, technology, maintenance and technical support services.

TTES's customers are mainly in the O&G field. Its PAT in 2013 is merely RM1mil and is unlikely to contribute significantly to Frontken in the near future.

In conclusion, Frontken is a good company, but I think its FY15's financial result is unlikely to beat FY14 unless it secured another fat contract like the Tanjung Bin contract this year.

7) [转贴] Frontken - cchleongAuthor: Tan KW | Publish date: Tue, 2 Jun 2015, 11:08 AM

前天买入的秘密股,这两天都在下跌,看看它这两天下跌的情形,真的有点怕它的业绩不妙,但根据自己所研究的数据,它的业绩肯定不会比去年差,所以就加码了一点。今天业绩终于出来,也让我松了口气,这股真的印证了之前所说的“业绩公布之前先打压”的做法。是的,我所买入的秘密股,就是它-Frontken,是一支热门炒股,业绩表现不错,revenue增长了60%。

虽然这支是个炒股,但炒股总需要一个主题,这股能够从10仙以下炒上来,当然有它的卖点,那它的卖点是什么? 卖点: 1。它在去年4月建议用1千100万令吉收购TTES团队与专家有限公司的45%股权。有关收购将获得首两年800万令吉的净利保障,意味未来2年内,TTES每年将贡献至少180令吉的净利(800万X45%/2)。 2。它在2013年9月获得丹戎宾私人有限公司颁发价值1亿1千万的港口设施主要承包商合约,为期20个月,今年4月已经完工,因此去年和今年兑现合约的大部分价值,提升业绩表现。 3。去年3月以170万新元脱售蒙受亏损的Chinyee工程与机械私人有限公司的20%股权,把亏损的业务卖了,业绩因此逐步提升。 4。这点最引人注目,持有57。7%的台湾上市子公司荣众科技(Ares Green Technology),该公司涉及半导体领域,它从TSMC(一家为APPLE生产手机芯片的生产商)获得不少生意,目前TSMC从Apple拿到了创纪录的订单,荣众也间接从中受惠,因此Frontken的业绩也获得提升。 荣众科技近期业绩算是不错。虽然,比去年12月的业绩下降了很多,但比之去年第一季的业绩却增长了不少。从以下的图表来看,去年第一季的每月营收皆不超过6千万新台币,但今年首三月,每月的营收皆超过了6千万新台币,因此也带动了Frontken在半导体领域的表现。 总结:虽然这股技术面目前并不好,但鉴于业绩和公司及基本面依然向好,我将继续持有直到获利为止,我买入的均价是0。275。 http://www.investalks.com/forum/forum.php?mod=redirect&goto=findpost&ptid=14464&pid=3604701&fromuid=14714 8) (Icon8888) Frontken Corp - Semiconductor Division Doing WellAuthor: Icon8888 | Publish date: Tue, 17 Feb 2015, 02:03 PMExecutive Summary (a) Provides surface metamorphosis (meaning treatment of objects surface by specialised technology) and mechanical engineering services. (b) Used to be loss making and mis-managed. The emergence of new major shareholder (Dr Jorg Helmut Hohnloser) from Germany helped cleaned up and turned the company around. (c) It owns 57.9% equity interest in Ares Green Technology Corp which is listed on Taiwan Stock Exchange and provides cleaning services to electronic / semiconductor manufacturers. Ares Green Tech has performed well in recent months and is expected to boast the group's overall results. (d) With the bulk of its sales from overseas operation, the group is a beneficiary of weak Ringgit. Frontken Corp Bhd (FRCB) Snapshot

Frontken Corporation Berhad provides surface metamorphosis and mechanical engineering services. The company offers industrial equipment services consisting of upgrade and maintenance services on stationary/rotating equipment and its components. It also provides various specialized engineering services, such as thermal spray coating, cold build up coating, plating and conversion coating, specialized welding, etc. In addition, the company provides surface treatment and precision cleaning for the thin film transistor-liquid crystal display and semiconductor industries. It serves oil and gas, petrochemical, power generation, semiconductor, aerospace, marine, electronics manufacturing, steel, cement, wood processing, etc. It operates in Malaysia, Singapore, the Philippines, Taiwan, China, and Indonesia. Strong balance sheets. Based on net assets of RM197 mil, cash of RM47 mil and loans of RM38 mil, the group is in net cash position. The group reported EPS of 0.52 sen in latest quarter. If annualised, full year EPS would be 2.08 sen. Based on existing share price of 17 sen, prospective PER is 8.2 times. (Of course, if based on 12 months cumulative EPS of 0.9 sen, historical PER would be 19 times) Quarter Result:

Malaysia and Taiwan operation are key earnings contributors :- According to Taiwan listed Ares Green Technology Corp's recent announcement to stock exchange, its sales increased substantially in the months of October, November and December 2014 :- (credit given to i3 member cpng for highlighting this piece of information) Ares Green Technology's share price has almost doubled over past twelve months due to better financial performance :- Appendix 1 - Frontken's principal business activities Appendix 2 - Ares Green Technology Corp's principal business activities (a 57.92% owned subsidiary listed on Taiwan Stock Exchange) |

没有评论:

发表评论