2020年12月31日星期四

2020年12月30日星期三

2020年12月28日星期一

金獅工业 4235 lionind 加倉。

2020年12月27日星期日

2020年12月23日星期三

2020年12月22日星期二

2020年12月21日星期一

2020年12月14日星期一

2020年12月9日星期三

2020年12月7日星期一

2020年12月1日星期二

2020年11月29日星期日

2020年11月18日星期三

2020年11月16日星期一

2020年11月12日星期四

2020年11月4日星期三

Tekseng 7200 德成控股Rm0.915 投资

2020年10月27日星期二

2020年10月23日星期五

0001scomnet 神通网络 rm2.38投资。

2020年10月19日星期一

2127comfort rm5.12投资。

2020年10月16日星期五

Mahsing 8583 马星93仙投资。

2020年10月14日星期三

2020年10月13日星期二

2020年10月7日星期三

Prulexus 8966宝翔集团(Rm1.71) 投资。

2020年10月5日星期一

2020年10月2日星期五

2020年10月1日星期四

2020年9月27日星期日

7200 tekseng rm0.72加倉。

2020年9月19日星期六

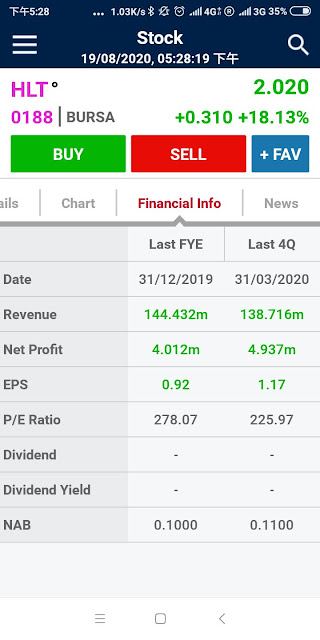

Hlt 0188合力科技 rm1.67投资。

2020年9月15日星期二

2020年9月14日星期一

2020年9月12日星期六

HLT 0188合力科技RM 1.24投资。

2020年9月9日星期三

Comfort 2127 康复手套 Rm3.45投资。

2020年9月8日星期二

0165 xox rm0.23 投资。

2020年9月4日星期五

Adventa 7191穩大Rm2.33投资。

NOW SHOWING: The Trilogy of FAST & FURIOUS Shows, PART 6C

NOW SHOWING: The Trilogy of FAST & FURIOUS Shows, PART 6C

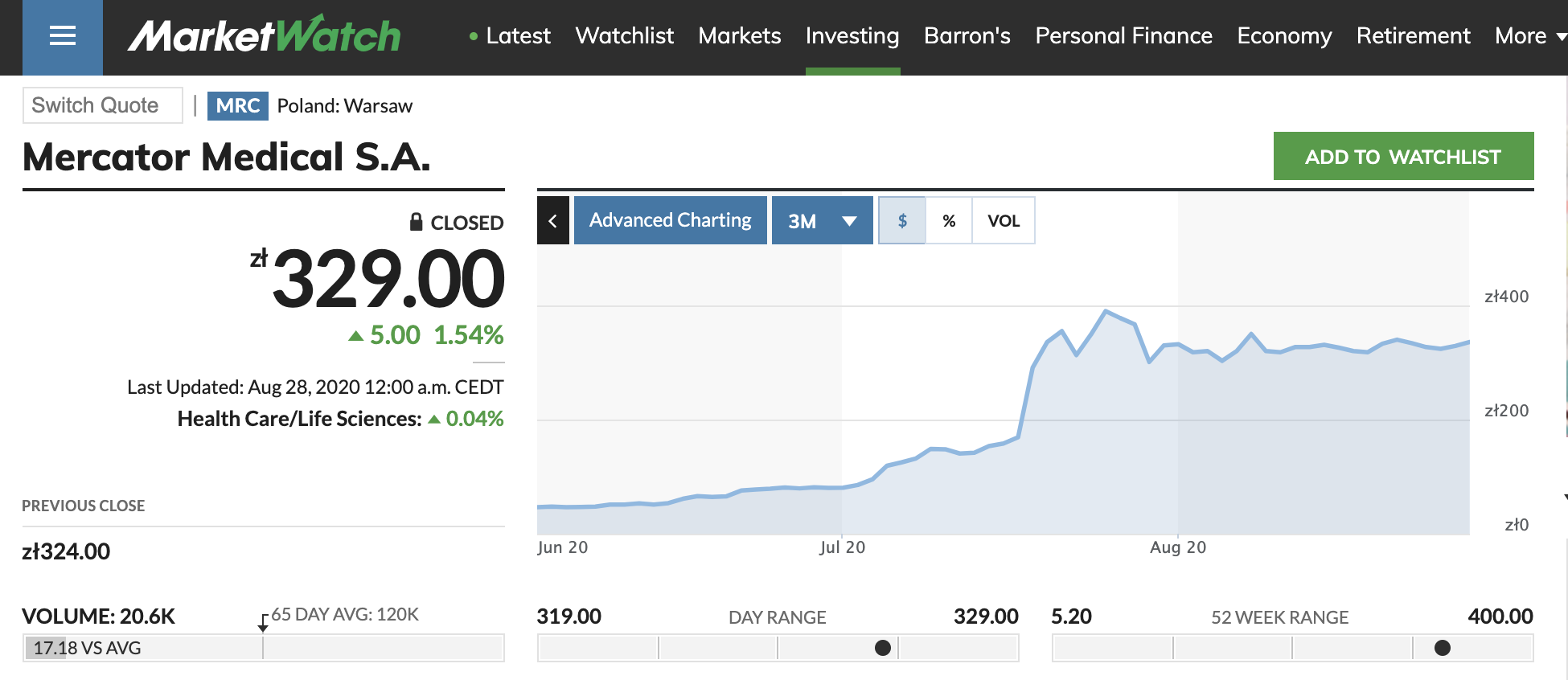

After years of flat profits, Mercator benefits from virus demand on gloves

WARSAW (July 22): Some investments take time to pay back.

Poland’s Mercator Medical SA bought its first factory producing latex gloves in Thailand in 2006, and tripled its capacity over the next 10 years. Initially, the investment didn’t help its market valuation, oscillating around the US$25 million mark in recent years. But demand for medical supplies amid the coronavirus pandemic changed all that.

