A)转自网站:谢谢他的功课.

如何计算和操作FBMKLCI Put Warrant?

顺应网友的要求,今天特别写一篇简单的Put Warrant计算方法,以及要如何操作这些Put Warrant。

我们都比较了解和熟悉Call Warrant(认购凭单),但是对于Put Warrant(认沽凭单),很多人还是不太了解。

在大马交易所上市的Put Warrant并不多,那些股票代号后头有H的(如HB, HC,HD,HE,HF,HG。。)就是Put warrant。

Call Warrant是博取在股票或指数上涨时赚钱,而Put Warrant则是博取在股票或指数下跌时赚钱。

简单来说,买进Put Warrant的目的就是希望股票或指数跌得越多越好,越跌就越赚钱。

要操作FBMKLCI的Put Warrant,我们首先必须要了解该凭单的转换价(Exercise/Conversion Level)和转换比例(Exercise/Conversion Ratio)。

就以FBMKLCI-HC作为例子好了。

从BURSA网站,所得到FBMKLCI-HC的资料(Profile for Structured Warrants)如下:

Issuer:Macquarie Capital Securities

Exercise Level:1820

Exercise Ratio:200:1

Maturity:30/6/2015

因为这是Put Warrant,所以必须要等到指数跌到低于1820点时才可以转换。

如果FBMKLCI-HC在截止时(2015年6月30日)综合指数是高过1820,那它将成为废纸,投行也无需支付一分钱。

如果在截止时指数是低于1820,那么投行将会结算出凭单的内在价值。

结算方法 =(Exercise Level - Final Level)/ Ratio

根据昨天综合指数的收市行情(1716.58点)来算,那么FBMKLCI-HC应该值得(1820 - 1716)/ 200 = RM0.52

也就是说假如昨天是该凭单的截止日的话,那么Macquarie Capital 投行就要付你RM0.52。

但是别忘了,FBMKLCI-HC昨天的闭市在RM0.755,如果你以这个价钱买进的话,你又只能够拿回RM0.52,那你还是倒亏RM0.235。

所以,何时买进与在何时卖出很重要,而且你还要对综合指数接下来的走势很有把握。

打个比方,如果你认为大盘接下来的表现将会很差很差,甚至估计综合指数在6月30日以前会去到1600点。

那么以1600点来做结算,FBMKLCI-HC将有机会可以去到(1820-1600)/ 200 = RM1.10

如果以目前的价位RM0.785买进,还有RM0.315或40%的增值空间。

但是,万一综合指数在截止时跟你来个大反弹,甚至高过1820点,那么你的所有投资将sayonara。

我不太鼓励新手(或者不了解的投资者)操作Call Warrant和Put Warrant,首先你要对股价或指数的走势很有把握,还要拿捏得当,也要在跌时果断止损,而且还要承受得住压力。

我认识很多人到头来是亏到一毛不剩的,因为这就好像在玩俄罗斯轮盘那样,到最后一定会有输家出现,只是看谁跑得比较快。

我还是那一句:不熟不买

我们都比较了解和熟悉Call Warrant(认购凭单),但是对于Put Warrant(认沽凭单),很多人还是不太了解。

在大马交易所上市的Put Warrant并不多,那些股票代号后头有H的(如HB, HC,HD,HE,HF,HG。。)就是Put warrant。

Call Warrant是博取在股票或指数上涨时赚钱,而Put Warrant则是博取在股票或指数下跌时赚钱。

简单来说,买进Put Warrant的目的就是希望股票或指数跌得越多越好,越跌就越赚钱。

要操作FBMKLCI的Put Warrant,我们首先必须要了解该凭单的转换价(Exercise/Conversion Level)和转换比例(Exercise/Conversion Ratio)。

就以FBMKLCI-HC作为例子好了。

从BURSA网站,所得到FBMKLCI-HC的资料(Profile for Structured Warrants)如下:

Issuer:Macquarie Capital Securities

Exercise Level:1820

Exercise Ratio:200:1

Maturity:30/6/2015

因为这是Put Warrant,所以必须要等到指数跌到低于1820点时才可以转换。

如果FBMKLCI-HC在截止时(2015年6月30日)综合指数是高过1820,那它将成为废纸,投行也无需支付一分钱。

如果在截止时指数是低于1820,那么投行将会结算出凭单的内在价值。

结算方法 =(Exercise Level - Final Level)/ Ratio

根据昨天综合指数的收市行情(1716.58点)来算,那么FBMKLCI-HC应该值得(1820 - 1716)/ 200 = RM0.52

也就是说假如昨天是该凭单的截止日的话,那么Macquarie Capital 投行就要付你RM0.52。

但是别忘了,FBMKLCI-HC昨天的闭市在RM0.755,如果你以这个价钱买进的话,你又只能够拿回RM0.52,那你还是倒亏RM0.235。

所以,何时买进与在何时卖出很重要,而且你还要对综合指数接下来的走势很有把握。

打个比方,如果你认为大盘接下来的表现将会很差很差,甚至估计综合指数在6月30日以前会去到1600点。

那么以1600点来做结算,FBMKLCI-HC将有机会可以去到(1820-1600)/ 200 = RM1.10

如果以目前的价位RM0.785买进,还有RM0.315或40%的增值空间。

但是,万一综合指数在截止时跟你来个大反弹,甚至高过1820点,那么你的所有投资将sayonara。

我不太鼓励新手(或者不了解的投资者)操作Call Warrant和Put Warrant,首先你要对股价或指数的走势很有把握,还要拿捏得当,也要在跌时果断止损,而且还要承受得住压力。

我认识很多人到头来是亏到一毛不剩的,因为这就好像在玩俄罗斯轮盘那样,到最后一定会有输家出现,只是看谁跑得比较快。

我还是那一句:不熟不买

B)

转自网站:谢谢他的功课.

