Tek Seng Holdings Bhd是一家投资控股公司。它分为四个板块:PVC板块板块,从事聚氯乙烯(PVC)板块,工业和消费类零件的制造和贸易。 PP无纺布分部,生产和贸易与PP无纺布相关的产品;从事与PVC皮革相关产品贸易的PVC皮革分部和赚取主要收入。它从事与PVC相关和无纺布相关产品的制造和贸易,

大马政府宣布从8月15日起,3层医用口罩的零售顶价从之前的每片1.50令吉调低至1令吉,以后可能会进一步下降至80仙或更低。随着大马政府强制民众必须在公共场合戴口罩,因此口罩需求依旧强劲,而且随着口罩价格下调,相信更多人能负担得起,因此商家也有责任确保市场供应充足。在此情况之下,除了越来越多企业转型制造口罩,也有企业开始进军生产口罩原料 - 无纺布业务。

上个星期就看到了一则新闻:UPA正式向大马交易所报备,旗下公司获大马投资发展局 (MIDA) 批准,正式进军熔喷无纺织布市场以开发口罩、面罩及相关原料制造业务。根据文告,相关生产线将耗资1000万令吉,每年最多可生产60万公斤的熔喷布或相等于1800万令吉的年营收,足以制作8600万片3层口罩或医用口罩,预计可在今年11月秒开始投产。按此估计,无纺布的平均价格是每片21仙。

这不禁让我想起,早前Tek Seng透露第三季会拨出2000万令吉购买新机械以扩增产能,从目前的300公吨月产量翻倍至600公吨。若以UPA提供的数字来做推算的话,那么Tek Seng的新机械每年可生产360万公斤无纺布或相等于1亿800万令吉的年营收,足以供给5亿1600万片3层医用口罩了。管理层最近在接受媒体访问时表示,由于口罩持续供不应求,业务赚幅已经从全球大流行前的6%到8%暴涨至15%,此外企业也准备扩展至欧美市场。趁着目前口罩需求大涨之时再出发,不难理解管理层也希望借此摆脱之前太阳能业务给集团带来的连年亏损。

其实在今年之前,Tek Seng的最主要业务是PVC帆布产品,而无纺布的营收贡献比重也只是占约25%而已,但是随着新冠疫情肆虐从而推高无纺布业务的销售表现,贡献比重在今年次季就已经上涨至70%。企业所生产的无纺布可以广泛应用在医疗物资(口罩和医护设备)和一次性卫生用品(尿片、卫生棉和湿巾)。这些来年随着消费者的卫生意识不断提升,对一次性卫生用品的需求有增无减,甚至已成为一种必需品,无论经济好坏都不会抑制这类产品的需求持续成长。而在经历这一次的疫情爆发之后,也促使消费者对医疗用品需求更加强烈,在新冠疫苗还没研制成功和正式面世之前,人们都必须长时间佩戴口罩与病毒共存,故医疗用品的长期需求备受看好,估计Tek Seng能在这场疫情下从中受惠。

虽然目前市场对医疗用品的需求结构是永久性还是暂时性暂且还不得而知,但是企业的产品质量和技术将决定企业竞争力如何可持续保持领先优势,从而巩固市场份额及获得更多订单。此外,随着Tek Seng从之前的工业供给转为目前更面向终端消费者的市场需求,管理层更是必须提高对价格的敏感度(口罩价格下调、原料价格上涨)以及保持灵活性的议价能力才能应对市场的变化走向。

转向生产医疗配备包括面罩和防护衣生意後,德成控股(TEKSENG 7200)第二季传捷报,净利按年大增264%!