Mercator shares rose 72% on Monday, after company reported second-quarter net income of US$54 million, four-times more than its cumulative profits in the last decade. The stock got another boost on Tuesday, ending 16% higher, and was Warsaw’s second-most traded stock after management said record earnings weren’t a one-off. The gains bring this year’s rally to 3,277% — surpassing its bigger Malaysian peers — and valuing the company at US$924 million.

Even so, the company’s founder and Chief Executive Officer Wieslaw Zyznowski, dubbed the “Polish rubber king,” isn’t considering cashing out of his 76% stake. Instead, he plans to invest in new production facilities in Thailand and expand into complementary businesses.

“During the war, we should prepare for peace,” Zyznowski, who has a PhD in philosophy, said on a videoconference on Tuesday. “We are working on scenarios for the company for the time when Covid-19 will be eventually tamed.”

| 2020 | POLAND ZLOTY | RM |

| YEAR LOW | 5.2 | 5.876 |

| YEAR HIGH | 400 | 452 |

| 1 JULY 2020 | 80.6 | 91.08 |

| 28 AUG 2020 | 329 | 371.77 |

EXCHANGE RATE: 1 Poland Zloty = RM1.13 (as of 28 Aug 2020)

BUSINESS PROFILE

Mercator Medical SA engages in the production and distribution of rubber gloves, factory in Thailand trading in medical materials.

Headquarter: Krakow, Poland

MALAYSIAN RUBBER GLOVE STOCKS

| TARGET PRICE | ||

| 1 | TOPGLOVE / 7113 | RM28.00 TO RM58.00 |

| 2 | SUPERMAX / 7106 | RM35.86 TO RM50.56 |

| 3 | HARTLEGA / 5168 | RM22.00 TO RM25.00 |

| 4 | KOSSAN / 7153 | RM20.00 TO RM23.00 |

| 5 | COMFORT / 2127 | RM7.28 TO RM9.00 |

| 6 | RUBBEREX / 7803 | RM7.21 TO RM9.00 |

| 7 | ADVENTA / 7191 | RM5.18 TO RM7.00 |

In short, still a lot of upward thrusts as the coming quarters - that are scheduled to announce in September, October, November 2020 will be substantial increasing earnings per share (EPS).