Put Warrants - Knowledge And Tricks

Author: RicheHo | Publish date:

Nowadays, index warrants, either call warrants or put warrants, are getting popular in Malaysia market. FYI, put warrants are only available in Bursa Malaysia since August 2009. Meaning, during 2008 economy crisis, put warrants are not exist in our market. Most investors did not have the opportunity to capture it. However, don’t forget global market is a cycle. When the bear market comes again, it will be the best time for put warrants to fly. In other words, if you are an expert, you can earn money during bull market and also bear market.

What is put warrants? I believe most investors only know that when FBMKLCI index drop, put warrants price will go up and put warrants price are affected by the movement of index. However, it is wrong. To be correct, put warrants price are affected by FBMKLCI futures price, and not FMKLCI index.

The FBMKLCI futures are listed and traded on the Bursa Malaysia, the index warrants price is linked to the movements in the futures price over time and at expiry settlement will be based on the closing level of the relevant futures expiry. This is done because the issuer will use the futures contract to hedge the index warrants.

This is the reason why sometimes you will notice when FBMKLCI index drops, some put warrants will also drop.

Just to share a trick or maybe an earning opportunity about warrants. When the future contracts change, there will be difference between the contracts figure. Hence, the warrants price also will adjust accordingly. Investors can make use of this opportunity to grab a cheaper put or call warrants. However, we don’t have the data of the futures that the issuer hedge.

FBMKLCI Index

27th August Closing --> 1,601.70

28th August Opening --> 1,609.04

Difference --> 7.34 points

| INDEX WARRANTS | 27th August – Closing | 28th August – Opening | Difference |

| FBMKLCI-HW | 0.415 | 0.39 | 0.025 |

| FBMKLCI-HX | 0.775 | 0.73 | 0.045 |

| FBMKLCI-HY | 0.60 | 0.55 | 0.05 |

| FBMKLCI-HZ | 0.49 | 0.445 | 0.045 |

| FBMKLCI-H1 | 0.47 | 0.44 | 0.03 |

| FBMKLCI-H2 | 0.82 | 0.78 | 0.04 |

| FBMKLCI-H3 | 1.13 | 0.995 | 0.135 |

1st September Closing --> 1,609.21

2nd September Opening --> 1,602.60

Difference --> 6.61 points

| INDEX WARRANTS | 1st September – Closing | 2nd September – Opening | Difference |

| FBMKLCI-HW | 0.51 | 0.515 | 0.005 |

| FBMKLCI-HX | 0.83 | 0.855 | 0.025 |

| FBMKLCI-HY | 0.63 | 0.66 | 0.03 |

| FBMKLCI-HZ | 0.485 | 0.495 | 0.01 |

| FBMKLCI-H1 | 0.515 | 0.54 | 0.025 |

| FBMKLCI-H2 | 0.895 | 0.905 | 0.01 |

| FBMKLCI-H3 | 1.11 | 1.15 | 0.04 |

I believe during 27th August, the issuer had referred to a new futures contract and hence the price of put warrants is adjusted accordingly. The above comparison is just for illustration.

In terms of market makers, the role of issuers is to provide continuous buy and sell quotes in their warrants. In doing so, the market makers provide liquidity in the warrants so that investors can easily enter and exit their trades. The quality of the issuers is often a big factor for investors choosing a warrant.

Before choosing a put warrants, you need to be confident that the market maker will be there to provide consistent pricing throughout the life of the warrant so that you can enter/exit the trade in a fair and liquid market.

The trading system will enter bid and offer quotes in the index warrants based on the price in the futures. As the price in the futures move, the issuer’s quotes will also adjust. Some making systems will also change their bid and offer volume to follow the volume in the underlying share.

In Malaysia, there are a few exemptions to the continuous quoting requirements, these can be found in the issuers’ listing documents. The most common being, when the warrant value falls below the minimum bid of certain price, in this case the warrant is considered worthless and the issuers are no long required to provide a bid price.

List of issuers of index warrants

- Macquarie Capital Securities

- RHB Investment Bank

- Kenanga Investment Bank

- CIMB Bank

- Maybank Investment Bank

For me, I preferred put warrants which issued by Macquarie. It is safer as Macquarie provides high liquidity in warrants. At the end of each trading day, Macquarie will also capture the bid price of the warrant slightly before the close of trading and use this to represent the 'closing price'. I am not sure with other issuers.

Regarding how to pick a put warrants, besides than the common use of discount/premium, gearing ratio and expiry date, there are still few other factors to consider. I will talk about this later.

Just for sharing.

https://klse.i3investor.com/blogs/rhinvest/82584.jsp

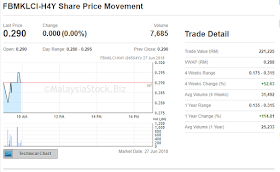

个人分享:

当股市前景不佳时,可買入PUT WARRANT,什么是认沽权证?我相信大多数投资者只知道当FBMKLCI指数下跌时,认沽权证价格会上涨,认沽权证价格受指数走势影响。但是,这是错误的。为了正确,认沽权证价格受FBMKLCI期货价格影响,而不受FMKLCI指数影响。这就是为什么有时你会注意到FBMKLCI指数下跌时,一些认沽权证也会下跌。

合理啦:

(1888-1665)/800=0.278

0.278+0.02=0.298

当综指继续下它就呈上升。

合理啦:

(1888-1665)/800=0.278

0.278+0.02=0.298

当综指继续下它就呈上升。

只是分享,无任何買卖建议,投资自负.