截至今年六月卅日第二季,德成控股录得净利653万令吉,去年同季净亏398万令吉,成功转亏为盈。

不过第二季营业额按年滑跌10.5%,由4611万令吉减至4128万令吉。

每股盈利1.82仙,比较去年每股净亏1.14仙。

2020财政年首六个月德成净利为1114万令吉,比去年增长417%,去年同期净亏305万令吉。

德成控股股价今午跌5.5仙至88.5仙。

让德成大赚的业务是防护用品(PPE)。

根据执行董事罗永俊透露,截至今年三月第一季,PPE业务为集团贡献25%营业额。

他预测,四月至六月第二季,PPE业务贡献会提高至30%;七月至九月可以提高至70%。

德成和其它宣布要进军PPE业务的上市公司不同,它已经是这个行业的"老手",生产线已非常熟练,提高产量就能提高生意额。

--🙏网友评论

ForceBWithU There's an interesting article in The Edge Weekly on Capital Markets section Pg 31 to 35. It list the Winners and Wannabes from the Covid-19 play. TS is mentioned there. You can assess that TS is a good example of a PPE play stock but a REAL laggard among the overpriced PPE counters.

My sincere views on TS and why it should be priced above RM2.00 is as follows:-

1. Improving QRs for 2 quarters and should see further improvements in QR3 and QR4

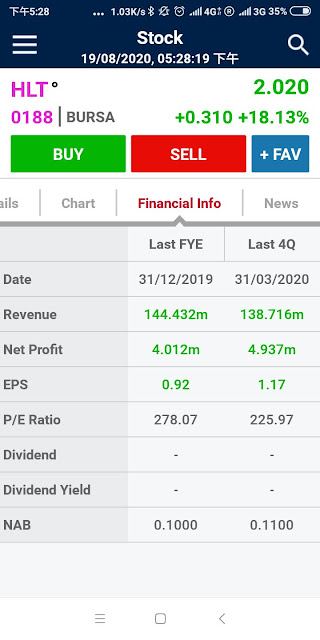

2. QR2 EPS 1.82. Annualised EPS 7.2. PE 20X 1.44

3. Forecast QR3 EPS 3.00 Annualised EPS 12.00 PE 20X 2.40

4. Forecast F/Y 2020 EPS (3.2+3.0+4.0) 10.2 . Dividend payout 30% ; 3.00 sen. If 40% . Payout 4.00 sen

5. Nett cash position @ 30/6/2020; RM37 million

6. Retained profit sufficient for capitalization by way of bonus issue of 2 for 3 .

7. Export market is still a big possibility

ForceBWithU在《资本市场边缘周刊》第31至35页上有一篇有趣的文章。其中列出了Covid-19比赛的获胜者和想要的人。 在那里提到了TS。 您可以评估TS是PPE股的一个很好的例子,但在价格过高的PPE柜台中却是落后的。

我对TS的真诚看法以及为何价格定在RM2.00以上的理由如下:

1.将QR改善2个季度,并应看到QR3和QR4的进一步改善

2. QR2 EPS 1.82。 年化每股收益7.2。 PE 20X 1.44

3.预测QR3 EPS 3.00年化EPS 12.00 PE 20X 2.40

4.预测2020财年EPS(3.2 + 3.0 + 4.0)10.2。 股息派发30%; 3.00仙 如果40%。 赔付4.00 sen

5.净现金状况@ 2020年6月30日; 3千700万令吉

6.通过2派发3的红利留有足够的资本化利润。

7.出口市场仍有很大可能性。

🙏网友评论

tonypang01 TS oso make this new products now for plastic ccp can view thru their website

Good ! meaning they oso do plastic packaging products

http://demo.broncos.com.my/our-business/

CPP

Our Cast Polypropylene sheets, commonly known as CPP are our new range of product offerings. CPPs are characterized and portrayed as cleaner and environmental friendlier products. They are widely used in stationery, food packaging and other industrial use.

20M investment I believe not just limit to PP Non Woven because the machine fit to all their PVS segment where this is the grow area for next few years

tonypang01 TS oso现在使这种新产品用于塑料ccp可以通过其网站查看

好! 这意味着他们也做塑料包装产品

http://demo.broncos.com.my/our-business/

CPP

我们的铸造聚丙烯板材(俗称CPP)是我们提供的新产品系列。 CPP的特征和描绘为更清洁,更环保的产品。 它们被广泛用于文具,食品包装和其他工业用途。

我相信2000万美元的投资不仅限于PP无纺布,因为该设备适合其所有PVS领域,这是未来几年的增长领域。

💪👍👏🙏谢谢他们的功课。