个人分享,買卖自负。

2020年9月3日星期四

2020年8月25日星期二

7148 Dpharma RM 3.73 投资。

趁回调買入,后疫情时段,買入疫苗藥品股,目标价6元。

💪💪股市赚钱不易,安穩的获取净利,疫苗藥品股刚上升中期,仍处于上升中,像当初的手套股一样,后疫情形势,顺势而为,買入待大丰收,dpharma 有政联大戶坐陣,主力己完全控盘,趁低进入,前景一片光明,6元不是夢。

--放眼5年内迈10亿大关‧联合药业跨向区域

https://klse.i3investor.com/m/blog/sinchew_company_story/2020-09-01-story-h1512633115.jsp

个人观点,買卖自负。

更多详细介绍:

转贴,谢谢分享人。

http://www.sharetisfy.com/2019/07/dpharma-7148-ep11.html?m=1

2020年8月24日星期一

Tekseng 7200 德成控股85仙投资。

Tek Seng Holdings Bhd是一家投资控股公司。它分为四个板块:PVC板块板块,从事聚氯乙烯(PVC)板块,工业和消费类零件的制造和贸易。 PP无纺布分部,生产和贸易与PP无纺布相关的产品;从事与PVC皮革相关产品贸易的PVC皮革分部和赚取主要收入。它从事与PVC相关和无纺布相关产品的制造和贸易,

无织布生产,口罩,防护衣的材料,疫情况态下,业绩增长持续。最高1.44回调至0.85,进入机会。

于30/6/2020公司库存价值3556万。

2020年估计EPs=6至7仙

Pe =20倍

股价=Rm1.20至1.40

个人观点,買卖自负。

转贴] 浅谈Tek Seng的无纺布业务

Saturday, August 15, 2020

这不禁让我想起,早前Tek Seng透露第三季会拨出2000万令吉购买新机械以扩增产能,从目前的300公吨月产量翻倍至600公吨。若以UPA提供的数字来做推算的话,那么Tek Seng的新机械每年可生产360万公斤无纺布或相等于1亿800万令吉的年营收,足以供给5亿1600万片3层医用口罩了。管理层最近在接受媒体访问时表示,由于口罩持续供不应求,业务赚幅已经从全球大流行前的6%到8%暴涨至15%,此外企业也准备扩展至欧美市场。趁着目前口罩需求大涨之时再出发,不难理解管理层也希望借此摆脱之前太阳能业务给集团带来的连年亏损。

其实在今年之前,Tek Seng的最主要业务是PVC帆布产品,而无纺布的营收贡献比重也只是占约25%而已,但是随着新冠疫情肆虐从而推高无纺布业务的销售表现,贡献比重在今年次季就已经上涨至70%。企业所生产的无纺布可以广泛应用在医疗物资(口罩和医护设备)和一次性卫生用品(尿片、卫生棉和湿巾)。这些来年随着消费者的卫生意识不断提升,对一次性卫生用品的需求有增无减,甚至已成为一种必需品,无论经济好坏都不会抑制这类产品的需求持续成长。而在经历这一次的疫情爆发之后,也促使消费者对医疗用品需求更加强烈,在新冠疫苗还没研制成功和正式面世之前,人们都必须长时间佩戴口罩与病毒共存,故医疗用品的长期需求备受看好,估计Tek Seng能在这场疫情下从中受惠。

虽然目前市场对医疗用品的需求结构是永久性还是暂时性暂且还不得而知,但是企业的产品质量和技术将决定企业竞争力如何可持续保持领先优势,从而巩固市场份额及获得更多订单。此外,随着Tek Seng从之前的工业供给转为目前更面向终端消费者的市场需求,管理层更是必须提高对价格的敏感度(口罩价格下调、原料价格上涨)以及保持灵活性的议价能力才能应对市场的变化走向。

--

生产医护用品转运

德成控股第二季净利飊264%

转向生产医疗配备包括面罩和防护衣生意後,德成控股(TEKSENG 7200)第二季传捷报,净利按年大增264%!

截至今年六月卅日第二季,德成控股录得净利653万令吉,去年同季净亏398万令吉,成功转亏为盈。

不过第二季营业额按年滑跌10.5%,由4611万令吉减至4128万令吉。

每股盈利1.82仙,比较去年每股净亏1.14仙。

2020财政年首六个月德成净利为1114万令吉,比去年增长417%,去年同期净亏305万令吉。

德成控股股价今午跌5.5仙至88.5仙。

让德成大赚的业务是防护用品(PPE)。

根据执行董事罗永俊透露,截至今年三月第一季,PPE业务为集团贡献25%营业额。

他预测,四月至六月第二季,PPE业务贡献会提高至30%;七月至九月可以提高至70%。

德成和其它宣布要进军PPE业务的上市公司不同,它已经是这个行业的"老手",生产线已非常熟练,提高产量就能提高生意额。

2020年8月19日星期三

5192 Kssc 誠成集团58仙投资。

💪💪kssc 5192 buy in

58sen,

--部分业务与Hlt 0188 相似。

转贴:KSSC HIDDEN GEM IN GLOVE DIPPING LINE. CUSTOMER IS TOPGLOVE KOSSAN AND OTHERS. WAIT TO LIMIT UP VERY SOON - Target Invest - We Target, We Invest | I3investor

--Glove Dipping Machine Manufacturer Malaysia, Medical Glove Supplier Selangor, Dipped Latex Product Supply Kuala Lumpur (KL) ~ KSG Engineering Sdn Bhd

https://m.ksgengineering.com/index.php?ws=pages&pages_id=14026

KSG Engineering Sdn Bhd成立于2010年,是手套浸胶行业的备件贸易商。在短短的几年内,KSG已转变为为手套制造行业的客户提供解决方案的提供商。我们可以设计,安装和调试大容量的浸渍线,并通过在尽可能短的时间范围内提供优质的零件和服务来持续支持您的运营。

我们以质量,可靠性和效率的价值为基础,我们将客户视为长期合作伙伴,共同成长。

我们拥有控股公司K. Seng Seng Corporation Berhad的资源作为后盾,K。Seng Seng Corporation Berhad是在大马交易所上市的知名公司,市值超过20亿令吉。

KSG在雪兰莪州Balakong占地5英亩的现代化工厂中运营,自2011年以来我们一直在使用该设施。雪兰莪州是马来西亚最繁荣和工业化的州,拥有一批熟练的工人和基础设施网络,可实现高效贸易,制造和技术支持。

除了专注于马来西亚客户外,我们的地域覆盖范围还扩展到了亚太地区,涵盖了中国,印度尼西亚,泰国和越南的关键且快速增长的市场。

--😂公司股数为96m

市值20亿的話

每股价值:Rm20

--💪💪kssc:

0.525 是隆股中与手套相关业务里,股价未大副度上升的漏网之鱼,假以时日,公司业绩在转亏为盈的路上,Nta达80仙,负债不多,只是16m,一支被低估的价值股,買入。

截至31/12/2019止公司库存价值为5813万。

截于15/6/2020止 公司大股东持有55.69%股份,而30大股东共持75.01%股份。

上升只是时间,全球最大的四家是它的客户。

目标价:RM 2

公司客户:

Kssc与Hlt的股价比较:

个人分享,買卖自负。

2020年8月13日星期四

0083 notion rm1.15投资。

https://m.facebook.com/story.php?story_fbid=2630288223886773&id=1520891084826498

--公司在口罩相关的业务预计每个月会增加 RM 17.5 Million 的营业额 或者每个季度增加 RM 52.5 Million(需要在 8 月后才正式看到全部的效果)!

至于口罩来说,管理层预计是 30% Gross Profit Margin,至于 PPMB 的话暂时由于价格上下不稳定,因此比较难以估计

资料来源:http://www.notionvtec.com/investor_relations/ir_library

取自网络以上讯息

--个人简单计算:口罩业务,

每季EPs:3sen, rolling 4Q:12sen

Pe:15, stock price:RM 1.80

以上未包括现有业务。

--以下取自网络:

我仍然相信,从中长期来看,公司将会变好。 在最近经历了一次异常但良好的增长之后,刚好出去保护我的利润。将会回来。

我们已经订购了现成的机械:

1)熔喷聚丙烯使产能从目前的50吨增加到每月200吨。平均售价为每吨RM100,000。

2)安装的20线三层面罩容量(包括电流)为每月5000万个。 ASP表示每台50仙

3)42条线的N95,容量为每月6000万个。 N95的平均售价为0.5美元至0.8美元。

4)生产2单位的PP树脂母料,用于我们的PP熔喷生产。

5)斥资2000万令吉,在巴生市购置新的3英亩工厂,安置医疗保健设施。

6)在Gelang Patah建3英亩的土地,以支持我们的EMS客户,因为他们的家电在线销售再增长了1000万令吉。 我们应该能够资助这些。 成为专利la,就销售额和希望的上限而言,我们正在将该集团打造成数十亿公司。仅六个月。 谢谢。

2020年8月11日星期二

2020年8月6日星期四

0083 notion RM 1.87还可投资吗?

Hi, i3 members. I am Another Perspective.

Here, I humbly share my first i3 article with you.

This article is strictly for sharing purpose only.

There is no buy or sell recommendation.

Any constructive feedback is welcomed.

Let’s dive in.

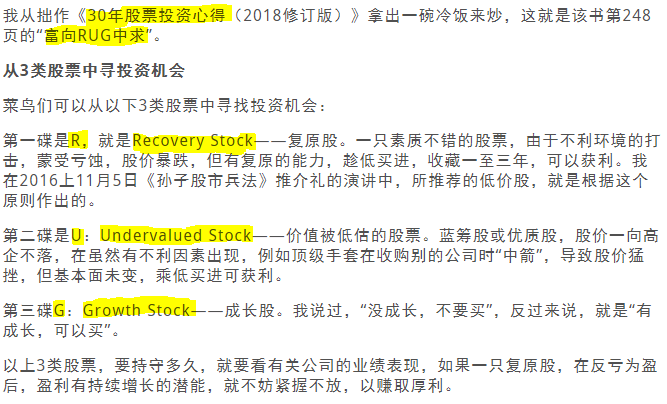

1) What are Mr. Fong’s stock selection criteria?

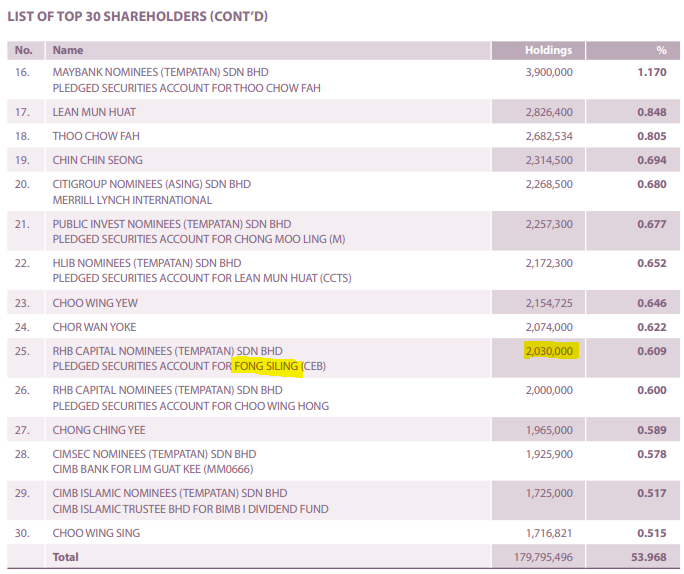

According to one of the Malaysia’s top investor, Mr. Fong Siling, investors can look for great investment opportunities in RUG stocks:

- R (Recovery Stock) – Companies that have good fundamentals but suffer from temporary setbacks may have extremely depressed stock prices. As long as the company can recover, we can buy the stock at depressed prices and keep them for 1-3 years. The investment returns should be good.

- U (Undervalued Stock) – Companies that are undervalued.

- G (Growth Stocks) – As long a company is growing, we should hold its stock.

2) How does Notion fits Mr. Fong’s RUG stock selection criteria?

- R (Recovery Stock) - Notion’s stock price has been severely impacted due to a series of incidents, including a fire at its main manufacturing facility in Klang in October 2017. After nearly two years, Notion has fully restored its operations in September 2019.

- U (Undervalued Stock) – Notion has an NTA of RM1.24. As a precision part manufacturer, its manufacturing equipment and facilities should fetch a value similar to, if not higher than the NTA. If even a non-operational Notion is worth RM1.24, how could Notion be worth at RM1.05 when there are management team and employees generating earnings in a business with high barrier of entry? If you check Notion’s peers, namely ATAIMS, VS and SKPRES, you will notice they are trading at stock prices much higher than NTAs.

- G (Growth Stock) – Notion’s three business segments, namely HDD, EBS and EMS, are all growing. Notion targets to reach a market capitalisation of RM1 billion by 2024 – a 3x increase in market capitalisation within five years. With a healthy Current Ratio of 4.41, Debt-to-Equity ratio of 0.16 and expected insurance claims, Notion should able to expand rapidly, without overstretching itself financially.

- HDD (Hard Disk Drive) – Their HDD parts precision manufacturing business is growing, due to the extensive application of Shingled Recording (SMR) and helium drives.

- EBS (Electronic Braking System) - Many people are not aware that Notion is one of the largest auto braking plunger suppliers in the world. Notion produces 30 million pieces of plungers annually for 15 million cars, as each braking system would need two plungers. Given that the global production of cars is about 90 million annually, it essentially means that one in every six cars in the world has plungers is made by Notion. Their clients include world-class automotive brands, including Mercedes-Benz, BMW, Audi, Volkswagen, Mitsubishi. Notion’s parts are being supplied to everywhere in the world. Recently, Notion had secured three new automotive customers, namely Delphi Technologies, Hilite International and BorgWarner, with orders expected to start coming in 1H2020.

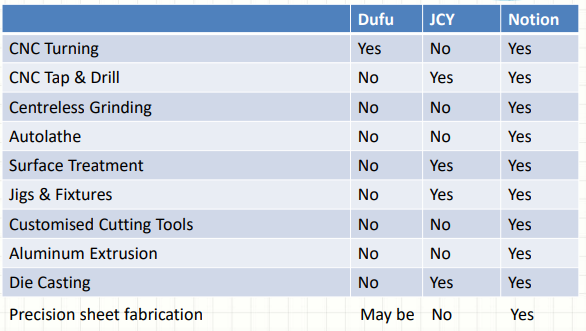

- EMS (Electronic Manufacturing Service) – This is Notion’s main growth driver. Notion is the specialist in metal parts, especially the aluminium parts. In 2H2019, it has secured a European EMS client to which it will supply the metal parts — both machine and fabricated parts — for its products. The client stated they are impressed by Notion’s capability and quick response. It is highly likely that the European EMS client is Dyson. Why? VS, SKPRES AND ATAIMS, which serve Dyson, are based in Johor. Their stock prices have soared ever since they started serving Dyson. If you notice, Notion’s EMS plant is based in Johor too. Secondly, they have comprehensive engineering capabilities. Refer table below, sourced from Notion’s Investor Relation slides (You may view them at Notion’s website).

- Let’s focus on Notion’s big picture. Underpinned by encouraging R, U, G factors, Notion targets to reach a market capitalisation of RM1 billion by 2024 – a 3x increase in market capitalisation within five years. It would be helpful to derive a stock price based on this input.

- With a market capitalisation of RM1 billion by 2024 and a total outstanding 335,821,905 stock units, each stock would be worth RM2.98 by 2024. Applying a sufficiently huge margin of safety of 50%, the stock would still be worth RM1.49 by 2024.

- EMS players, namely ATAIMS, SKPRES and VS have PERs of 16-20x. Assuming Notion is valued at just a PER of 15x, a stock price of RM2.98 is equivalent to an EPS of RM0.20 and annual earnings of RM66.7 million.

- Is this Notion able to achieve this target? No one can give an exact answer - We have no crystal balls. We shall monitor their performance from time to time, to see whether they underdeliver, deliver or overdeliver.

4) Is there any prominent investor believing in Notion?

5) What does Notion’s chart suggest?

- At RM1.05, Notion is standing as its 1-year high. However, it is still 16% lower than its NTA of RM1.24. Notion’s peers, namely ATAIMS, VS and SKPRES, you will notice they are trading at stock prices much higher than NTAs.

- Notion has been uptrend stock since the October 2019, right after it has fully recovered from the fire incident in 2017- Positive signs for value + trend investors.

6) Are there risks buying Notion?

Yes. No matter how good a company is, it is not risk-proof.

- Business Risk - Notion may not hit its target - a 3x increase in market capitalisation within five years due to different reasons, such as termination of client projects, or incidents like floods and fire.

- Market Risk – In the short term, anything can happen to the stock market. Notion’s stock price could fluctuate with respect to changing market sentiments.

7) Conclusion?

a. Notion fulfils the RUG stock selection criteria.

- R (Recovery) – Notion has fully recovered its operation in September 2019.

- U (Undervalued) – Notion’s current stock price is 14% below NTA, while its peers are traded at prices much higher than their NTAs.

- G (Growth) – All growth drivers combined (HDD, EBS, EMS); Notion targets a 3x increase in market capitalisation by 2024. If achieved, with a total outstanding 335,821,905 stock units and a PER of 15x, each Notion stock would be worth RM2.98 by 2024. Applying a sufficiently huge margin of safety of 50%, the stock would still be worth RM1.49 by 2024.

c. By investing in Notion, investors should expect business and market risks.

Is Notion a worthwhile investment? You decide.

This article is strictly for sharing purpose only.

There is no buy or sell recommendation.

Any constructive feedback is welcomed.

Thanks,

Another Perspective

https://klse.i3investor.com/blogs/anotherperspective/2020-01-19-story-h1482841839-NOTION_A_2020_Gem_Stock_that_fulfils_Mr_Fong_s_RUG_Criteria.jsp